43% of Those Under 40 Thinking About Returning to School: Survey

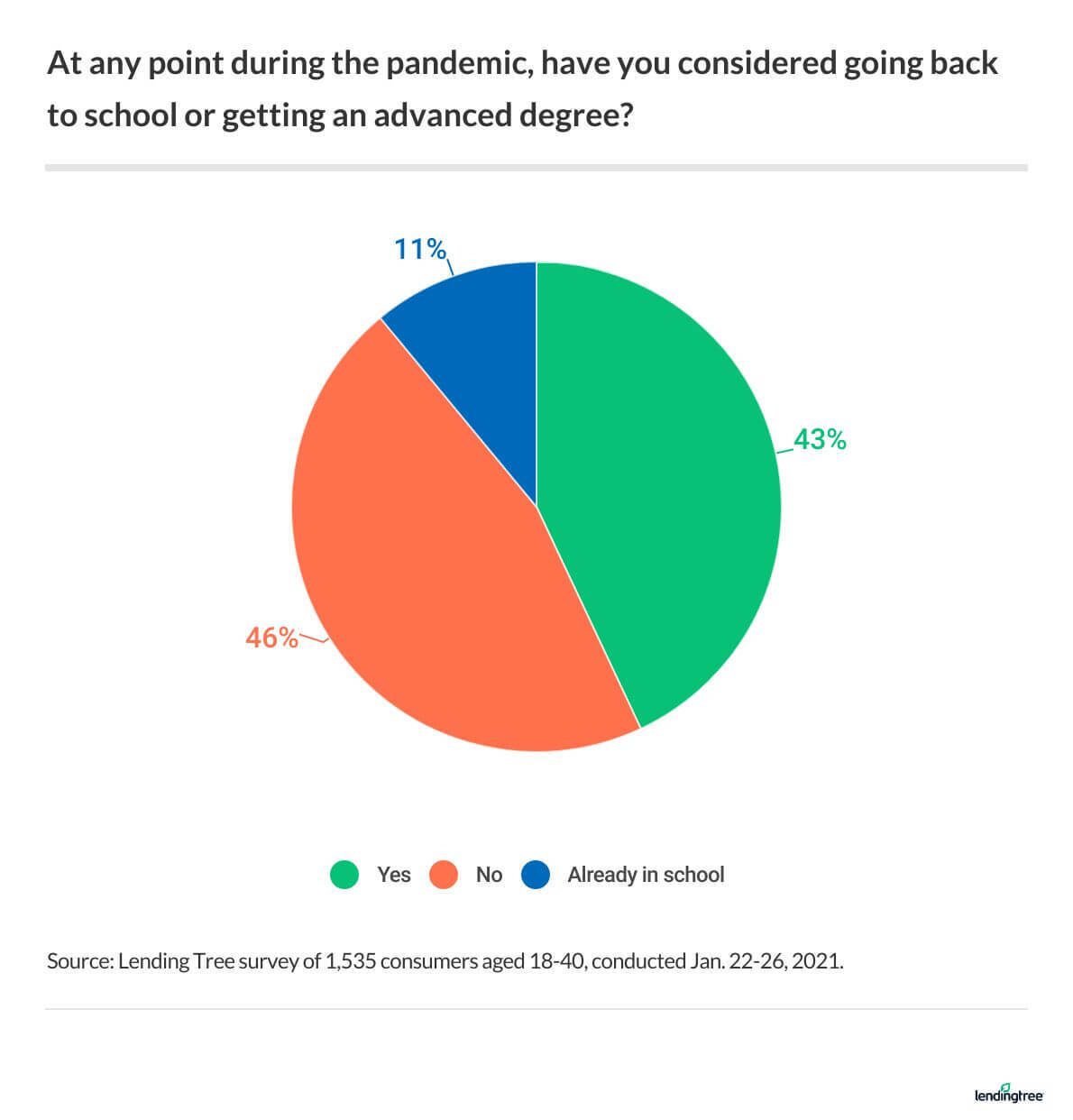

If you’ve grown weary of baking banana bread and binge-watching Netflix, you could consider another activity to get you through the pandemic — going back to school. LendingTree surveyed over 1,500 Americans between the ages of 18 and 40, and we found that 43% of them are contemplating furthering their education.

Their primary motivation? To increase their income. Plus, many respondents are also interested in changing their careers entirely.

Key findings

- 43% of adults aged under 40 have considered going back to school amid the pandemic. Those who have student loan debt or who have been laid off or furloughed are especially likely to be thinking about continuing their education. (Read more)

- 57% of those surveyed expect that furthering their education would result in a significant salary increase. Almost half (49%) want to start a new career. (Read more)

- Millennials seem to be more drawn to MBA programs, while Gen Zers tend to prefer law school. Women were more likely to consider a medical or nursing degree, but men appeared more focused on business and law. (Read more)

- Among student loan borrowers, 46% said they would take on additional debt to earn an advanced degree. (Read more)

- Of those not considering a return to school, 35% said they would reconsider it if they didn’t need to pay for their education, and 34% they would do so if it led to a higher income. (Read more)

43% of consumers interested in going back to school

The global pandemic and concomitant economic downturn has many Americans thinking about going back to school. As noted above, our findings show 43% of consumers have thought about pursuing an advanced degree amid the pandemic.

The proportion of those considering school rises to 54% among those who were laid off or furloughed, and 51% among those whose hours or salary were cut.

But while job loss might be motivating people to further their education, having student loan debt doesn’t seem to be a big deterrent. Nearly 3 in 5 (59%) of those with student loan debt said they were considering going back to school, even though it might involve taking on additional student loans.

Some focus on education as a way to increase income

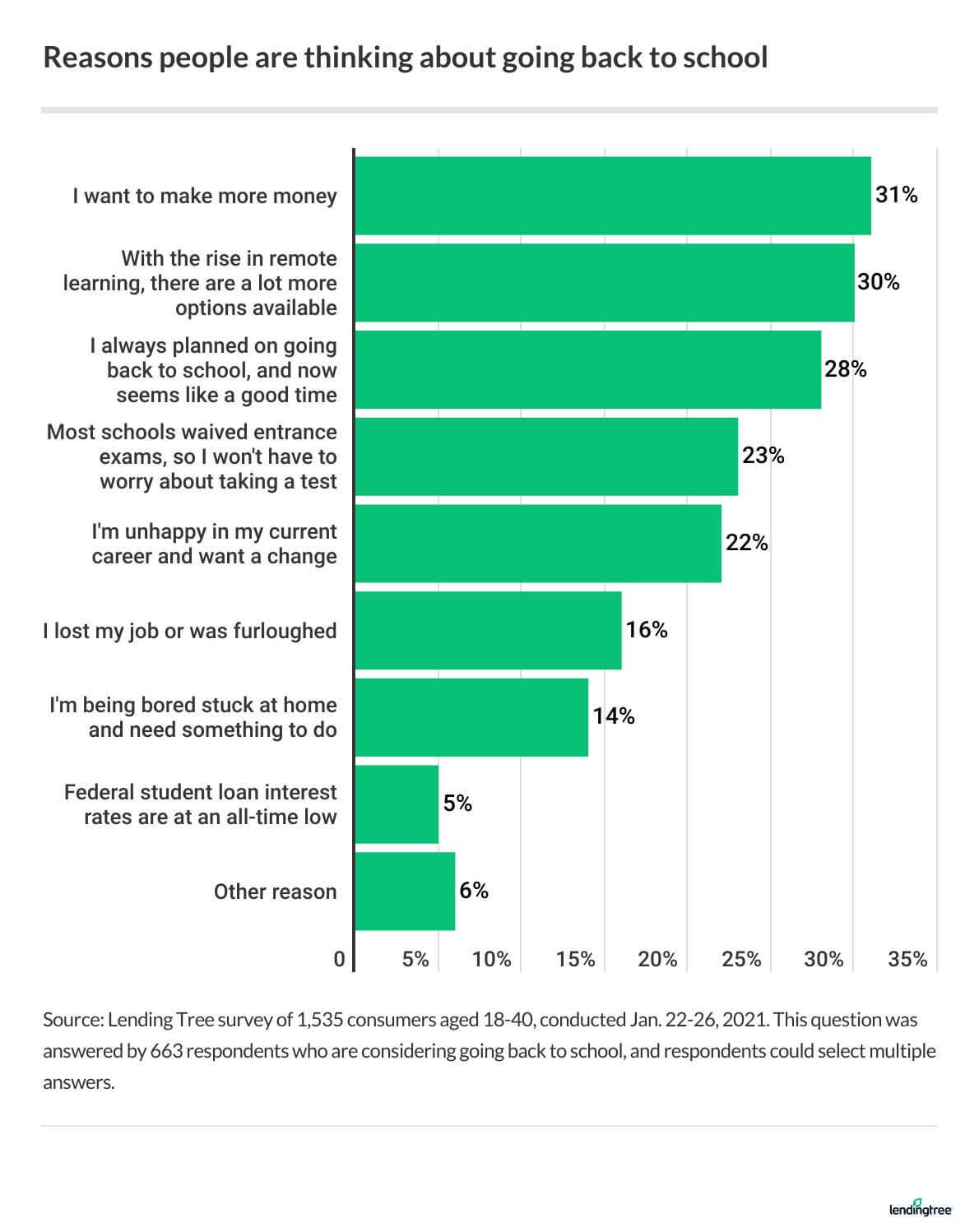

It’s no secret that furthering your education can lead to an increase in income, and this appears to be the primary motivation for roughly a third of those considering going back to school.

Here are the top reasons people said they were interested in obtaining another degree:

- 31% wanted to make more money

- 30% said the rise in remote learning provides more options

- 28% had always planned on going back to school, and now seemed like a good time

- 23% said that since many schools were waiving entrance exams, they wouldn’t have to worry about taking a test

- 22% were unhappy in their career and wanted a change

- 16% lost their job or were furloughed

- 14% were bored being stuck at home and needed something to do

- 5% said they were interested because federal student loan interest rates are at an all-time low

A little over one-third of respondents considering a return to school (36%) said they would continue in their current field after graduating, but almost half (49%) planned to start a new career entirely. (The remaining 15% had yet to decide.)

The number of people interested in changing careers was especially high among older millennials (ages 33-40), with 60% looking at this option. By comparison, 45% of younger millennials (ages 25-32) and 43% of Gen Zers were also looking at a new career.

And this interest isn’t just theoretical — 35% said they had already applied to a degree program, and another 27% had started filling out their applications.

Business, medical and law school are most popular options

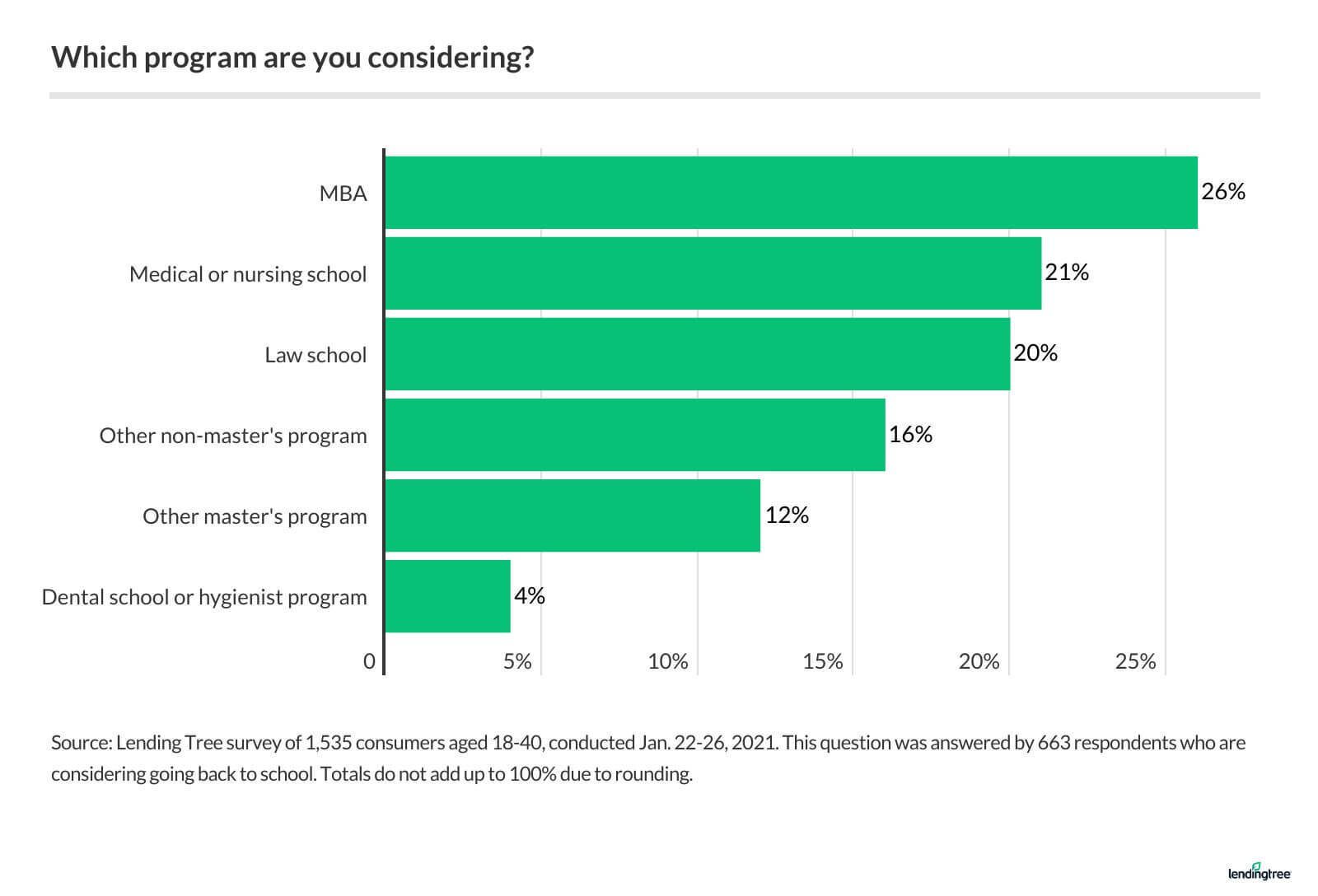

When it comes to choosing a degree program, respondents were roughly split among MBA, medical or nursing school and law school, with business school slightly edging out the other two.

Among those respondents who said they might return or would return to school, 26% were considering an MBA, 21% had their sights set on medical or nursing school, and 20% were interested in law school.

Men were more likely to be interested in business school than women (32% versus 20%), as well as law school (24% versus 15%). Women, on the other hand, were more than twice as likely to pursue medical or nursing school (30% versus 13%).

Meanwhile, 32% of older millennials were interested in an MBA versus just 20% of Gen Zers. However, members of Gen Z were more likely to consider law school, with 27% interested versus 14% of older millennials.

Of course, business, medical and law school aren’t your only options for going back to school. Among respondents, 12% were interested in another type of master’s program, such as a master’s in education, engineering or psychology.

A slightly larger percentage — 16% — indicated plans for vocational training or other post-secondary schools, such as medical billing, welding, culinary school, paramedic school and esthetician programs.

An additional 4% said they were interested in dental school or a dental hygienist program.

Regardless of what they planned to study, those surveyed were divided over whether they preferred in-person or online classes. Even if there were no coronavirus restrictions in place, 45% said they’d prefer to take classes online, while 47% would rather join an in-person program.

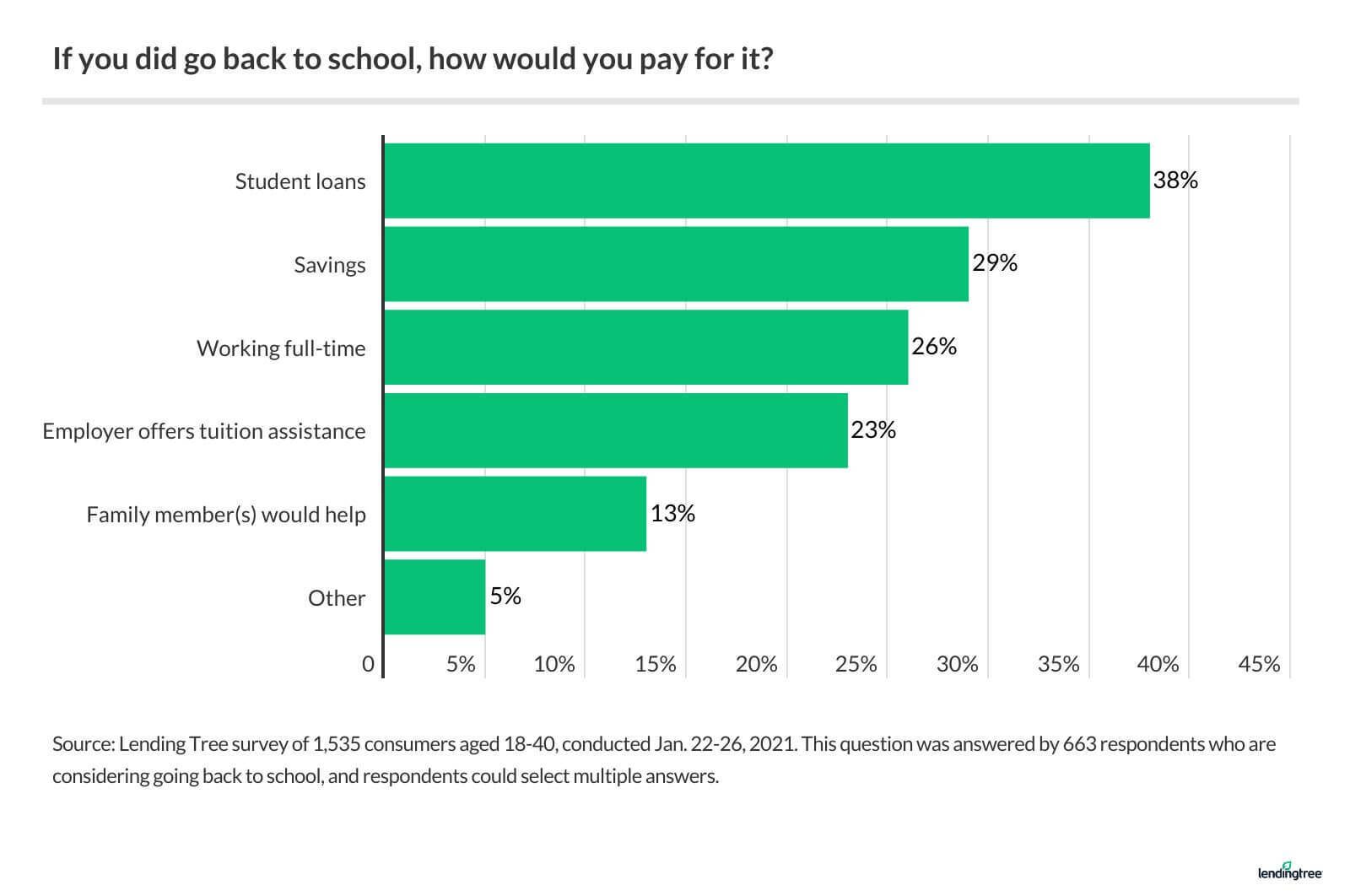

Many would borrow student loans to pay for school

When it comes to paying for school, student loans appeared to be the most popular option. In total, 38% said they would take out student loans to finance their degree. Women were especially likely to turn to student loans — 46% said they would borrow, compared to 30% of men.

Current student loan borrowers were also willing to take on more debt to further their education, with 46% of borrowers say they would take out more.

An additional 29% said they would rely on savings, 26% planned to work full-time while going to school, and 23% said their employer offered tuition assistance. Another 13% said they had parents or other family members who could help.

Although the costs of graduate school can be high, many respondents said they believed the investment would pay off in the long run. Among those who wanted to continue their education, 57% said they expected a “significant” salary increase upon graduation, and 32% expected a “small” salary increase.

More people would consider grad school if it were less expensive

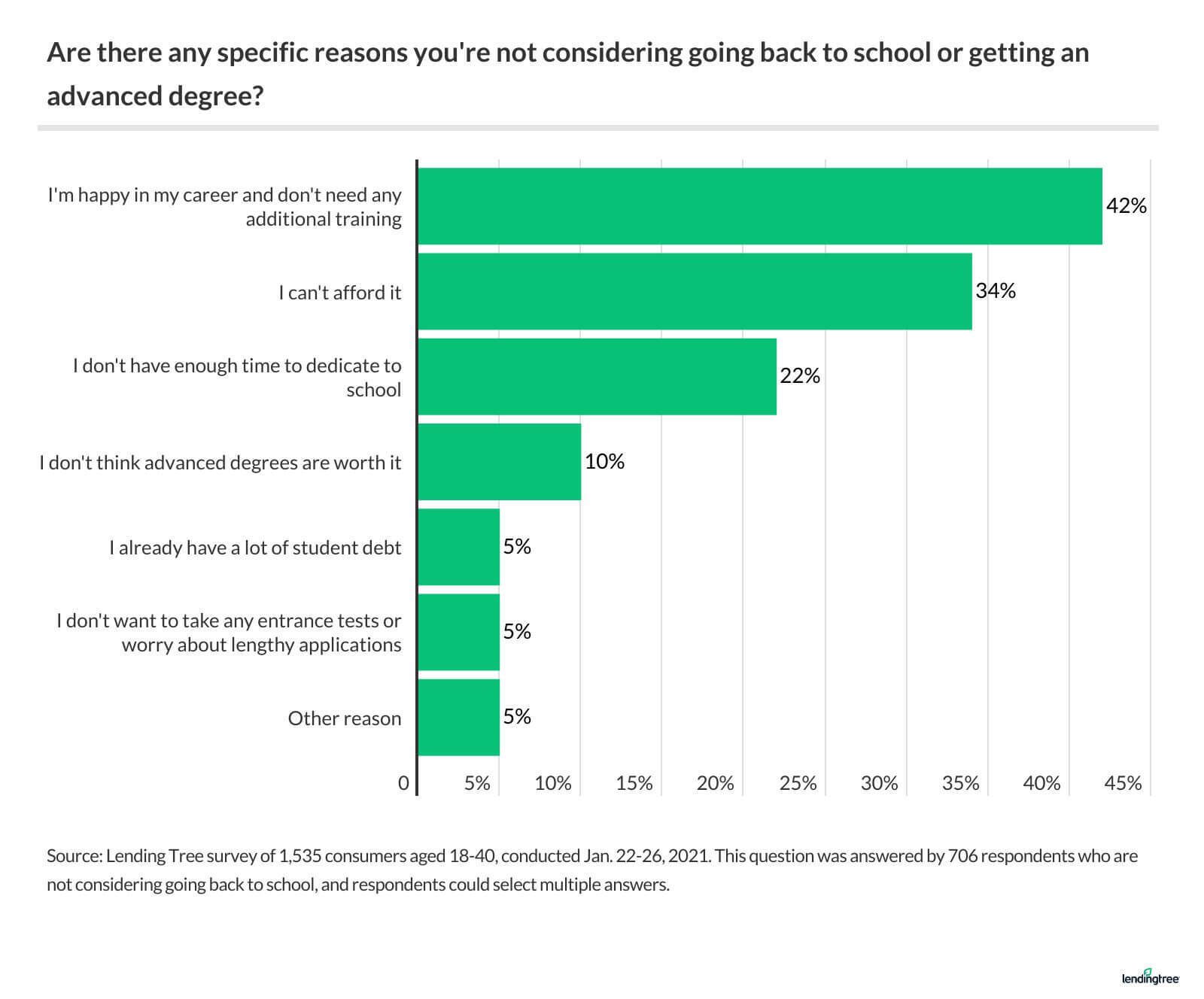

Still, not everyone is interested in returning to school. A plurality of those surveyed — 46% — said they weren’t considering going back to school at all. And within that group, 42% said they were happy in their career and didn’t need any additional training.

Here were some other reasons why people were not considering a return to school:

- 34% couldn’t afford it

- 22% didn’t have enough time for school

- 10% didn’t think advanced degrees were worth it

- 5% already had a lot of student debt

- 5% didn’t want to take any entrance tests or worry about lengthy applications

At the same, 69% of those not planning on further education said that they would be interested if circumstances were different. Specifically, 35% expressed interest if they didn’t have to pay for it, while 34% saying they’d consider it if it would boost their salary.

Consider the return on investment of going back to school

While furthering your education can lead to a boost in salary or a new career, it’s useful to consider your potential return on investment before enrolling. Graduate school can require a significant amount of time and money, so you’ll want to make sure your efforts will pay off.

Consider what career you’ll pursue after graduating and how your future earnings could offset the amount you spend in gaining your degree. You could also consider bringing costs down by working while you study, as well as by applying to scholarships.

If you’re considering student loans, federal loans should probably be your first choice, since they come with relatively low interest rates and flexible repayment plans. But if you need additional funding, make sure to compare your options for private student loans, so you can find one with borrower-friendly terms and a low cost of borrowing.

Methodology

LendingTree commissioned Qualtrics to field an online survey of 1,535 Americans aged 18 to 40. The survey was conducted Jan. 22-26, 2021, and administered using a non-probability-based sample, with quotas used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined the generational cohorts as the following ages in 2021:

- Generation Z: 18 to 24

- Younger millennial: 25 to 32

- Older millennial: 33 to 40