LightStream Personal Loan Review

- APR

- 6.49% – 25.29%

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent auctor magna eu enim fringilla, eget lobortis mi cursus. Proin accumsan feugiat augue non consectetur. Phasellus tempor lectus magna, vel sagittis lorem tristique et. Nulla vulputate sollicitudin venenatis. In hac habitasse platea dictumst. Etiam varius velit tellus, et sagittis erat consequat ut. Morbi ut dui nec felis rhoncus feugiat. Duis non ante in nibh tincidunt porttitor. Phasellus sed metus nunc. Aenean faucibus elementum libero eu mollis.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent auctor magna eu enim fringilla, eget lobortis mi cursus. Proin accumsan feugiat augue non consectetur. Phasellus tempor lectus magna, vel sagittis lorem tristique et. Nulla vulputate sollicitudin venenatis. In hac habitasse platea dictumst. Etiam varius velit tellus, et sagittis erat consequat ut. Morbi ut dui nec felis rhoncus feugiat. Duis non ante in nibh tincidunt porttitor. Phasellus sed metus nunc. Aenean faucibus elementum libero eu mollis.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent auctor magna eu enim fringilla, eget lobortis mi cursus. Proin accumsan feugiat augue non consectetur. Phasellus tempor lectus magna, vel sagittis lorem tristique et. Nulla vulputate sollicitudin venenatis. In hac habitasse platea dictumst. Etiam varius velit tellus, et sagittis erat consequat ut. Morbi ut dui nec felis rhoncus feugiat. Duis non ante in nibh tincidunt porttitor. Phasellus sed metus nunc. Aenean faucibus elementum libero eu mollis.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent auctor magna eu enim fringilla, eget lobortis mi cursus. Proin accumsan feugiat augue non consectetur. Phasellus tempor lectus magna, vel sagittis lorem tristique et. Nulla vulputate sollicitudin venenatis. In hac habitasse platea dictumst. Etiam varius velit tellus, et sagittis erat consequat ut. Morbi ut dui nec felis rhoncus feugiat. Duis non ante in nibh tincidunt porttitor. Phasellus sed metus nunc. Aenean faucibus elementum libero eu mollis.

- Eligibility and access: 3/5

- Cost to borrow: 5/5

- Loan terms and options: 4.6/5

- Repayment support and tools: 4/5

LightStreamoffers personal loans online ranging from $5,000 to $100,000. As the online lending division of Bank, this lender specifically caters to borrowers with good or excellent credit.

- Same-day funding: LightStream can sometimes disburse personal loan funds the same day you apply. However, your application will need to be approved, verified and closed by 2:30 p.m. Eastern time.

- Doesn’t charge fees: As a LightStream customer, you won’t have to worry about paying any fees — this includes prepayment penalties or origination fees, a common personal loan administrative fee.

- Autopay discount: If you sign up for automatic loan payments during the application process, you can receive a 0.50% APR discount. To qualify, you’ll need to sign up for autopay before your loan is funded.

- Flexible loan features: LightStream offers one of the widest ranges of repayment terms on the personal loan market (24 to 84 months) as well as some of the largest loan amounts (up to $100,000).

- No option to prequalify: Unfortunately, if you want to see the rates and terms you may qualify for, you’ll have to officially apply and submit to a hard credit check. LightStream doesn’t allow borrowers to prequalify for a loan.

- Only available to those with good or excellent credit: However, the lender also reviews other factors like debt-to-income (DTI) ratio and the age of your credit history when assessing your ability to repay a loan.

- Best for excellent-credit borrowers: If you have a good credit score, solid credit history, variety of accounts and assets, consistent payment history and a low DTI ratio, you’ll have a much better chance of getting approved for a LightStream personal loan and all the benefits that come with it.

LightStream pros and cons

LightStream personal loans have many strengths, but no financial product is a perfect fit for every consumer. Before applying with this lender, be sure to weigh its benefits and drawbacks.

Pros

- Doesn’t charge any fees

- Same-day funding available (conditions apply)

- APR discount available when signing up for autopay

- Offers Rate Beat Program

Cons

- Exclusive to good- to excellent-credit borrowers

- No option to prequalify for a loan

- Requires at least several years of credit history

- Must borrow at least $5,000

LightStream customers don’t have to pay any fees and can receive funds the same day they apply for a personal loan — as long as they meet the lender’s requirements. By signing up for autopay before you receive your loan funds, you can qualify for a 0.50% APR discount. LightStream also features a Rate Beat program: The lender will beat a competitor’s interest rate by 0.10 percentage points, as long as it’s an unsecured loan.

On the other hand, LightStream may not be good for those seeking small loans, since its loan amounts start at $5,000. In addition, this lender doesn’t allow borrowers to prequalify for a loan, so checking your rates can negatively impact your credit score. This lender also has strict personal loan requirements, and you’ll need at least several years of credit experience as well as an excellent credit score.

LightStream requirements

LightStream doesn’t provide many details on its personal loan eligibility requirements, but here’s what we do know:

| Minimum credit score | Must have good or excellent credit |

| Other requirements |

|

If you meet the basic requirements listed above, you may need to disclose how you plan to use your personal loan. While LightStream does allow borrowers to use its funding for a variety of purposes, there are certain expenses you cannot put the money toward.

LightStream loans CAN be used for…

- Debt consolidation

- Home improvement projects

- Adoption

- Fertility treatments

- Medical bills

- Wedding expenses

LightStream loans CANNOT be used for…

- Refinancing an existing LightStream loan

- College expenses

- Cash-out refinance purposes

- Purchasing bonds and stocks

- Contributing to a retirement plan, life insurance or education savings account

- Purchasing cryptocurrency

If LightStream’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with LightStream

LightStream doesn’t offer the option to prequalify for a personal loan. While this allows you to skip a step, it also means that you can’t check your potential rates and terms without impacting your credit score.

Fill out an application

Start by filling out a LightStream personal loan application and providing details like your personal information, whether you’re filing an individual or joint application, how much you want to borrow and how you plan to use the loan. If you apply with a cosigner, they will also need to provide their information.

Once you submit your application, LightStream will run a hard credit pull, which will allow them to view the information on your credit reports. This process can cause your credit score to drop by a few points, but the effect is temporary.

Verify your information

Before offering you a personal loan, LightStream will need to verify the information you provided in your loan application. You may need to provide copies of bank statements or recent pay stubs to show proof of income. You’ll also need to provide a copy of a government-issued form of ID, like a driver’s license or passport.

Close on your loan

To complete the personal loan application process, you’ll officially accept the loan offer and sign a loan contract with LightStream. Be sure to read the fine print before signing to be sure you fully understand the terms of your contract.

If LightStream has denied your personal loan application, it may be time to improve your chances of getting approved for a personal loan. You may need to expand your credit portfolio to include other forms of credit, pay down current debt or take steps to improve your credit score.

How LightStream compares to other personal loan companies

Even if you believe LightStream aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how LightStream stacks up against similar personal loan lenders.

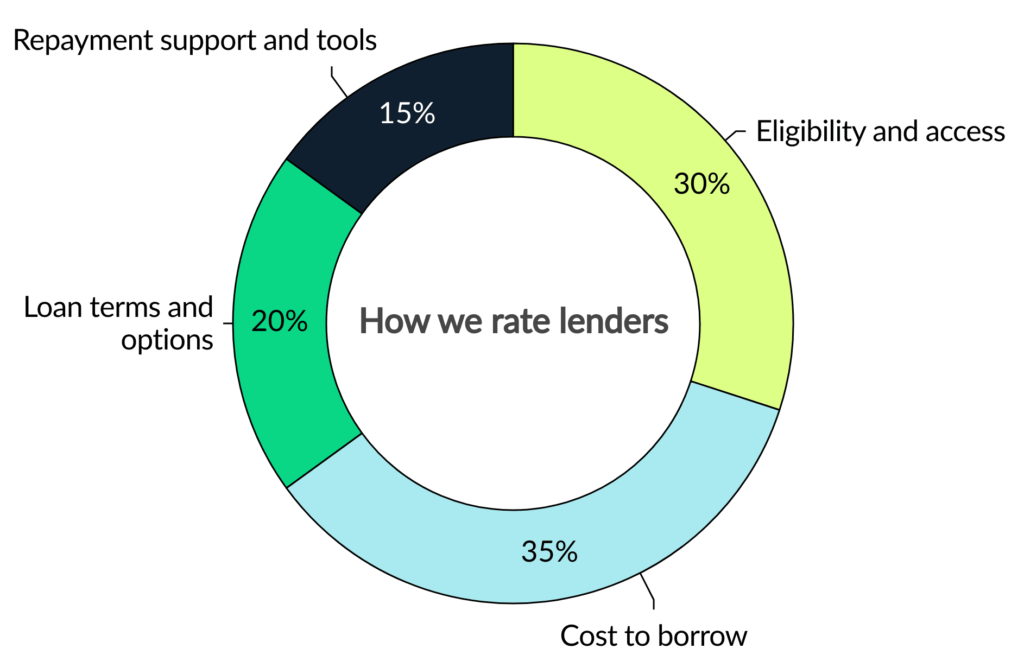

How we rated LightStream

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

LightStream doesn’t specify its credit score requirement, but it does state that it only offers loans to those with good to excellent credit. It’ll also consider the length of your credit history, DTI ratio and payment history.

LightStream may approve and fund your personal loan the same day you apply if you sign your loan agreement by 2:30 p.m. ET and meet other requirements. This may make it a good fit for consumers looking for quick loans.

LightStream is a popular online lender that offers loans to those with strong credit. As of publication, this lender has had no major regulatory actions against it within the last three years.

Get personal loan offers from up to 5 lenders in minutes