Survey: 43% of Credit Card Holders Have More Than $15,000 in Debt

Americans have more credit card debt than ever, with a total of $1.029 trillion in December 2017, according to the Federal Reserve. That’s an average of $8,732 per household, based on current census data.

If you have credit card debt, getting a credit card consolidation loan can help you lower your interest rate and pay down your debt faster. But according to a new LendingTree survey, only 52% of people with more than $6,000 in credit card debt have ever consolidated.

Find out why so many people are hesitant to try consolidation and get some tips on how to pay down your credit card debt faster.

Key findings

We surveyed more than 1,000 people with more than $6,000 in credit card debt and found the following:

- More than 4 in 10 have more than $15,000 in credit card debt.

- Fifty-eight percent have carried credit card debt for more than a year; 21% have carried credit card debt for more than two years.

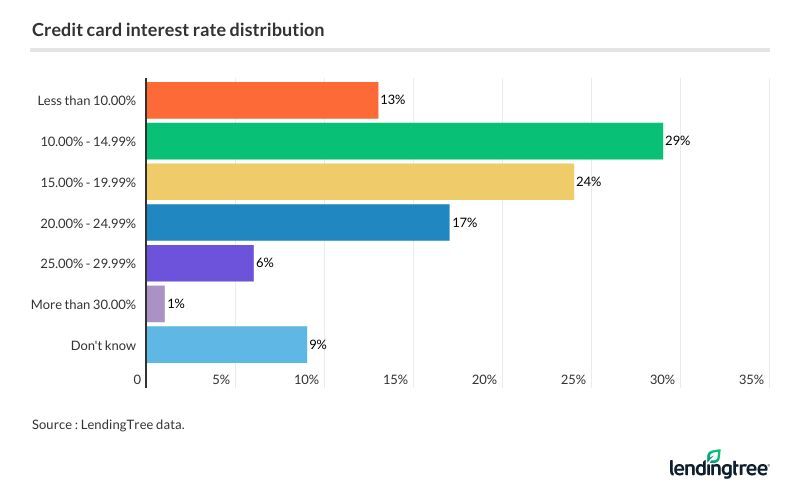

- Roughly a quarter are paying an average APR of 20.00% or more; nearly 10% don’t know their interest rate at all.

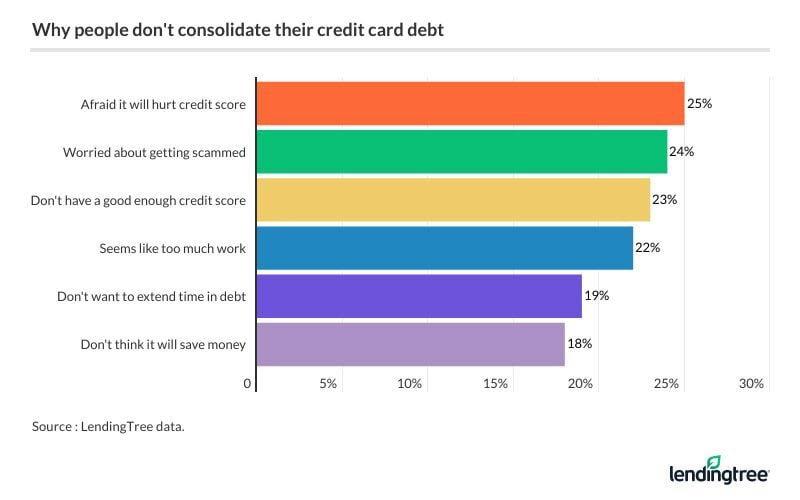

- Almost half have never tried to consolidate their credit card debt. Reasons include “I’m afraid it will hurt my credit score,” “I’m worried about getting scammed,” and “It seems like too much work.”

- Roughly a third have hidden their credit card debt from a significant other out of shame or fear of causing an argument.

How credit card debt can hurt your finances

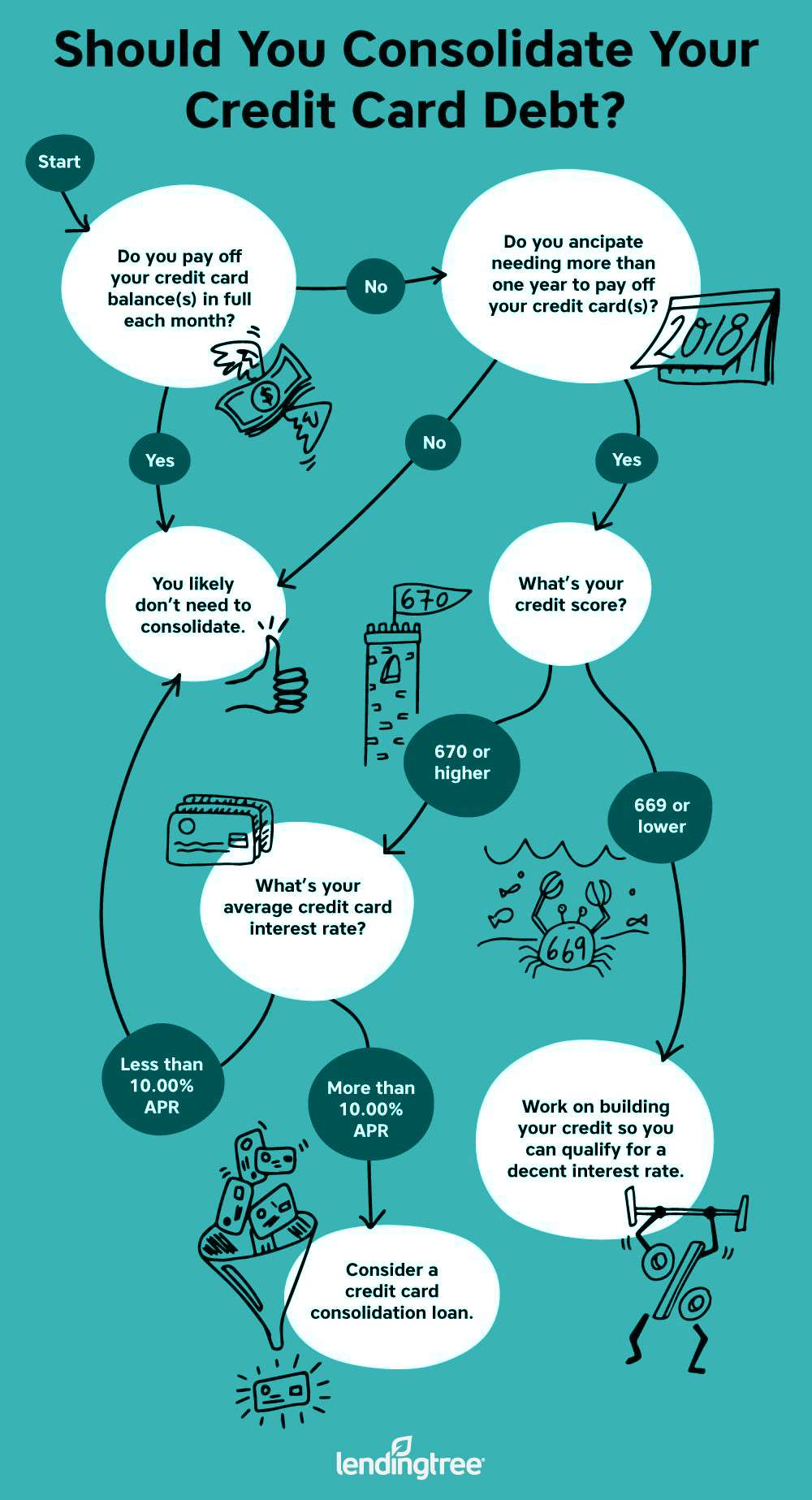

If you pay off your credit card balances every month, you don’t need to consolidate your debt. But if you consistently carry a balance, it can threaten your financial well-being.

For example, 58% of the people we surveyed have had at least $6,000 on their credit cards for more than a year, and 43% have more than $15,000 in credit card debt.

High interest rates don’t help, and almost half the people we surveyed are paying interest rates higher than the average, which the Federal Reserve pegs at 14.99%.

In some cases, you might be able to negotiate your interest rate, but credit card issuers aren’t always cooperative.

Combining high interest rates and high balances can be poison to your financial well-being. For example, let’s say you have $15,000 in credit card debt with an APR of 14.99% and a minimum payment of $300.

Assuming you don’t continue using your credit card and you make the minimum payment each month, it will take you more than six and a half years to pay off your debt. And you’ll spend $8,676 in interest along the way.

Credit card debt also can damage your relationships. For example, 32% of the people we surveyed have hidden their credit card debt from their significant other because they were ashamed or in denial or thought it would be a deal breaker.

Potential roadblocks to credit card consolidation

Forty-eight percent of the people we surveyed have never tried to consolidate their credit card debt. When we asked them why, many of them gave more than one response, meaning the decision can be complicated.

Additionally, 11% of the people we surveyed hadn’t even heard of credit card consolidation.

For the most part, these concerns are valid. But for many people, understanding the consolidation process could help clear the path.

3 ways credit card consolidation loans can help you

It’s true that credit card consolidation loans aren’t for everyone. But for those who qualify, they’re worth considering as a way to eliminate toxic debt.

1. They might offer lower interest rates

If you have good credit and you’re paying an above-average interest rate, you might be able to get a lower interest rate on a consolidation loan.

For example, let’s take another look at the above scenario. Here are those numbers again:

- Credit card balance: $15,000

- Interest rate: 14.99%

- Minimum payment: $300

- Payoff time: 79 months

- Interest paid: $8,676

But this time, let’s say you apply and get approved for a personal consolidation loan with a 10.00% APR and a five-year repayment term.

In this scenario, you’d be free of the debt in five years and spend $4,122 in interest, cutting your interest paid by more than half. And here’s the kicker: Your monthly payment would increase by only $19.

2. They establish a firm repayment plan

Credit cards are tricky because they don’t have set repayment terms like installment loans do. In fact, there are some situations in which you could remain in credit card debt perpetually, even if you pay the minimum each month.

Consolidating your credit card balances by finding a personal loan can help you become more disciplined with your payoff. With a set monthly payment and a set repayment term, you’ll always have the end in sight.

3. They simplify your repayment

If you have debt across multiple credit cards, it can be tough to remember how much you owe and when your monthly payments are due.

“With a personal loan, you don’t have to keep up with multiple credit card payments,” said Alia Dudum, a millennial money expert at LendingClub. “Instead, you can combine all credit card balances into a single easy payment.”

Addressing credit card consolidation concerns

If you have some of the same concerns as the people we surveyed, you might not be sure consolidating is right for you. Here are some things to consider.

How consolidating credit cards affects your credit

Unfortunately, there’s no way to know exactly how consolidating credit card debt will affect your credit score. But here are some factors that are impacted by the decision.

Your credit utilization goes down

Your credit utilization is calculated by dividing each credit card’s balance by its credit limit. Then, you do another calculation for all your cards combined.

For example, let’s say you have three credit cards:

- Card A: $1,000 balance, $4,000 credit limit

- Card B: $3,000 balance, $6,000 credit limit

- Card C: $500 balance, $750 credit limit

Here’s what your credit utilization would be for each card:

- Card A: 25%

- Card B: 50%

- Card C: 66.67%

To get your overall utilization, you combine the three cards:

($1,000 + $3,000 + $500) / ($4,000 + $6,000 + $750)

$4,500 / $10,750 = 41.86%

The higher your credit utilization, the more it hurts your credit, so paying off a credit card with a high utilization will improve your score. Keep in mind, however, that if you consolidate your credit card debt and then rack up more, the additional debt could damage your credit score.

Your total debt owed stays the same

How much you owe is the second-biggest factor in your FICO credit score. Although you’re taking out a new loan, you’re not adding new debt because you’re using the loan to pay off existing debt. As a result, this amount shouldn’t be impacted.

Your credit report will take a hard inquiry

Every time you apply for credit, the lender does a hard credit check on your credit report, which can knock a few points off your score temporarily. But the negative effect typically doesn’t linger, especially if you don’t borrow often.

How to avoid debt relief scams

Some debt relief companies offer to help you negotiate with your creditors and get on a better payment plan or settle for less than you owe.

“Debt relief or settlement companies often claim that they can work with your creditors to reduce the amount of money you owe, but that doesn’t necessarily mean your loan will settle,” said Dudum. “Your loan can actually continue to accumulate interest or penalties until it’s paid off.”

That’s because these companies sometimes encourage you to stop making your credit card payments. “Unless you’re able to settle all or most of your debt with the company, the buildup of charges and fees could wipe out any savings on the settled debt,” Dudum added.

In some cases, these companies are out to scam you or charge you fees to do things you can do on your own for free.

As a result, we recommend avoiding debt relief companies. Instead, consider applying for a personal loan you can use to consolidate your debt. Banks, credit unions, and online lenders offer these loans, and many of them don’t charge any fees to process the loan for you.

How your credit score affects eligibility

It’s true that if your credit score is low, you might not get approved for a loan, let alone one with a good interest rate.

“[Lenders] look at your application, credit report, and other factors in order to estimate the likelihood that you’ll be able to pay back your loan,” said Dudum. “Lower credit risks will get an offer with a lower APR, and higher credit risks will receive an offer with a higher APR.”

The good news is that’s a hurdle you can eventually jump by improving your credit. For example:

- Check your credit score using a monitoring service, such as Discover Credit Scorecard or Credit Karma.

- Learn which factors are negatively impacting your credit score so you know where to focus.

- Tackle each factor in turn. For example, if you have late payments, start paying on time. If your credit utilization is high, start aggressively paying down your cards with higher balances. Whatever it is, work to turn your credit weaknesses into strengths.

- Check your credit report for errors or fraud and dispute any instances you find. You can get a free copy of each report once a year at AnnualCreditReport.com.

If your credit score is good but you’re not sure you’d qualify for a good rate, many personal loan companies allow you to check your rates without a hard credit check.

Credit card consolidation is worth the work

In general, applying for a personal loan to consolidate your credit card debt is an easy process. Once you get the loan disbursement in your bank account, you use it to pay off your credit cards.

Even if you hit some snags along the way, the time and money you can save by consolidating make it worth a little legwork upfront.

You can choose your repayment term

In most cases, lenders offer a range of repayment terms, so you can choose how long you have to repay the debt. The shorter your repayment term, the higher your monthly payment. But if you can afford it, you’ll be debt-free sooner and pay less in interest.

If you want a lower monthly payment, you can opt for a longer repayment term. Just keep in mind that you’ll end up paying more interest than you would with a shorter repayment period.

Do the math to see if consolidating saves you money

Even if you can get a lower interest rate, the math might not work out in your favor if the repayment term is too short.

Use our debt consolidation calculator to run the numbers for your situation:

Consolidate your credit card debt now and save more money

Interest never sleeps, so the longer you take to start the process of consolidating your credit card debt, the more you’ll pay.

“For those looking for an affordable, predictable, and convenient way to access money, a debt consolidation loan with a low, fixed rate could be a great financial option,” said Dudum. “Our users, on average, save almost $300 per month.”

To determine if consolidating is right for you, start by gathering information about your credit card debt. Then, compare several personal loan companies to see the rates you might qualify for. Many personal loan companies allow you to see a rate without a hard credit check, so you don’t have to worry about dinging your credit.

Once you have all the information you need, use our calculator above to do the math and determine if consolidating is the right move. If so, apply for the best available option and begin your journey to be free of credit card debt.