The Extended Repayment Plan Could Lower Your Student Loan Payments

“I love deadlines. I love the whooshing noise they make as they go by.” Author Douglas Adams probably wasn’t talking about student loans, but he might as well have been.

If you have a large amount of federal student loan debt, meeting the standard 10-year deadline for paying it off can feel impossible. An extended repayment plan could push back that deadline, offering up to 15 additional years to pay off your federal student loans.

Read on for a deeper look at the extended repayment plan, including…

How the extended repayment plan works

Pros of the extended repayment plan

Cons of the extended repayment plan

Comparing your federal student loan repayment options

How the extended repayment plan works

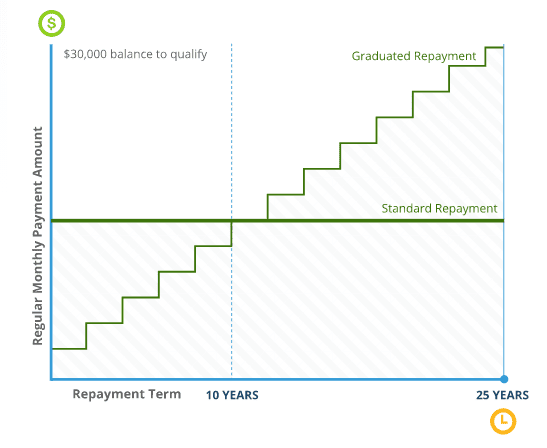

The extended repayment plan gives you up to 25 years to pay off your loans, so your monthly payment will generally be lower.

With extended repayment, you have two options for paying your student loan payments:

- Extended fixed repayment plan: Your monthly student loan bills stay the same throughout repayment.

- Extended graduated repayment plan: Your payments start low and then increase — usually every two years.

Your monthly payments will be lower than what they’d be with the standard or graduated repayment plans, though you’ll pay more (in interest) than you would under the standard one.

Which student loans are eligible?

The extended repayment plan is best for borrowers with a large amount of debt. You’ll need to have at least $30,000 in federal student loans to be eligible.

You must also have at least one of the following loans:

- Direct subsidized loan

- Direct unsubsidized loan

- Direct PLUS loan

- Direct consolidation loan

- Subsidized federal Stafford loan

- Unsubsidized federal Stafford loan

- Federal family education loan (FFEL) PLUS loan

- FFEL consolidation loan

Let’s say you have $35,000 in federal direct loans and $5,000 in an FFEL consolidation loan. You could put your direct loans on the extended repayment plan, but your FFEL loans wouldn’t qualify. The only workaround would be to consolidate your student loans before applying.

Neither direct loan and FFEL borrowers can have outstanding balances from before Oct. 7, 1998. But as long as you have at least $30,000 in direct or FFEL loans that you obtained after this date, you might be eligible for the extended repayment plan.

Pros of the extended repayment plan

The benefit of an extended repayment plan is that it lowers your monthly payments.

For example, if you have $35,000 in unsubsidized federal student loans with a 4.53% interest rate, you might struggle to keep up with the $363 monthly payment on the standard plan.

By applying for the extended repayment plan with fixed payments, you could lower your bill to $195 a month.

As we’ve noted, you can also pay back your loans under a fixed or graduated amount. For our example — $35,000 at 4.53% — here’s what your payments could look like on each plan.

| Extended fixed repayment plan | Extended graduated repayment plan | |

|---|---|---|

| Initial monthly payment | $195 | $130 |

| Final monthly payment | $195 | $338 |

| Total paid over time | $58,541 | $64,235 |

Cons of the extended repayment plan

Although lowering your monthly student loan bill might sound tempting, there are also downsides of the extended repayment plan.

You’ll be in debt longer. This plan can add as many as 15 years to the typical 10-year plan, which means you’ll be making student loan payments for a long time.

You’ll pay a lot of student loan interest. Let’s take that example of a $35,000 loan again. On the standard 10-year plan, you’ll pay $8,589 in student loan interest — on the extended repayment plan with fixed payments, you’ll pay $23,541.

Other plans could get you lower monthly payments. Income-based repayment, for example, could lower your student loan payments to as little as 10% of your discretionary income — if you qualify.

This plan doesn’t qualify for Public Service Loan Forgiveness (PSLF). If you’re working toward Public Service Loan Forgiveness, you wouldn’t be able to qualify under this plan — payments on the extended repayment plan are not eligible.

Before choosing extended repayment, weigh the pros and cons. Although this plan might help in the short term, it may be less appealing when you consider the long-term costs.

Comparing your federal student loan repayment options

If you’re looking to lower your monthly student loan payments, the extended repayment plan isn’t your only option. Check out these other federal student loan repayment plans and choose what’s best for your wallet:

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-based repayment (IBR)

- Income-contingent repayment (ICR)

- Income-sensitive repayment (ISR)

- Graduated repayment plan

Some of these plans could lower your monthly payments even more than the extended plan. Plus, several of them offer loan forgiveness after 20 or 25 years of on-time repayment.

Before selecting a repayment plan, explore all your options. As you compare the plans, take a bird’s-eye view of both the short- and long-term results of your decision — you can use our student loan repayment calculators to help.

In the end, the extended plan might be a lifesaver if you’re hovering near default. But you’ll also need to be prepared for up to 25 years of student loan payments.

If you’re looking to reduce your monthly payments for your federal or private loans, consider student loan refinancing as well. Just be aware that if you refinance a federal loan, you’ll no longer have access to the extended plan, or any other federal repayment plans or forgiveness programs. Refinancing is only a good idea if you’re confident you’ll make enough income to keep up with your payments.