White Americans Have the Highest Homeownership Rates but There Are Large Differences Among Cities

LendingTree, the nation’s leading online loan marketplace, has examined how race impacts homeownership rates in the nation’s 50 largest metros. This study, similar to another piece we published that looked at homeownership rates among black Americans, examines homeownership rates among white Americans.

Specifically, we ranked the nation’s 50 largest metros by the percentage of owner-occupied homes owned in a given area by those who identify as white. While it varies from metro to metro, our analysis indicates that white Americans tend to own a disproportionately high number of homes relative to the overall population in an area.

Key findings

Americans who identify as white own a disproportionately large percentage of homes in all of the nation’s 50 largest metros. White Americans make up an average of 59% of people in the metros featured in our study, but they own around 73% of owner-occupied homes.

Just as they own more homes than other Americans from other racial backgrounds, white Americans who live in the nation’s largest metros also tend to earn more money than those who identify as belonging to another race. The average income for white Americans in the nation’s largest metros is $73,630. This means that on the whole, white Americans outearn every other racial demographic in the U.S. except for those who identify as Asian.

White homeowners own the largest percentage of homes relative to their total population in the New York metropolitan area. In the New York metro, people who identify as white make up about 47% of the population, but they own almost 67% of all owner-occupied homes in the area.

Pittsburgh is where white Americans own the smallest percentage of homes relative to their overall population. Nonetheless, white Americans still own 93.29% of owner-occupied homes in Pittsburgh, despite only representing about 86% of the population.

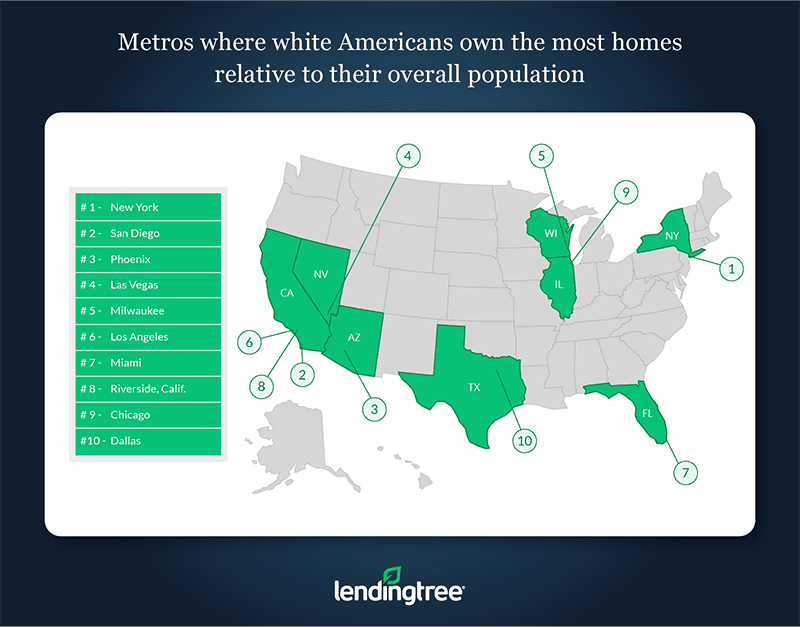

Where white Americans own the most homes relative to their overall population

New York

% of the population – White alone: 46.99%

Median household income – White alone: $91,806

% of owner-occupied homes – White alone: 68.65%

Difference between % of owner-occupied homes and % of population: 21.66%

San Diego

% of the population – White alone: 46.20%

Median household income – White alone: $80,276

% of owner-occupied homes – White alone: 65.37%

Difference between % of owner-occupied homes and % of population: 19.17%

Phoenix

% of the population – White alone: 56.41%

Median household income – White alone: $64,423

% of owner-occupied homes – White alone: 75.17%

Difference between % of owner-occupied homes and % of population: 18.76%

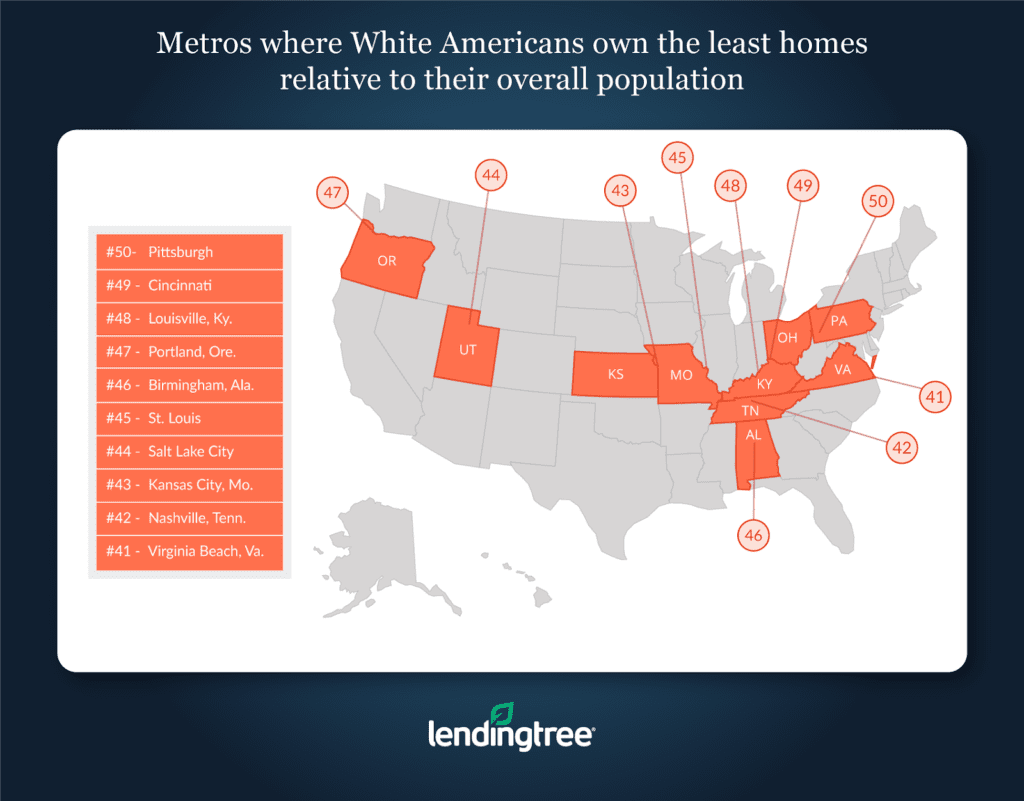

Where white Americans own the least homes relative to their overall population

Pittsburgh

% of the population – White alone: 85.82%

Median household income – White alone: $59,089

% of owner-occupied homes – White alone: 93.29%

Difference between % of owner-occupied homes and % of population: 7.47%

Cincinnati

% of the population – White alone: 80.04%

Median household income – White alone: $64,825

% of owner-occupied homes – White alone: 89.42%

Difference between % of owner-occupied homes and % of population: 9.38%

Louisville, Ky.

% of the population – White alone: 76.95%

Median household income – White alone: $59,725

% of owner-occupied homes – White alone: 87.90%

Difference between % of owner-occupied homes and % of population: 10.95%

Reasons behind the data

On a very basic level, there are a few reasons why white Americans own a disproportionately larger share of homes than most Americans who identify as other races do. For example, aside from those who identify as Asian, white Americans have higher average incomes and are more likely to have a college degree than those who identify as belonging to a different race.

However, on a deeper level, it becomes more difficult to pinpoint why white Americans seem to have so many advantages over Americans who identify as belonging to nonwhite races.

Ultimately, it appears as most, if not all, of the advantages afforded to white Americans on the whole are the result of numerous social factors that have historically made it more accessible for white Americans to gain meaningful employment, higher levels of wealth and access to credit.

Taking advantage of homebuying programs

Our analysis shows that overall, white Americans own a disproportionate number of homes in America’s 50 largest metros. However, that does not mean all white Americans will necessarily have an easy time affording a home. Regardless of which race Americans identify as, should make sure to carefully consider all of their options when looking to purchase or refinance a home.

One of the easiest ways to make homeownership more achievable is to simply shop around for a loan before buying. Comparing mortgage rates may save potential buyers thousands of dollars every year and may also bring down their monthly mortgage payments.

Beyond shopping around, there are other tools that homebuyers can use to make their goal of owning a home a reality. For example, the U.S. Department of Housing and Urban Development offers an online resource for consumers interested in learning more about homeownership options in their state. See HUD’s local homebuying programs directory for more information.

Fannie Mae and Freddie Mac loans

Certain types of conventional loans — mortgages that are eligible for purchase by government-sponsored enterprises Fannie Mae or Freddie Mac — are reserved for low- to moderate-income borrowers who are either first-time or repeat homebuyers.

Fannie Mae’s HomeReady® mortgage program requires a 3% down payment and a minimum 620 credit score. Private mortgage insurance is required, but it is cancelable once you reach 20% equity in your home.

Freddie Mac’s Home Possible® program also requires 3% down and private mortgage insurance that can be canceled once you reach 20% equity. But unlike Fannie Mae’s HomeReady program, you might be able to qualify for the program without a usable credit score, but you’d need to contribute at least a 5% down payment.

FHA loans

The Federal Housing Administration, which is overseen by HUD, insures FHA loans provided by approved mortgage lenders. FHA loans give consumers the opportunity to buy a home at a lower barrier of entry, including homebuyers with bad credit.

In most cases, you’ll need a minimum 580 credit score and 3.5% down payment. You may qualify with a credit score as low as 500, but your required down payment jumps would jump to a 10% minimum. There’s also a mortgage insurance premium requirement that sticks around for the life of the loan unless you put down at least 10%.

Other programs

Additional homebuying programs include USDA loans, which are backed by the U.S. Department of Agriculture’s Rural Housing Service. USDA loans are meant to assist borrowers looking to buy a home in a designated rural area. Depending on the loan type, there may be no required down payment.

Read our guide on homebuying programs for a rundown of other available options.

Methodology

This study ranks the nation’s 50 largest Metro Statistical Areas, or MSAs, by the difference between the % of owner-occupied homes in that area that are owned by those who identify as white (and no other race) and the % of an area’s population that identifies as white (and no other race). The further this difference is from zero, the more disproportionate the number of white homeowners in the area is.

The population, homeownership and income data used in this study are based on estimates from U.S. Census Bureau’s 2017 American Community Survey. It should be noted that the data in the survey is estimated, so there is a slight margin or error of up to 5% for our data.