Student Loan Repayment Pause Set To End, But 56% of Borrowers Don’t Know What They Owe

Given that millions of federal student loan holders haven’t had to pay down their debts since the government froze repayment in March 2020, it’s not surprising that some borrowers have lost track of their repayment status. What’s alarming, however, is that most don’t know the basic details of their debt and may be unprepared when the bills resume next year.

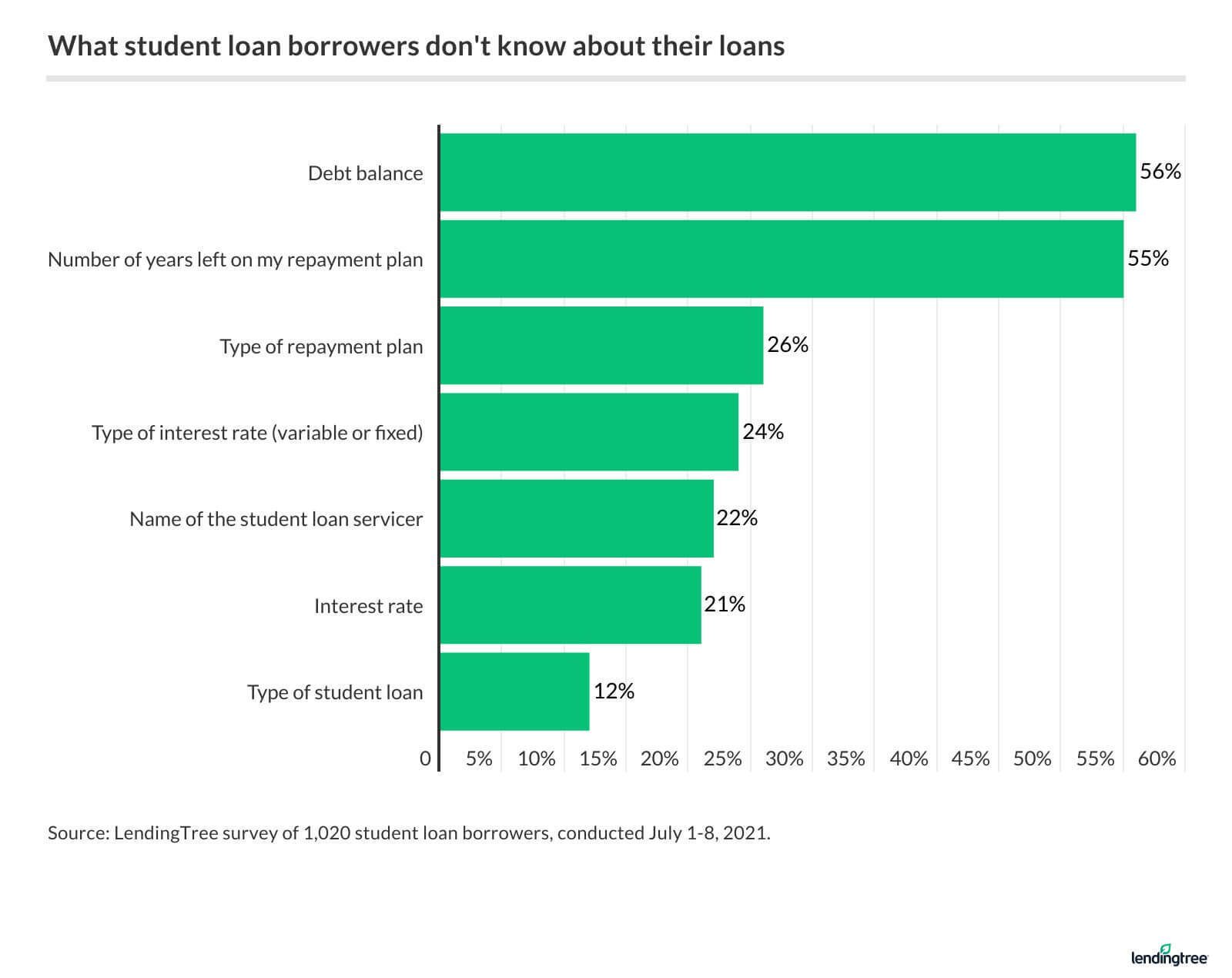

About 56% of borrowers are unaware of their balance, and 55% don’t know the end date of their debt, according to our new survey of 1,020 Americans with student loans.

In fact, many respondents had potentially adverse misconceptions about student loan forgiveness and eligibility for student loan refinancing — and in many respects, borrowers identifying as female were more disadvantaged than their male peers in terms of information about their debt.

Key findings

- Beyond being uncertain of their balances and repayment horizons, many borrowers have no idea which type of repayment plan they’re using (26%), don’t know the name of their student loan servicer (22%) and couldn’t quote their own interest rate (21%). (Read more)

- Men report knowing more about their student loans than women when it comes to loan details such as balance, interest rate, loan type and repayment plan. However, borrowers identifying as female are more knowledgeable about eligibility for loan forgiveness and refinancing. (Read more)

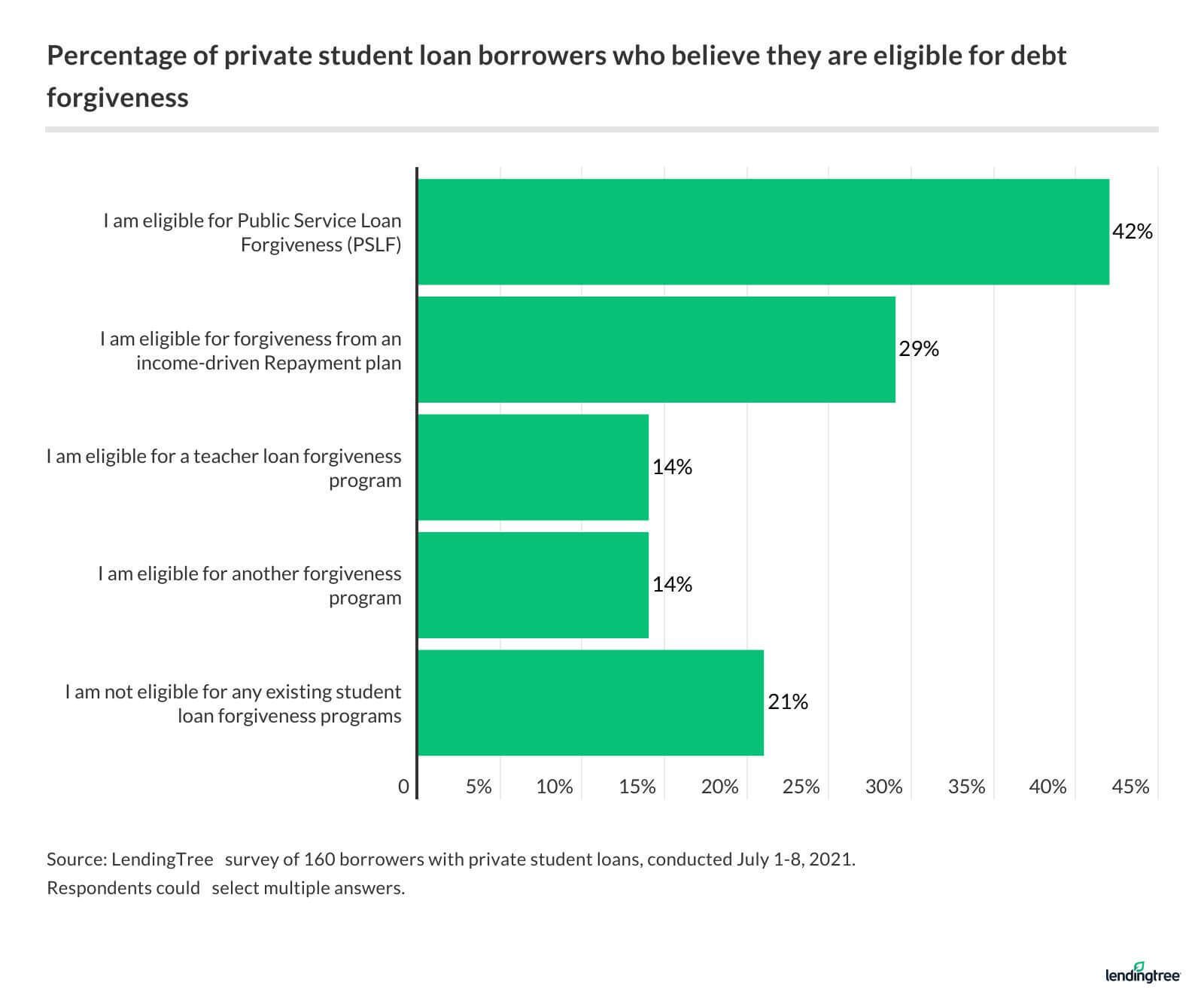

- In light of the ongoing national conversation about student loan relief, 58% of respondents (and 68% of those holding private loans) incorrectly believe everyone would be eligible for student loan forgiveness under proposals currently being considered by Congress and the White House. On top of that, 79% of private loan borrowers wrongly assume they’re eligible for existing federal loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF). (Read more)

Borrowers still don’t know the details of their education debt

Past surveys by LendingTree (from 2018 and 2019) show that misunderstandings around student borrowing start in college. Current students have reported, for example, not knowing their interest rates, or even how interest rates work.

Given this, it’s no surprise that borrowers of all ages are still unclear on the basics, from their balance and loan term to their repayment plan and rate, as well as federal loan servicer. (We may actually see a dramatic uptick in borrowers being confused about the identity of their loan servicer, as a handful of federal contracts are set to expire by the end of 2021.)

For example, on the topic of annual percentage rates (APRs) — the yearly cost of interest rates and fees — nearly 1 in 4 survey respondents (24%) said they don’t know if their loan is tagged with a fixed rate or a variable rate. That’s unnerving, as variable rates shift according to market forces and usually result in fluctuating monthly payments that can wreck (or sometimes save) a family’s monthly budget.

Also on the alarming side of our results: 12% of borrowers don’t know which type of federal or private student loans they have. This lack of information could also prove costly because different loans have different safeguards. Only federal student loans, for example, are likely to be eligible for certain relief programs.

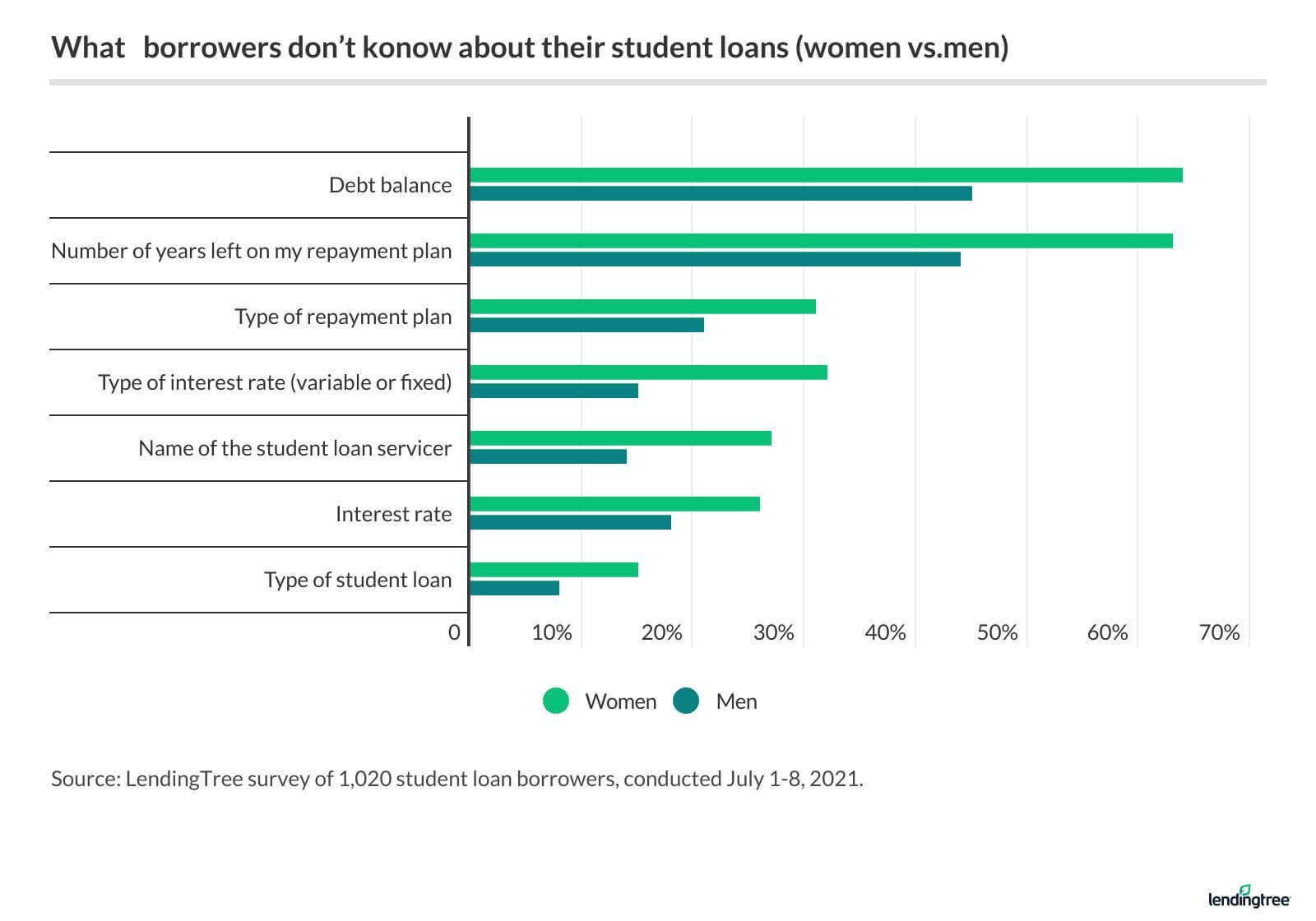

Male borrowers more likely to be familiar with their loans

Past LendingTree research indicates that men are more likely to exhibit financial confidence when it comes to money, such as in negotiating a raise at work or having a rosier outlook about their education debt.

That confidence could help to explain why borrowers identifying as male report knowing more about their loans than their female counterparts.

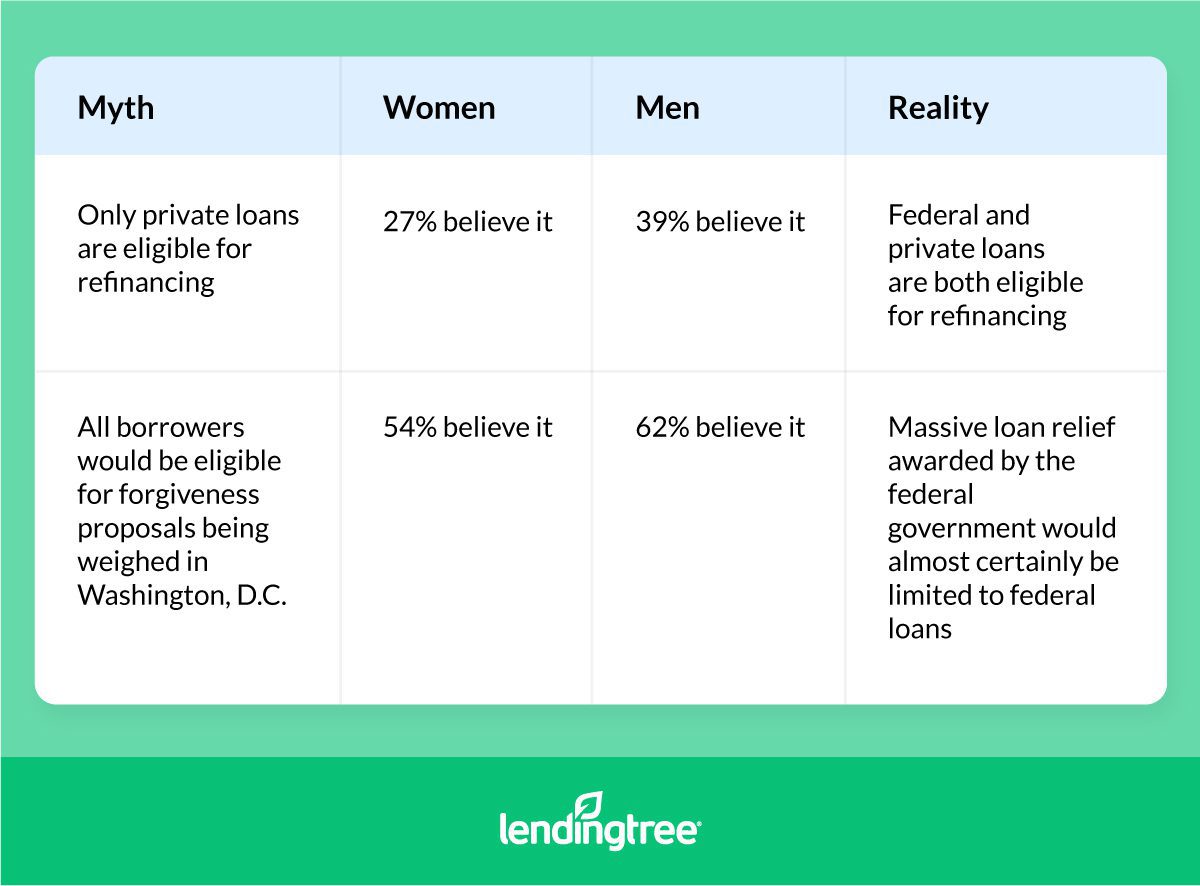

Note, however, that the survey didn’t go so far as to conclude whether men actually know more about their loans than women. In fact, it found that women are smarter than men when it comes to ignoring myths about eligibility for loan forgiveness and student loan refinancing.

Private student loan borrowers have misconceptions about forgiveness

Student loan relief has been a constant in headlines, particularly as the COVID-19 pandemic caused more borrowers to struggle with their monthly dues. Unfortunately, those headlines often lack context, yielding commonly held student loan forgiveness myths.

Aside from a majority of federal and private loan borrowers believing that mass forgiveness proposals would help 100% of borrowers, that won’t be the case. While 8 of 10 of private loan borrowers think they’re eligible for existing federal debt forgiveness programs, they won’t be.

In reality, federal loan forgiveness programs are limited to federal loan borrowers, even though private borrowers could access state and employer-offered loan repayment assistance programs.

At the same time, about 1 in 3 survey respondents (35%) said they weren’t aware that student loan forgiveness was recently made tax-free by Congress. (Note, however, that many forms of forgiveness will become taxable again in 2026.)

An even larger cohort believed that borrowers never had to pay taxes on forgiven debt (36%), a dangerous assumption given that some of those receiving forgiveness in the past have faced big tax bills.

What you don’t know about your student loan debt could cost you

It’s easy to get lost in the world of student loans, which is perhaps why 11% of borrowers were at least 90 days late on their debt even before the coronavirus pandemic began, according to our student loan debt statistics.

Unfortunately, not knowing the details of your debt — and your options for repayment — could cost you severely.

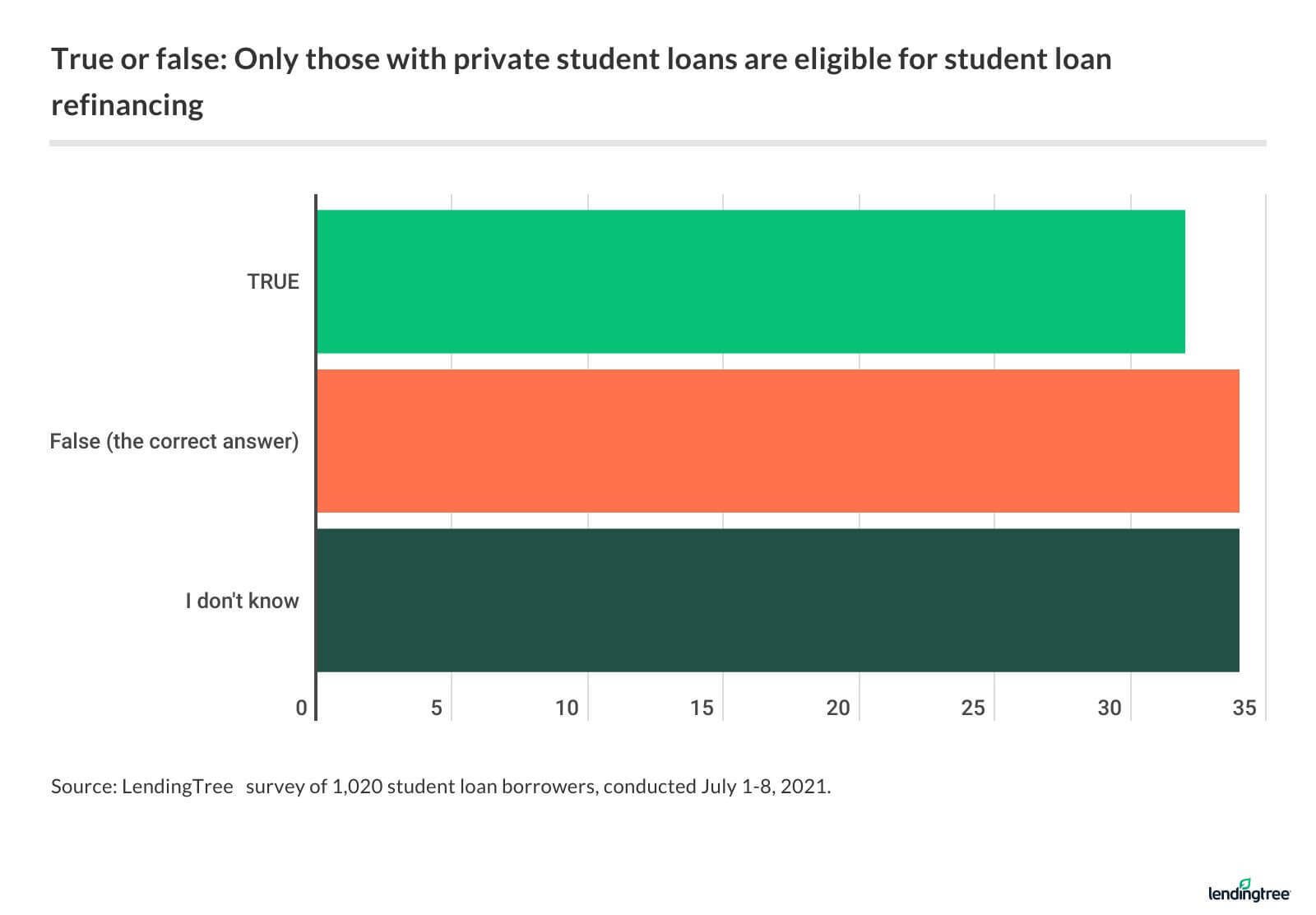

Besides the misconceptions about loan relief, there’s also a widely shared misunderstanding around student loan refinancing. Nearly a third of our survey respondents (32%) thought that only private loan borrowers were eligible for refinancing. And another third (34%) said they didn’t know.

That’s a potentially costly mistake, as student loan refinancing can potentially lower your interest rate (saving you money) and/or lower your monthly payment amount (saving you stress).

That said, refinancing is not the right move for many borrowers, including federal student loan borrowers who enjoy the ongoing repayment suspension and can access government-exclusive safeguards like Public Service Loan Forgiveness and income-driven repayment (IDR).

So whether it’s refinancing or interest rates or opportunities for forgiveness, a bit of knowledge can sometimes put extra money in your pocket.

LendingTree commissioned Qualtrics to field an online survey of 1,020 student loan borrowers, conducted July 1-8, 2021. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the U.S. population. All responses were reviewed by researchers for quality control.