94% of Americans Say Owning a Home Is Part of the American Dream, but 51% Who Don’t Own Fear They Never Will

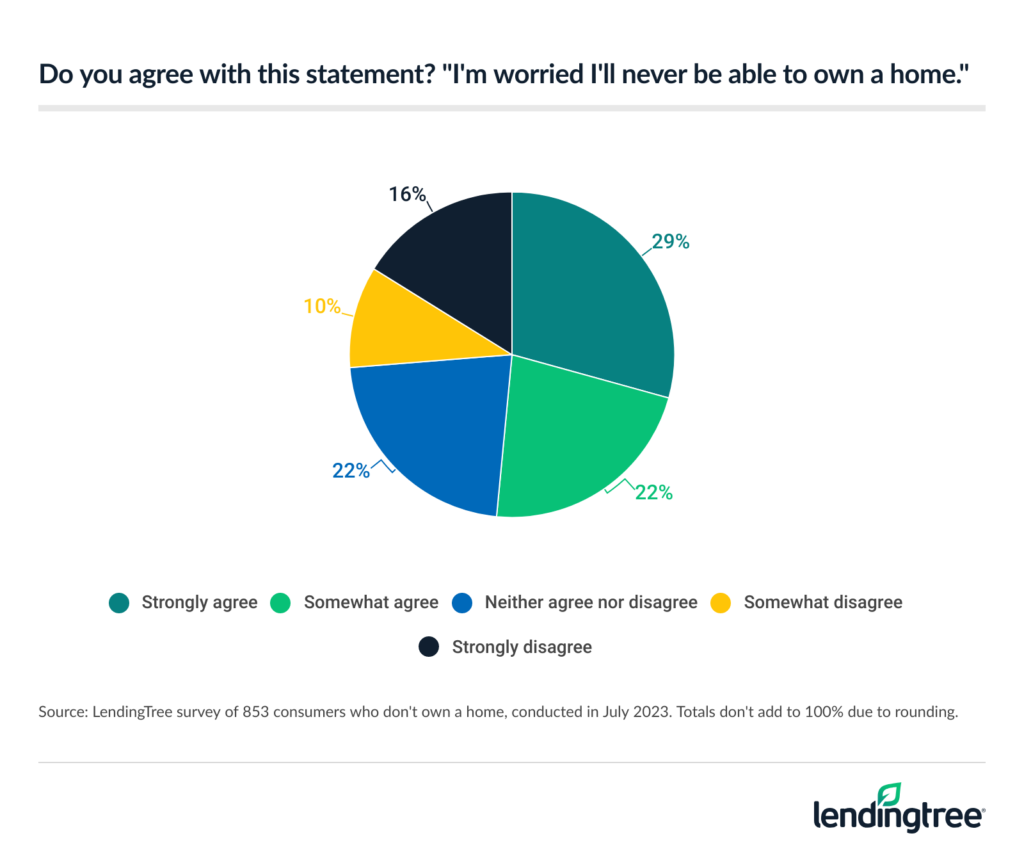

Owning a home has long been considered the quintessential American dream, but the path to those white picket fences is far from smooth. Although 84% of Americans say they’d like to own a home one day, 51% who don’t own today worry they’ll never get there.

We asked 2,000 U.S. consumers about their homeownership dreams, fears and challenges — here’s what we found.

Key findings

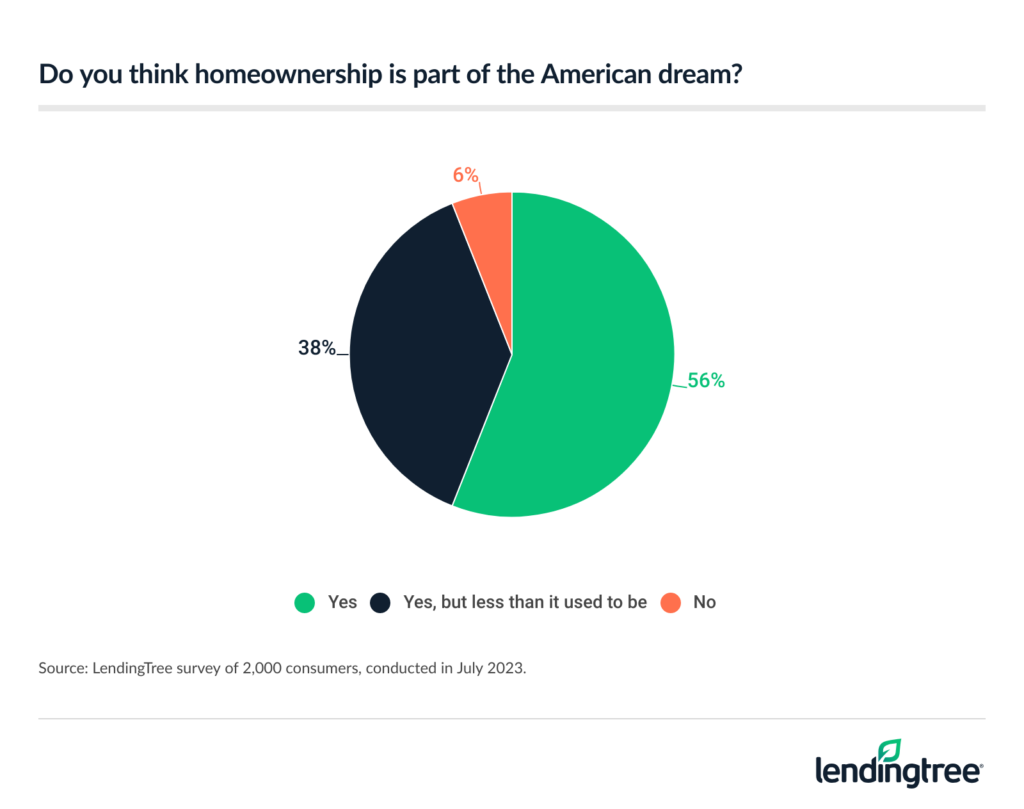

- Happy homeowners are living the American dream. An overwhelming 94% of consumers say owning a home is part of the American dream — even if only 84% say it’s part of their dream. These sentiments are reinforced, as homeowners report being much more satisfied with their current housing situation than renters (82% versus 51%).

- For those who rent, the path to homeownership is full of challenges. 51% of respondents who don’t own a home say they’re worried they never will. Among those who would own a home in an ideal world but don’t now, 49% say they can’t afford a down payment and 40% say home prices are too high in their area. Student loan debt weighs heaviest on millennials, with 19% citing it as a roadblock to homeownership. They’re also the generation most concerned about interest rates, at 41%.

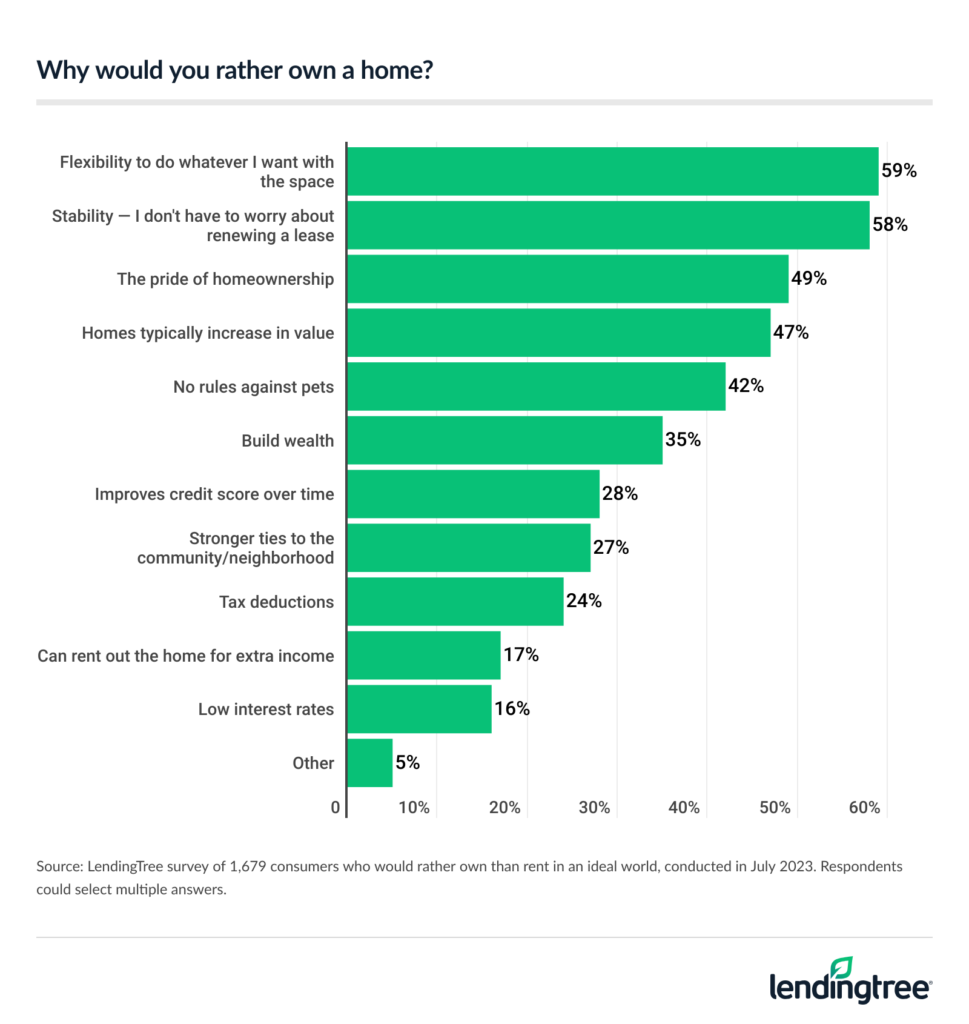

- Those who want to own a home crave the stability and flexibility homeownership offers. Of the 84% who’d rather own a home than rent, nearly 3 in 5 (59%) say they like the flexibility to do whatever they want with the space — that’s just ahead of not having to worry about renewing a lease (58%) as the top reason to prefer homeownership. Being proud of homeownership (49%) and expecting a home to increase in value (47%) are also among the top-cited reasons for buying a home.

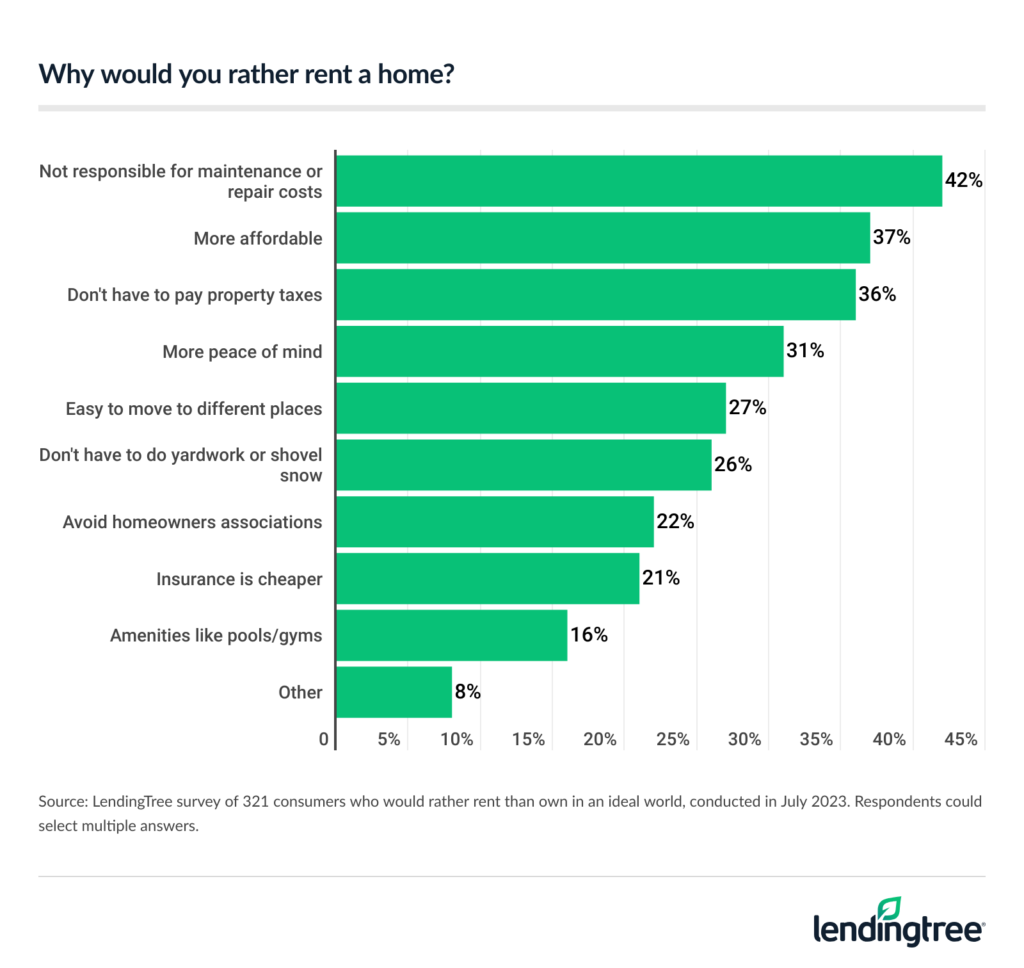

- However, renting also has its perks. Among the 16% who say they prefer to rent, 42% like not being responsible for maintenance or repair costs. Meanwhile, for some, it simply comes down to money: More than 1 in 3 (37%) say it’s more affordable to rent.

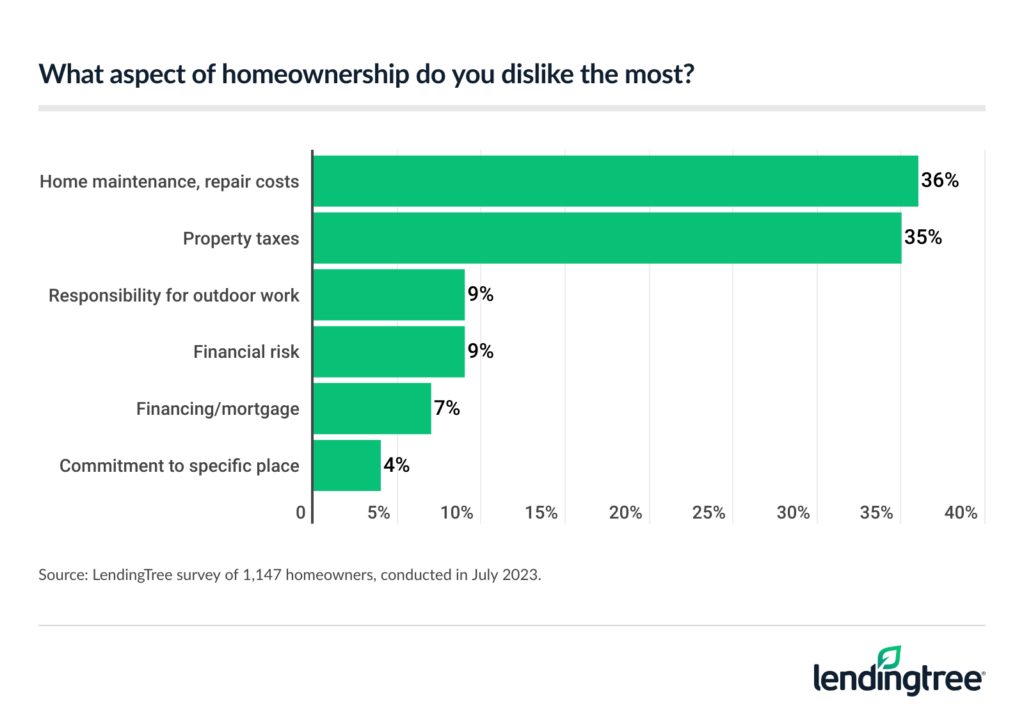

- Both renting and homeownership have their drawbacks. Home maintenance and repair costs are the No. 1 aspect homeowners dislike about their decision to buy, at 36%; property taxes (35%) are a close second. Among renters, 30% say the worst part about their current situation is the unexpected rent increases, followed by having to deal with a landlord (22%).

Homeowners are more satisfied with their housing than renters

Most Americans think homeownership is a key milestone. In fact, 94% of consumers say owning a home is part of the American dream — though 38% of this group say it’s less important than it used to be. And not all consumers consider it a personal goal, either: Just 84% say they’d own a home in an ideal world.

Younger generations in particular are bucking traditional homeownership goals. Among Gen Zers (ages 18 to 26), just 75% say they’d rather own a home than rent — the least of any group. That compares with:

- 84% of millennials (ages 27 to 42)

- 84% of Gen Xers (ages 43 to 58)

- 89% of baby boomers (ages 59 to 77)

Men (88%) are much more likely to dream of homeownership than women (80%). In addition, some consumers may think about what homeownership would mean for their kids, as those with children younger than 18 (89%) and those with adult children (88%) are far more likely to say they’d rather own a home than consumers without children (76%).

And because homeownership can be financially burdensome, it may not be surprising that high-income consumers are more likely to set their sights on homeownership. Six-figure earners (96%) are the most likely group to say they’d rather own than rent, while those earning less than $35,000 (72%) are the least likely.

There’s a good reason that owning a home is considered an American dream: Those who own are generally happier. While just 51% of renters say they’re satisfied with their current housing situation, 82% of homeowners feel similarly.

According to LendingTree senior economist Jacob Channel, it’s understandable that so many believe owning a home is part of the American dream, especially considering the perks that can come with homeownership. That can range from a higher net worth to more freedom to modify your living space.

“That said, while homeownership can be a great goal to strive for, there are more important things in life,” he says. “If you’re in a position where you can afford it and are willing to take on the responsibilities of homeownership, buying can be well worth it. But if you’re not in a position to buy, you shouldn’t be too hard on yourself.”

Majority of those who don’t own a home fear they never will

With housing prices as high as they are, it’s understandable that homeownership may feel increasingly out of reach for consumers. Among those who don’t currently own a home, 51% say they’re worried they never will.

By generation, millennials who don’t own a home are the most worried about their chances of doing so at 60%. That compares with:

- 51% of Gen Zers

- 51% of Gen Xers

- 36% of baby boomers

Those with children younger than 18 (61%) are much more likely to worry than those without children (49%) and those with children 18 and older (43%).

“There’s no getting around how tough buying a home can be in today’s high interest rates and high price housing market,” Channel says. “As tough as it may seem, those who want to buy but can’t afford to right now should try to keep hope. The more time you give yourself to do things like save for a down payment and work on your credit score, the more likely you’ll be able to buy one day.”

What’s holding would-be homeowners back? Among those who would own a home if they could, 49% say they can’t afford a down payment — making it the top reason. However, Channel notes that those concerns may be unfounded.

“Though many people think they need to save up 20% of a home’s value for a down payment, that generally isn’t the case,” he says. “If you’ve got a high credit score and earn a decent wage, you may be able to get away with a down payment closer to 10% or even lower on a conventional mortgage.”

Following down payments, 40% say home prices are too high in their respective areas. Meanwhile, 31% say rates are too high. That’s followed by:

- Credit scores making it hard to qualify for a mortgage (30%)

- Inability to maintain a home (29%)

- Not having a stable job (23%)

- Too expensive to buy for one’s family size (20%)

- Not being sure where to settle down (17%)

- Student loan debt (13%)

- Too much competition in the market (8%)

- A desire to get married first (8%)

- Not having enough time to dedicate to the homebuying process (7%)

- Nothing (5%)

- Other (4%)

Millennials in particular have some concerns, particularly when it comes to high rates (41%) and student loan debt (19%). Meanwhile, those earning between $50,000 and $74,999 (46%) are most concerned about home prices in their area.

Flexibility is the top reason for wanting a home

Homeownership isn’t just something to check off the list of life milestones — there are good reasons for wanting to own. Of the 84% who’d rather own a home than rent, 59% say they like the flexibility to do whatever they want with the space, making it the top reason. That’s especially true of baby boomers (64%), those earning between $50,000 and $74,999 (64%) and those with adult children (62%).

That’s followed by not having to worry about renewing a lease (58%), being proud of homeownership (49%) and expecting a home to increase in value (47%).

By age group, Gen Zers are particularly likely to say they want a home because they could rent it out for extra income (24%). Meanwhile, millennials are the generation most interested in low interest rates (20%), while Gen Xers are most interested in pride of homeownership (52%).

Reasons for wanting a home vary by gender, too. By gender, men are more likely than women to say their main reasons for wanting a home are because they typically increase in value (at 54% versus 39%) and to build wealth (at 41% versus 30%). Meanwhile, women are more likely than men to say they don’t have to worry about rules against pets (at 48% versus 36%) or renewing a lease (at 62% versus 53%).

Some prefer renting — here’s why

Still, not everyone sees the appeal of the American dream, and those people have their reasons, too. Among the 16% who say they prefer to rent, 42% say they like not being responsible for maintenance or repair costs — making it the top reason.

Finances are another factor: More than a third (37%) say it’s more affordable to rent, while 36% say they like not having to pay property taxes. Following that, 31% say renting offers more peace of mind than ownership.

“While owning a home may be part of most people’s American dream, there’s nothing wrong with renting instead,” Channel says. “Renting is often cheaper than owning. Not only that, renters also tend to have more freedom to move around than homeowners. After all, it’s generally easier to pack up and go when your lease expires than it is to go through the hassle of selling a house.”

Consumers feel financial pains regardless of whether they own or rent

The grass isn’t always greener on the other side, and housing is no exception. When it comes to what homeowners dislike about their current housing situation, home maintenance and repair cost comes first at 36%. In particular, Gen X homeowners (41%) and baby boomers (40%) are the most likely to feel the pain of repair costs.

That’s followed by property taxes (35%), though that’s especially true among baby boomers (44%), homeowners with adult children (44%) and those making between $50,000 and $74,999 (41%).

Meanwhile, 30% of renters say unexpected rent increases are the biggest challenges of renting — a particular pain point for renters making between $50,000 and $74,999 (36%) and baby boomers (35%). That’s followed by having to deal with a landlord (22%).

It’s important people remember that neither homeownership nor renting will automatically lead to a “perfect” life, Channel says: “At the end of the day, as long as your living arrangements are affordable and allow you to live a healthy and comfortable lifestyle, it doesn’t really matter if you own or rent.”

Jumping the rental ship? Expert tips on deciding to buy a home

If you share the American dream of homeownership, being patient may be hard right now — particularly if you’ve been hit with rent increases. Still, Channel cautions that homeownership is a big decision — and not one to be taken lightly.

If you’re looking to make the leap to homeownership, here’s what he recommends:

- Be sure you’re truly able to afford it before you start actively looking to purchase a home. “As a general rule of thumb, you should aim to spend no more than 30% of your pretax monthly income on housing costs — including your mortgage as well as other expenses like utility payments and maintenance fees,” Channel says. “If you don’t make enough money to comfortably afford all your homeownership-related expenses, you may want to hold off on buying.” Consider using a mortgage calculator to get a better sense of what you can afford.

- Never rush into making a big purchase, especially one as large as a house. “Before you buy, be sure that it’s something that you want and that you’re ready for all the responsibilities that owning brings,” he says. “If you buy a house without proper preparation, you can ruin your credit score, burn through your savings or otherwise make yourself miserable.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 77 from July 7-12, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

View mortgage loan offers from up to 5 lenders in minutes