Student Loan Forgiveness Is Top Education Priority for Voters This Election: Survey

The 2020 presidential election is around the corner, and while voters might be focusing on the economy or the COVID-19 pandemic, many are also worried about education issues.

A new LendingTree survey found that when it comes to education, student loan forgiveness is the top concern, cited by nearly 1 in 5 respondents, with a majority hopeful it could happen soon.

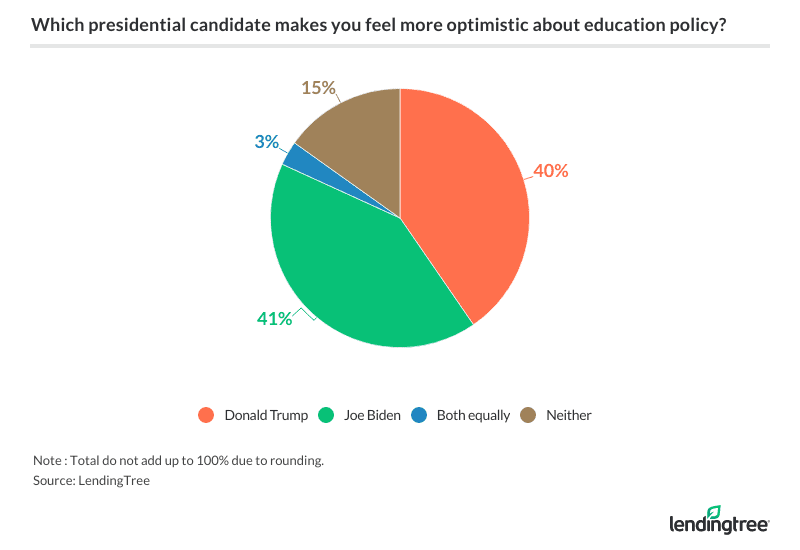

In terms of views on the candidates themselves, however, the survey found Americans split over which contender – President Trump or former Vice President Joe Biden – made them feel more optimistic about education policy.

Key findings:

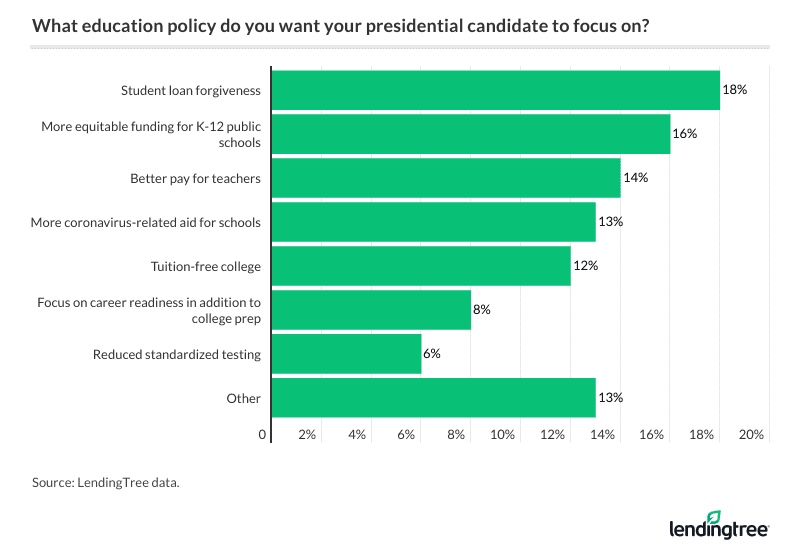

- Student loan forgiveness (18%) and more equitable funding for K-12 public schools (16%) were the top two most important education policy issues cited. (Read more)

- Biden narrowly beats out Trump (41% to 40%) as the candidate about whom respondents felt more optimistic in terms of education policy. However, 15% of those questioned said neither candidate made them feel hopeful about education policy. (Read more)

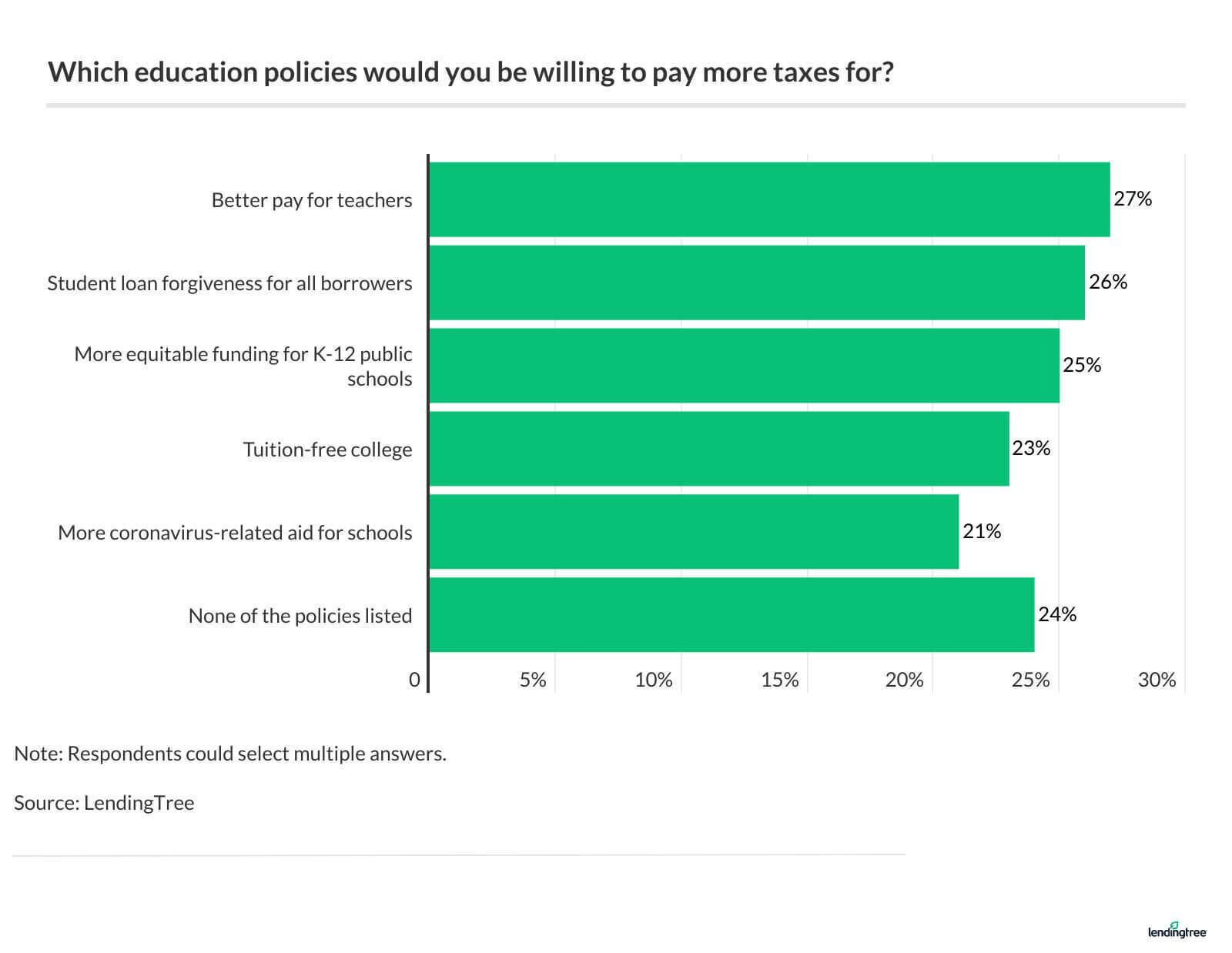

- More than three-quarters of Americans said they were willing to take on an additional tax burden for certain education policies, especially better pay for teachers (27%) and student loan forgiveness (26%). (Read more)

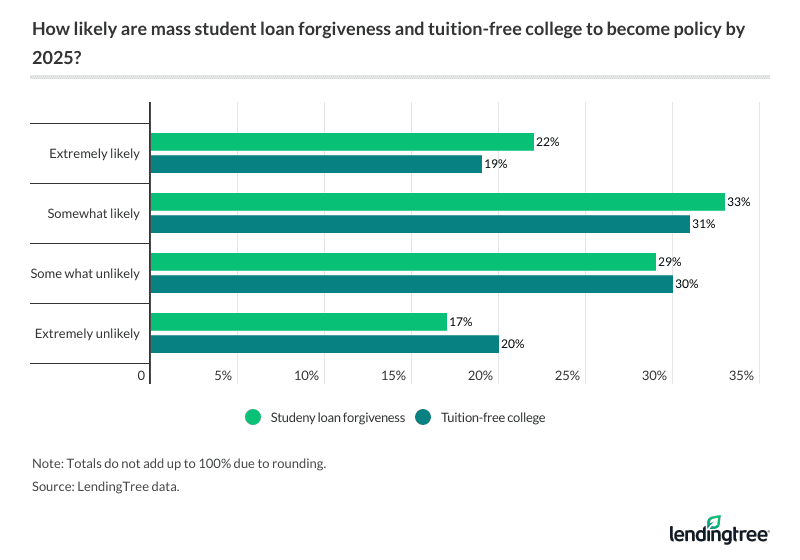

- Consumers have slightly higher hopes for the passage of mass student loan forgiveness within the next five years (55%) than they do for the possibility of tuition-free college (50%). (Read more)

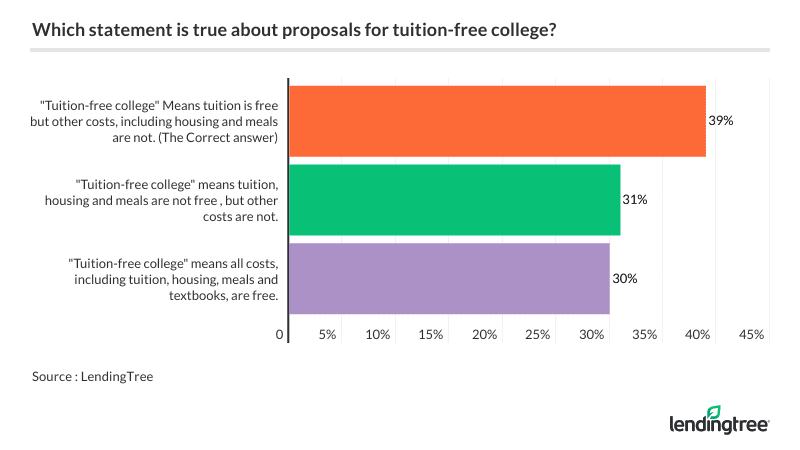

- Although tuition-free college was cited by some as a top policy priority, 61% of respondents have misconceptions about what that policy actually means. (Read more)

- About half of those polled felt that the presidential candidates were not focusing on education-related policies enough. (Read more)

Student loan forgiveness tops list of most important education policies

With the national student loan debt now higher than ever ($1.64 trillion according to the latest count), the idea of mass student loan forgiveness has been a frequent topic of public conversation and media reports. And in fact, our survey found student loan forgiveness to be the education policy most sought after by respondents.

In total, 18% of consumers said student loan forgiveness was their top priority education issue, making it the most-cited concern for Democrats, Republicans and independents alike.

Following close behind were “more equitable funding for K-12 schools” (16%), “better pay for teachers” (14%), and “tuition-free college” (12%).

Student loan forgiveness was the top education policy focus for Generation Z, millennial and Generation X respondents, while baby boomers were more concerned with K-12 funding, and the silent generation cared most about more coronavirus-related aid for schools.

Current student loan borrowers were more strongly in favor of forgiveness, with 45% listing it as their No. 1 concern.

Potential voters split on which candidate would be better for education

Respondents were more or less evenly split on which candidate would be better for education, with 41% picking Biden and 40% naming Trump.

Biden had a bigger lead among Gen Z, with 52% saying he made them feel more optimistic about education policy, as opposed to just 17% saying the same for Trump. About 43% of millennials responded that Biden gave them hope about education policy, compared to 35% of them sharing the same sentiment about Trump. For more comparison among the age groups, 55% of Gen Xers favored Trump on education issues, versus 33% preferring Biden.

Meanwhile, about 15% of those polled said neither candidate made them feel hopeful about education policy, including 27% of Gen Z (the highest proportion with this answer among the age groups surveyed). Only 3% said both Trump and Biden made them optimistic for better education policy.

More than 1 in 4 would pay more taxes for better pay for teachers

Some education policies might require consumers to pay higher taxes or otherwise strain government budgets. Nonetheless, more than three-quarters of respondents said they’d be willing to take on a higher tax burden in order to implement certain policies.

For example, 27% said they would pay more in taxes if it meant better pay for teachers. Likewise, 26% would pay more for student loan forgiveness for all borrowers, 25% would be willing to do so for more equitable funding for K-12 public schools, and 23% would accept an increase in their tax bill if it meant tuition-free college.

Current student loan borrowers were especially willing to accept a future tax raise in exchange for student loan forgiveness, with 52% in favor.

On the other hand, 24% said none of the education policies listed would be worth a tax hike. Views differed here based on partisan leanings, as self-identified Republicans were more likely to rule out adding taxes for such programs (26%) compared to Democrats (13%).

About 1 in 2 say student loan forgiveness and tuition-free college may happen soon

As for whether such policy proposals might be enacted in the future, a majority of respondents saw tuition-free college (50%) and student mass loan forgiveness (55%) as either “somewhat likely” or “extremely likely” to become reality by 2025.

Views on this differed by partisan leanings, with more self-identified Republicans seeing mass forgiveness as “extremely likely” over the next five years, compared to their Democratic counterparts (30% versus 21%).

The same trend held for those predicting tuition-free college as extremely likely, with more Republican supporters holding this opinion than Democrats (29% versus 16%).

As for generational differences, 41% of Gen X respondents said student loan forgiveness was extremely likely over the next five years, while somewhat fewer Gen Zers (16%) and millennials (24%) agreed. Among baby boomers and the silent generation, however, only 5% saw an extreme likelihood of mass forgiveness.

Voters unclear on what tuition-free college means

Despite tuition-free college being one of the top education concerns, the majority of those surveyed had misconceptions about what the policy actually means.

Just 39% were aware that tuition-free college generally means students would still need to pay for housing, meals, books and course fees. But 31% mistakenly believed “tuition-free” included housing and meal costs, and 30% thought it would cover all of a student’s expenses.

A larger proportion of younger respondents had these misconceptions, compared to older generations. Likewise, current student loan borrowers were more likely to wrongly think the proposal includes all expenses (49%) than were those who never took out student loans (24%).

The truth is that “tuition-free” – as the term is used by most colleges and policymakers –usually refers only to covering students’ tuition, rather than the entire “cost of attendance.”

Most think candidates aren’t focusing enough on education policy

While our survey found that many prospective voters do care about education-related issues, a slight majority (51%) said the two main presidential candidates were not focusing on education policies enough during their campaigns.

Student loan borrowers were especially likely to feel this way (62% versus 47% who never had student loans). At the same time, more self-identified Democrats (61%) and independents (50%) felt this way than did self-identified Republicans (43%).

Regardless of their priorities when it comes to education issues, a large majority of respondents said they planned to make their voices heard this November. Roughly 82% said they were either “100% likely” or “most likely” to vote, while about 10% were “somewhat unlikely” or “100% unlikely,” and 9% were unsure. This would compare to a 61% voter turnout in 2016, as reported by the U.S. Census Bureau.

LendingTree commissioned Qualtrics to conduct an online survey of 1,029 Americans over 18 years of age, with the sample base proportioned to represent the overall population. The survey was fielded Aug. 25, 2020. Responses were included regardless of how likely the respondent said they were to vote.

For the purposes of our survey, generations are defined as the following age brackets:

- Gen Z as ages 18-23

- Millennials as ages 24-39

- Gen X as ages 40-54

- Baby boomers as ages 55-74

- Silent generation as ages 75+