Luck of the Irish? Across the 50 Largest US Metros, Those With Irish Ancestry Report Higher Homeownership Rates and Incomes Than the Overall Population

For centuries, people from Ireland have immigrated to the U.S. Today, those who report Irish ancestry make up one of the largest demographics in the country.

With St. Patrick’s Day around the corner, LendingTree analyzed U.S. Census Bureau data to examine where people with Irish ancestry make up the largest share of the population — and what their finances look like.

Specifically, we ranked the nation’s 50 largest metropolitan areas by the share of their population that identifies as having Irish ancestry. Additionally, we looked at how homeownership rates, home values, household incomes and the share of households that aren’t housing cost-burdened* differ between homes headed by those with Irish ancestry and the overall population.

We found that households headed by people with Irish ancestry tend to be better off financially — read on for more.

*For our study, non-housing cost-burdened households are those that spend less than 30% of their monthly income on housing costs.

Key findings

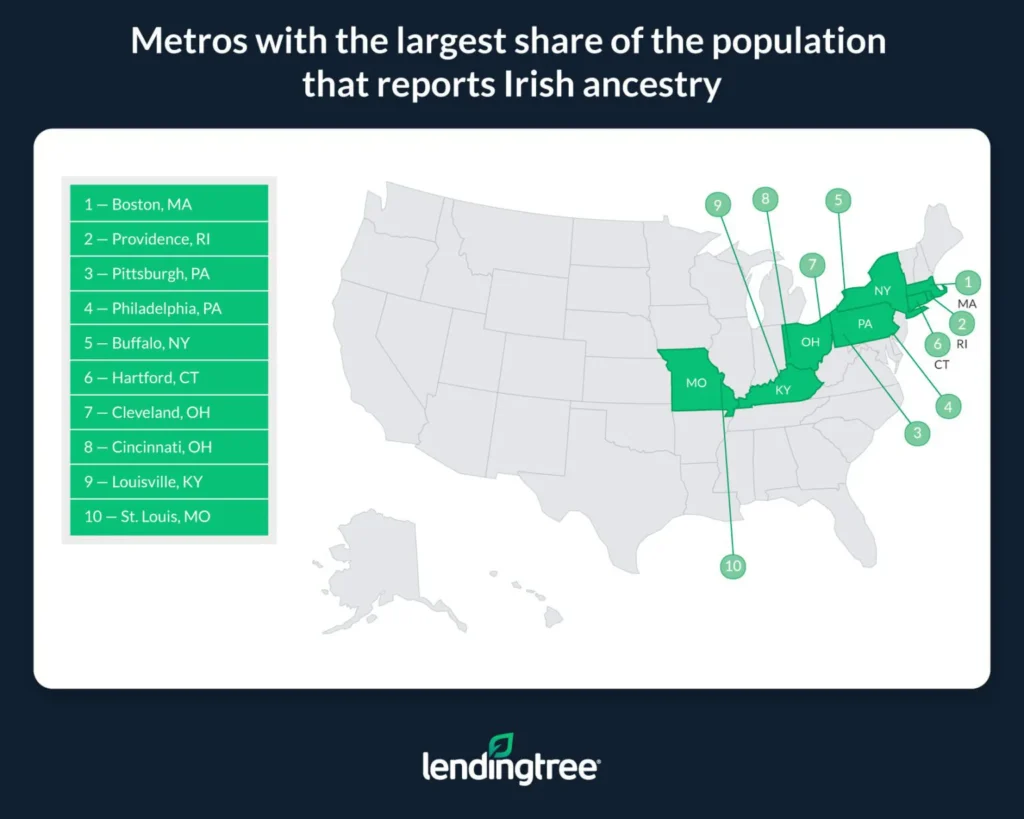

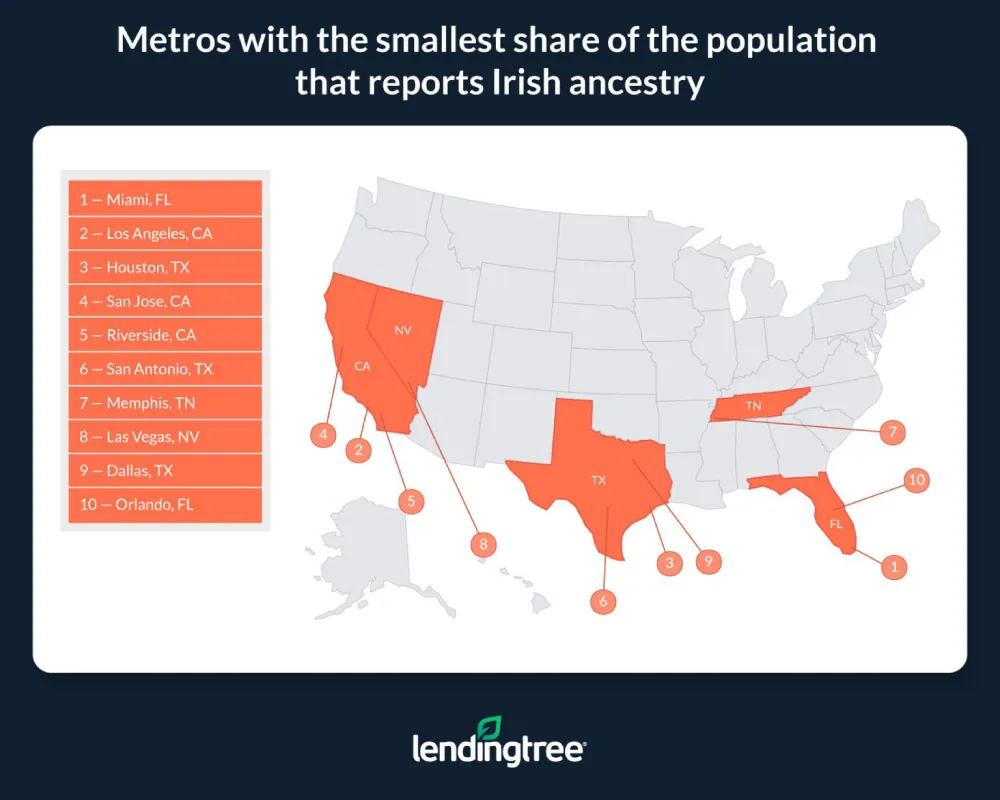

- The metros with the largest share of the population identifying as having Irish ancestry are Boston, Providence, R.I., and Pittsburgh. In these three Northeast metros, an average of 17.67% of the population identifies as having Irish ancestry. The share of the population with Irish ancestry is lowest in Miami, Los Angeles and Houston, at an average of 4.38%. Generally speaking, those with Irish ancestry tend to make up a lower share of the population in warmer metros.

- In each of the country’s 50 largest metros, median household incomes are higher in homes headed by those with Irish ancestry. Compared to an area’s overall median household income, the median household incomes in homes led by people with Irish ancestry are an average of $12,969 higher.

- The homeownership rate for households headed by those with Irish ancestry is an average of 70.46% — 6.34 percentage points higher than the average overall homeownership rate. The homeownership rate for households headed by those with Irish ancestry is highest in Memphis, Tenn., Detroit and Atlanta.

- Across the metros featured, the median value of homes owned by those with Irish ancestry is an average of $25,804 higher than the median value of homes owned by the overall population. The median values of homes owned by people with Irish ancestry are less than those owned by the overall population in only two metros — New York ($27,700 less) and Seattle ($12,000 less).

- Most owner-occupied homes with a mortgage and a householder with Irish ancestry aren’t housing cost-burdened. On average, 77.54% of households with a mortgage owned and occupied by someone with Irish ancestry spend less than 30% of their monthly income on housing costs. For the overall population, that figure is 72.25%.

Metros where the largest share of the population reports Irish ancestry

No. 1: Boston

- Percentage of the population that reports Irish ancestry: 19.39%

- Median household income for homes led by those with Irish ancestry: $114,282

- Homeownership rate for homes led by those with Irish ancestry: 70.50%

- Median value of owner-occupied homes led by those with Irish ancestry: $566,500

- Share of owner-occupied households led by those with Irish ancestry who have a mortgage and spend less than 30% of their monthly household income on housing costs: 75.50%

No. 2: Providence, R.I.

- Percentage of the population that reports Irish ancestry: 16.85%

- Median household income for homes led by those with Irish ancestry: $87,909

- Homeownership rate for homes led by those with Irish ancestry: 66.10%

- Median value of owner-occupied homes led by those with Irish ancestry: $383,900

- Share of owner-occupied households led by those with Irish ancestry who have a mortgage and spend less than 30% of their monthly household income on housing costs: 72.30%

No. 3: Pittsburgh

- Percentage of the population that reports Irish ancestry: 16.77%

- Median household income for homes led by those with Irish ancestry: $73,562

- Homeownership rate for homes led by those with Irish ancestry: 73.80%

- Median value of owner-occupied homes led by those with Irish ancestry: $190,800

- Share of owner-occupied households led by those with Irish ancestry who have a mortgage and spend less than 30% of their monthly household income on housing costs: 84.00%

Metros where the smallest share of the population reports Irish ancestry

No. 1: Miami

- Percentage of the population that reports Irish ancestry: 4.11%

- Median household income for homes led by those with Irish ancestry: $81,691

- Homeownership rate for homes led by those with Irish ancestry: 69.90%

- Median value of owner-occupied homes led by those with Irish ancestry: $390,200

- Share of owner-occupied households led by those with Irish ancestry who have a mortgage and spend less than 30% of their monthly household income on housing costs: 66.90%

No. 2: Los Angeles

- Percentage of the population that reports Irish ancestry: 4.27%

- Median household income for homes led by those with Irish ancestry: $102,281

- Homeownership rate for homes led by those with Irish ancestry: 53.60%

- Median value of owner-occupied homes led by those with Irish ancestry: $866,400

- Share of owner-occupied households led by those with Irish ancestry who have a mortgage and spend less than 30% of their monthly household income on housing costs: 63.10%

No. 3: Houston

- Percentage of the population that reports Irish ancestry: 4.75%

- Median household income for homes led by those with Irish ancestry: $92,673

- Homeownership rate for homes led by those with Irish ancestry: 71.80%

- Median value of owner-occupied homes led by those with Irish ancestry: $274,400

- Share of owner-occupied households led by those with Irish ancestry who have a mortgage and spend less than 30% of their monthly household income on housing costs: 79.30%

Success isn’t guaranteed for Irish Americans

As our study shows, those in the U.S. with Irish ancestry tend to report higher household incomes, higher homeownership rates and a lower likelihood of being housing cost-burdened. Similarly, they also report lower poverty rates than the general population. But this doesn’t mean everyone in America with Irish ancestry is in great financial shape.

For example, 23% of owner-occupied households nationwide with a mortgage that are headed by someone with Irish ancestry spend 30% or more of their monthly incomes on housing costs. As a result, they would be defined as housing cost-burdened. Similarly, nearly 460,000, or 5.2%, families headed by someone with Irish ancestry live in poverty. This figure jumps to 36.4% when looking at families made up of single women caring for children younger than 5.

While these numbers don’t indicate that being financially strained is especially widespread among Americans with Irish ancestry, they show that financial difficulties still exist.

Even though it’s certainly worth celebrating the success that many people with Irish ancestry have achieved in America, it’s important to remember that success isn’t universal. Otherwise, we may lose sight of the struggles facing some of the individuals who make up the whole.

Tips for making your own luck in the homebuying process

Today’s housing market can be tough to navigate. For some, it might feel like their only option to deal with it is to rely on blind luck. But blind luck isn’t everything, and there are plenty of ways would-be buyers can help make their own luck in the housing market. Here are three tips:

- Shop around for a mortgage. Although mortgage rates are still steep — especially compared to their record lows during the height of the coronavirus pandemic — homeowners can still potentially secure a relatively low rate by shopping around for a mortgage. Because different lenders can offer different rates to the same borrowers, shopping around can help borrowers get a more competitive rate, making buying more affordable.

- Know that a down payment isn’t everything. Even though a 20% down payment is often recommended for buyers, it isn’t always necessary. In fact, there are plenty of mortgage options — such as loans backed by the Federal Housing Administration (FHA) that allow down payments below 5%. While buyers should try to save as much as possible for a down payment, they should also recognize that even if they don’t have a ton of cash for one, their dream of homeownership can still be attainable.

- Keep your options open. In today’s housing market, it can be especially expensive and time-consuming for would-be buyers to find affordable homes that fit their needs. As a result, some people won’t be in a place where they’ll be able to successfully buy. Because of this, people should try to keep their housing options open and recognize that more affordable choices like renting can be worthwhile. While options like renting or living with family aren’t always ideal, they’ll probably work out better than stretching your budget beyond its breaking point to buy a house.

Methodology

We analyzed the U.S. Census Bureau 2021 American Community Survey with one-year estimates (the latest available) for this study. Specifically, we looked at data from individuals who identify as having Irish ancestry and households where the householder identifies as having Irish ancestry.

According to the Census Bureau, “ancestry refers to a person’s ethnic origin, heritage, descent or ‘roots,’ which may reflect their place of birth or that of the previous generations of their family.”

Note that some people report multiple ancestries; as long as one of those ancestries was Irish, individuals with multiple ancestries were included in our data. In addition, unless they also identified as having specifically “Irish” ancestry, those who reported “Scotch-Irish” ancestry were excluded from our data.

View mortgage loan offers from up to 5 lenders in minutes