A Year Into Pandemic, Credit Card Debt Is Down 10% as Credit Scores Rise

The coronavirus pandemic has impacted consumers differently, but despite the financial challenges it has presented, Americans on average have improved aspects of their financial health in the year since the public health crisis emerged.

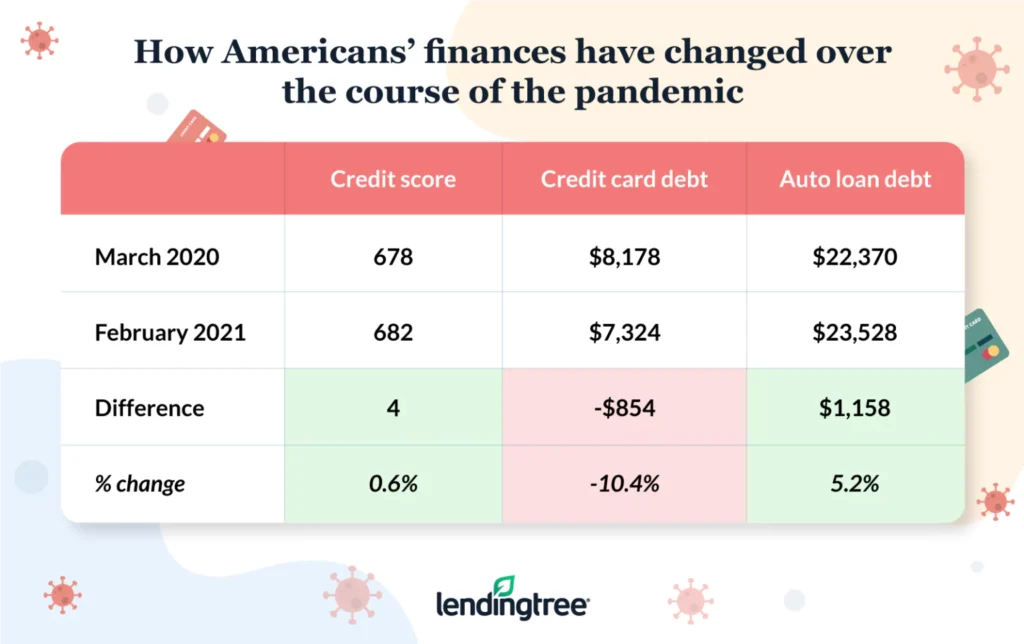

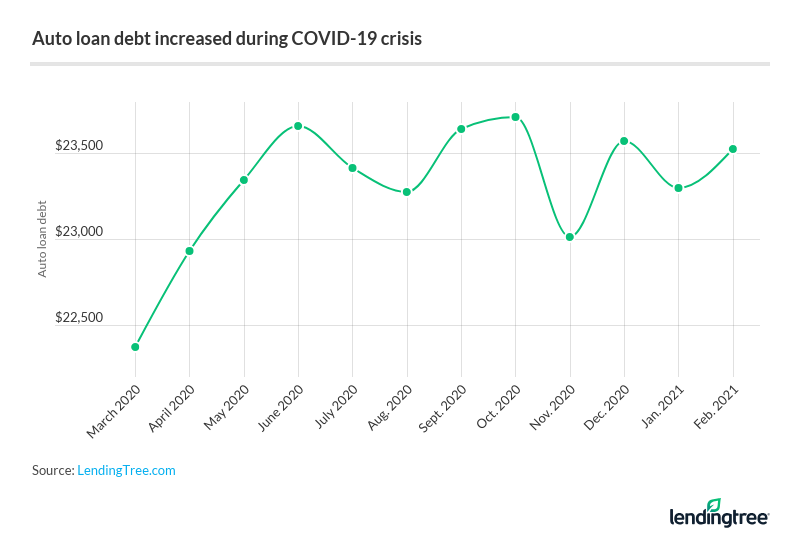

Credit scores are up four points and credit card debt is down 10.4% since March 2020, according to a March 2021 analysis by LendingTree researchers. Auto loan debt is up slightly, but it’s about in line with the percentage increase in average new-vehicle prices. See what else we found in the report below.

Key findings

- Credit scores are slightly up since the coronavirus pandemic began. The average credit score rose four points from 678 in March 2020 to 682 in February 2021. Older generations saw larger credit score gains, while millennials saw a 12-point drop.

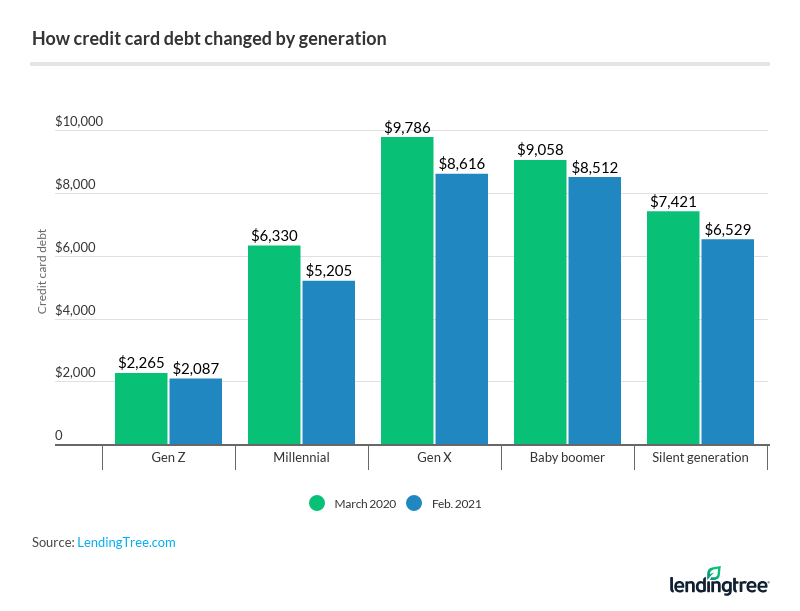

- Americans utilized the pandemic to pay down credit card debt. The average amount among those who carry credit card debt fell from $8,178 to $7,324. Millennials lowered their credit card debt by 17.8%, the most of any age group.

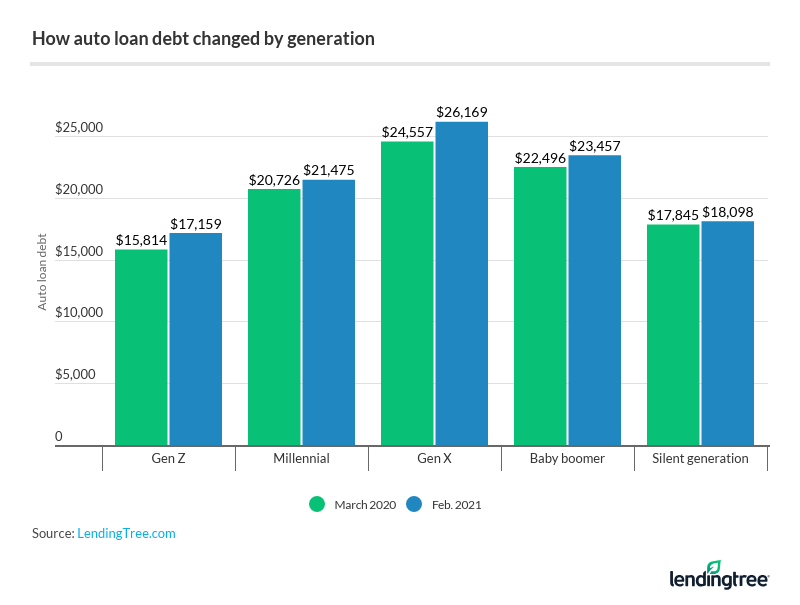

- Auto loan debt increased, perhaps a response to people feeling less safe about public transportation. Among those with auto loan debt, the average amount increased by 5.2%. Gen Z increased their auto debt the most, from $15,814 to $17,159 — an increase of 8.5%.

Credit scores are up for everyone — except millennials

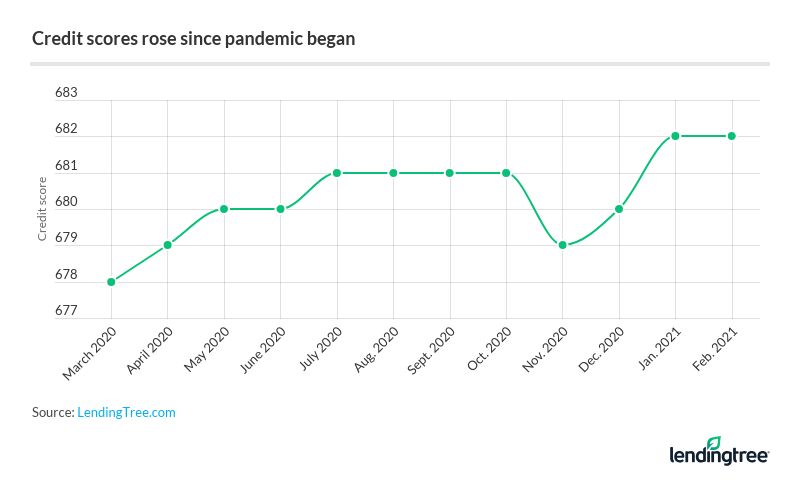

As a whole, consumers saw their credit scores rise slightly during the pandemic. In March 2020, the average credit score among LendingTree app users was 678. By February 2021, that figure had risen four points, to 682. That’s a gain of 0.6%.

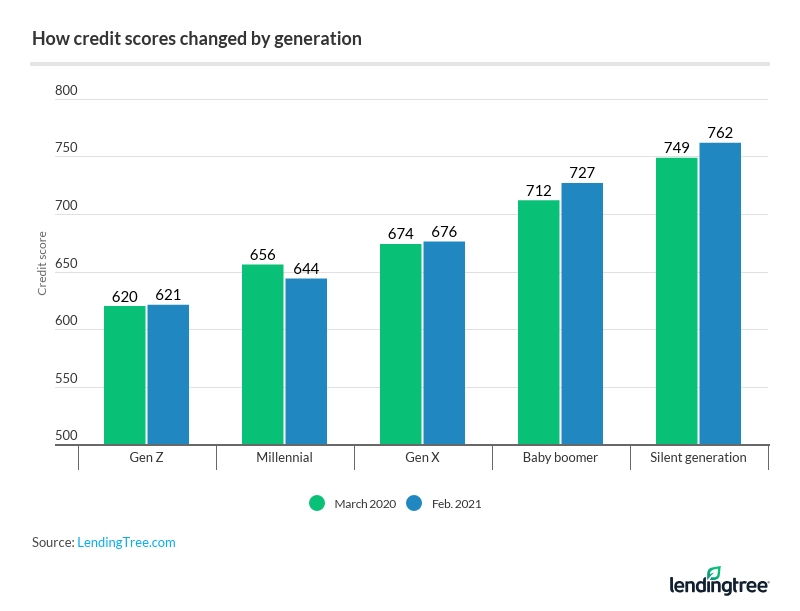

However, some generations saw greater gains than others. Baby boomers and the silent generation saw their credit scores rise by 15 and 13 points, respectively. Gen Xers and Gen Zers saw much smaller gains, at two points and one point. Millennials are the only age group that saw their credit scores fall, losing 12 points on average.

In general, younger Americans have had a tougher time in the labor market in 2020. This might be why they’re seeing smaller gains (and even losses) compared with older Americans.

Those with lower starting scores saw the largest gains

Consumers with extremely high or extremely low credit scores saw the largest changes over the course of the pandemic. Those who started with a poor credit score below 580 at the beginning of the pandemic gained 35 points on average. Those who started with an exceptional credit score of 800 or higher saw their credit scores drop an average of 13 points. See a breakdown in the table below:

How credit scores have changed by starting credit band

| Starting credit score | Credit score in March/April 2020 | Credit score in Jan/Feb 2021 | Gain/loss |

|---|---|---|---|

| Poor <580 | 525 | 560 | 35 |

| Fair 580-669 | 624 | 632 | 8 |

| Good 670-739 | 703 | 700 | -3 |

| Very Good 740-799 | 764 | 755 | -8 |

| Exceptional 800-850 | 811 | 798 | -13 |

Consumers have paid down credit card debt during pandemic

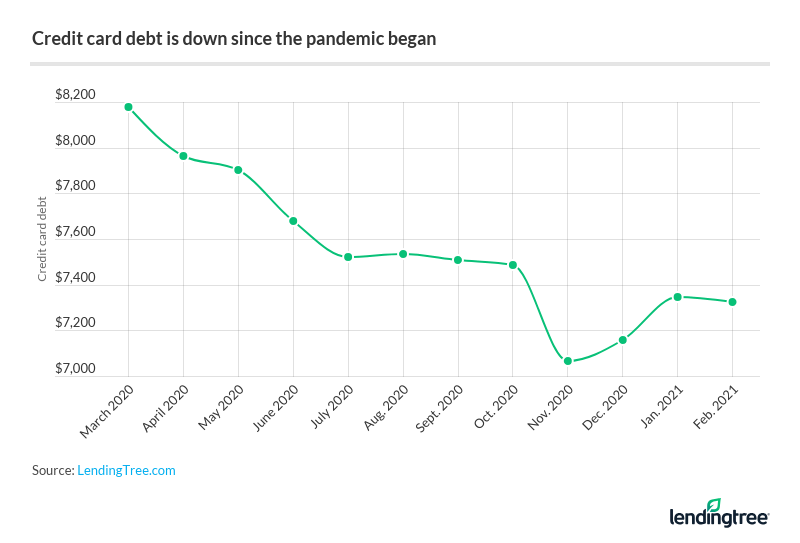

The coronavirus pandemic has posed challenges for many Americans who have dealt with furloughs, layoffs and pay cuts. Despite this, many Americans were able to cut down their credit card debt over the past year, perhaps using stimulus checks and unemployment to make a dent in their balances.

The average balance among those with credit card debt dropped 10.4%, from $8,178 in March 2020 to $7,324 in February 2021. That’s a difference of $854.

Credit card debt hit a low in November 2020, when the average fell to $7,067. It has increased slightly since then, which could be due to increased optimism about the coronavirus vaccines. As the pandemic winds down, it’s possible to speculate that some financial metrics will return to a pre-pandemic level, but it may take a while, according to LendingTree chief consumer finance analyst Matt Schulz.

“The big question is whether the financial scars of the pandemic will have brought about some fundamental change in the way Americans view savings and spending,” Schulz said. “I’d bet that things may change for a little while, but in the long run, Americans’ views on money won’t look too different after COVID-19 than they did before.”

Millennials lowered credit card debt 18%, but their credit scores still fell

While credit card debt fell among all Americans, it saw the sharpest drop proportionally among millennials. The average balance among millennials with credit card debt fell $1,125 over the course of the pandemic, from $6,330 to $5,205.

Despite the fact that millennials lowered their credit card debt by the largest percentage of any generation, they’re the only age group that suffered a drop in credit scores. It seems counterintuitive, but millennials were the generation most likely to have their credit limit slashed or credit card account closed during the pandemic, Schulz said.

“That’s a really big deal because it means that your credit score can fall even when your balance shrinks,” Schulz said. “Meanwhile, boomers and silent generation Americans were far less likely to have their limits slashed and their cards closed, so it is likely that if they were able to reduce their credit card balances during the pandemic, those decreases would’ve translated directly into higher credit scores.”

How credit card balances changed, March 2020 vs. February 2021

| Age group | $ change | % change |

|---|---|---|

| Gen Z | -$178 | -7.9% |

| Millennial | -$1,125 | -17.8% |

| Gen X | -$1,170 | -12.0% |

| Baby boomer | -$546 | -6.0% |

| Silent generation | -$892 | -12.0% |

Auto loan debt increases as many opt out of public transportation

The average auto loan balance has grown steadily over the course of the pandemic. Among those who have an auto loan, the average was $22,370 in March 2020. By February 2021, the average balance increased by $1,158 to $23,528. That’s an increase of 5.2%, which is about in line with the percentage change in the cost of a new car over that time period.

It would make sense that Americans are still buying cars, despite the financial hardship the pandemic has caused. Some may have prioritized their physical health over their financial well-being, taking on more auto loan debt to avoid crowds and possibly contract COVID-19. It can be difficult to stay socially distant on public transportation, and some people may choose to avoid crowds altogether by driving rather than taking the train or a bus.

Plus, with comparatively low interest rates, paying down auto loan debt may not be a high priority for many consumers right now.

“It’s typically a lower-interest-rate type of debt, so many Americans have chosen to put their extra cash toward paying down credit card debt or building an emergency fund instead,” Schulz said. Given that the average interest rate on a new auto loan is 4.31%, according to the latest data from Experian, and the average credit card APR is nearly 20%, Schulz said that’s probably the right move.

Auto loan debt increased among all generations, but some age groups saw larger increases than others. Gen Zers, who are currently 18 to 24, saw the largest spike in auto loan debt during the pandemic. Their average auto loan debt increased 8.5%, although this generation still has the lowest auto loan balances of any generation at $17,159 as of February 2021.

Methodology

Analysts used anonymized data from more than 30,000 LendingTree app users to see how a variety of personal finance metrics have changed between March 2020 and February 2021. Specifically, we compared the change in credit score, credit card debt and auto loan debt. We compared these metrics across generations, as well.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

- Silent generation: 76 and older

Get personal loan offers from up to 5 lenders in minutes