Do Millennials Have It Better or Worse Than Generations Past?

It’s time to settle the debate on millennials once and for all. Where one person might call millennials entitled, another might say they were dealt a rotten hand. Where one says they should stop complaining and grow up, another says that financial hardships are unfairly holding them back.

So which one is it? Are millennials lazy or unlucky? Do they have difficult circumstances or is it all an excuse?

In an effort to understand what millennials are dealing with, we decided to evaluate the cost of living for generations past. From the silent generation to the newly minted Generation Z, here’s our study on how the cost of living has changed over the past few decades.

Key study takeaways

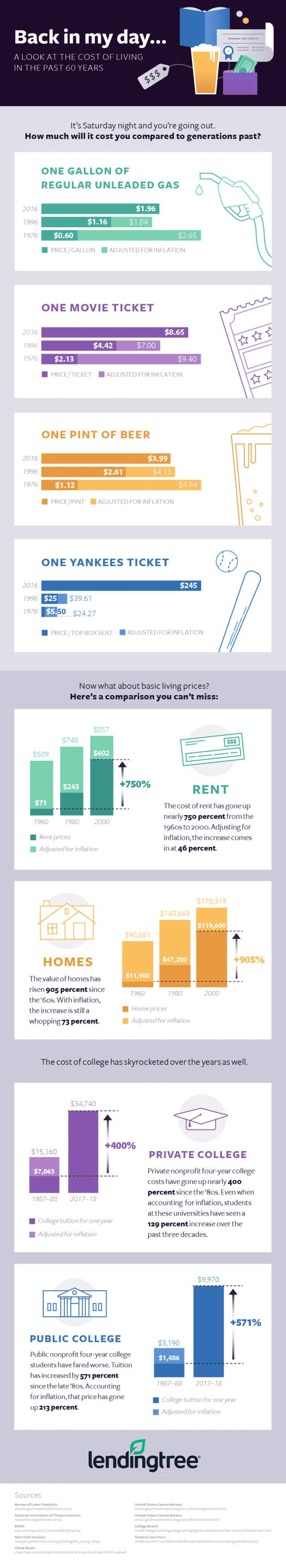

- Rent costs: Millennials pay the highest rents when entering the workforce, with a 2017 average of $1,358. By comparison, Gen-Xers paid just $850 (in today’s dollars) in rent per month at the same life stage, and the Silent Generation paid under $500.

- Homeownership: Millennials buying their first homes today will pay 39% more than baby boomers taking the same step in the 1980s.

- Getting a degree: When millennials were born, tuition at public 4-year colleges was just $3,190 per year (adjusted for inflation). By the time they grew up and enrolled in college, tuition rose 213% to today’s cost of $9,970 per year.

- Earning more: Millennials and other generations have benefitted from a 67% rise in wages since 1970. However, these gains have not been enough to keep up with ever-inflating living costs. Rent, home prices, and college costs have all increased faster than incomes in the U.S.

Cost of living by generation

Before getting into the facts about how much life has cost for each generation, we should first talk about what these generations are. The years for each one vary slightly depending on who you ask, but here’s how the Pew Research Center defines them:

| Generation | Birth years |

|---|---|

| Silent generation | 1928-1945 |

| Baby boomers | 1946-1964 |

| Generation X | 1965-1980 |

| Millennials | 1980 and on |

In short, if you’re an older millennial, your grandparents were likely in the silent generation, your parents were probably baby boomers, and your older cousins might be part of Generation X.

And your little cousins or siblings? The newest generation is being referred to as Generation Z. Those born around 1996 commonly fall into this group.

Wondering why a mortgage isn’t in your sights? It could be your rent

Nothing seems to represent the American dream more than owning your own home. After all, many millennials grew up hearing the adage that happiness is a house with a white picket fence, a dog, and kids.

So why does the dream seem so far-fetched now? Besides home values, the sheer amount of your paycheck going to rent could have a lot to do with it. It can be hard saving for a home down payment when you have nothing to spare after you pay your bills.

The U.S. Census Bureau calculated median gross rental costs between 1940 and 2000. Here’s how the numbers looked nationwide over the past few decades, and what they would look like today:

| Year | Median gross rent | Cost in today's dollars |

|---|---|---|

| 1940 | $27 | $471 |

| 1950 | $42 | $434 |

| 1960 | $71 | $588 |

| 1970 | $108 | $693 |

| 1980 | $243 | $758 |

| 1990 | $447 | $852 |

| 2000 | $602 | $866 |

In other words, the silent generation paid under $500 for rent on average (in today’s dollars) as they were entering the workforce, whereas Generation X was stuck with a bill of around $850.

And now? Real estate data aggregator Yardi Matrix showed the average U.S. rent in November 2017 was $1,358. The exact amount varies depending on where you live.

According to Apartment List, current residents of lower-cost states, such as Kansas, only have to pay an average of $560 for a one-bedroom apartment. But residents of San Francisco have to shell out a cool $2,400, beating out even New York City’s $2,100 average. Nestled in the middle are cities such as Atlanta, Denver, and Chicago, which average around $1,000.

How about those home values? You might want to start saving

“Quit throwing money away on rent,” they say. “Invest in a home.” That’s easier said than done. When it comes to present-day property values, buying a home might not be so easy.

Let’s see why, with the help of data from the U.S. Census Bureau:

| Year | Median home value | Cost in today's dollars |

|---|---|---|

| 1940 | $2,938 | $51,328 |

| 1950 | $7,354 | $75,993 |

| 1960 | $11,900 | $98,627 |

| 1970 | $17,000 | $109,213 |

| 1980 | $47,200 | $147,326 |

| 1990 | $79,100 | $150,773 |

| 2000 | $119,600 | $172,058 |

The sharp rise in home values makes the recommended 20% down payment even more difficult to achieve. In November 2017, real estate website Zillow showed that the median home value was a whopping $205,100.

Compared to what baby boomers might’ve paid in 1980, that’s a 39% increase. And compared to the homes in which the silent generation grew up, you’re looking at a nearly 300% higher price in today’s dollars.

And if you want a good job to pay the bills, don’t forget about college

Here comes the really fun statistic: the price of college. With nearly $1.5 trillion in outstanding student loan debt and 44 million student loan borrowers, the heavy cost of college weighs on the economy. But do these eye-popping numbers mean the cost is increasing? Or are more people going to college?

Here’s what the College Board shows in prices for four-year nonprofit public colleges and four-year nonprofit private colleges:

| Year | Public | Public school cost in today's dollars | Private | Private school cost in today's dollars |

|---|---|---|---|---|

| 1987-1988 | $1,490 | $3,190 | $7,050 | $15,160 |

| 1997-1998 | $3,110 | $4,740 | $13,790 | $21,020 |

| 2007-2008 | $6,190 | $7,280 | $23,420 | $27,520 |

| 2017-2018 | $9,970 | $9,970 | $34,740 | $34,740 |

The numbers are clear: It hasn’t taken long for tuition to increase. Between the years when millennials were born and a few years after they finished college, the cost of an undergraduate degree rose 213% at public schools.

Private school college students fared somewhat better, with their cost of tuition going up by 129%.

While older data is harder to come by, college tuition was more affordable for older generations. For example, the University of Pennsylvania, a private Ivy League university, cost $640 in 1948, right around when the silent generation began college. That’s a little more than $6,200 in today’s dollars, compared to the school’s current sticker price of around $50,000.

So where does income come into play?

Life’s major milestones are now more expensive. But are millennials’ take-home pay increasing along with these costs?

Here’s what the U.S. Census Bureau has to say:

| Year | Average annual income | Value in today's dollars |

|---|---|---|

| 1970 | $3,177 | $20,410 |

| 1980 | $7,787 | $24,306 |

| 1990 | $14,387 | $27,423 |

| 2000 | $22,346 | $32,147 |

| 2010 | $26,558 | $29,763 |

| 2016 | $33,205 | $34,035 |

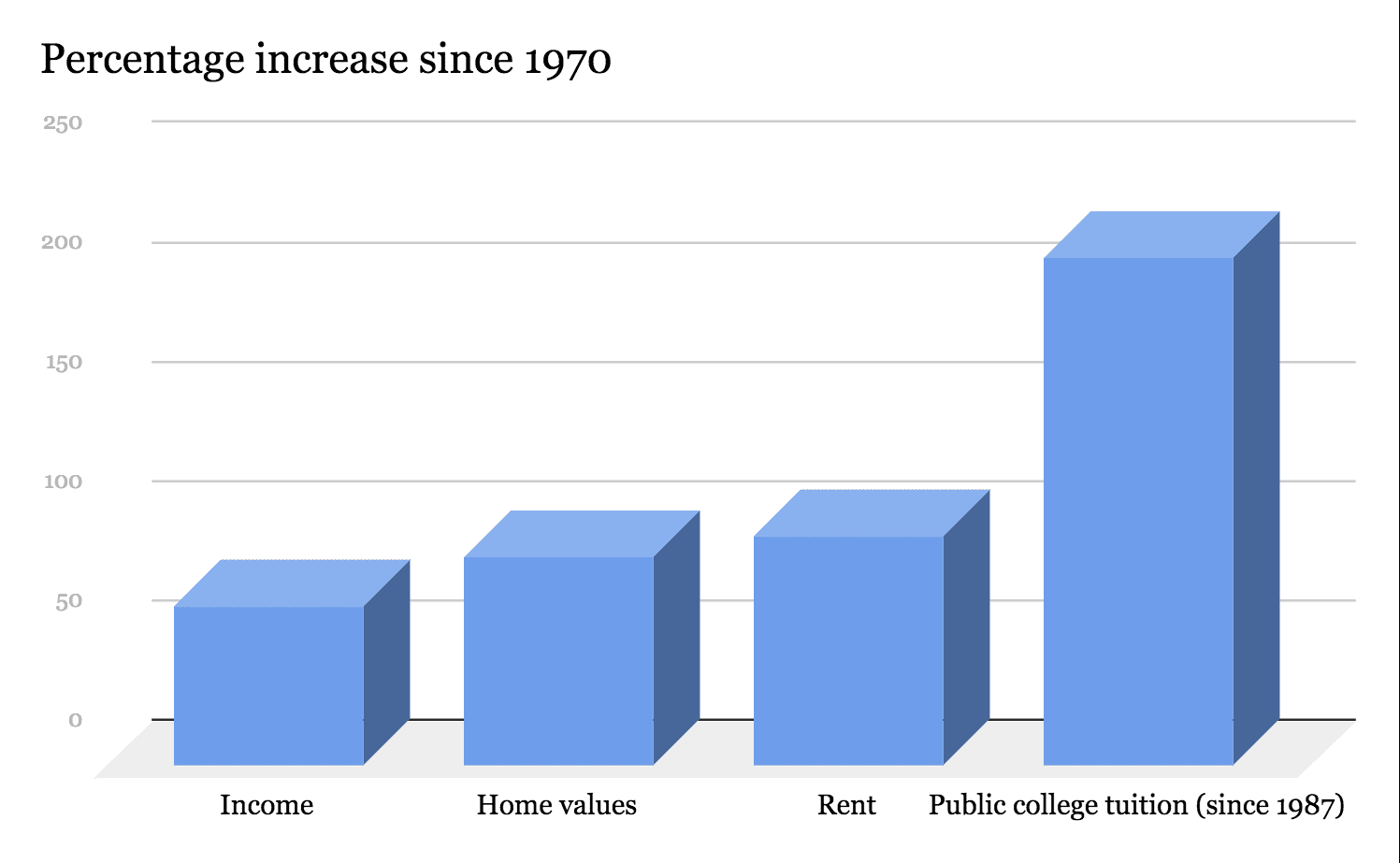

This data points to a 67% growth of income since 1970, when members of the silent generation were well into their careers and older baby boomers were entering the workforce. Now, let’s compare that to the growth in costs:

As you can see, the growth of income isn’t enough to cover the increase in the cost of shelter. And it doesn’t even come close to the increasing cost of college.

Millennials must adapt to today’s financial realities

Every generation has its own struggles. While it seems as though the silent generation’s prices were lower in comparison to today, many people from that generation were born into the Great Depression and witnessed World War II. Things certainly weren’t easy for the generation responsible for helping rebuild the U.S.

Even still, millennials coming of age during the Great Recession faced a rude awakening when the high cost of an education didn’t lead to higher earnings. Underemployment and living costs coupled with student loan payments have made it difficult for millennials to get ahead.

Facing a stark set of financial circumstances, millennials started adulthood with less room for financial mistakes than previous generations. In response, they are managing their money differently. More millennials are refinancing student loans, delaying a home purchase, and looking for creative ways to earn more money through side hustles.

Bottom line: This study shows that millennials are not falling behind financially due to their own failings. Far from it — their ingenuity and flexibility have allowed them to adapt, despite the high demands and high costs they face.

Methodology

Data was sourced from the Pew Research Center, the U.S. Census Bureau, Yardi Matrix, Apartment List, Zillow, and the College Board. All prices from past decades were converted to the equivalent in January 2017 dollars using the Bureau of Labor Statistics Inflation Calculator. The only exception was with college prices, which were reported in 2017 dollars and converted to their historical nominal prices for September of the given year to line up with the start of the academic calendar.