What You Need To Know About Late Mortgage Payments

What actually happens when your mortgage payment is late? The answer can vary from person to person based on your financial history, your loan’s specific rules and how late your payment is.

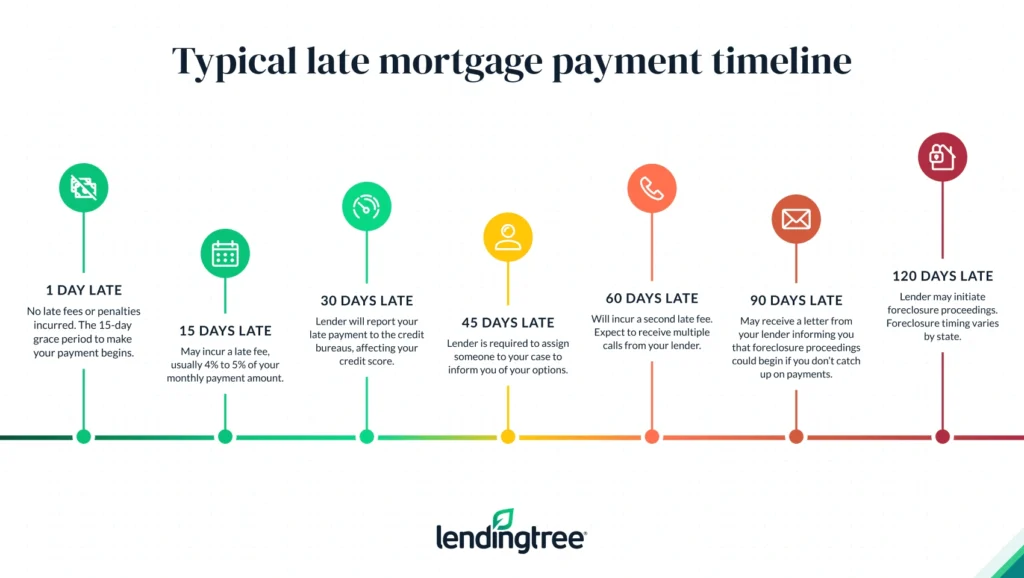

We’ll go through the entire late mortgage payment timeline in detail — including the grace period — so you know your options if you’ve fallen behind on mortgage payments.

When is a mortgage payment considered late?

A mortgage payment is technically late as soon as you miss the due date listed on your loan paperwork. If you’re not sure about your due date, it should be listed on your mortgage statement, promissory note and closing disclosure.

If this is your first mortgage payment, it’s typically due on the first day of the second month after your loan closing.

And if you’re already late, don’t panic — most lenders offer a grace period that gives you extra time to submit your payment without incurring a late fee or other negative repercussions.

Lenders typically report a payment as “late” to the credit bureaus 30 days after the due date.

What is a grace period for a mortgage?

A grace period gives you extra time — usually 10 to 15 days — to get your payment in before it’s officially counted as “late.” If you can make your payment during that period, you’ll dodge the negative consequences of a late payment, which can include:

- Late fee. This is typically 4% to 5% of your overdue payment amount, though it can vary by lender.

- Additional interest charges. Some lenders increase your mortgage interest rate as soon as your payment is late and the grace period ends. Conventional loans don’t allow this, but some other loan types do. This can make missed payments a big mistake that’ll continue to cost you for the rest of your loan term.

- Non-sufficient funds fee. If you attempt to make the payment but it doesn’t go through because your account has insufficient funds, the lender may charge a $15 to $75 fee.

- Report to credit bureaus. Once a payment reaches 15 days late, the lender may choose to report it to the credit bureaus, which means it’ll show up on your credit report for up to seven years.

- Foreclosure fees and costs. If you remain behind on your mortgage payments for long enough, the lender can initiate foreclosure proceedings and send you a bill for many of the costs. A homeowner can expect to pay around $12,500 in foreclosure costs and fees, according to data from the Consumer Financial Protection Bureau (CFPB).

We break down the intricacies of the late mortgage payment timeline in detail below. If you’re more interested in how a late payment affects your credit, you can jump to that section now.

Most mortgage payments are due on the first day of the month. Although your payment is technically late at one day past-due, most mortgage servicers won’t give you a late payment penalty after only a day because of the mortgage grace period — this is the set time after your due date during which you can still make a payment without incurring a penalty.

For most mortgages, the grace period is 15 calendar days. So if your mortgage payment is due on the first of the month, you’ll have until the 16th to make the payment.

Your grace period typically ends after 15 days. At this point, your lender may assess a late fee that can be charged each month that you miss a payment. The fee can be significant, generally ranging between 4% and 5% of the total overdue balance. Check your loan documents if you’re unsure what late fees your lender is allowed to charge.

Your servicer may report the delinquency to the credit bureaus. This can impact your credit, since you’ve passed the grace period and officially missed a payment.

By 36 days late, federal law requires the servicer to try to make contact with you. If they receive no response, the servicer may send a Notice of Default, which documents how far behind you are, what you can do to rectify the situation and — if you don’t — what date the lender intends to sell your home.

You’ll usually have at least 30 days’ notice to pay your outstanding mortgage balance, plus any accumulated interest and fees, in full. The laws in most states give more time to work out payment arrangements before foreclosure. Keep in mind that most lenders would rather work with you to get your mortgage payments current than go through foreclosure.

Federal law requires the servicer to assign a company staff member to your file. This staffer is tasked with connecting you to available assistance options and answering any questions you may have. You’ll receive a written notice of this assignment.

By now, you’ve missed two monthly payments and you’ve likely been charged a second late fee. Your lender has probably called several times, in attempts to discuss why you haven’t made a payment.

If you’re having financial troubles, it may be difficult or embarrassing to discuss — but you shouldn’t ignore your lender’s calls. They may be able to work with you or refer you to resources that can help.

Once you’ve missed three payments, your lender will likely send another, more serious notice. This is known as a “Demand Letter” or “Notice to Accelerate,” and it’s essentially a notice to bring your mortgage current or face foreclosure proceedings.

The process and timeline for foreclosure varies from state to state. You can look up information on your state’s foreclosure laws and procedures online.

If you haven’t paid in full or made other payment arrangements by the deadline spelled out in the Demand Letter, your lender will refer you to their attorney, who will schedule a foreclosure sale. You’ll receive a notice by mail and have a notice taped to your door. In addition, the sale may be advertised in your local paper.

You can miss around four payments before foreclosure. Your mortgage servicer can start the foreclosure process once you’re 120 days behind on your payments, according to CFPB regulations. That is, unless you have an active application for a foreclosure-prevention option — such as a loan modification or short sale — in which case they have to put foreclosure on hold until your application has been evaluated.

For more details on the timelines related to loan assistance, including the application and appeal process, visit the CFPB’s foreclosure avoidance page.

How a late mortgage payment affects your credit

Once a mortgage lender reports your late payment to the credit bureaus, your credit score will go down. Even one late payment can remain on your credit report for up to seven years, bringing down your credit score. However, as time passes, the late payment’s impact on your credit history decreases.

In addition, the hits to your credit score will only get worse the more you fall behind. Your credit report will indicate whether the payment is 30 or more days late, as well as what was done to resolve the late payment. If your late payments ultimately result in foreclosure, that will remain and continue to affect your credit score for up to seven years.

How does foreclosure affect your credit?

Foreclosure involves your lender taking ownership of your home and selling it to recoup their investment, and it’s what will happen if you can’t pay your mortgage for a prolonged period of time.

Your credit will suffer as a result of foreclosure — you can expect your score to drop by at least 100 points.

What to do if you can’t pay your mortgage

If you reach a point where you’re unable to pay your mortgage, there are several potential options to consider that could help lessen penalties or keep you in your home.

Housing counseling

You can reach out to a housing counselor approved by the U.S. Department of Housing and Urban Development (HUD) if you’re struggling to pay your mortgage and want to avoid foreclosure.

The housing counselor will help you work with your mortgage lender, and they may even be able to contact the mortgage company on your behalf.

Mortgage forbearance

Mortgage forbearance is an option that allows you to temporarily pause or lower your mortgage payments for a set time period if you’re experiencing financial hardship.

The terms of these agreements vary — however, in most cases, after your forbearance period ends, you must repay all missed payments with interest. You can pay in a lump sum, but your lender may give you the option to enter into a repayment plan by adding a portion of your past-due balance to each of your monthly payments. In some cases, you can resume your regular mortgage payments and pay off your missed payments at the end of your loan term.

Mortgage modification

A mortgage modification adjusts your original loan terms to help make your mortgage payments more affordable. The adjustments can take several different forms, including:

- Adding your past-due balance to your outstanding loan amount and recalculating your repayment term

- Extending your repayment term — for example, going from a 30 to 40-year mortgage

- Lowering your mortgage interest rate

- Reducing your outstanding principal balance

You should also note that a mortgage modification isn’t the same as a mortgage refinance. You’re not replacing your original mortgage — your lender is just modifying the existing terms.

Home sale

The thought of selling a home can be daunting, especially if you’re already experiencing financial hardship. But it’s something to consider if you can no longer afford your mortgage payments, and it can help you exit the situation without damaging your credit any further.

The cost to sell a home usually comes to around 5% to 10% of the home’s sales price, and it’s possible to sell a home fast — in fact, it only takes 43 days on average.

Short sale

A short sale allows a homeowner who owes more on their house than it’s worth to sell the home for less than they owe on their mortgage. The goal is to pay off as much of the balance as possible, so the mortgage lender isn’t left with a huge unpaid balance. In some instances, the lender may even forgive the leftover balance from a short sale.

If you believe this could be the best option for you given your situation, begin by reaching out to your mortgage lender or servicer to determine your eligibility for a short sale.

Deed-in-lieu of foreclosure

A deed-in-lieu of foreclosure (also called a mortgage release) is where you voluntarily transfer ownership of your home to your lender. This allows you to get rid of your mortgage balance without repaying it.

Once you’ve decided that this option might be best for you, reach out to your lender to determine your eligibility. If they agree that this may be the best option for you, the process can be completed in around 90 days.

Foreclosure

We covered what foreclosure is above, but it can bring major consequences that go beyond your credit score:

- You’ll lose your house. Not only will you lose a large asset, you’ll have to move out and find a new place to call home.

- You could still be on the hook for some of your outstanding balance. If your debt isn’t fully covered by the home’s sale, your lender can require you to pay the difference.

- You’ll have to wait to buy another home. Mortgage lenders require borrowers with a foreclosure in their past to wait a certain amount of time before they can qualify for a new home loan. That period can range from two to seven years, depending on your circumstances and the type of loan you want to take out.

With such serious consequences, it’s best to look at foreclosure as a last resort. If you’re late on mortgage payments, reach out to your lender or a housing counselor as soon as possible.

View mortgage loan offers from up to 5 lenders in minutes