What Is PMI? All About Private Mortgage Insurance

You’re required to pay private mortgage insurance (PMI) if you can’t make at least a 20% down payment when purchasing a home using a conventional loan. Unlike homeowners insurance, PMI doesn’t protect you or your home — it only covers your lender’s losses if you default on your mortgage.

Homeowners pay for PMI monthly, usually as part of their normal mortgage payment. Knowing what determines your PMI premiums can help you save money, or even eliminate PMI altogether.

What is private mortgage insurance?

Private mortgage insurance protects your lender if you can’t repay your mortgage. The policy is required for anyone who doesn’t put down at least 20% when purchasing a home with a conventional loan.

Who requires it: PMI only applies to conventional loans, which are loans that follow guidelines set by Fannie Mae and Freddie Mac. However, other loan types can also come with their own forms of mortgage insurance.

How it’s paid: You’re typically required to pay PMI monthly, but in some cases you can also pay upfront or a combination of the two. Some lenders may offer to pay for PMI on your behalf, but in return you’ll have to accept a higher interest rate.

You don’t have to pay PMI forever — jump down to our section on how to get rid of PMI to find out more.

PMI vs. homeowners insurance

The most important difference between PMI and homeowners insurance is that homeowners insurance covers you, the homeowner, if something unexpected happens — PMI does not. Nonetheless, as a homeowner you’re responsible for paying the premiums for both PMI and homeowners insurance.

Another important difference is that, with PMI, you can’t choose your insurance company — the lender chooses it. That’s why it’s important to keep a close eye on your loan estimates when shopping for a purchase or refinance loan: to see how the PMI costs compare.

PMI vs. MIP

MIP is the annual mortgage insurance premium paid by FHA loan borrowers. Just like PMI, it covers only the lender’s losses if a borrower defaults on their home loan.

How much is private mortgage insurance?

You can usually expect to pay between $30 and $70 per month for every $100,000 you borrow. On a median-priced home today, that comes to between $126 and $294 per month.

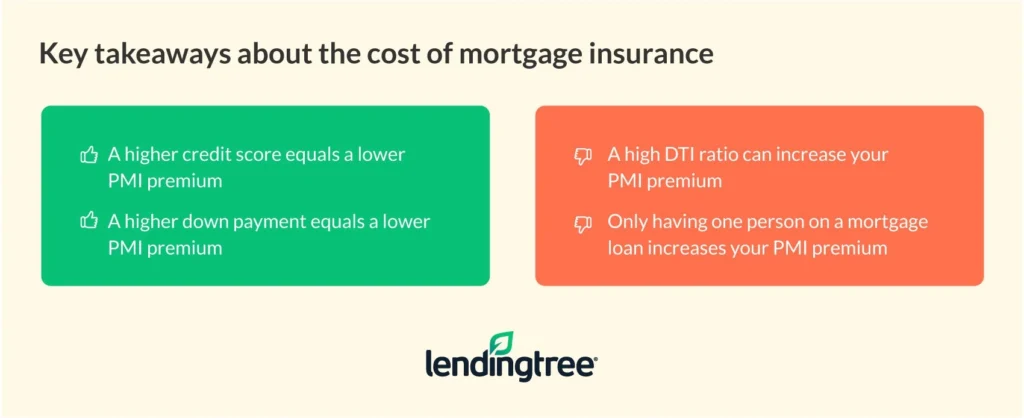

The exact amount you’ll pay is determined by nine factors, which we’ll explain in the next section. However, you can’t control all of those factors. Here’s a quick look at the major factors you can control:

9 factors that affect the cost of PMI

-

Your credit score and credit history. A higher credit score will snag you a lower PMI premium.

Aim for a 740 to 760 score or higher to get the best PMI rates. -

Your loan-to-value ratio. Your loan-to-value (LTV) ratio measures how much of your home’s value you’re borrowing. The lower your down payment, the higher your LTV ratio, and the more expensive your PMI will be.

Aim for an LTV ratio under 85% to get the best PMI rates. -

Your debt-to-income ratio. Unlike with credit scores, where there are many different ranges with significance for your rate, everyone with a debt-to-income (DTI) ratio above 45% is in the same boat when it comes to PMI. So, unless you can get yours below 45%, you don’t need to improve your DTI to get a better rate.

Aim for a 45% DTI ratio or better to get the best PMI rates. -

The loan term. Although 30-year mortgages are the most common choice, it pays to choose a shorter loan term if you can afford the higher monthly payments. You’ll get a break on your PMI premium — as well as on loan interest — if you do.

Aim for a loan term under 20 years to get the best PMI rates. - Your occupancy. You’ll get the cheapest PMI if you’re buying a home you intend to live in as your primary residence. Expect to pay more for PMI on a second home.

- The type of home you’re financing. Single-family homes usually cost the least to insure. Multifamily homes and manufactured homes typically have higher premiums.

- How many people are borrowing. You’ll get a slight PMI discount if you borrow with someone else, versus flying solo.

- The loan purpose. You’ll get the best PMI premiums if you buy or refinance your home without taking extra cash out.

- Whether your rate is fixed or adjustable. Adjustable-rate mortgages (ARMs) with interest rates that can change in less than five years will require a higher PMI payment.

How to choose the best PMI payment type for you

As mentioned above, you can choose to pay your PMI monthly, pay all of it upfront or combine those options with “split” payments. You also have the option to let your lender pay the PMI premium — but you’ll have to accept a higher interest rate in exchange. For more detail on each option, click that option’s name below.

Monthly PMI — also known as borrower-paid mortgage insurance (BPMI) — is the most common PMI choice, because it allows you to spread out the cost and add it to your monthly payment. The premium is based on a percentage of your loan amount.

This may also be called “single-premium PMI” and allows you to prepay the full cost of your PMI in a lump sum as part of your closing costs.

You can mix and match the monthly and upfront premium options, paying a portion of the PMI upfront and adding the remaining balance to your monthly payment. You may also see this option called “combination PMI.”

If you agree to a bump in your mortgage interest rate, your lender may offer lender-paid mortgage insurance (LPMI). The lender pays the PMI premium on your behalf with this option. However, you’re stuck with the higher rate for as long as you have the loan (unless you refinance).

How to choose the best PMI option for your financial situation

| Choose monthly PMI if: | Choose upfront PMI if: | Choose split PMI if: | Choose lender-paid PMI if: |

|---|---|---|---|

|

|

|

|

How to get rid of PMI

There are three ways you can remove private mortgage insurance:

- Refinance your mortgage. A refinance may make sense if current rates are headed lower while your home’s value is headed higher. If your new LTV ratio is 80% or less, you won’t need PMI on your refinance loan. However, you’ll spend 2% to 6% of your loan amount on closing costs, so make sure the break-even point is worth it.

- Cancel your PMI. If home values are spiking in your area and it looks like your loan balance may have dropped below 80% of your home’s value, you can ask your loan servicer to cancel your PMI. Your lender may require a new home appraisal, but the cost may be worth it if you can get rid of PMI.

- Wait for your PMI to drop off. Lenders should automatically stop charging you for PMI once your loan balance reaches 78% of your home’s original value.

How to avoid PMI

If you don’t have the money to come up with a 20% down payment and don’t want to pay PMI, there are a few more options worth considering:

- Get a piggyback loan. With this option, you’ll take out two mortgages. The first loan covers most of the amount you borrow, and a second mortgage — usually a home equity loan or home equity line of credit (HELOC) — “piggybacks” onto the first to make up the difference. One popular piggyback option is the 80-10-10 loan. With this loan, you make a 10% down payment and get a second mortgage for another 10%. The remaining 80% of your home’s value is financed with a first mortgage, eliminating the need for mortgage insurance.

- Get a VA loan. Eligible military borrowers don’t have to pay for mortgage insurance — even if they put no money down — if they qualify for a VA loan. Backed by the U.S. Department of Veterans Affairs, these loans typically offer very competitive loan terms. However, they do require a funding fee, unless you’re exempt due to a service-related disability.

-

Get an FHA loan. If you have low credit scores, choosing an FHA loan backed by the Federal Housing Administration (FHA) may save you money. Unlike PMI premiums, FHA mortgage insurance premiums aren’t impacted by your credit score. However, there are three important things to understand about FHA mortgage insurance:

- You’ll pay it for the life of your loan if you make a minimum 3.5% down payment

- You have to pay both an upfront and monthly FHA mortgage insurance premium (you can’t choose one or the other like you can with conventional PMI)

- FHA mortgage insurance is required on all new FHA purchase and refinance loans, regardless of your down payment or how much equity you have in your home

View mortgage loan offers from up to 5 lenders in minutes