Nearly 18 Million Owner-Occupied Homes in US Are Housing Cost-Burdened, Including 43% of Those Headed by Single Moms

It’s no secret that owning a home can be expensive. While some homeowners can comfortably manage their housing costs, others are housing cost-burdened and can’t.

What housing cost-burdened looks like will vary by homeowner. Generally speaking, those who spend at least 31% of their monthly income on housing costs (including their mortgage payment and other costs like insurance and utilities) are considered cost-burdened.

With that in mind, LendingTree analyzed U.S. Census Bureau American Community Survey data to determine the share of owner-occupied households in each state spending at least 31% of their income on monthly housing costs.

Millions of owner-occupied households across the country are cost-burdened, and some types of households — like those headed by single mothers — are much more likely to overspend on housing costs than others.

On this page

- Key findings

- States with the highest share of housing cost-burdened owner-occupied households

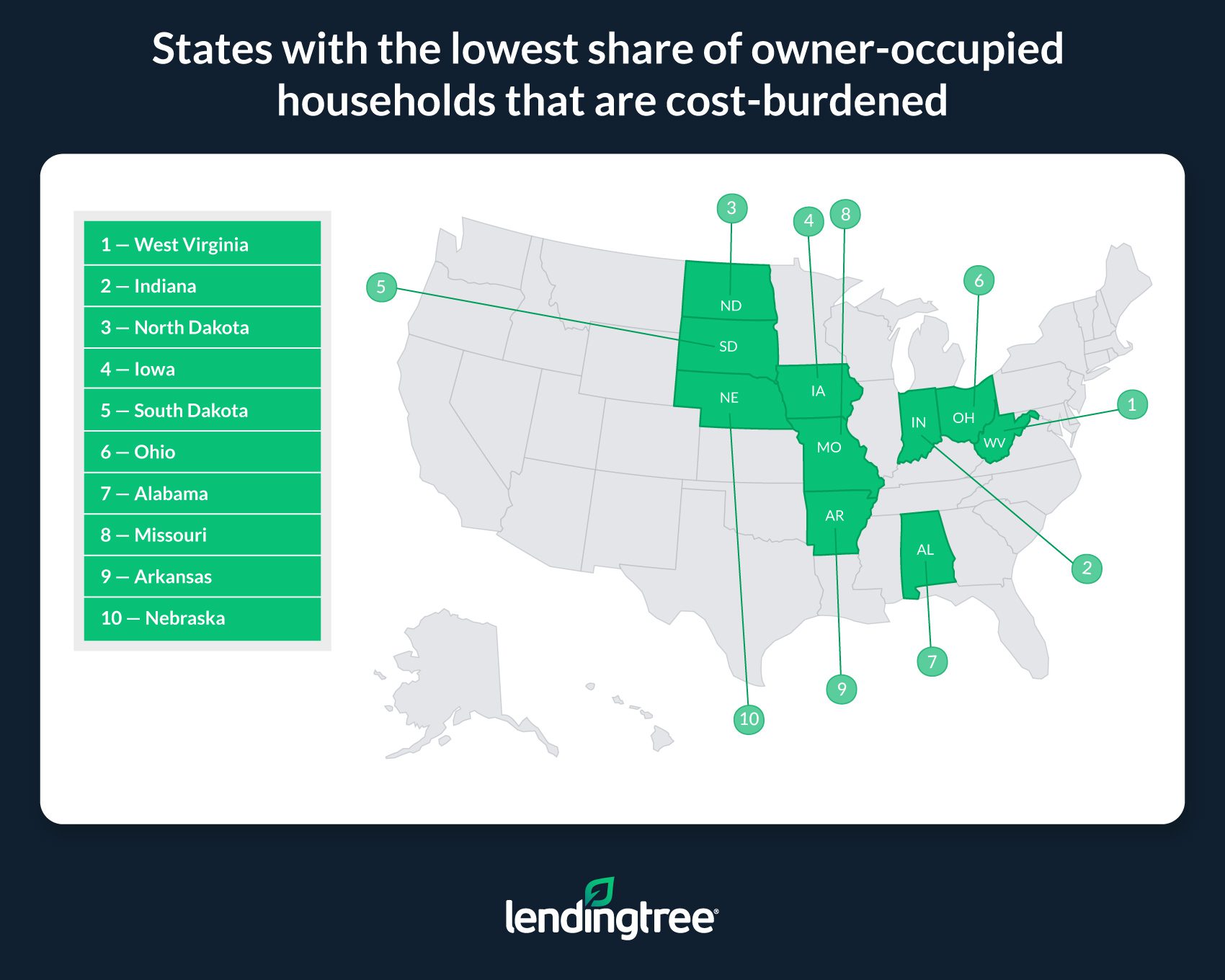

- States with the lowest share of housing cost-burdened owner-occupied households

- There’s often wiggle room with how much you should spend on housing costs

- Tips for staying on top of your housing costs

- Methodology

Key findings

- 21.48% of owner-occupied households in the U.S. are housing cost-burdened. To put that into perspective, 17,768,140 owner-occupied homes are cost-burdened.

- Hawaii, California and New Jersey have the largest share of cost-burdened homes. An average of 29.98% of owner-occupied households in these states are housing cost-burdened.

- The least cost-burdened states are West Virginia, Indiana and North Dakota. Across these states, an average of 14.97% of owner-occupied households are housing cost-burdened.

- Married couple households are least likely to be housing cost-burdened. Nationwide, 14.47% of owner-occupied households headed by married couples without children younger than 18 living at home are cost-burdened. The share is slightly higher for couples with kids at home at 15.80%. While dealing with housing costs generally appears more challenging for people whose kids live with them, married couples across the board tend to earn enough money to comfortably manage their housing expenses.

- Single women homeowners are most likely to be housing cost-burdened. 39.62% of single women homeowners who live by themselves and 43.31% of single women homeowners with children younger than 18 are housing cost-burdened.

- Though single men aren’t as burdened by housing costs as single women, they still face more difficulty than married couples. 32.59% of single men homeowners who live by themselves are housing cost-burdened, versus 30.36% of single men homeowners with children younger than 18. Single men are the only group where parents with children younger than 18 living at home are less likely to be cost-burdened.

States with the highest share of housing cost-burdened owner-occupied households

No. 1: Hawaii

- Share of housing cost-burdened households: 31.81%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 29.75%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 22.52%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 57.10%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 59.37%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 46.83%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 48.19%

No. 2: California

- Share of housing cost-burdened households: 29.65%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 24.83%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 22.91%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 49.66%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 50.51%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 42.92%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 39.05%

No. 3: New Jersey

- Share of housing cost-burdened households: 28.47%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 20.54%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 20.24%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened:52.17%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 56.51%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 43.83%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 39.10%

States with the lowest share of housing cost-burdened owner-occupied households

No. 1: West Virginia

- Share of housing cost-burdened households: 14.28%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened:10.00%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 7.70%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 27.13%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 27.69%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 23.11%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 32.73%

No. 2: Indiana

- Share of housing cost-burdened households: 15.05%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 9.78%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 8.19%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 32.81%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 35.28%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 24.19%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 23.71%

No. 3: North Dakota

- Share of housing cost-burdened households: 15.57%

- Share of households owned and occupied by married couples with children younger than 18 that are housing cost-burdened: 10.16%

- Share of households owned and occupied by married couples without children younger than 18 that are housing cost-burdened: 10.19%

- Share of households owned and occupied by single women who live alone that are housing cost-burdened: 29.31%

- Share of households owned and occupied by single mothers with children younger than 18 that are housing cost-burdened: 58.85%

- Share of households owned and occupied by single men who live alone that are housing cost-burdened: 26.40%

- Share of households owned and occupied by single fathers with children younger than 18 that are housing cost-burdened: 16.40%

There’s often wiggle room with how much you should spend on housing costs

As this study shows, those who spend at least 31% of their monthly income on monthly housing costs are considered housing-cost burdened. The reason is because households that spend more than this can end up with less money than needed for their savings or to keep up with important bills, like food and car or credit card payments.

That said, spending 31% or more of your income on housing costs isn’t necessarily the end of the world. Some people can be financially secure while spending more money on housing than what is generally recommended.

For example, households with little to no debt might be able to successfully allocate more money toward housing if they have fewer bills to worry about. Similarly, those who don’t need a car to get around or don’t need to spend much on groceries may be able to get away with spending 31% or more of their income on housing. In some instances, it may even be advisable for a person to spend more than what’s generally recommended on housing costs if doing so is the only way they’ll be able to find a safe and secure place to live.

At the end of the day, you should do your best to keep the amount you spend on your home manageable. However, what “manageable” will look like will vary by person and household. Owing to this, though the recommendation that people spend less than 31% of their monthly income on housing costs is often good to follow, it’s far from an absolute rule.

Tips for staying on top of your housing costs

There’s no getting around how expensive housing can be in today’s economy, but the following tips can still help homeowners keep up with costs:

- Shop around before you buy. Though there are ways to lower your housing costs after you’ve bought your home, one of the best ways to make sure you won’t be housing cost-burdened is to try to get offered a low mortgage payment before you buy. To do this, you’ll not only want to have a strong credit score and a low debt-to-income ratio, but you’ll also want to shop around for a mortgage lender. Different lenders can offer different rates and payments to the same borrowers, and, as a result, shopping around before you buy can help you get the best possible deal on your loan.

- Work on getting rid of your mortgage insurance. If you made a less-than-20% down payment toward your home purchase, odds are you’re paying private mortgage insurance (PMI) each month. Fortunately, if you have a conventional loan, your mortgage insurance automatically goes away once your loan principal balance reaches 78% of your home’s value. Alternatively, you can ask your lender to remove your mortgage insurance once you’ve built up at least 20% equity in your home.

- Ask about a mortgage modification. Some homeowners having serious issues keeping up with their housing costs may be able to work with their lender to get a mortgage modification. Depending on lender options, a mortgage modification can help a person lower their monthly housing costs by reducing their mortgage payment.

Methodology

LendingTree used data from the U.S. Census Bureau 2021 American Community Survey with one-year estimates — the latest available at the time of writing — to conduct this study.

More specifically, LendingTree used American Community Survey microdata to determine the share of owner-occupied households in each of the nation’s 50 states that were spending 31% or more of their monthly household incomes on housing costs. Generally speaking, households are described as “housing cost-burdened” when they spend more than 30% of their income on housing costs. Owing to how Census Bureau microdata is presented, this study rounds “more than 30%” up to 31%.

The Census defines housing costs for owner-occupied housing units as: “The sum of payments for mortgages, deeds of trust, contracts to purchase or similar debts on the property (including payments for the first mortgage, second mortgages, home equity loans and other junior mortgages); real estate taxes; fire, hazard and flood insurance on the property; utilities (electricity, gas, and water and sewer); and fuels (oil, coal, kerosene, wood, etc.). It also includes, where appropriate, the monthly condominium fee for condominiums and mobile home costs (personal property taxes, site rent, registration fees and license fees).”