The Most and Least Debt-Ridden Places in California

California is the most populous and one of the most prosperous states in America. It may not be surprising that there are big differences in how Californians manage their finances in different cities, given its size and relative wealth. But the size of the fiscal gap among California cities may astonish some.

A case in point: Temecula, the city with the highest median non-mortgage debt, has nearly four times the median non-mortgage debt of Santa Cruz, the city with the lowest median non-mortgage debt.

To create this study, we looked at anonymized credit report data from November 2018 to January 2019, of LendingTree users who live in 165 California cities to find the places with the highest median non-mortgage debt.

Key findings

- Auto loans are the largest single credit line for the average resident in nearly 84% of California cities.

- Generation X shouldered the biggest amount of non-mortgage in 81% of California cities, compared with Baby Boomers and millennials.

- Millennials carried the highest median non-mortgage debt in the least debt-saddled cities (Santa Cruz, Cupertino and Milpitas).

- Temecula is the most debt-ridden California city. Its residents carry a median non-mortgage debt of $30,163, with just over 41% of their debt coming from auto loans.

- Student loans and credit card debt make up the second and third largest portions of debt in Temecula, at 24% and 22% respectively, with personal loans making up 13%.

- Santa Cruz residents are the best off in terms of the median amount of debt of non-mortgage debt they owe, equaling $8,563.

- Credit card debt was the largest credit line in Santa Cruz, which made up 34% of the total debt burden for the average person of the three main generations: millennials, Generation X and Baby Boomers.

An overhead view of debt in California

Living in California is expensive. California is the second most expensive state, behind only Hawaii, according to data from the U.S. Census Bureau on median monthly housing costs.

Despite being home to some of the most in-demand cities in the world, California is not a very densely populated state, forcing people into living farther away from where they work. The average California commuter spends about 30 minutes to get to work every day, ranked No. 5, after Washington, D.C., for commuting time.

Nearly 85% of California workers drive to work, and 76% of workers drive to work alone. Just 2.6% of Californians rely on public transportation to get to and from work. All of that economic logic leads to the auto loans being the largest single credit line for the average resident in 84% of California cities. These findings are unsurprising considering how frequently California cities appeared in our study on where millennials owe the most on their cars.

Student loan debt, meanwhile, made up the largest share of non-mortgage debt in 19 California cities. In Berkeley, one of the least indebted California cities (No.156), nearly half of the non-mortgage debt carried by an average resident is student loan debt.

Credit card debt is the largest source of debt in just eight cities.

Across all the 165 cities, credit card debt and student loan debt took up similar portions of the Californian’s debt portfolio: 25%. However, an overwhelming majority of Californians (86%) carried credit card debt, while a sizeable minority of Californians (19%) had student loans.

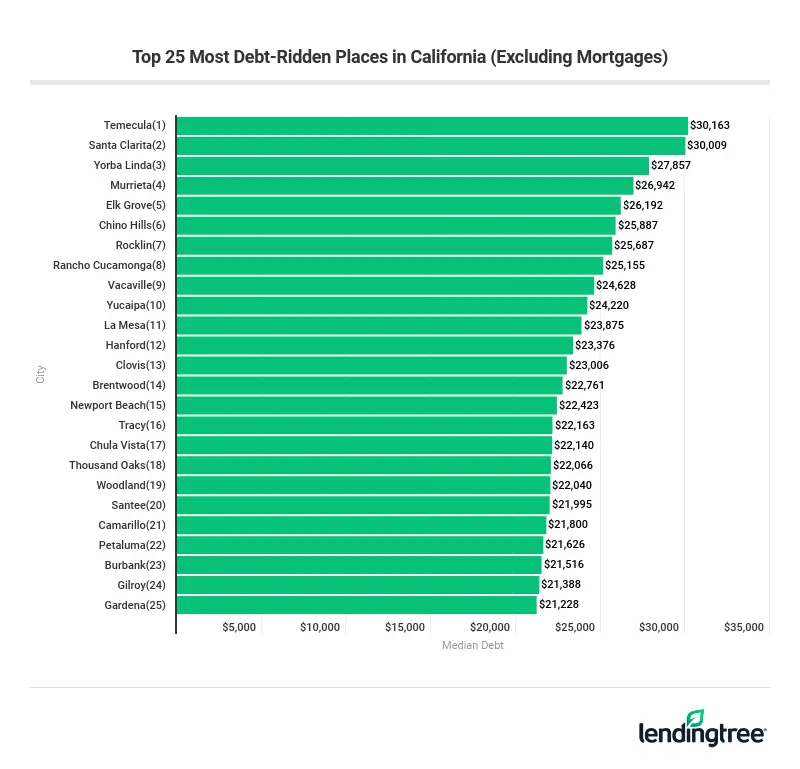

California cities carrying the most non-mortgage debt

The majority of the top debt-ridden cities are in Southern California. Among the 25 cities where residents carried the highest non-mortgage debt, 60% of them are SoCal cities.

Temecula is the most debt-ridden city located in Southern California. Its residents carried an average debt of $30,163, with just over 41% of their debt coming from auto loans.

Auto loans unanimously made up the largest source of the non-mortgage debt of residents in southern California. In Hanford, nearly half of the average non-mortgage for an average resident comes from auto debt, the highest percentage among all cities.

Percentage-wise, people in La Mesa shouldered a relatively higher portion of student loan debt than other most debt-saddled cities, at 28%, totaling $10,504.

Petaluma residents had the highest portion of credit card debt, at 31%, equalling $9,607.

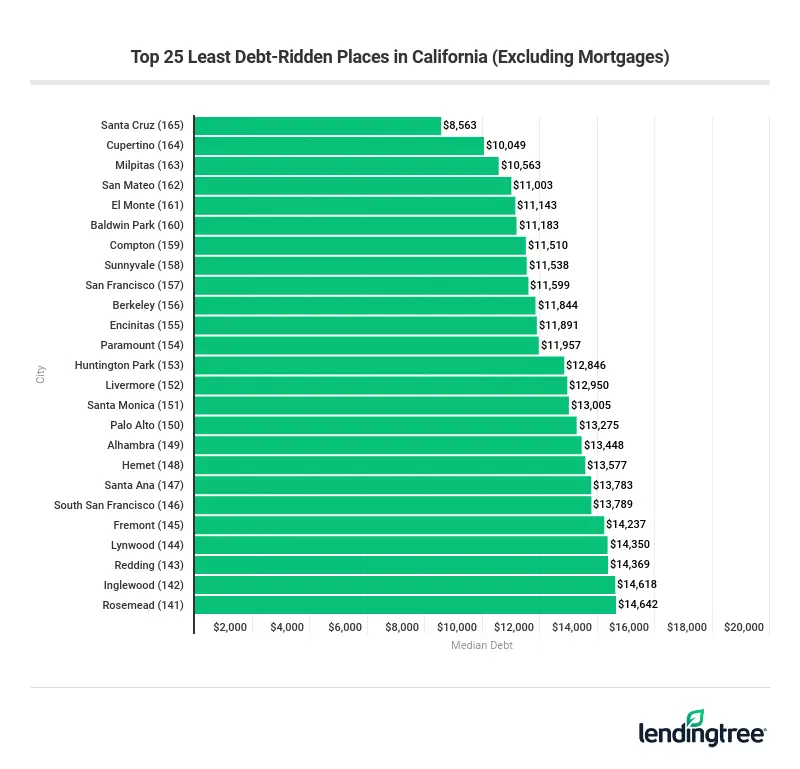

California cities carrying the least non-mortgage debt

Residents in California’s most populated cities tend to carry less debt, despite often being some of the most expensive places to live.

The city with the least debt is Santa Cruz, where the median non-mortgage debt among residents on average was $8,563.

Los Angeles, the largest California city by population, ranked no. 135 for median non-mortgage debt amount. Major technology hub San Jose was at no. 137, and San Francisco ranked no. 157. Of the 10 largest California cities, San Diego alone ranked in the top half (no. 77).

Besides San Jose residents, those living in other Silicon Valley cities, such as Palo Alto, Cupertino and Sunnyvale, were also among the least indebted in California.

Carrying high debt? 8 simple ways to handling it

Here are eight actionable tips for you to get out of debt faster or save money in interest payments.

- Snowball your debt payments: One of the ways to tackle your debt is to direct all your money toward your smallest debt balance until it’s paid off. Then apply the money you were paying toward that debt to your next largest debt, and continue the pattern once that debt balance is paid.

- Debt avalanche: Another method that may save you interest payments is to put your extra monthly allotment toward the debt with the highest interest rate while paying minimum monthly payments on other debts.

- Utilize financial windfalls: When you receive large payments, such as tax refunds, bonuses and pay raises, put them toward your car loan, credit card debt or student loans. This way, you could pay off your debt faster and potentially free up your cash flow for other expenses.

-

Reduce unnecessary expenses: Make a monthly budget and stick to it. Make sure the money coming out doesn’t exceed the money coming in.

Control your spending and free up cash for extra debt payments by:- Downgrading your cell phone data plan

- Getting rid of a few video streaming services if you don’t watch TV much

- Foregoing fashion trends or other unnecessary items

- Apply for a balance transfer card: If you have a huge pile of credit card debt and your interest rates are sky-high, a balance transfer could be a great option to reduce your debt. It allows you to roll over your debt from one credit card (or several) to another one with a lower rate or, even better, with 0% APR.As such, you can pay less in interest than you would if you kept the debt where it is. Note that you have to have good to excellent credit to qualify for a good balance transfer card. Most of the credit cards that offer 0% intro APR require a minimum credit score of 700. You will also need to repay your debt in full before the promotional ends if you want to avoid interest charges.

- Consolidate your high-interest debt with a personal loan: If you qualify for a loan at a lower rate than your credit card, you may want to consider consolidating your debt with a personal loan. Personal loans are unsecured loans offering a fixed amount of money at a fixed rate for a fixed amount of time. You could get a personal loan in one lump sum, use it to pay off the credit card debt that has a higher interest rate, and then make the fixed monthly payments until the end of the loan term. But it’s important to look at the potential costs that come with the personal loan. It only makes sense to consolidate your debt if you can save money on debt and interest payments.

- Pay off your auto loan early: The terms of an auto loan can stretch as long as 84 months, which can wrack up a significant amount of interest, so paying your auto loan off early can save money.If you lender allows you to pay off your loan faster, use an auto loan calculator to determine how much you’ll save in interest payments if you pay the loan off early. Note that prepayment penalties could negate savings. If you have a simple-interest auto loan, you can pay it off more quickly by making additional payments toward the principal. This is because if you pay off the principal faster, you’ll also pay less interest and reduce the overall cost of the loan.

- Consider refinancing your auto loan: If your car loan has a high interest rate and monthly fees, refinancing your auto loan to a lower rate and fees may save you money if your credit score is good. Keep in mind that your goal is to pay off the loan quickly. Refinancing with a new auto loan may stretch out your payment term even longer. If you choose to do so, do look at shorter terms and a lower interest rate and make bigger payments toward your loan.

Methodology

Using an anonymized sample of over 500,000 users, researchers calculated total debt balances from November 2018, December 2018 and January 2019 credit reports. These results were then aggregated to the California cities with a population of at least 50,000 to calculate median non-mortgage debt obligation. Included in this analysis researchers also found the average distribution of debts across the following debt types: auto, credit cards, personal loans, and student.

LendingTree Spring is a free credit monitoring service available to the general public, regardless of their debt and credit histories, or whether they’ve pursued loans on a LendingTree platform. LendingTree’s platform has over nine million users.

Get personal loan offers from up to 5 lenders in minutes

Recommended Articles