Diamonds in the Rough? Best Hidden Gem Metros for Homeownership

Hundreds of metropolitan areas exist in the U.S., but the 50 largest — including New York, Los Angeles and Chicago — often get disproportionate attention. These heavily populated metros can be great for homeowners, but others are worth considering.

With that in mind, LendingTree studied often-overlooked areas. Specifically, we used U.S. Census Bureau data to examine 142 metros with populations of at least 250,000 but not among the 50 largest. We ranked them based on seven categories:

- Median home value

- Homeownership rate

- Median household income of owner-occupied homes with a mortgage

- Median monthly housing costs of owner-occupied homes with a mortgage

- Median monthly housing costs as a percentage of household income for owner-occupied homes with a mortgage

- Median annual property taxes for homes with a mortgage

- Share of families who live below their poverty threshold in an owner-occupied home

To learn why we chose these variables, see the methodology.

Based on those categories, here are the 50 metros (from the 142 analyzed) that are hidden gems for homeownership.

Key findings

- Huntsville, Ala., is the best hidden gem metro for homeownership. The metro doesn’t rank first in any individual category, but its general affordability for homeowners and strong showing in multiple categories help it rise to the top. For example, Huntsville homeowners with a mortgage spend only 17.5% of their income on median monthly housing costs — the second-lowest among the metros analyzed. The metro also has the fourth-lowest property taxes, with the median amount only $963 annually.

- Two states, West Virginia and Indiana, account for four of the five best hidden gem metros for homeownership. Beyond Huntsville, Huntington, W.Va., Fort Wayne, Ind., Charleston, W.Va., and South Bend, Ind., round out our top five. Broadly speaking, while these metros aren’t home to the highest income earners in the country, their affordable housing costs can make them good places for homeownership.

- All 50 of the metros highlighted can be solid for homebuyers. While we only focused on 50 top metros, we looked at 142 when determining the nation’s hidden gems. Because of this, even metros that just cracked the top 50 — Omaha, Neb. (50th), Scranton, Pa. (49th), and Syracuse, N.Y. (48th) — can be great for house hunters to consider.

Metros don’t have to be perfect to achieve a high rank. The overall rankings in this study are based on multiple equally weighted factors. As a result, high rankings across the board can offset a low rank in one or two categories. For this reason, Hunstville can rank first overall despite having a relatively high median home value, while Huntington and Fort Wayne can rank second and third even though their median household incomes are relatively low.

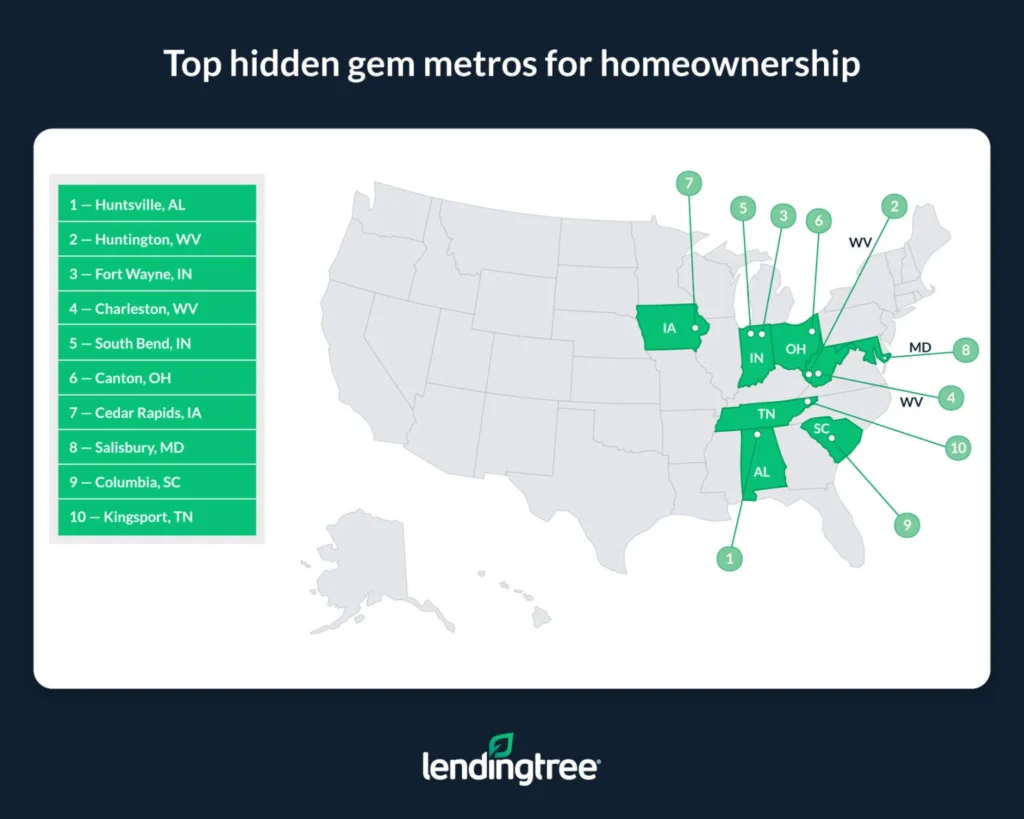

Top hidden gem metros for homeownership

No. 1: Huntsville, Ala.

- Population: 514,465

- Median home value: $292,700

- Homeownership rate: 70.46%

- Median household income of owner-occupied homes with a mortgage: $110,729

- Median monthly housing costs of owner-occupied homes with a mortgage: $1,412

- Median monthly housing costs as a percentage of household income for owner-occupied homes with a mortgage: 17.50%

- Median annual property taxes for homes with a mortgage: $963

- Share of families who live below their poverty threshold in an owner-occupied home: 4.31%

No. 2: Huntington, W.Va.

- Population: 354,304

- Median home value: $155,200

- Homeownership rate: 74.30%

- Median household income of owner-occupied homes with a mortgage: $89,559

- Median monthly housing costs of owner-occupied homes with a mortgage: $1,200

- Median monthly housing costs as a percentage of household income for owner-occupied homes with a mortgage: 17.60%

- Median annual property taxes for homes with a mortgage: $1,209

- Share of families who live below their poverty threshold in an owner-occupied home: 6.90%

No. 3: Fort Wayne, Ind.

- Population: 426,076

- Median home value: $200,400

- Homeownership rate: 70.67%

- Median household income of owner-occupied homes with a mortgage: $89,948

- Median monthly housing costs of owner-occupied homes with a mortgage: $1,195

- Median monthly housing costs as a percentage of household income for owner-occupied homes with a mortgage: 17.90%

- Median annual property taxes for homes with a mortgage: $1,535

- Share of families who live below their poverty threshold in an owner-occupied home: 4.37%

No. 4: Charleston, W.Va.

- Population: 250,554

- Median home value: $128,400

- Homeownership rate: 68.93%

- Median household income of owner-occupied homes with a mortgage: $92,579

- Median monthly housing costs of owner-occupied homes with a mortgage: $1,137

- Median monthly housing costs as a percentage of household income for owner-occupied homes with a mortgage: 17.20%

- Median annual property taxes for homes with a mortgage: $977

- Share of families who live below their poverty threshold in an owner-occupied home: 7.98%

No. 5: South Bend, Ind.

- Population: 323,637

- Median home value: $187,400

- Homeownership rate: 68.86%

- Median household income of owner-occupied homes with a mortgage: $93,453

- Median monthly housing costs of owner-occupied homes with a mortgage: $1,226

- Median monthly housing costs as a percentage of household income for owner-occupied homes with a mortgage: 17.80%

- Median annual property taxes for homes with a mortgage: $1,605

- Share of families who live below their poverty threshold in an owner-occupied home: 4.94%

Hidden gem metros can provide a good blend of affordability and opportunity

Looking for a new area to call home can be challenging. This is especially true if you’re trying to avoid spending an arm and leg for a house, while also ensuring your new neck of the woods isn’t a ghost town with a small jobs market and not much to do (assuming you’re not into that kind of thing).

In many ways, the metros in this study provide the best of both worlds for homebuyers. They’re not necessarily as crowded, expensive or fast-paced as some of the country’s biggest cities, nor are they as low-key as many of the nation’s towns. Instead, they tend to offer various employment opportunities and housing options while not being prohibitively expensive.

Owing to this, these metros can be good for would-be buyers to consider in today’s expensive housing market where finding an affordable place to live can be challenging.

As is always the case, would-be buyers should carefully research an area they’re thinking about moving to before packing their bags. No metro is without faults, and even areas that rank highly in this study have weaknesses. It’s important to look holistically at an area. Don’t hyper-fixate on only one aspect, like seemingly cheap home prices, while ignoring everything else. If you do, you could buy a property in an area that doesn’t fit your needs.

Tips for homebuyers

Even in areas generally friendly to homebuyers, purchasing a home can be difficult. Here are three tips that can make the buying process smoother.

- Remember: The lower your rate, the more you save. By shopping around for a mortgage before buying, you can increase your odds of finding the best possible rate on a mortgage. This could help you lower your monthly payments and spend less in interest over your loan’s lifetime.

- Consider different mortgage options. While a conventional 30-year, fixed-rate mortgage might be the best option for some, it’s not for everyone. For example, loans backed by government agencies like the Federal Housing Administration (FHA) might be a better option for first-time buyers without amazing credit or much cash for a down payment. In the same way that shopping around for a mortgage can help you find a better loan, looking at different mortgage options can help you find options that best fit your needs.

- Don’t stretch yourself too thin. Spending too much on housing costs can increase your risk of falling behind on other important bills or defaulting on your mortgage. While different households may have slightly different financial needs, trying to spend no more than 30% of your monthly income on housing costs can help you keep on top of your bills and reduce your risk of becoming house poor.

Methodology

Data in this study comes from the U.S. Census Bureau 2022 American Community Survey with one-year estimates — the latest available at the time of writing. The seven variables that make up the overall ranking were weighted equally. We chose them for the following reasons:

- Median home value: While other variables like income also play a major role in how affordable or easy it is to buy a house in a metro, areas with lower home prices can be more accessible to would-be buyers in today’s high-price/high-rate housing market.

- Homeownership rate: Higher homeownership rates can signify that homeownership is easier to attain than in areas with lower rates.

- Median household income of owner-occupied homes with a mortgage: Higher incomes can make dealing with the costs associated with homeownership easier and less stressful.

- Median monthly housing costs of owner-occupied homes with a mortgage: Lower housing costs can leave homeowners with more wiggle room in their monthly budgets and more money to put into savings.

- Median monthly housing costs as a percentage of household income for owner-occupied housing units with a mortgage: The less of their income that households in a given area need to allocate toward their housing payments, the easier it will typically be for those households to maintain their home by staying on top of things like their mortgage payments, as well as the costs associated with regular maintenance. This figure isn’t found by dividing the median monthly housing costs of owner-occupied homes with a mortgage by the median household income of owner-occupied homes with a mortgage. Instead, it’s derived by looking at the share of the income that each household surveyed in a given area spends on housing costs, and then finding the median share allocated among all those households.

- Median annual property taxes for homes with a mortgage: Lower property taxes can signify that an area is more affordable.

- Share of families who live below their poverty threshold in an owner-occupied home: The lower the poverty rate for homeowners in a given area, the stronger its broader economy and the finances of its homeowners are likely to be.

Metros with populations below 250,000 were excluded.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles

Luck of the Irish? Across the 50 Largest US Metros, Those With Irish Ancestry Report Higher Homeownership Rates and Incomes Than the Overall Population

Black People Own Disproportionately Small Share of Homes in 50 Largest US Metros

Homeownership Gender Gap: Single Women Own More Homes Than Single Men