CreditWise Review: A Look at Capital One Credit Monitoring

- CreditWise from Capital One is a free credit monitoring service that tracks your FICO Score and alerts you when there are changes to your Experian or TransUnion reports.

- It’s available to everyone 18 and older with a Social Security number — Capital One customers and non-customers alike.

- CreditWise also monitors the dark web for your Social Security number and email address, giving you a heads-up on potential identity theft.

- Capital One CreditWise reviews are largely positive for both Apple and Android apps.

CreditWise features and benefits

Credit tracking

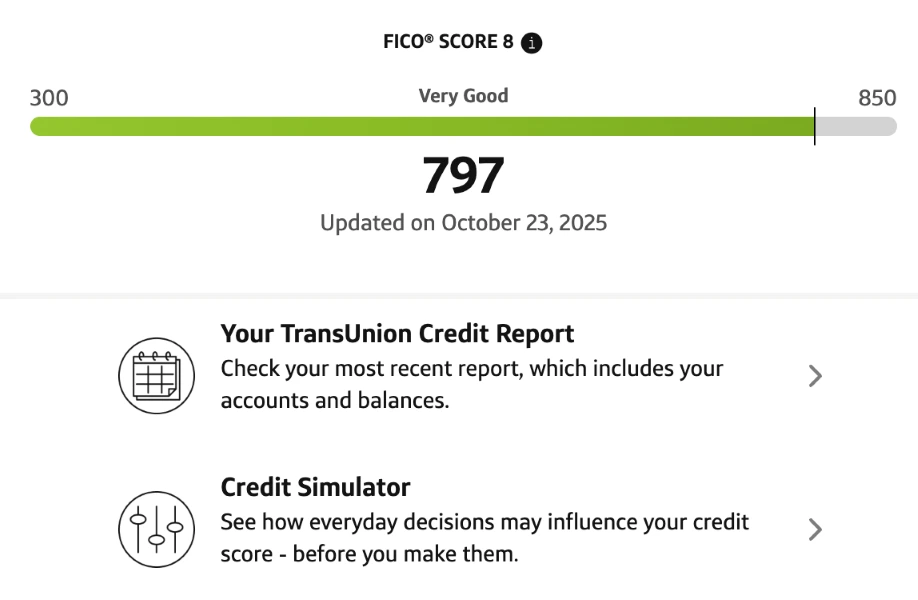

CreditWise offers standard credit monitoring services that allow you to check your credit score for free without impacting your score. You can also view your TransUnion credit report and see how you measure up against each of the five factors that affect your credit score.

Here’s an example of what your homepage may look like:

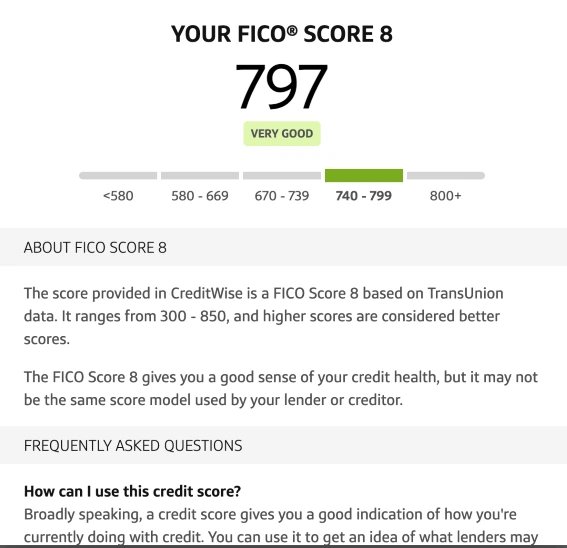

The CreditWise interface is intuitive and interactive — you can click on different parts of the page to learn more about your credit. Here’s an example of what you’ll see when you click on your credit score:

CreditWise even gives you a detailed report on each aspect of your credit — payment history, amount of debt, length of credit history, amount of new credit and credit mix — and how you compare to FICO High Achievers, or people with the top 25% of FICO scores.

Dark web monitoring

CreditWise alerts you when your Social Security number or email address appears on the dark web. This can be an early warning sign of identity theft, so CreditWise’s alerts could help you stop identity theft in real time.

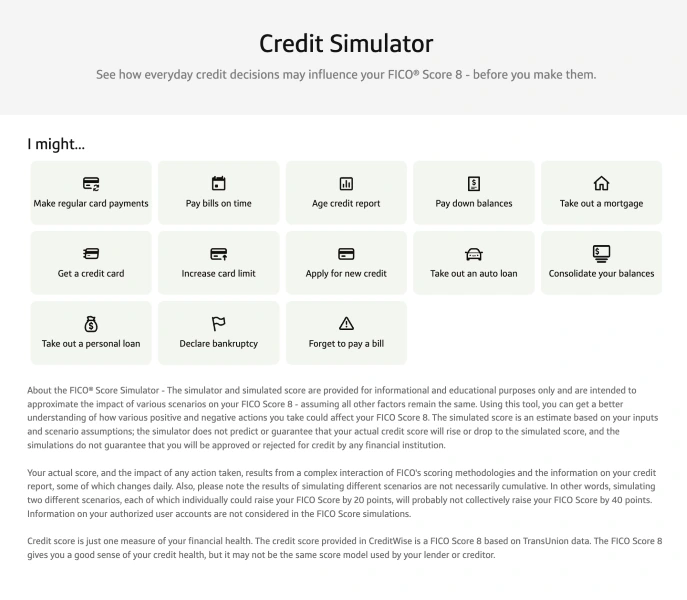

Credit score simulator

CreditWise’s credit score simulator helps you plan your next financial move by predicting how different actions will affect your credit. Here’s what it might look like:

You can simulate what would happen to your credit if you take out different types of debt, start making regular credit card payments or even forget to pay a bill. It’s not perfect — it just makes predictions, and the formulas behind your credit score are complex — but the CreditWise simulator can help you estimate how your credit will change based on your actions.

Free credit report

CreditWise gives you free access to your latest TransUnion credit report and alerts you when there are changes to your TransUnion or Experian credit reports. Staying on top of your credit profile can help you spot credit report errors so you can dispute them right away and avoid damage to your credit.

Keep in mind that TransUnion and Experian are two of the three credit bureaus. The third, Equifax, may have different information. You can get your Equifax report for free at AnnualCreditReport.com or use a paid credit monitoring service to get access to all three reports.

Many people get what they need from free credit monitoring tools like CreditWise. That said, if you’re looking for help with identity theft, freezing your credit or even public records monitoring, a paid credit monitoring service may be worth it to you.

Personalized credit tips

CreditWise gives you personalized insights about your credit and how it stacks up against each of the metrics used to calculate your credit score. Plus, CreditWise partners with Khan Academy to offer a free financial literacy course that can help you understand your credit and improve your financial health.

CreditWise vs. competitors

| CreditWise | Experian free credit monitoring | Chase Credit Journey | |

|---|---|---|---|

| Credit score tracking | |||

| Credit score simulator |

This is a paid feature under Experian CreditWorks Premium, which costs $24.99 per month after a trial as of this writing.

| ||

| Free credit reports | |||

| Dark web monitoring |

Experian offers one-time dark web monitoring rather than ongoing dark web alerts. You can pay Experian for additional monitoring.

| ||

| Personalized credit tips | |||

| Credit report alerts | |||

| Credit card and loan recommendations | |||

| Freeze your credit |

CreditWise is similar to other credit monitoring services like Chase Credit Journey and Experian. All of these services offer free credit monitoring, though some (notably Experian) charge for additional services like credit score simulators.

If you already have a Capital One account, you don’t have to do anything to download CreditWise — you can just access it directly from your Capital One mobile app.

Bottom line: If you’re already a Capital One customer, it makes sense to use CreditWise to monitor your credit. You can easily access CreditWise through the Capital One mobile app. If not, see if your bank offers free credit monitoring or check out services like LendingTree Spring.

LendingTree Spring

Supercharge your score

Get free, personalized recommendations on how to improve each of the factors that affect your credit score with LendingTree Spring. We’ll show you how your credit stacks up and what to do to boost your score.

Capital One CreditWise reviews

The Capital One CreditWise app has high scores with a 4.8 rating on the iPhone App Store and a 4.6 on Google Play.

Positive reviews praise CreditWise for helping users build or rebuild credit and for offering access to your FICO Score 8, the score often used by lenders when making credit decisions. Negative reviews take issue with the accuracy of the score simulator.

Frequently asked questions

Yes. CreditWise pulls your FICO Score 8 directly from your TransUnion credit report. It’s important to note that you have many different types of credit scores, so you may see a different score when you use another credit monitoring service.

Checking your credit score doesn’t lower it — that’s a popular myth that can actually do more damage to your credit than good. Checking your credit can help you spot credit report errors and take control of your financial health.

Yes, CreditWise is free and available to everyone — you don’t need to be a Capital One client or cardholder to use the service.

Get personal loan offers from up to 5 lenders in minutes