How to Make and Stick to a Student Budget in College

A college student budget can be easy to set up and manage because there may be fewer sources of income and expenses to track. Even though you may not have a lot of income as a college student, learning how to budget may wind up being one of the most valuable skills you pick up.

How to budget for students

While the basic budgeting process requires you to track your income and expenses, the deeper fundamentals can be more difficult. You’ll want to identify and set goals, and then figure out how to budget and save money to make progress toward achieving those goals. Here are four steps you can take to start.

Plus:

1. Estimate your monthly expenses

College expenses can vary greatly depending on where you go to school, your program, extracurriculars and your arrangements for room and board. You can start estimating how much you spend each month by writing down all the potential expense categories, including:

- Food

- Transportation

- Entertainment

- Clothing

- Books and supplies

- Rent

- Utilities

Depending on how precise you want your student budget to be, you can break the categories into subcategories as well. For example, you might create subcategories under food for groceries, coffee, eating out and eating in the dining hall.

Over time, you’ll figure out your average monthly expenses for each category and can make sure you plan ahead and have enough money to cover your bills — or have a plan for cutting back and saving money. But to start, write down an estimated amount next to each category.

2. Determine your monthly income

The average college student’s income may be fairly low. While more than 70% of college students work while enrolled, many take on part-time jobs, have limited work-study awards or work during the summer to build their savings. Some students may also have “income” from their parents. You should try to openly discuss how much money you can expect to receive and whether it’s a steady amount for living expenses or only for emergencies.

Student loans can also seem like income, as you may be able to use the money for living expenses. However, while a loan can give you money to spend, remember that you’ll also have to repay the loans plus interest. Limiting how much you borrow now can make budgeting trickier, but it’ll also help you save money later.

If you don’t have a steady income and are relying on savings or loans, it can be tricky to figure out what you should use for your monthly income in your student budget. Consider dividing what you have by the number of months you need to make it last. For example, if you save up $3,000 over the summer and have eight months of school, you can divide the $3,000 by eight and set your monthly “income” at $375.

In the end, you want your monthly expenses and income to at least match up. When you have more expenses, you’ll need to find ways to save money or increase your income. And when you have more income, you can put the extra money into one of your savings goals.

3. Track your spending

After you have your estimates for your expenses and income, you can start tracking your spending. Over time, the data you collect can help you better understand and control your finances. There aren’t many specific budgeting apps for college students, but the top budgeting apps can work well for students and graduates alike.

You may have semi-regular expenses, such as payments for room and board, that are due at the beginning of each semester or quarter. Similar to your income, you may want to split up and track the expense monthly. Or, you may want to subtract the expense from your income at the start of each term and use the remaining difference as the starting point for your monthly income. Learning how to deal with these semi-regular expenses is a standard part of budgeting after graduation as well. Many major expenses, including insurance and registration, get charged semiannually or annually.

Try to track every expense at first — even if you spend $1 on a snack — but don’t get discouraged if you forget sometimes or find your monthly income doesn’t cover all your monthly expenses.

Getting into the habit of budgeting and adjusting the numbers as you go is part of the process. Although, if you find you’re spending hundreds of dollars going out every weekend, part of the adjustment may be a lifestyle change. Either find additional income or cut back on your expenses.

4. Remember to set some money aside

Another important part of budgeting is making sure you’re saving money for life’s necessities and pleasures.

You can do this by adding different savings goals as expenses within your budget, and allocating your income to cover the “expense” every month. In practice, you can move the money into a separate savings account if you don’t spend it that month.

You might not know how much to save each month, but try to save up several hundred dollars in an emergency fund. You can use the money to:

- Repair your vehicle

- Buy a last-minute flight home

- Cover another unexpected crisis

Other goals may be a little more fun:

- Saving up for a semester abroad

- Traveling during spring break

- Collecting a security deposit for off-campus housing

Or, if you’re taking a long-term approach to your finances, perhaps you want to pay off student loans early (or avoid taking them out altogether) to save money on interest.

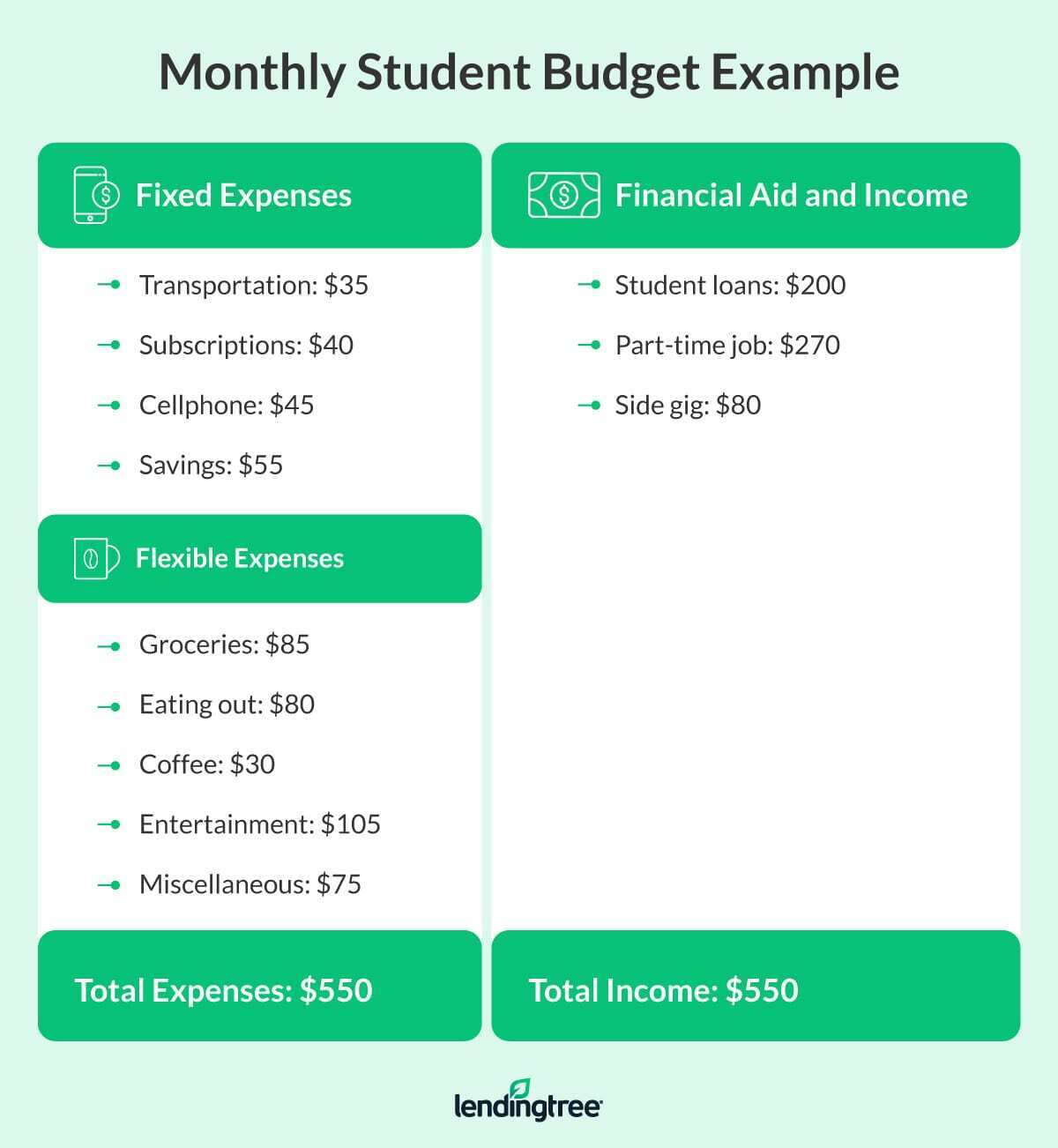

Example of a college budget template

Basic budgeting worksheets for students will have spaces for fixed and flexible expenses, and you can compare these expenses to your income. You can find college student budget templates online or create your own using a spreadsheet.

More budgeting tips for college students

Here are some more budgeting tips that that can help you stay the course by increasing your income, decreasing your expenses and wisely using your money:

- Be cautious with credit. You may have access to a credit card or student loans, but try to plan ahead before you swipe your card or take a disbursement. Remember, you’ll need to repay the money you spend plus interest, which can strain your budget in the future.

- Rent or buy used textbooks. Renting textbooks, or buying used books, is a tried-and-true way to save money in college. Start by asking around to see if anyone you know recently finished the course in which you’re interested, and buy directly from the person rather than the campus bookstore.

- Take advantage of student discounts. Many retailers and restaurants offer a student discount if you show your student ID or have a .edu email address. These can help you save money on clothing, electronics, food and more.

- Look for freebies. Online marketplaces such as Craigslist often have freebie sections, and you can join local Facebook groups devoted to giving away (rather than selling) unwanted products. It’s a great way to save money and reuse something that may otherwise wind up in the trash.

- Become a rewards member. Airlines, movie theaters, restaurants and other stores have loyalty programs, and you can join many of them at no cost. You might receive instant savings or earn rewards that you can redeem later. But don’t stop comparison shopping.

- Start a side gig. Sometimes it’s easier to earn money than to cut back, especially if you’re already fairly frugal. There are many side gigs available to college students, and some of them can even become lucrative small businesses. Ask around campus as well, as some college departments may pay you to participate in research studies.

- Use your school’s resources. Part of your tuition goes toward funding school programs, and you should learn about and use these resources. There may be no-cost tutors, health care, career advisors and emergency loans or grants available, but you have to ask for help first.