Study: College-Educated Women Face Larger Gender Pay Gap, Even If Women Are More Likely to Enroll and Graduate Than Men

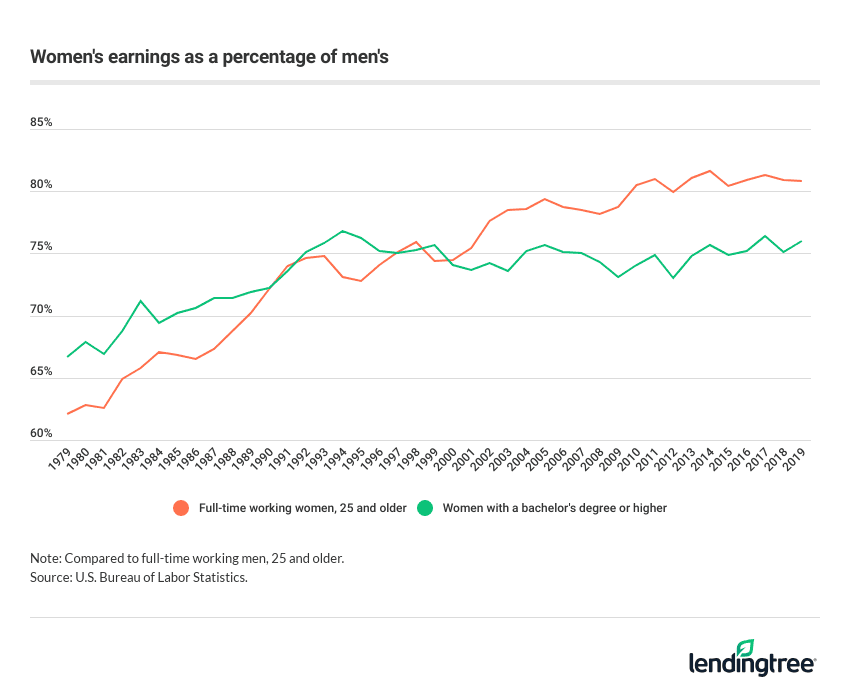

Despite the gender pay gap being hotly debated over the years, the conversations haven’t resulted in much change. Women are rising through the ranks when it comes to higher education, but a degree doesn’t necessarily lead to an increase in pay. In fact, women with bachelor’s degrees or higher earned just 76% of what men did in 2019, according to the latest LendingTree study.

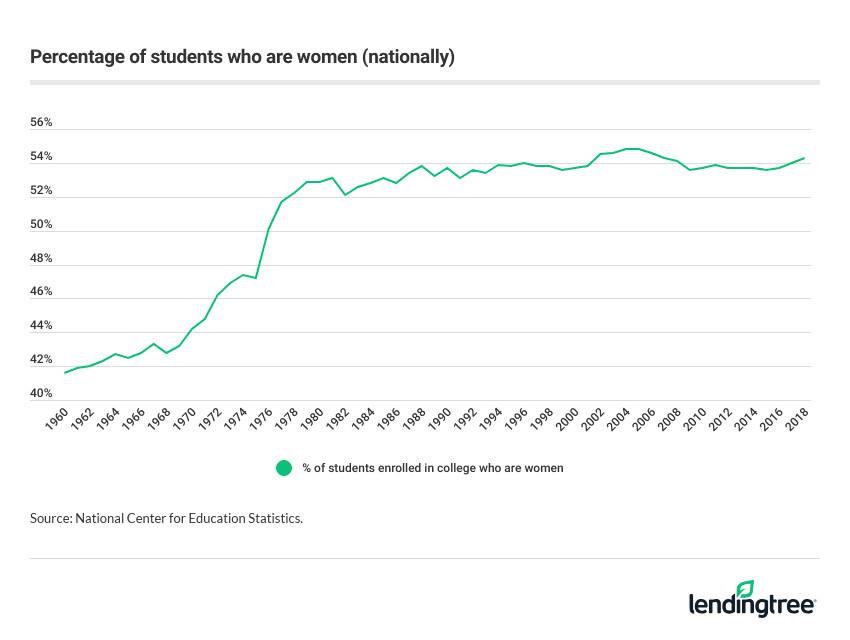

Our researchers found that women have been the student majority at U.S. colleges since 1976, when just over half (50.1%) of students were women. By 2018, that number had risen to 54.3%. Today, New Hampshire (61.9%), Minnesota (61.7%) and Delaware (60.9%) are the states with the most women enrolled in college. Let’s examine these educational trends closer.

- Key findings

- Women with bachelor’s degrees or higher make 76% of what men do

- Women have been the majority student at U.S. colleges since 1976

- New Hampshire, Minnesota lead way with nearly 62% of students being women

- North Dakota, Wyoming at the bottom with less than 54% of students being women

- Women earn more college degrees than men

Key findings

- Women are more likely to enroll in college and graduate, but they’re still making a portion of what men do — degree or not. Women with bachelor’s degrees or higher earned only 76% of what men did in 2019 — the latest available data.

- Women have been the student majority at U.S. colleges since 1976, when 50.1% of students were women. As of 2018 — the latest available data — that figure is 54.3%.

- In New Hampshire and Minnesota, 61.9% and 61.7% of students, respectively, enrolled in college are women — highest in the country. Delaware comes in at No. 3.

- North Dakota has the most even distribution of students.51.7% of students enrolled in North Dakota colleges are women, followed by Wyoming and Montana.

- While women make up 54.3% of students, they earned between 54.3% and 60.9% of degrees — from associate to doctoral — in 2018.

Women with bachelor’s degrees or higher make 76% of what men do

Women with bachelor’s degrees or higher earned only 76% of what full-time working men — 25 and older — did in 2019. Given that the percentage was slightly higher in 1994, 1995 and 2017, the U.S. isn’t seeing much improvement on this front.

However, that percentage does climb gradually when you look at all full-time working women — 25 and older — regardless of degree. In this specific group, women earned 80.8% of what men did in 2019. But to find the year when women with bachelor’s degrees had a closer earnings ratio to men than working women 25 and older in general, you have to go back to 1999.

The earliest data available shows college-educated women used to face a smaller gender pay gap than their less-educated peers, with them earning a higher percentage compared to men than women in general every year between 1979 and 1990.

In 1991, that trend turned, however, and the gender pay gap for all women sunk to lower than that for women with bachelor’s degrees — with college-educated women earning 73.6% of what their male counterparts earned versus 74% for women overall.

Women have been the majority student at U.S. colleges since 1976

In 1976, women made up 50.1% of students, which was their first time passing the 50% threshold on record. From 1976 to 2018 — the latest available data — the rate of women enrolled in college never dropped below 50%, reaching the 54% range by 2018.

When it comes to male college students, enrollment has also risen higher in recent years. In 1976, there were 1,170,326 first-time degree or certificate-seeking male students in degree-granting postsecondary institutions. By 2018, that number was 1,317,522.

However, the number of enrolled male students has ebbed and flowed significantly since 1976, dropping as low as 984,558 in 1994.

New Hampshire, Minnesota lead way with nearly 62% of students being women

Certain states appear to attract more female students than others. Both New Hampshire (61.9%) and Minnesota (61.7%) lead the way — followed closely by Delaware (60.9%) — as the states with the most female students enrolled in college.

Geographically, New Hampshire (Northeast), Minnesota (Midwest) and Delaware (South) are spread out, but they all have female populations that are slightly over 50% — New Hampshire (50.4%), Minnesota (50.2%), and Delaware (51.7%).

North Dakota, Wyoming at the bottom with less than 54% of students being women

The states with the least female students are North Dakota (51.7%) and Wyoming (53.9%), both of which have rates of less than 54%. Montana is close behind at 52.4%.

Similar to the three states at the top of this list, these three have a commonality that could help explain the enrollment figures. Montana (49.7%), Wyoming (49.1%) and North Dakota (48.8%) have female populations of less than 50%, according to U.S. Census Bureau data.

Women earn more college degrees than men

In 2018, women made up the majority of students (54.3%), but they accounted for even more of the student population graduating with master’s degrees (60.9%) and bachelor’s degrees (57.4%).

When it comes to graduation rates, women are much more likely to complete their degrees than men. For example, 39.7% of men in the 2013 cohort — this is the latest data, which represents anyone who entered school that year and graduated within four years — graduated, compared with 49.9% of women.

LendingTree senior writer for student loans Andrew Pentis believes the rise in college enrollment among women is part of a valuable strategy.

According to past LendingTree research, women generally report having less financial confidence than men. They also generally report being less likely to feel confident negotiating their salary.

Pentis believes the first step toward closing the gender gap is for people to get more comfortable talking about compensation with their bosses or human resources departments. He said American workplaces are generally secretive about who earns what, which means that workers must put in the research to understand how to fight for their worth.

He shared a few tips for making this research easier:

- Get online. Visiting salary comparison websites such as Glassdoor can give you a frame of reference for what others, men and women, working in your field and with similar experience are raking in annually.

- Search for a new job. Applying for and receiving job offers can also help you gauge your worth. If a competing company is willing to offer you $60,000 and you’re only making $45,000, you now have ammunition for discussions with your current employer.

- Start with trusted colleagues. Removing the taboo from money conversations at work is a possible step in the right direction. You might broach the topic of compensation with coworkers with whom you have a close relationship.

- Get an outside opinion. If you don’t feel comfortable talking about salary with a fellow employee, you might contact a recruiter who can help estimate your value in the field. That’s another good way to figure out whether there’s an unfair gap between what you’re earning and what your male peers are earning.

Heavy amounts of student loan debt and high monthly payments caused by attending college can be even more stressful for those being underpaid.