97.1% of Retirement-Age Americans Have Nonmortgage Debt, With Residents in Largest Metros Owing Median of $11,349

Many of us look forward to retirement as a time of peace and tranquility, both in our lives and in our finances. Yet, according to the latest LendingTree analysis, nearly all (97.1%) U.S. adults of retirement age — 66 to 71 — still have nonmortgage debt.

This study examines what kinds of debts the retirement-age population carries, as well as which of the 50 largest U.S. metros have it worst (and best) in this regard. One interesting note: Auto loans account for the largest share of nonmortgage debt carried by retirees, on average, across the country, which may be partially due to the rate of older drivers rising over the last decade.

Key findings

- Retirement-age adults across the 50 largest metros have a median nonmortgage debt of $11,349. An average of one-third (33.3%) of this debt comes from auto loans, while 31.7% is from credit card balances and 15.6% is from student loans.

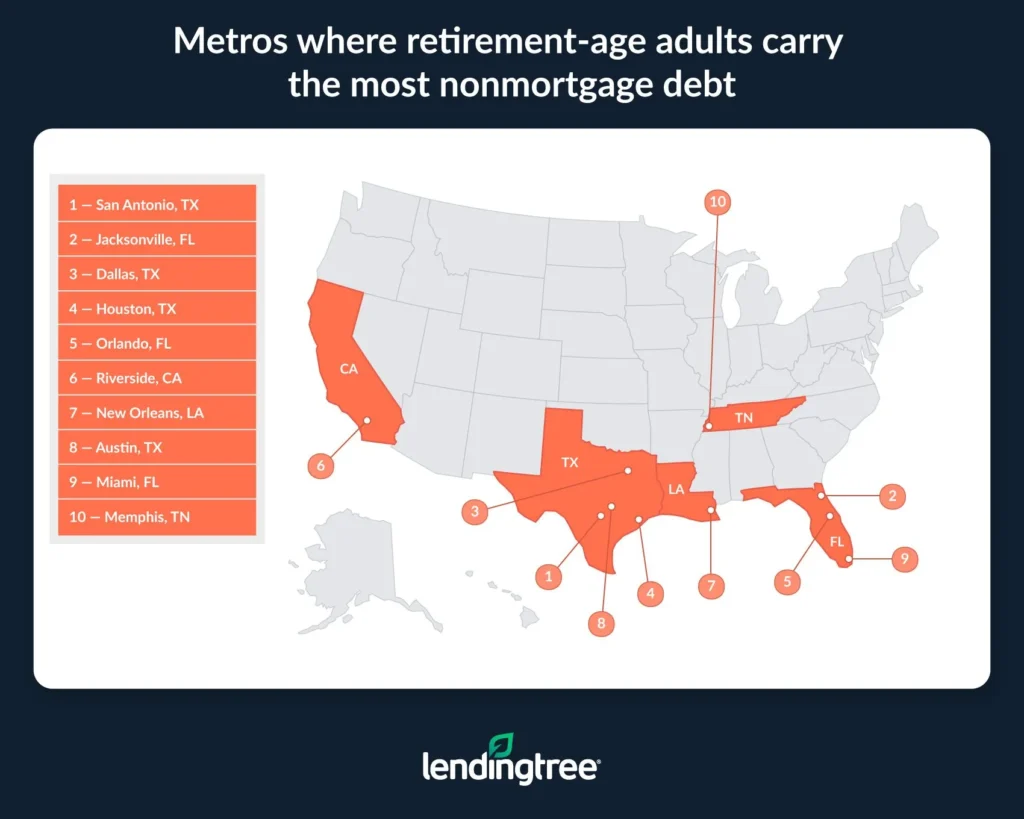

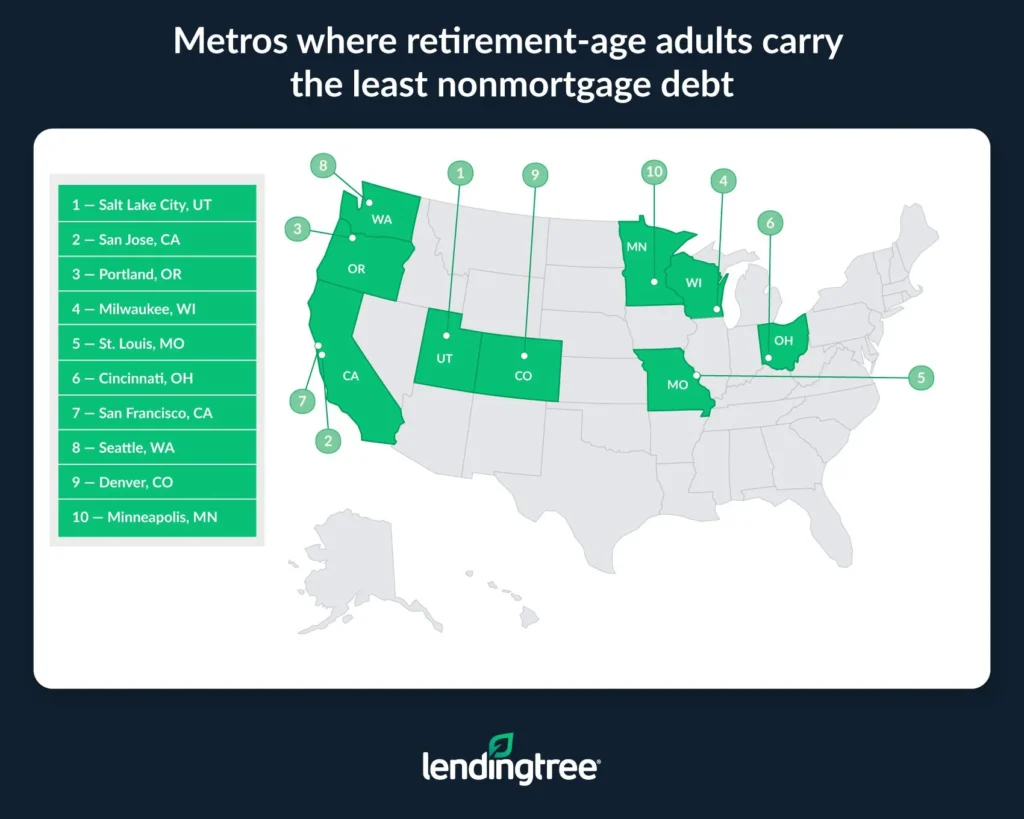

- Texas and Florida have seven metros among the 10 with the highest median retirement-age nonmortgage debt. Older San Antonio adults have the highest median nonmortgage debt at $18,107, ahead of Jacksonville, Fla. ($17,811), and Dallas ($16,985). Among the 50 largest metros, Salt Lake City ($6,717), San Jose, Calif. ($6,731), and Portland, Ore. ($6,782), have the lowest median nonmortgage debt.

- Auto loan debt accounts for 43.6% of retirement-age nonmortgage debt in Jacksonville — the highest among the analyzed metros. In contrast, San Jose has the smallest proportion of auto loan debt at 24.5% but the highest proportion of credit card debt at 42.5%.

- Across the U.S., credit card debt is the most common nonmortgage debt type for retirement-age Americans, with 92.6% carrying a balance. Meanwhile, 36.8% of retirement-age adults have auto loans, 19.3% have personal loans and 8.0% have student loans.

Retirement-age median nonmortgage debt in largest metros: $11,349

Across the 50 largest U.S. metros, retirement-age adults hold a median of $11,349 in nonmortgage debt. (Our study includes seniors ages 66 to 71, born between Jan. 1, 1953, and Dec. 31, 1958, and debt categories considered include auto loans, credit cards, personal loans, student loans and an “other” debt category. It’s worth noting that many seniors still have mortgages, too.)

LendingTree chief consumer finance analyst Matt Schulz admits he’s “not surprised” that debt totals are so high among retirement-age Americans.

“The combination of a fixed income, stubborn inflation, rising auto prices and sky-high interest rates on both cars and credit cards has created this perfect storm that has left many, many Americans wrestling with debt,” he says.

Rising auto prices seem to be a particular challenge point: On average, across the 50 studied metros, a third of U.S. seniors’ debt total, or 33.3%, is in the form of auto loans. That’s the largest share. Credit card balances are a close second (31.7%), followed by student loans (15.6%) and personal loan balances (13.0%).

Key details on retirement-age debt across the 50 largest metros

| Category | $/% |

|---|---|

| Median nonmortgage debt | $11,349 |

| Percentage from auto loan debt | 33.3% |

| Percentage from credit card debt | 31.7% |

| Percentage from student loan debt | 15.6% |

| Percentage from personal loan debt | 13.0% |

| Percentage from other debt | 6.2% |

Texas, Florida dominate 10 metros with highest nonmortgage debt among older adults

While soon-to-be and early retirees hold a median four figures (or more) of nonmortgage debt in every metro studied, the issue is worse in some places than others. (Fortunately, nearly half of the studied metros — 21 out of 50 — have median nonmortgage debts below $10,000.)

Texas and Florida, specifically, are overrepresented among the top-ranking metros for highest nonmortgage debt among seniors: Metros in the Lone Star and Sunshine states account for seven of the top 10 metros.

San Antonio leads the charge with a median nonmortgage debt total of $18,107, the bulk of which — 39.9% — is coming from auto loan balances.

Auto loan balances also account for the largest share (33.4%) of nonmortgage debt for this population in Dallas, which comes in third for highest nonmortgage median debt total ($16,985). The trend continues in Houston and Austin a bit further down the list — which might make some sense, considering all the highways criss-crossing the Lone Star State’s wide-open spaces.

Jacksonville, Fla., comes in second for the highest median nonmortgage debt total among retirement-age adults at $17,811 — and again, the bulk of it, 43.6%, comes from auto loans. (As we’ll discuss below, that’s also the largest proportion of retirement-age nonmortgage debt from auto loans among the studied cities.)

Although Florida’s population centers aren’t quite as spread-out as those in Texas, Jacksonville specifically is the largest city by landmass in the contiguous U.S., so again, extra transportation expenses may make sense.

Meanwhile, at the other end of the spectrum, Salt Lake City enjoys the lowest median nonmortgage debt total among retirement-age adults at $6,717 — which is 40.8% lower than the overall 50-metro median. The majority of what debt Salt Lake City’s seniors carry comes in the form of credit card balances, which account for 39.9% of the total.

San Jose, Calif., comes in second with a total median nonmortgage debt of $6,731, followed by Portland, Ore., where the median sits at $6,782.

As we’ll see below, auto loan debt is least common in San Jose of any of the 50 metros studied, though it does carry the highest proportion of credit card debt, which accounts for 42.5% of its seniors’ total. For its part, Portland’s largest shares of nonmortgage debt among seniors are spread relatively evenly between auto loans (30.6%) and credit card balances (31.5%).

As to why some areas have it so much worse in this regard, Schulz says that, in many cases, it may come down to income: San Jose and Portland both enjoy above-median household incomes, while San Antonio, Jacksonville and Orlando are on the other end of the spectrum.

“The income that you brought in during your high-earning years will play a huge role in determining your financial security in your golden years,” Schulz concludes.

Full rankings

Metros where retirement-age adults carry the most/least nonmortgage debt

| Rank | Metro | Median nonmortgage debt |

|---|---|---|

| 1 | San Antonio, TX | $18,107 |

| 2 | Jacksonville, FL | $17,811 |

| 3 | Dallas, TX | $16,985 |

| 4 | Houston, TX | $16,101 |

| 5 | Orlando, FL | $15,945 |

| 6 | Riverside, CA | $15,727 |

| 7 | New Orleans, LA | $15,108 |

| 8 | Austin, TX | $15,046 |

| 9 | Miami, FL | $14,397 |

| 10 | Memphis, TN | $14,204 |

| 11 | Atlanta, GA | $13,852 |

| 12 | Nashville, TN | $13,582 |

| 13 | Tampa, FL | $13,151 |

| 14 | Phoenix, AZ | $13,126 |

| 15 | Charlotte, NC | $13,020 |

| 16 | Virginia Beach, VA | $12,902 |

| 17 | Detroit, MI | $12,160 |

| 18 | Richmond, VA | $12,105 |

| 19 | Oklahoma City, OK | $11,937 |

| 20 | New York, NY | $11,689 |

| 21 | Los Angeles, CA | $11,628 |

| 22 | Buffalo, NY | $11,455 |

| 23 | Las Vegas, NV | $11,327 |

| 24 | Baltimore, MD | $11,204 |

| 25 | Raleigh, NC | $11,086 |

| 26 | Philadelphia, PA | $10,551 |

| 27 | Cleveland, OH | $10,304 |

| 28 | Pittsburgh, PA | $10,196 |

| 29 | Indianapolis, IN | $10,194 |

| 30 | Washington, DC | $9,913 |

| 31 | Columbus, OH | $9,877 |

| 32 | Kansas City, MO | $9,810 |

| 33 | Sacramento, CA | $9,562 |

| 34 | Birmingham, AL | $9,531 |

| 35 | San Diego, CA | $9,328 |

| 36 | Boston, MA | $9,080 |

| 37 | Providence, RI | $8,741 |

| 38 | Chicago, IL | $8,736 |

| 39 | Louisville, KY | $8,159 |

| 40 | Hartford, CT | $8,110 |

| 41 | Minneapolis, MN | $7,950 |

| 42 | Denver, CO | $7,804 |

| 43 | Seattle, WA | $7,744 |

| 44 | San Francisco, CA | $7,573 |

| 45 | Cincinnati, OH | $7,530 |

| 46 | St. Louis, MO | $7,466 |

| 47 | Milwaukee, WI | $6,931 |

| 48 | Portland, OR | $6,782 |

| 49 | San Jose, CA | $6,731 |

| 50 | Salt Lake City, UT | $6,717 |

Auto loan debt most common in Jacksonville, Fla., least common in San Jose, Calif.

It’s not just total nonmortgage debt that varies by metro. Our analysis also dives into which types of nonmortgage debt are most prevalent in each of the 50 studied metros for the retirement-age population.

Since auto loan debt is the largest proportional share of nonmortgage debt overall, we’ll start there. As mentioned, Jacksonville has the highest proportion of auto loan debt in our study, with 43.6% of seniors’ nonmortgage total coming from car loans. (Runners-up include Cincinnati, where 42.3% of the total comes from auto loan balances, and Detroit, where the figure is 41.8%.)

The metro that enjoys the least auto loan debt is San Jose, where only 24.5% of the nonmortgage total is owed to car payment balances — though as we’ll see in just a minute, this Bay Area metro (which is well-served by public transit) has the largest share of credit card debt. To that point, San Francisco has the second-lowest prevalence of car loan debt in our study (27.2%), followed by Salt Lake City and Seattle, which tie at 28.5%.

Credit card debt most common in San Jose

Next up comes credit card debt — in which, as mentioned, San Jose has the dubious distinction of taking the lead. In the so-called Capital of Silicon Valley, 42.5% of retirement-age Americans’ nonmortgage debt comes in the form of credit card balances.

Once again, it has a similar debt profile to nearby San Francisco, which comes in second at 41.1%. All that technology means a lot of fun gadgets to swipe your credit card for — not to mention the high cost of Bay Area living. Salt Lake City comes in third with 39.9% of seniors’ nonmortgage debt coming from credit cards.

Meanwhile, credit card debt is lowest in Oklahoma City (23.6%) — which also happens to have the fourth-highest proportion of auto loan debt. The lower credit card balance/higher auto loan balance dynamic seems to be a trend, as the metro with the second-lowest credit card debt, San Antonio, is fifth-highest for auto loan debt. (Credit cards account for 24.6% of its seniors’ total nonmortgage debt.)

Riverside, Calif., comes in third at 26.4%.

Student loan debt most common in Cleveland

Student loan debt, the third-most prevalent type of debt across the 50 studied metros, is proportionally highest in Cleveland, where it accounts for 21.8% of nonmortgage debt among retirement-age adults. Baltimore comes in second at 21.6%, followed by Kansas City, Mo., at 21.1%.

Meanwhile, residents of Jacksonville enjoy the lowest proportional levels of student loan debt (7.6%), followed by Milwaukee (7.7%) and Richmond, Va. (8.7%).

Personal loan debt most common in Richmond, Va.

Finally, we look at personal loan debt, which accounts for the lowest proportion of total debts overall (outside of the “other” category).

Although it has the third-lowest proportion of student loan debt in our study, Richmond is in the lead when it comes to personal loan balances, which make up 24.3% of its retirement-age residents’ nonmortgage debt total. (That’s 3.6 times higher than Salt Lake City’s 6.8% personal loan proportion, the lowest in our ranking.)

Second-highest is Memphis, Tenn., where 20.3% of retirement-age residents’ nonmortgage debt total comes from personal loans, followed by Virginia Beach, Va., at 20.2%.

At the bottom of the list, next up from Salt Lake City comes Indianapolis, where personal loans account for only 7.3% of the studied median debt totals, followed by Cleveland at 9.8%.

Full details

Distribution of nonmortgage debt among retirement-age adults

| Metro | Auto loan balance | Credit card balance | Personal loan balance | Student loan balance | Other balance |

|---|---|---|---|---|---|

| Atlanta, GA | 32.5% | 31.9% | 15.1% | 16.3% | 4.2% |

| Austin, TX | 39.5% | 27.7% | 12.4% | 9.6% | 10.8% |

| Baltimore, MD | 34.1% | 29.1% | 10.4% | 21.6% | 4.9% |

| Birmingham, AL | 39.9% | 28.3% | 10.7% | 14.2% | 6.9% |

| Boston, MA | 29.9% | 36.0% | 10.1% | 19.4% | 4.6% |

| Buffalo, NY | 36.5% | 32.5% | 12.3% | 14.0% | 4.7% |

| Charlotte, NC | 39.0% | 30.5% | 12.2% | 15.1% | 3.1% |

| Chicago, IL | 29.1% | 31.8% | 14.6% | 16.5% | 8.0% |

| Cincinnati, OH | 42.3% | 31.2% | 11.2% | 12.6% | 2.7% |

| Cleveland, OH | 34.9% | 29.0% | 9.8% | 21.8% | 4.5% |

| Columbus, OH | 39.5% | 29.7% | 10.4% | 14.1% | 6.4% |

| Dallas, TX | 33.4% | 30.6% | 13.8% | 15.4% | 6.8% |

| Denver, CO | 29.0% | 34.8% | 11.9% | 16.9% | 7.5% |

| Detroit, MI | 41.8% | 27.6% | 10.7% | 15.0% | 4.9% |

| Hartford, CT | 28.8% | 35.5% | 11.7% | 20.6% | 3.4% |

| Houston, TX | 34.5% | 27.0% | 15.2% | 13.1% | 10.2% |

| Indianapolis, IN | 36.9% | 34.5% | 7.3% | 14.1% | 7.2% |

| Jacksonville, FL | 43.6% | 30.4% | 15.5% | 7.6% | 2.9% |

| Kansas City, MO | 32.0% | 31.4% | 10.5% | 21.1% | 5.1% |

| Las Vegas, NV | 33.5% | 27.9% | 16.4% | 16.4% | 5.8% |

| Los Angeles, CA | 31.4% | 34.0% | 13.6% | 16.7% | 4.4% |

| Louisville, KY | 34.1% | 37.4% | 12.5% | 12.2% | 3.8% |

| Memphis, TN | 33.1% | 27.0% | 20.3% | 14.4% | 5.2% |

| Miami, FL | 35.8% | 32.0% | 10.2% | 14.4% | 7.6% |

| Milwaukee, WI | 37.8% | 36.6% | 13.9% | 7.7% | 4.0% |

| Minneapolis, MN | 31.5% | 29.9% | 10.0% | 13.3% | 15.3% |

| Nashville, TN | 30.7% | 28.9% | 15.5% | 11.8% | 13.1% |

| New Orleans, LA | 34.5% | 27.7% | 17.5% | 16.6% | 3.6% |

| New York, NY | 29.6% | 35.5% | 12.2% | 19.3% | 3.5% |

| Oklahoma City, OK | 41.7% | 23.6% | 11.4% | 14.8% | 8.4% |

| Orlando, FL | 36.8% | 29.7% | 12.3% | 14.8% | 6.4% |

| Philadelphia, PA | 32.3% | 31.0% | 11.4% | 20.6% | 4.7% |

| Phoenix, AZ | 33.8% | 30.2% | 13.6% | 10.6% | 11.8% |

| Pittsburgh, PA | 36.4% | 30.2% | 14.1% | 12.6% | 6.7% |

| Portland, OR | 30.6% | 31.5% | 10.8% | 12.7% | 14.4% |

| Providence, RI | 29.4% | 30.7% | 12.8% | 20.6% | 6.4% |

| Raleigh, NC | 33.8% | 34.3% | 11.1% | 14.8% | 6.0% |

| Richmond, VA | 33.5% | 30.6% | 24.3% | 8.7% | 2.8% |

| Riverside, CA | 35.4% | 26.4% | 14.6% | 12.7% | 10.9% |

| Sacramento, CA | 30.2% | 37.6% | 17.0% | 10.7% | 4.6% |

| Salt Lake City, UT | 28.5% | 39.9% | 6.8% | 10.7% | 14.2% |

| San Antonio, TX | 39.9% | 24.6% | 14.8% | 12.6% | 8.1% |

| San Diego, CA | 31.2% | 36.2% | 17.7% | 13.6% | 1.3% |

| San Francisco, CA | 27.2% | 41.1% | 14.9% | 14.0% | 2.9% |

| San Jose, CA | 24.5% | 42.5% | 13.7% | 14.2% | 5.1% |

| Seattle, WA | 28.5% | 35.4% | 12.7% | 11.3% | 12.2% |

| St. Louis, MO | 38.1% | 32.2% | 11.2% | 13.4% | 5.1% |

| Tampa, FL | 37.5% | 28.7% | 14.8% | 12.2% | 6.8% |

| Virginia Beach, VA | 35.1% | 32.9% | 20.2% | 9.3% | 2.6% |

| Washington, DC | 31.1% | 32.1% | 13.5% | 19.9% | 3.4% |

97.1% of retirement-age adults (regardless of location) have debt

Across the U.S. (not just the studied metros), 97.1% of retirement-age adults carry nonmortgage debt of some kind — in other words, almost all of them.

For a whopping 92.6%, the mix includes credit card debt, though some of these retirees may pay off their balances monthly.

Auto loan debt, unsurprisingly given the rest of our study, is the debt seniors are next most likely to carry, with 36.8% having a balance left to pay off. And nearly a fifth, 19.3%, carry a personal loan debt balance.

Interestingly, more retirement-age adults carry an “other” debt balance (12.8%) than student loan debt (8.0%).

| Category | % |

|---|---|

| Percentage with nonmortgage debt | 97.1% |

| Percentage with credit card debt | 92.6% |

| Percentage with auto loan debt | 36.8% |

| Percentage with personal loan debt | 19.3% |

| Percentage with other debts | 12.8% |

| Percentage with student loan debt | 8.0% |

3 tips for older adults to reduce debt

Debt reduction can be a challenge, no matter your age — but reducing debt can help make your golden years shine brighter. Here are three expert tips to help you dial down your totals, even if retirement is closer on the horizon.

- Pay attention to your interest rates. Interest means you pay more for whatever you purchased with the borrowed money, and high interest rates can keep you from the cash flow you need to chip away at principal balances. Debt consolidation can be an easy way to pay less interest overall, along with simplifying your monthly repayment strategy — either a personal loan or a 0% balance transfer credit card can be an incredible tool, Schulz says. But that’s not the only option: “Consider calling and asking your credit card issuer for a lower interest rate,” he suggests. “It works way more often than you’d imagine.”

- “Prioritize, prioritize, prioritize,” as Schulz puts it. “Managing while on a fixed income can mean making some tough decisions: Do you still need as big a house or as fancy a car as you have? Do you need cable or would a few streaming services be fine? Should you consider getting a part-time job?” Such questions might not be fun, Schulz allows, “but they may be necessary if you’re struggling mightily with debt.”

- Ask for help when you need it. “Lenders are often willing to work with people going through a short-term financial rough patch or whose financial circumstances have changed,” Schulz points out. Of course, taking advantage of that flexibility requires being vulnerable enough to ask for assistance — which can be challenging but worth it. “Talking to a nonprofit credit counselor can be an excellent choice, too,” Schulz says.

Methodology

LendingTree researchers analyzed a sample of about 40,000 anonymized credit reports of LendingTree users from January to September 2024 — the first three quarters of 2024.

This analysis focuses on consumers ages 66 to 71, born between Jan. 1, 1953, and Dec. 31, 1958.

Analysts looked at users with the following debt types:

- Auto loan debt

- Credit card debt

- Personal loan debt

- Student loan debt

- Other debt

Researchers calculated median nonmortgage debt totals and the distribution of debts.

The findings were then aggregated for the 50 largest metropolitan statistical areas.

Get personal loan offers from up to 5 lenders in minutes