Most Popular Metros for Military Veteran Homebuyers

Originally introduced in 1944, mortgages guaranteed by the U.S. Department of Veterans Affairs (VA) have long been part of the homebuying experience. And while today’s VA loans aren’t identical to their World War II-era counterparts, they’re still a good option for many veterans looking to buy a house.

To better understand where veterans are looking to get mortgages and how much money VA loans can potentially help them save, LendingTree analyzed more than 537,000 mortgage inquiries made on our platform from Oct. 1, 2022, through Sept. 30. 2023.

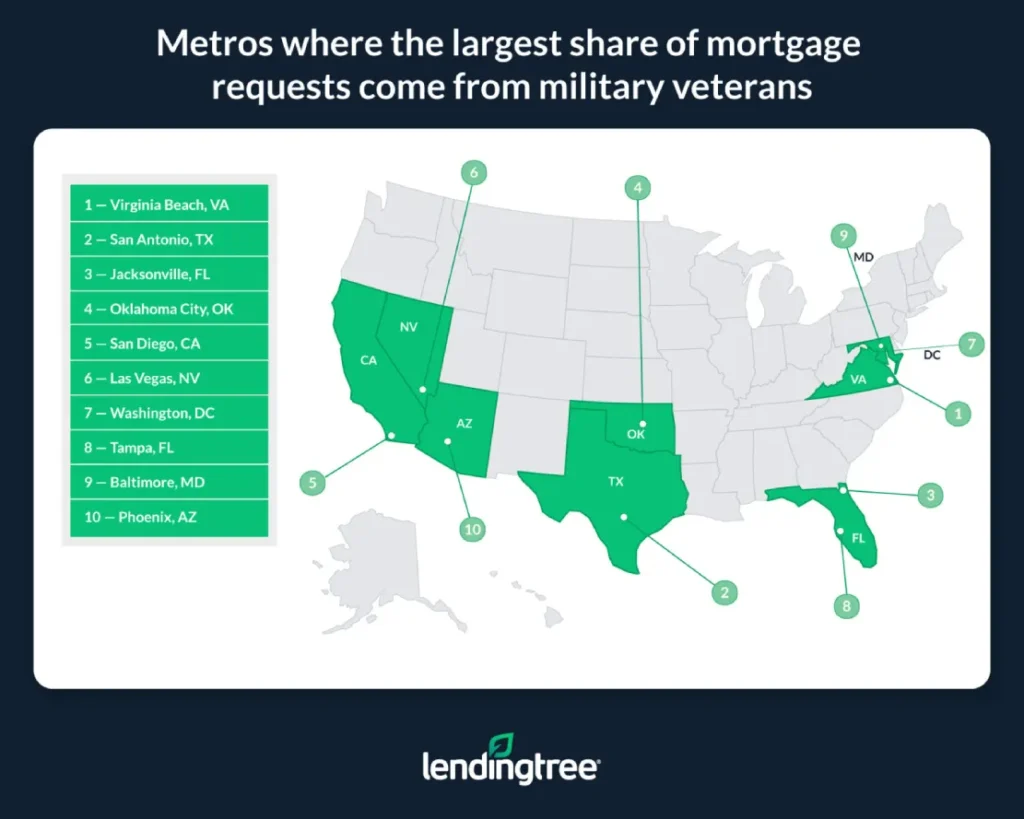

We’ll highlight which of the nation’s 50 largest metros see the largest share of mortgage requests from veterans, as well as what kind of mortgage offers they typically receive.

Key findings

- 6.38% of mortgage purchase requests in the nation’s 50 largest metros come from military veterans. In most of these metros, the share of requests from vets is typically between 5.00% and 10.00%.

- Virginia Beach, Va., San Antonio and Jacksonville, Fla., are the metros where the largest share of mortgage purchase requests come from veterans. In these metros, 20.35%, 14.22% and 12.27% of mortgage requests come from vets.

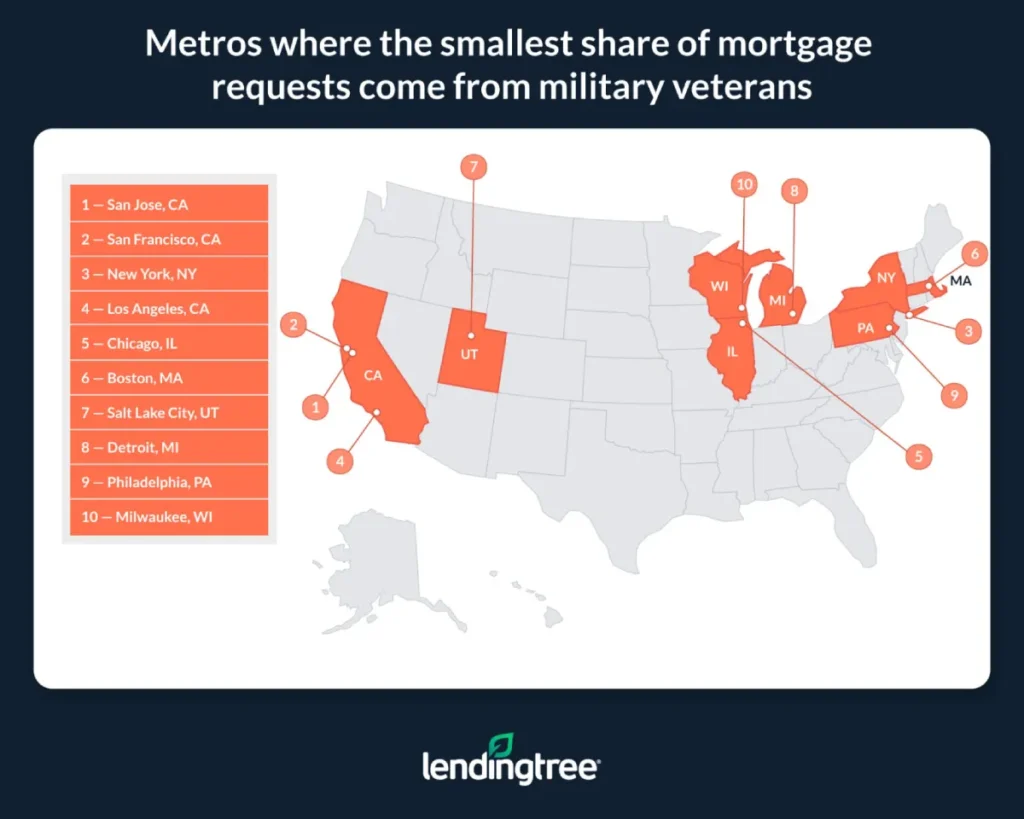

- Veterans make up the smallest share of mortgage requesters in San Jose, Calif., San Francisco and New York. Only 2.79%, 3.14% and 3.85% of requests in these metros come from veterans.

- Though some vets may prefer VA-backed mortgages, that’s not the only option they’re likely to be offered. Across the nation’s 50 largest metros, 46.31% of mortgages offered to vets are VA loans, 45.51% are conventional loans and 8.09% are Federal Housing Administration (FHA) loans.

- Even if other options are on the table, a person offered VA, FHA and conventional loans would likely benefit significantly from selecting the VA option. On average, offers for VA mortgages in the nation’s 50 largest metros come with APRs 43 basis points lower than for FHA loans and 51 basis points lower than for conventional loans.

- The lower APRs with VA loans can help borrowers across the nation’s largest metros secure notably lower monthly payments. For example, assuming loan sizes remain the same, borrowers who opt for VA mortgages over FHA mortgages save an average of $97 a month. Those who choose a VA mortgage over a conventional loan could save an average of $126 a month.

- As with other mortgage types, the loan amounts, monthly payments and APRs offered with VA loans can vary significantly by metro. For example, at nearly $670,000 and over $4,400 a month, the average offered loan amount and monthly payment for VA mortgages in San Francisco are the highest among the nation’s 50 largest metros. On the flip side, they’re lowest in Cleveland, at more than $285,000 and $1,900-plus a month. APRs generally vary less than loan amounts and monthly payments, but average as high as 6.41% in Buffalo and as low as 6.02% in San Diego.

Metros where the largest share of mortgage requests come from military veterans

No. 1: Virginia Beach, Va.

- Share of mortgage requests from veterans: 20.35%

- Share of mortgages offered to vets that are VA: 48.9%

- Share of mortgages offered to vets that are conventional: 38.7%

- Share of mortgages offered to vets that are FHA: 12.3%

- Average APR offered for VA mortgages: 6.15%

- Average loan amount offered for VA mortgages: $365,666

- Average monthly payment offered for VA mortgages: $2,469

- Reduction in APR from choosing VA mortgage over FHA: 41 basis points

- Reduction in APR from choosing VA mortgage over conventional: 51 basis points

- Monthly savings from choosing VA mortgage over FHA: $81.23

- Monthly savings from choosing VA mortgage over conventional: $110.14

No. 2: San Francisco

- Share of mortgage requests from veterans: 3.14%

- Share of mortgages offered to vets that are VA: 45.8%

- Share of mortgages offered to vets that are conventional: 48.6%

- Share of mortgages offered to vets that are FHA: 5.5%

- Average APR offered for VA mortgages: 6.03%

- Average loan amount offered for VA mortgages: $668,437

- Average monthly payment offered for VA mortgages: $4,412

- Reduction in APR from choosing VA mortgage over FHA: 48 basis points

- Reduction in APR from choosing VA mortgage over conventional: 45 basis points

- Monthly savings from choosing VA mortgage over FHA: $203.18

- Monthly savings from choosing VA mortgage over conventional: $185.29

No. 3: Jacksonville, Fla.

- Share of mortgage requests from veterans: 12.27%

- Share of mortgages offered to vets that are VA: 50.9%

- Share of mortgages offered to vets that are conventional: 42.6%

- Share of mortgages offered to vets that are FHA: 6.4%

- Average APR offered for VA mortgages: 6.18%

- Average loan amount offered for VA mortgages: $370,950

- Average monthly payment offered for VA mortgages: $2,482

- Reduction in APR from choosing VA mortgage over FHA: 45 basis points

- Reduction in APR from choosing VA mortgage over conventional: 55 basis points

- Monthly savings from choosing VA mortgage over FHA: $92.56

- Monthly savings from choosing VA mortgage over conventional: $119.70

Metros where the smallest share of mortgage requests come from military veterans

No. 1: San Jose, Calif.

- Share of mortgage requests from veterans: 2.79%

- Share of mortgages offered to vets that are VA: 42.3%

- Share of mortgages offered to vets that are conventional: 49.2%

- Share of mortgages offered to vets that are FHA: 8.4%

- Average APR offered for VA mortgages: 6.03%

- Average loan amount offered for VA mortgages: $629,618

- Average monthly payment offered for VA mortgages: $4,123

- Reduction in APR from choosing VA mortgage over FHA: 35 basis points

- Reduction in APR from choosing VA mortgage over conventional: 47 basis points

- Monthly savings from choosing VA mortgage over FHA: $117.25

- Monthly savings from choosing VA mortgage over conventional: $167.32

No. 2: San Francisco

- Share of mortgage requests from veterans: 3.14%

- Share of mortgages offered to vets that are VA: 45.8%

- Share of mortgages offered to vets that are conventional: 48.6%

- Share of mortgages offered to vets that are FHA: 5.5%

- Average APR offered for VA mortgages: 6.03%

- Average loan amount offered for VA mortgages: $668,437

- Average monthly payment offered for VA mortgages: $4,412

- Reduction in APR from choosing VA mortgage over FHA: 48 basis points

- Reduction in APR from choosing VA mortgage over conventional: 45 basis points

- Monthly savings from choosing VA mortgage over FHA: $203.18

- Monthly savings from choosing VA mortgage over conventional: $185.29

No. 3: New York

- Share of mortgage requests from veterans: 3.85%

- Share of mortgages offered to vets that are VA: 30.1%

- Share of mortgages offered to vets that are conventional: 62.0%

- Share of mortgages offered to vets that are FHA: 7.9%

- Average APR offered for VA mortgages: 6.30%

- Average loan amount offered for VA mortgages: $418,885

- Average monthly payment offered for VA mortgages: $2,806

- Reduction in APR from choosing VA mortgage over FHA: 50 basis points

- Reduction in APR from choosing VA mortgage over conventional: 56 basis points

- Monthly savings from choosing VA mortgage over FHA: $142.87

- Monthly savings from choosing VA mortgage over conventional: $145.87

For those who qualify, VA loans can be especially helpful in today’s expensive housing market

With rates and home prices across the U.S. as high as currently seen, buying a house can be extremely challenging — even for those who might not have struggled to buy before or during the height of the coronavirus pandemic.

Owing to this, many would-be buyers are understandably searching for ways to make purchasing a home less challenging. For those who qualify for them, VA loans are tools that can help buyers do just that.

As our study shows, the lower rates typically offered on VA mortgages can make housing payments less expensive than with other loan types. On top of that, the additional benefits of VA loans — among them, their lack of down payment and mortgage insurance requirements — can make it easier for would-be buyers to get approved for a mortgage.

Of course, this isn’t to say that VA loans are a cure-all for every problem in today’s housing market. On the contrary: Not every vet will qualify for a VA mortgage, and those who do may still find that many homes remain outside their price range.

Ultimately, while those who receive a VA mortgage are unlikely to circumvent all the challenges associated with today’s high home prices and mortgage rates, they can nonetheless benefit from the numerous perks offered by VA loans.

Tips for getting a lower rate on a VA mortgage

Like any other type of mortgage, the rates offered to borrowers who opt for VA loans aren’t universal and will vary based on factors like what lender a person is working with or what their finances look like. Here are three tips that can help a VA borrower get an even lower rate on their mortgage.

- Boost your credit score. The higher your credit score, the less risky a lender is likely to view you and the better loan terms you’re likely to be offered. To improve your score, focus on paying bills on time, reducing outstanding debts and correcting any errors on your credit report. Remember, even a relatively modest increase in your credit score can lead to more favorable loan terms.

- Shop around. Different lenders can offer different rates and terms to the same borrowers. By shopping around for a mortgage and comparing offers from different lenders, you can increase your chances of securing a lower interest rate and potentially saving thousands of dollars over the life of the loan.

- Save for a larger down payment. Though you may not be required to put any money toward a down payment on a VA mortgage, the more you can put toward one, the smaller your loan will be and the lower the rate you’ll likely be offered. A lower rate and a smaller loan amount mean you’ll spend less in interest over the lifetime of your loan.

Methodology

LendingTree researchers reviewed 537,552 inquiries from consumers looking for mortgage offers from Oct. 1, 2022, through Sept. 30, 2023, to determine how many identified as veterans in the 50 largest U.S. metropolitan statistical areas (MSAs).

Researchers then compared the term loans offered to veterans, depending on whether they were VA, FHA or conventional loans. The terms offered through a VA loan were then compared to those offered to the same veteran through the other loan programs, and these differences were then averaged across each metro.

View mortgage loan offers from up to 5 lenders in minutes