Study: The Cost of Foreclosure in 2019

The strong housing market — with home prices rising for seven years on the back of an economic expansion that is now the longest in modern history — means that homeowners’ ability to manage their mortgage expenses is as good as it has ever been.

Nonetheless, some homeowners find themselves struggling with their home payments. In 2018, there were more than 600,000 homes in foreclosure in the U.S. This is the lowest since the financial crisis, when foreclosures peaked at about 2.9 million in 2010.

Beyond the upheaval in their living situation, homeowners who face foreclosures find that it can have a devastating impact on their credit scores, which can make it more challenging to get back on their feet.

To assess how long the damage from a foreclosure lingers, LendingTree conducted a lengthy study of how credit scores trend after foreclosure. We also assessed the loan terms offered to borrowers with a foreclosure on their record compared to those without.

The results were encouraging. First, a foreclosure does not stay on your report forever, falling off after at least seven years. Credit scores and loan terms start to improve well before those seven years as the foreclosure recedes into the background and is superseded by more recent information.

Key findings

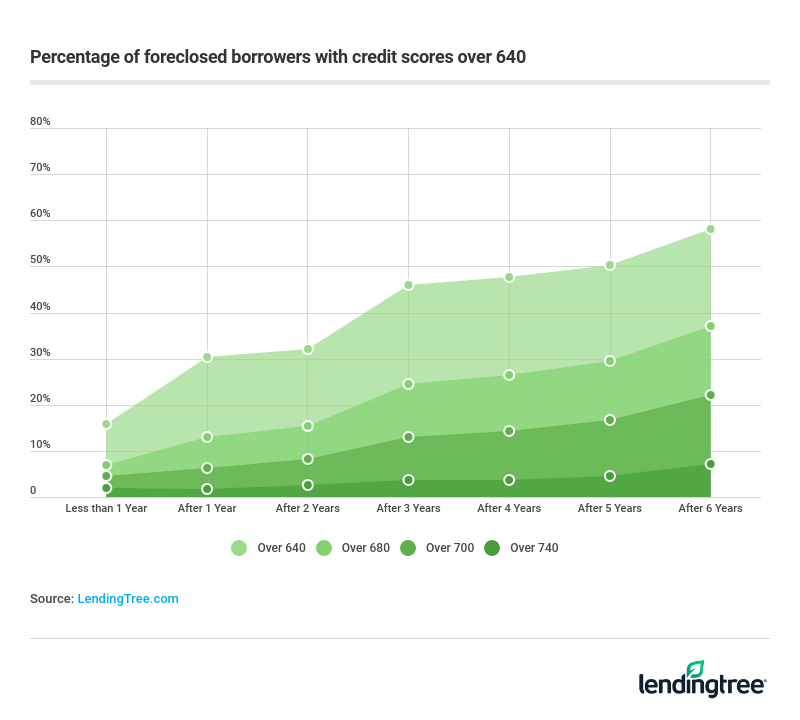

- Credit scores can decline by 150 points or more with foreclosure, but many borrowers still maintain a high score even after this. Seven percent of borrowers end the year of foreclosure with a score above 680, while 2% finish with one above 740. The latter category is considered super-prime borrowers.

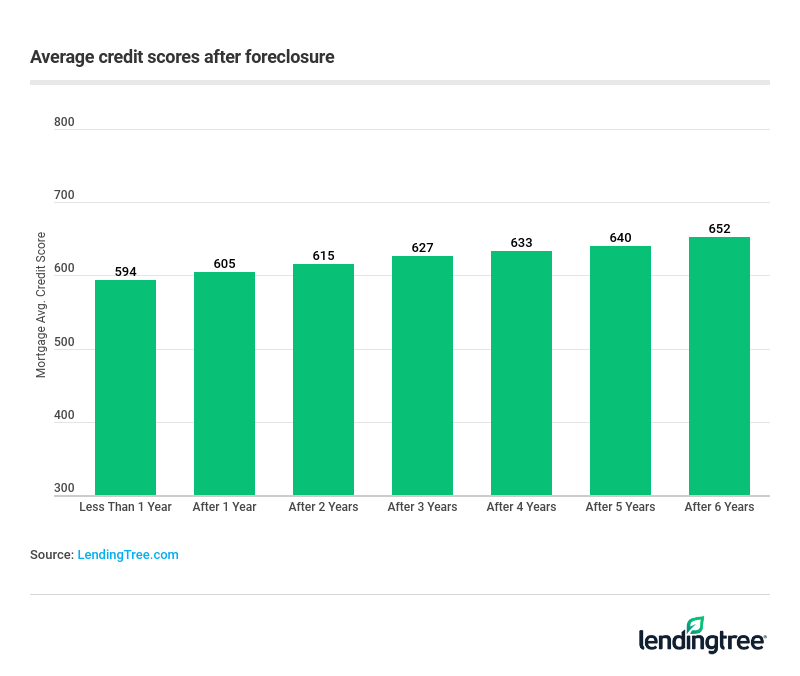

- Credit scores increase by about 10 points for each year after foreclosure.

- More than 30% of people with a foreclosure on their credit file have a credit score of 640 or higher within a year of the foreclosure. That number rises to 46% after three years.

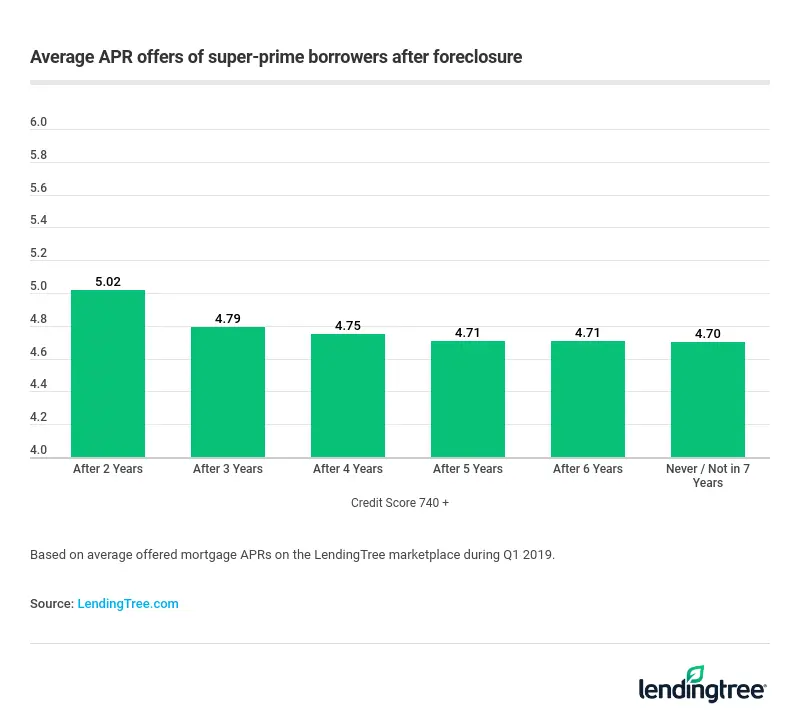

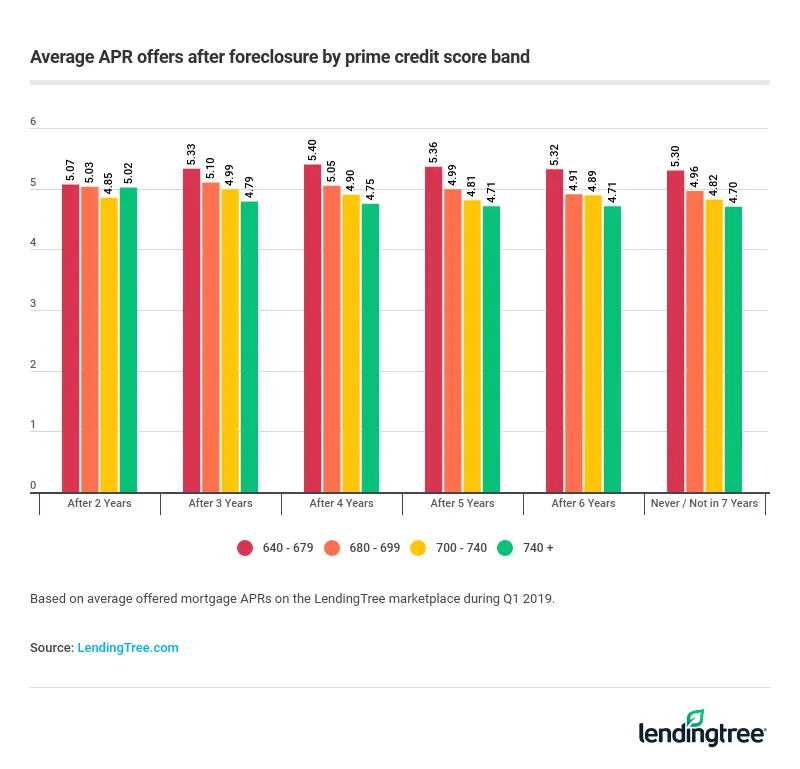

- Borrowers are able to quickly reenter the homebuying market after foreclosure — in as little as two years. However, they pay a premium to do so. In our sample, those borrowers with a credit score above 740 paid an average rate of 5.02%, compared with 4.70% for borrowers who have never had or did not reflect a foreclosure in the previous seven years.

- The foreclosure dominates your credit score in the first two years after foreclosure. This is evident from interest rates not correlating to credit scores when borrowing two years after foreclosure. However, when borrowing after three years or more, the expected pattern emerges with higher credit score borrowers paying lower interest rates.

- A $250,000 mortgage incurs an extra $17,135 in borrowing costs for borrowers with a score above 740 seeking loans two years after foreclosure. This drops to $4,580 for those who wait at least three years after foreclosure to request a new mortgage.

Recovering from foreclosure

The keys to recovering from foreclosure are the same as those required to prudently manage your personal finances and credit score. Don’t overextend yourself when borrowing, pay on time, keep revolving balances low and maintain an emergency fund so you can meet your obligations if there is a disruption to your income. This should allow your credit score to recover, as well as restore your access to credit more quickly.

For mortgage borrowing, many loan programs require a grace period before you can borrow again. For example, conventional mortgages require a seven-year waiting period. However, exceptions can be made if the foreclosure was the result of some extenuating circumstances, such as loss of employment. This could shorten the waiting period to as little as three years. Thus, foreclosure does not mean never owning a home again.

Methodology

LendingTree looked at offers for a sample of over 1 million users who requested lender rate offers for mortgages in 2018. Individual users are presented with multiple offers from lenders, and these were averaged for each user.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles