Black Americans Own Disproportionately Small Share of Homes in 50 Largest US Metros

Racial inequality is a major issue in the U.S., with people of different races facing varying socioeconomic outcomes due to systemic racism and historical discrimination. This is especially true for Black Americans, who are among the most economically disadvantaged groups.

To highlight an area in which Black Americans are often disadvantaged, LendingTree analyzed U.S. Census Bureau data to look at homeownership rates for Black people in the nation’s 50 largest metros. Specifically, we compared the share of homes owned by Black people to the population of Black people living in each metro.

In doing so, we found that Black Americans own a disproportionately small share of homes relative to their population in each of the 50 largest metros.

Key findings

- In each of the nation’s 50 largest metros, Black people own a disproportionately small share of homes relative to their population size. Black people made up 14.49% of the population across the nation’s 50 largest metros in 2023, but they only owned 10.51% of owner-occupied homes across the same metros — a difference of 3.98 percentage points. That’s an improvement from a difference of 4.33 points in 2022.

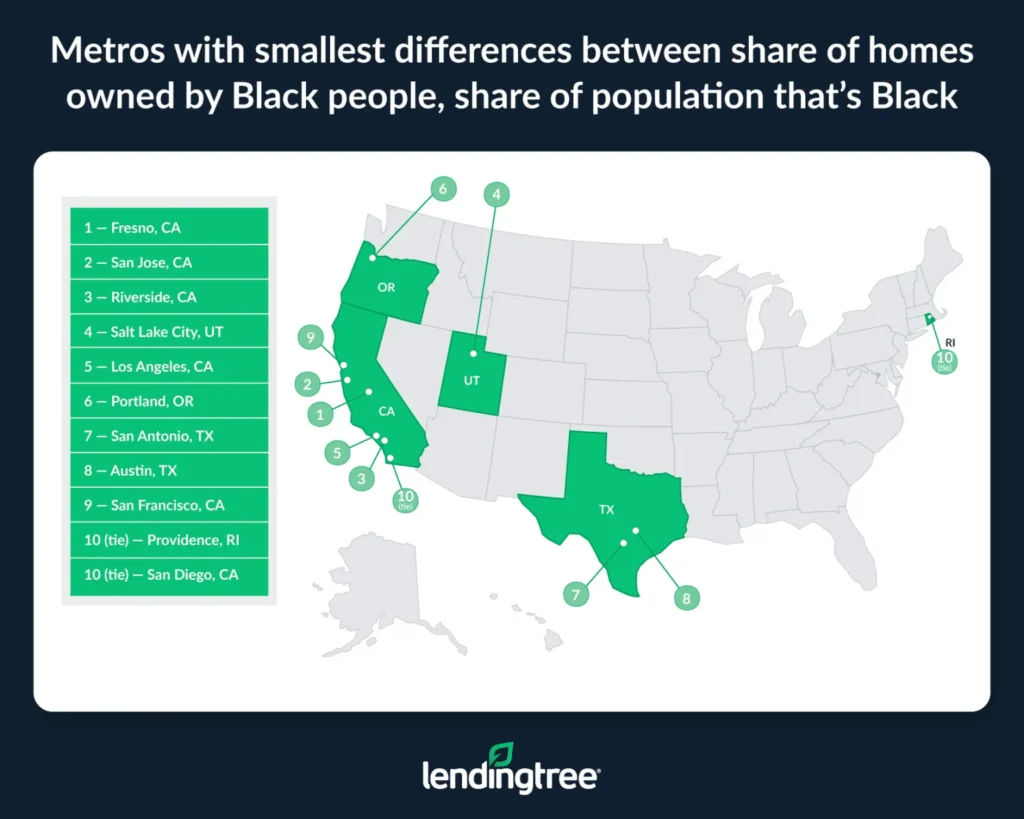

- Three California metros — Fresno, San Jose and Riverside — have the smallest differences between the share of homes owned by Black people and the share of the population that’s Black. 3.79% of the Fresno population is Black, while Black homeowners own 2.92% of owner-occupied homes — a difference of 0.87 percentage points. The differences in San Jose and Riverside are 1.02 and 1.04 points, respectively.

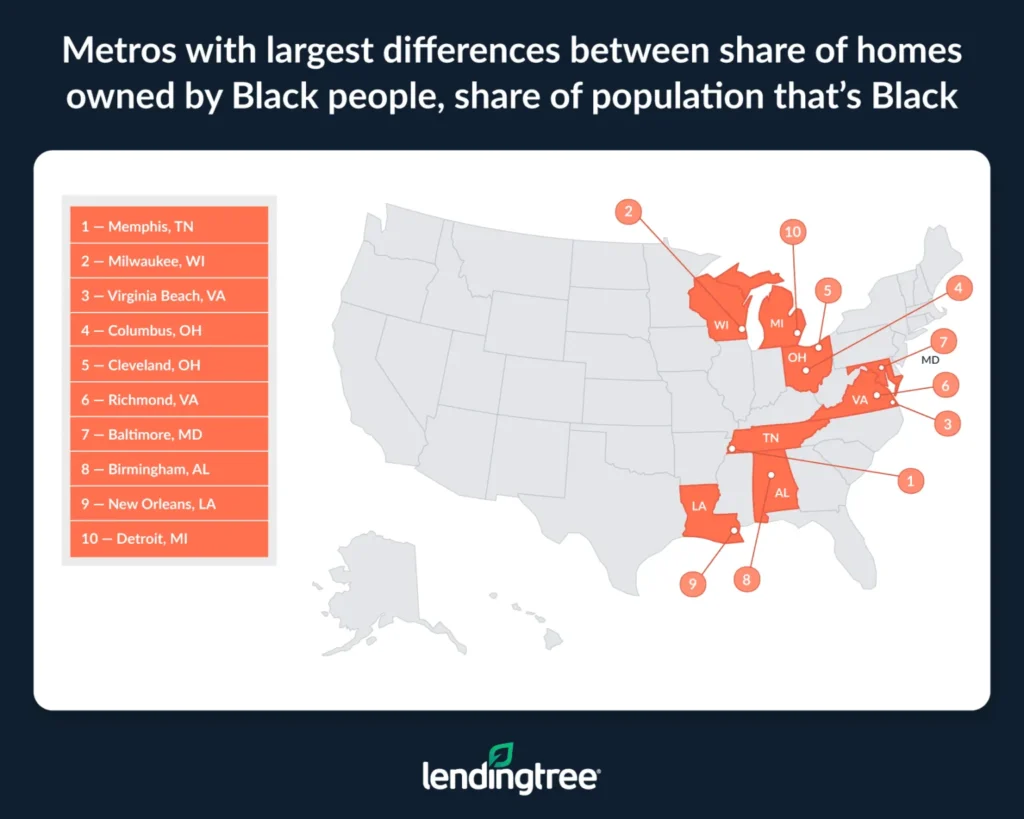

- Memphis, Tenn., has the biggest difference between the share of homes owned by Black people and the share of the population that’s Black. In Memphis, Black people make up 45.76% of the population — the largest in our study. However, they only own 35.82% of owner-occupied housing units in the metro, for a disparity of 9.94 percentage points. Milwaukee (8.33 points) and Virginia Beach, Va. (7.89), round out the bottom three.

Metros with smallest differences between share of homes owned by Black people, share of population that’s Black

No. 1: Fresno, Calif.

- Percentage of population that’s Black: 3.79%

- Percentage of owner-occupied homes owned by Black people: 2.92%

- Difference: 0.87 percentage points

No. 2: San Jose, Calif.

- Percentage of population that’s Black: 2.40%

- Percentage of owner-occupied homes owned by Black people: 1.38%

- Difference: 1.02 percentage points

No. 3: Riverside, Calif.

- Percentage of population that’s Black: 7.05%

- Percentage of owner-occupied homes owned by Black people: 6.01%

- Difference: 1.04 percentage points

Metros with largest differences between share of homes owned by Black people, share of population that’s Black

No. 1: Memphis, Tenn.

- Percentage of population that’s Black: 45.76%

- Percentage of owner-occupied homes owned by Black people: 35.82%

- Difference: 9.94 percentage points

No. 2: Milwaukee

- Percentage of population that’s Black: 15.67%

- Percentage of owner-occupied homes owned by Black people: 7.34%

- Difference: 8.33 percentage points

No. 3: Virginia Beach, Va.

- Percentage of population that’s Black: 29.35%

- Percentage of owner-occupied homes owned by Black people: 21.46%

- Difference: 7.89 percentage points

Full rankings: Disparity between Black homeownership rate and Black population by metro

| Rank | Metro | % of population that’s Black | % of owner-occupied homes owned by Black people | % point difference | Population | Owner-occupied homes |

|---|---|---|---|---|---|---|

| 1 | Fresno, CA | 3.79% | 2.92% | 0.87 | 1,180,020 | 222,251 |

| 2 | San Jose, CA | 2.40% | 1.38% | 1.02 | 1,945,767 | 374,116 |

| 3 | Riverside, CA | 7.05% | 6.01% | 1.04 | 4,688,053 | 975,837 |

| 4 | Salt Lake City, UT | 1.64% | 0.55% | 1.09 | 1,267,864 | 306,200 |

| 5 | Los Angeles, CA | 6.14% | 4.91% | 1.23 | 12,799,100 | 2,189,902 |

| 6 | Portland, OR | 3.16% | 1.71% | 1.45 | 2,509,925 | 639,150 |

| 7 | San Antonio, TX | 6.97% | 5.33% | 1.64 | 2,703,999 | 634,407 |

| 8 | Austin, TX | 7.14% | 5.43% | 1.71 | 2,473,275 | 602,192 |

| 9 | San Francisco, CA | 6.69% | 4.90% | 1.79 | 4,566,961 | 975,016 |

| 10 | Providence, RI | 5.27% | 3.20% | 2.07 | 1,677,803 | 428,357 |

| 10 | San Diego, CA | 4.65% | 2.58% | 2.07 | 3,269,973 | 643,311 |

| 12 | Denver, CO | 5.34% | 3.19% | 2.15 | 3,005,131 | 785,480 |

| 13 | Sacramento, CA | 6.78% | 4.33% | 2.45 | 2,420,608 | 564,741 |

| 14 | Phoenix, AZ | 5.87% | 3.15% | 2.72 | 5,070,110 | 1,285,690 |

| 14 | Washington, DC | 24.41% | 21.69% | 2.72 | 6,304,449 | 1,530,307 |

| 16 | Seattle, WA | 6.25% | 3.21% | 3.04 | 4,044,837 | 974,123 |

| 17 | Oklahoma City, OK | 9.14% | 5.71% | 3.43 | 1,477,926 | 362,384 |

| 18 | Boston, MA | 7.49% | 3.90% | 3.59 | 4,919,179 | 1,200,208 |

| 19 | Nashville, TN | 13.51% | 9.83% | 3.68 | 2,104,235 | 561,010 |

| 20 | Pittsburgh, PA | 7.75% | 4.04% | 3.71 | 2,422,725 | 760,526 |

| 21 | Orlando, FL | 15.71% | 11.85% | 3.86 | 2,817,933 | 670,080 |

| 22 | Tampa, FL | 11.47% | 7.56% | 3.91 | 3,342,963 | 922,351 |

| 23 | Raleigh, NC | 18.76% | 14.67% | 4.09 | 1,509,231 | 397,366 |

| 24 | Houston, TX | 17.66% | 13.37% | 4.29 | 7,510,252 | 1,677,691 |

| 25 | Las Vegas, NV | 12.11% | 7.50% | 4.61 | 2,336,573 | 509,177 |

| 26 | Kansas City, MO | 11.83% | 7.21% | 4.62 | 2,219,865 | 599,608 |

| 27 | Philadelphia, PA | 20.04% | 15.39% | 4.65 | 6,246,160 | 1,668,735 |

| 28 | Chicago, IL | 15.71% | 10.86% | 4.85 | 9,262,559 | 2,420,840 |

| 29 | Dallas, TX | 16.48% | 11.61% | 4.87 | 8,100,037 | 1,769,613 |

| 30 | Cincinnati, OH | 11.24% | 6.33% | 4.91 | 2,272,910 | 620,924 |

| 31 | Indianapolis, IN | 15.06% | 9.93% | 5.13 | 2,139,689 | 579,462 |

| 32 | Buffalo, NY | 11.55% | 6.12% | 5.43 | 1,155,604 | 332,076 |

| 33 | Louisville, KY | 13.09% | 7.56% | 5.53 | 1,364,742 | 392,931 |

| 33 | Miami, FL | 19.57% | 14.04% | 5.53 | 6,183,199 | 1,452,129 |

| 35 | New York, NY | 15.77% | 10.22% | 5.55 | 19,498,249 | 3,825,885 |

| 36 | Atlanta, GA | 33.62% | 28.04% | 5.58 | 6,305,839 | 1,570,338 |

| 37 | Minneapolis, MN | 9.51% | 3.69% | 5.82 | 3,712,020 | 1,054,444 |

| 38 | St. Louis, MO | 16.78% | 10.95% | 5.83 | 2,795,504 | 837,482 |

| 39 | Charlotte, NC | 21.83% | 15.97% | 5.86 | 2,805,115 | 721,432 |

| 40 | Jacksonville, FL | 20.10% | 14.02% | 6.08 | 1,713,240 | 462,206 |

| 41 | Detroit, MI | 21.23% | 15.06% | 6.17 | 4,342,304 | 1,275,982 |

| 42 | New Orleans, LA | 37.80% | 31.16% | 6.64 | 962,165 | 251,953 |

| 43 | Birmingham, AL | 28.23% | 21.43% | 6.8 | 1,184,290 | 334,827 |

| 44 | Baltimore, MD | 28.58% | 21.54% | 7.04 | 2,834,316 | 755,740 |

| 45 | Richmond, VA | 28.00% | 20.57% | 7.43 | 1,350,123 | 362,767 |

| 46 | Cleveland, OH | 18.43% | 10.91% | 7.52 | 2,158,932 | 633,722 |

| 47 | Columbus, OH | 16.20% | 8.55% | 7.65 | 2,180,271 | 529,437 |

| 48 | Virginia Beach, VA | 29.35% | 21.46% | 7.89 | 1,781,671 | 449,813 |

| 49 | Milwaukee, WI | 15.67% | 7.34% | 8.33 | 1,560,424 | 398,419 |

| 50 | Memphis, TN | 45.76% | 35.82% | 9.94 | 1,335,549 | 317,899 |

What’s driving this trend?

As our study shows, Black people in each of the nation’s 50 largest metros own a disproportionately small share of homes relative to their population.

There are many potential reasons why. According to the U.S. Census Bureau Current Population Survey (CPS) 2024 Annual Social and Economic (ASEC) Supplement, the median income for Black households is $56,490. That’s $28,140 less than the $84,630 median income for white households.

Black Americans also:

- Generally have less household wealth

- Are more likely to be unbanked

- Experience higher mortgage denial rates

Further, the legacies of historical policies meant to disenfranchise Black homebuyers, like “redlining,” have had a long-lasting impact that still contributes to the disproportionately low homeownership rates among Black people today.

That said, it’s important to note that while these examples can shed some light on why homeownership rates are relatively low for Black people, they’re not all the reasons why a Black person may struggle to become a homeowner.

Tips for Black homebuyers

The intersection between racial identity and economic outcomes is complicated. Though Black Americans tend to own a disproportionately small share of homes relative to their population, that doesn’t mean homeownership is out of reach for most Black Americans.

Here are three tips that could help make the homebuying process easier:

- Shop around for a mortgage. Mortgage rates in early 2025 again crossed 7.00%, making it crucial to shop around for a mortgage. By comparing offers from different lenders, homebuyers could get a more competitive rate.

- Know your rights. It’s illegal to deny someone a mortgage or refuse to sell them a house based on their race. If you believe your rights have been violated during the homebuying process, you can file a complaint with the U.S. Department of Housing and Urban Development (HUD) or with various local housing and human rights commissions.

- Consider different types of mortgages. One of the reasons homeownership rates tend to be disproportionately low among Black homeowners is that Black households often earn smaller incomes. But there are many low-income home loans for which Black homebuyers may qualify. By taking advantage of these types of loans, it‘s often easier to get approved for a mortgage and buy a home.

Methodology

We analyzed the U.S. Census Bureau 2023 American Community Survey with one-year estimates (the latest available with one-year estimates). We also utilized the U.S. Census Bureau 2022 American Community Survey with one-year estimates for comparisons.

This study ranks the nation’s 50 largest metropolitan statistical areas (MSAs) by the difference between the percentage of owner-occupied homes in a metro owned by those who identify as Black (and no other race) and the percentage of an area’s population that identifies as Black (and no other race). The difference is displayed in percentage points.

The further this difference is from zero, the more disproportionate the share of Black homeowners in an area is. A positive difference would indicate that Black homeowners own a disproportionately large share of homes. In contrast, a negative difference indicates that Black homeowners own a disproportionately small percentage of homes.

View mortgage loan offers from up to 5 lenders in minutes