Should You Get a No-Closing-Cost Mortgage?

A no-closing-cost mortgage can be a lifesaver if you’re short on cash to buy or refinance a house. Instead of draining your bank account to pay thousands out of pocket — including origination, title and appraisal fees — the lender covers them. In exchange, they’ll charge you a higher interest rate or add the closing costs to your loan amount.

The catch? You’ll save money upfront but pay significantly more in interest charges over the life of your loan. We’ll help you understand when they make financial sense so you can decide if this trade-off is right for your situation.

- No-closing-cost mortgages allow you to avoid paying upfront closing costs, which typically come to about 2% to 6% of your total loan amount (in today’s market, that’s around $8,216 to $24,648 on a median-priced home).

- You’ll have to either accept a higher interest rate or roll the costs into your loan, both of which will make your monthly payments more expensive.

- It’s more expensive to borrow money using a no-closing-cost mortgage compared to a traditional loan, and it could add tens of thousands of dollars to your total loan costs over a 30-year term.

What is a no-closing-cost mortgage?

With a traditional mortgage, the fees and charges known as “closing costs” usually must be paid by the time you close the loan. Since these closing costs can total thousands or tens of thousands of dollars — and are usually paid in cash — some homebuyers are looking to avoid them. To cater to these buyers, some lenders offer what’s called a “no-closing-cost” or “zero-closing-cost” mortgage.

With these loans, you can avoid paying cash at closing for any of the fees and charges you’d normally pay. However, it’s important to understand that you’re making a trade-off, not getting a true discount. You’ll still pay for those costs in the long term. The question is: how?

Mortgage closing costs typically range from 2% to 6% of your loan amount. That may sound minor, but it can add up to tens of thousands of dollars. On a $410,800 loan, which is the current median home price in the U.S., you’d likely pay between $8,216 to $24,648 in closing costs and fees.

Closing costs hit low-income and first-time homebuyers especially hard. More than 14% of them face closing costs that equal or even exceed their down payment. That’s because closing costs are “regressive,” an economic term meaning they take up a bigger chunk of the home price for low-income people than they do for wealthier buyers. Luckily, there are many down payment and closing cost assistance programs out there to help first-time buyers cover these costs.

Keep in mind that not all mortgage lenders will cover the same costs and fees when they talk about covering “closing costs.” Be sure to talk to your lender about whether they cover lender and origination charges as well as third-party charges, like title and settlement costs or attorney fees. Also be aware that prepaid costs at closing, like upfront mortgage insurance or homeowners insurance, may be treated differently.

List of typical closing costs

| Type of closing costs | Examples of charges it may include | Mean cost (among U.S. homebuyers) | Typical (mean) percentage of home price |

|---|---|---|---|

| Lender and origination charges | Appraisal fee, application fee, credit report fee, processing fee, automated underwriting fee, document preparation fee | $2,406 | 0.90% |

| Title and settlement charges | Settlement fee, title endorsement fee, title closing fee, title examination fee, wire transfer fee | $1,961 | 0.70% |

| Other charges | Home warranty fee, attorney fees, pest inspection fee, HOA dues | $342 | 0.12% |

How does a no-closing-cost mortgage work?

There are generally two ways a no-closing-cost mortgage can work:

- You roll the closing costs into your mortgage. Instead of paying closing costs in cash upfront, they’re added to the mortgage, increasing the total loan balance. This will make your monthly payment higher, but it will free up the cash you would’ve used for closing costs.

- Your lender covers the closing costs but charges you a higher interest rate. You’ll save money now, but a higher mortgage interest rate will also increase your monthly payment amount. This is very similar to a “buy-up” or lender credit, except that a no-closing-cost mortgage covers the total amount of your closing costs, whereas a lender credit may only cover a portion of what you owe.

Takeaway: No matter which route you take, the trade-off with no-closing-cost mortgages is that you save money upfront but end up paying much more over time. In a way, what you’re really doing is financing the closing costs just as you financed the home.

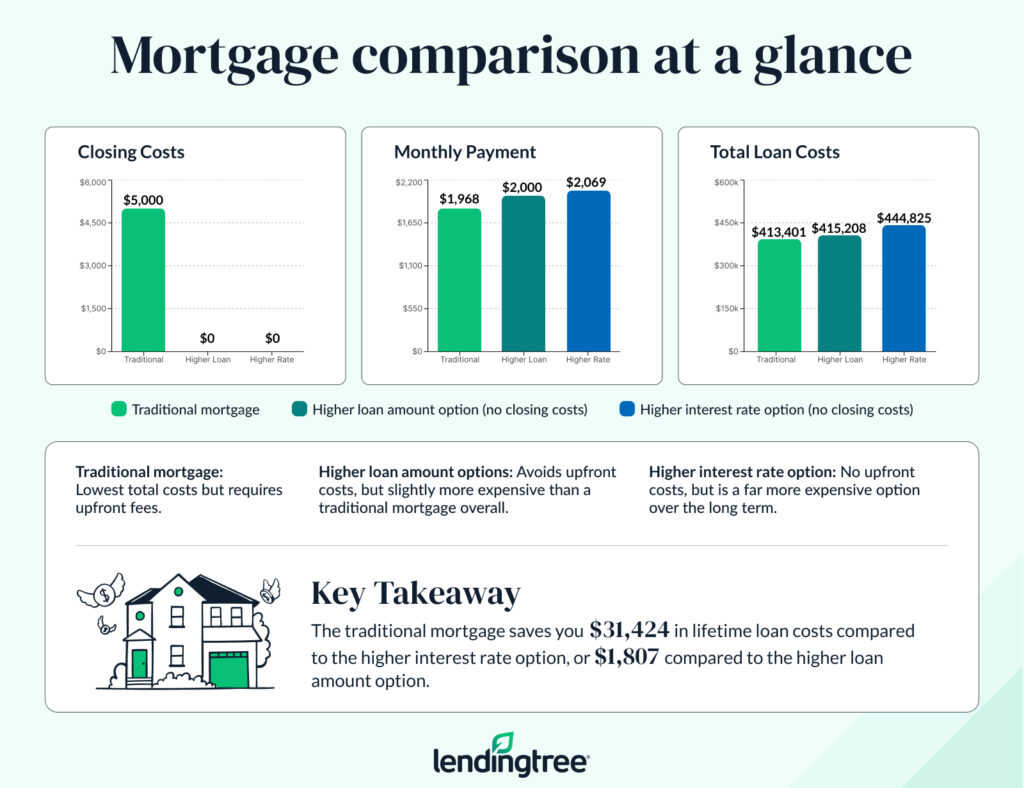

Example: How much more will I pay for a no-closing-cost mortgage vs. traditional mortgage?

You’ll pay more both per month and over the life of the loan (compared to paying the closing costs with cash), but how much more varies by the exact type of no-closing-cost mortgage you choose.

For our example, we assume you want to purchase a $300,000 home, but you don’t want to pay the $5,000 in closing costs upfront. Here are your options, compared with a traditional mortgage:

| Traditional mortgage with closing costs | No-closing-cost mortgage with higher loan amount | No-closing-cost mortgage with higher interest rate | |

|---|---|---|---|

| Loan amount | $300,000 | $305,000 | $300,000 |

| Interest rate | 6.86% | 6.86% | 7.36% |

| Total cost paid at closing | $5,000 | $0 | $0 |

| Monthly payment (principal and interest) | $1,967.78 | $2,000.58 | $2,068.96 |

| Lifetime interest costs | $408,400.99 | $415,207.68 | $444,825.38 |

How much more you’ll pay, compared to paying the closing costs with cash:

| No-closing-cost loan with higher loan amount | No-closing-cost loan with higher interest rate | |

|---|---|---|

| Extra monthly payment cost | + $32.80 | + $101.18 |

| Lifetime interest cost | + $6,806.69 | + $36,424.39 |

Who offers no-closing-cost mortgages?

Any lender that offers mortgage loans can elect to offer no-closing-cost mortgages. Large, well-respected lenders like Rocket Mortgage and Bank of America offer them. Others, like TD Bank, have lender credit programs that may allow you to purchase a home and have some or all of the closing costs covered.

Pros and cons of no-closing-cost mortgages

Pros

- You save cash upfront. If you don’t have a lot of savings, a no-closing-cost mortgage can help you close on a home without stretching your cash too thin.

- You might be able to make a bigger down payment. Since you’ve freed up some cash, you can make a larger down payment on your home than you would otherwise. This immediately gives you more equity and could help you avoid paying private mortgage insurance (PMI) since it’s usually required if you make a down payment of less than 20%.

- You reach your refinance break-even point sooner. If you’re using a no-closing-cost refinance, it might mean you break even on the refinance sooner. The break-even point with a refinance is when the amount you save in monthly payments by refinancing outweighs what you paid in refinance closing costs.

Cons

- You might pay more in interest. No-closing-cost mortgages tend to charge a higher interest rate. This leads to a higher monthly payment and higher total interest costs.

- You might have a larger loan. If your lender chooses to roll the closing costs into your mortgage, your loan balance will be bigger than it would be if you paid the closing costs. This will result in a higher monthly payment, so make sure your monthly budget can accommodate the payments before you commit.

- You might face a prepayment penalty on your mortgage. Because lenders are eating the upfront costs, some will require you to pay a prepayment penalty if you choose to refinance within a certain period of time. This could increase your costs if you want to refinance to a lower interest rate down the line.

When is a no-closing-cost mortgage a good idea?

- If your goal is to get into a house, and you can afford the payments but don’t have enough cash on hand to cover closing costs, then this type of mortgage could make sense. In some situations, having the security and stability of a place to call home is worth paying extra for. However, it’s important to go in with a plan and know how much extra you’re willing to pay.

- If you’re planning to move or refinance before your break-even point, it can make financial sense to choose a no-closing-cost mortgage. The reason is that you may be able to exit the loan before you pay out more in interest than you saved by not paying closing costs.

Let’s say you take out a no-closing-cost mortgage for a $400,000 house and roll in $12,000 worth of closing costs in exchange for a 0.5% increase in your interest rate. The higher interest rate bumps up your monthly payment by $200, meaning you’ll reach your break-even point after 60 months or five years.

However, even if it looks like the basic math is working in your favor, you’ll need to be on the lookout for prepayment penalties that can add yet another line item to your total costs (if you refinance before a date set by your lender). Make sure you check your loan terms or ask your lender directly about these fees.

No-closing-cost mortgage requirements

While most requirements will be the same whether you choose to finance your closing costs, you’ll have to qualify for a higher monthly payment. This usually means you’ll need to show more income or less debt to qualify.

That’s not usually a huge gap to cross, but if you were already at the edge of what you could afford, it could stop you from qualifying for a no-closing-cost mortgage.

Read more about the minimum mortgage requirements you’ll have to meet.

How to get a no-closing-cost mortgage

The mortgage process for a no-closing-cost loan is the same as a regular mortgage:

- Research different lenders to compare ballpark rates and terms, and confirm which lenders offer no-closing-cost loans.

- Fill out an application to receive a preapproval letter showing how much you can borrow.

- Shop for a home and, when you’ve found one you like, put in an offer.

- Get loan estimates from multiple lenders for that specific property. Compare the rates and terms they offer you side by side to choose the best one. This is also a great time to crunch the numbers to help you decide on a no-closing-cost option versus paying closing costs upfront.

- Finalize your loan with the lender of your choosing, and don’t forget to request a mortgage rate lock. Keep track of the expiration date to make sure you’re not stuck paying costly extension or relock fees.

Alternatives to a no-closing-cost mortgage: 4 ways to reduce your closing costs

A no-closing-cost mortgage or lender credit isn’t the only way to save some upfront cash when buying a home. Here are a few other options to consider if you’re looking for a low-closing-cost mortgage.

- Negotiate with your lender. Closing costs aren’t set in stone. Many fees can be waived or reduced — especially lender application and origination fees. Explain your needs to your lender and ask if it can reduce or remove fees. You may be able to lower your upfront costs without increasing your interest rate.

- Look for lenders that advertise low- or no-fee loans. “No fee” in this context only refers to lender fees, which means that you’ll still face third-party fees like appraisal, title and attorney fees. Still, finding a lender willing to eliminate its fees can be a way to reduce the amount of cash you’ll need to bring to the closing table. Just be cognizant of the fact that the lender will likely recoup these costs by making some other part of the loan more expensive.

- Find a homebuyer assistance program. Many cities and states offer programs that include grants or other assistance for your down payment and closing costs. These can take the form of a no-interest loan or a forgivable loan. Many of these programs have income limits and other requirements, so be sure to read the fine print.

- Ask the seller to cover the closing costs. Usually the buyer pays closing costs, but you can negotiate with the home seller and ask them to cover some of the costs. Closing costs that the seller agrees to cover are known as “seller concessions,” and they can be negotiated as you head toward closing.

Frequently asked questions

It’s up to your lender whether it wants to offer a no-closing-cost mortgage option; there’s no rule that would prohibit conventional loans from being no-closing-cost loans. Assuming that the loan wouldn’t violate the guidelines set by Fannie Mae and Freddie Mac, a no-closing-cost loan could in theory also still be a conforming loan. If the loan violated the rules for a qualified mortgage (QM) loan set under the Truth in Lending Act, it could still be conventional but may be a nonqualified mortgage.

Yes, you can refinance a mortgage with no closing costs just the same way you can take out a no-closing-cost purchase loan. In fact, no-closing-cost refinances are becoming more common and may be a little easier to find than no-closing-cost purchase loans.

With a no-closing-cost refinance, if you choose to roll the closing costs into the loan, you’ll be increasing the loan balance, which in turn means you’ll be using more of your home equity. This is, however, the cheaper of the two methods you can use to achieve a no-closing-cost refinance. Taking a higher interest rate in exchange for having your lender cover closing costs will typically be the most expensive option.

View mortgage loan offers from up to 5 lenders in minutes