Inflation Is Making Pet Ownership More Expensive, and More Than a Quarter of Pet Owners Report Struggling to Afford Rising Costs

With inflation on the rise, consumers are increasingly feeling the pressure on their pockets, and pet owners are no exception. In fact, more than 75% of pet owners say the cost of their four-legged friend’s care is rising — and more than a quarter of them are struggling to afford it.

In this LendingTree survey, we asked over 1,000 pet owners about their pet expenses, the financial sacrifices they’ve made for their furry friends and pet-related debts they’ve had. Here’s what we found.

Key findings

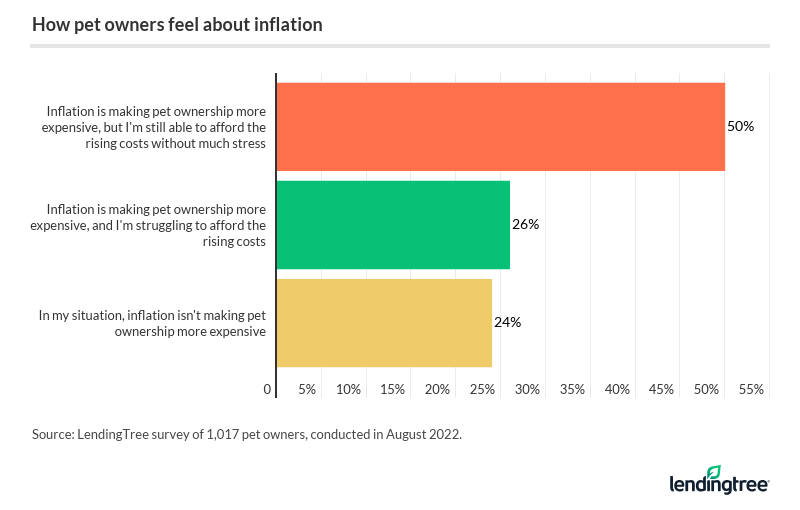

- More than 75% of pet owners say inflation is making pet ownership more expensive, and 26% are struggling to afford the rising costs. By generation, millennials (32%) are most likely to say they’re having trouble paying for pet expenses amid inflation.

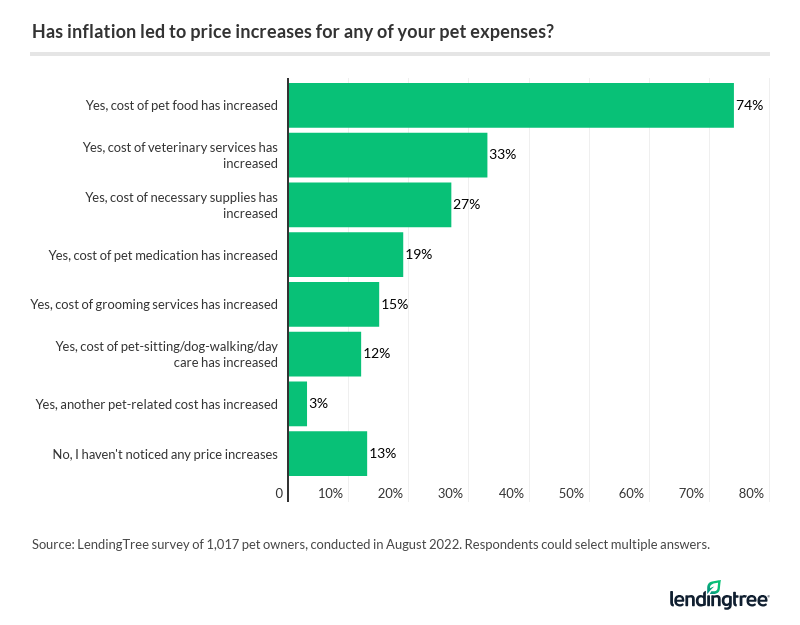

- While prices for common expenses are rising, pet spending is down. Overall, 87% of pet owners say they’ve noticed increased pricing on key expenses, especially pet food (74%) and veterinary services (33%). Meanwhile, owners now say they’re spending an annual average of $984 on their pets — down from the $1,163 owners reported spending in a 2021 LendingTree survey on pet expenses.

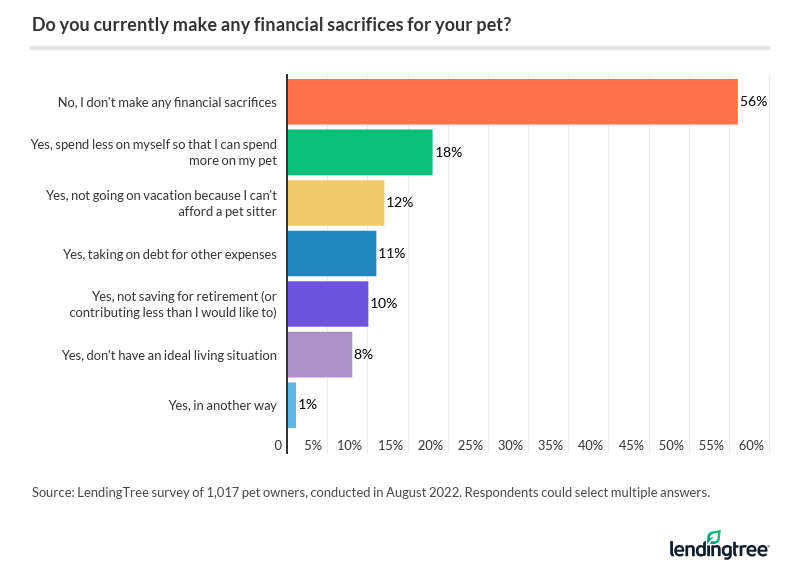

- 44% of pet owners report making financial sacrifices for their pet — and nearly 1 in 4 (23%) have taken on debt for their furry friends. Pet owners are also spending less on themselves (18%), and some are even limiting their retirement savings contributions (10%).

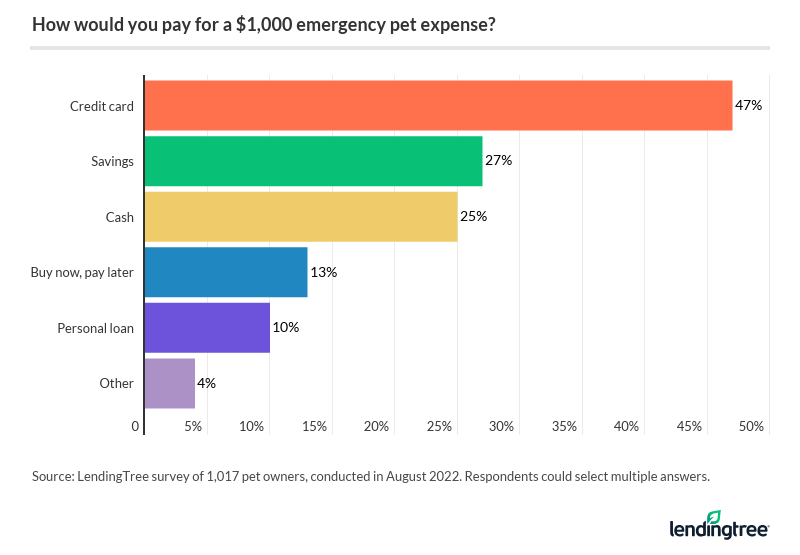

- The majority of pet owners would take on debt to cover an emergency expense. When asked how they’d handle a $1,000 pet emergency, many indicated they’d take on debt by charging a credit card (47%), using a buy now, pay later service (13%) or taking out a personal loan (10%).

- 80% of pet owners don’t have pet insurance. At the same time, 22% of pet owners have had an unexpected medical expense for their pet arise within the past year — costs that could have been lessened by an insurance policy.

Owners say cost of pet care is rising, and they’re struggling to afford it

In total, three-quarters of pet owners (75%) say inflation is making pet ownership more expensive. Of this group, just over a quarter (26%) are struggling to afford the rising costs — though some are more likely to struggle with others.

By generation, millennials (ages 26 to 41) are most likely to say they’re having trouble paying for pet expenses amid inflation, at 32%; that’s followed by Gen Zers (ages 18 to 25) (28%). Comparatively, baby boomers (ages 57 to 76) are the least likely to struggle with pet expenses amid inflation — just 16% of the oldest group of pet owners say they’ve been struggling with increasing costs.

Despite key expenses rising in cost, pet spending is down overall

Overall, 87% of pet owners say they’ve noticed prices rising for vital pet expenses. In particular, 74% have noticed that their pet’s food is more expensive, ranking it as the top expense that owners have noticed price increases for. Following that, 33% have noticed higher costs for veterinary services.

But it goes without saying that inflation has impacted the cost of many essential expenses beyond pets, and as a result, consumers are tightening their pet care budgets. While pet owners reported spending an average of $1,163 annually on their pets in a 2021 LendingTree survey, in 2022, owners say they’re spending just $984 per year — a nearly $180 difference.

While that might not seem like a significant difference, expense cuts vary by generation. Gen Zers have cut back the most, with average expenses falling from around $1,885 annually to just $887. That’s a whopping $998 difference, which takes them from being the top pet spenders to ranking just above baby boomers, who, at just $885 annually on average, spend the least on their pets.

Meanwhile, Gen Xers (ages 42 to 56) have cut back the least, spending just $52 less than they did last year. With annual pet expenses now hovering at an average of $1,048 per year, Gen Xers have taken the youngest generation’s spot as the top pet spenders.

Meanwhile, millennials are the only other age group still spending upward of four figures on their pets, with an annual spend of $1,025 (down from a previous $1,195).

44% make financial sacrifices to afford their pets

Though pet owners are tightening their budgets, many are still making personal accommodations to pay for the care of their pet. Overall, 44% of pet owners report making financial sacrifices for their pet; of these, 18% spend less on themselves, while 12% forgo vacations because they can’t afford a pet sitter. Even more notably, 1 in 10 go so far as to limit their retirement savings contributions to cover costs related to their furry (or feathered) companions.

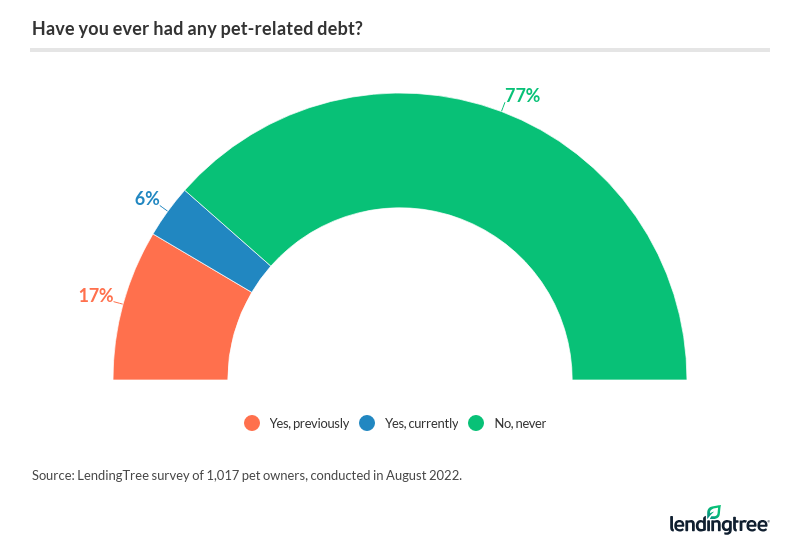

Also among these financial sacrifices: 11% report taking on debt for other expenses not directly related to their pets to afford pet care. However, close to 1 in 4 (23%) have gone into debt as a direct result of pet-related expenses. And their bills have been hefty, too — 30% of owners who’ve been in debt have owed $1,000 or more.

Of the 6% who currently have pet-related debt, nearly 24% currently owe $1,000 or more, though the majority of indebted owners (25%) owe between $300 to $499.

Many would take on debt to cover an emergency expense

Debt may loom for even more pet owners should an emergency happen to their pet. When asked what they’d do if a $1,000 pet-related emergency expense came up, 70% of owners say they aren’t prepared to cover the cost and would have to use some form of credit to pay for at least a portion of the bill; a notable 47% say they’d use a credit card to pay for it. Meanwhile, only 27% report they’d be able to use their savings and 25% say they’d use cash.

According to LendingTree insurance expert Robin Townsend, more pet owners should try doing the same at least for a portion of the bill, since using a credit card for pet expenses can come with risks.

“Unless there is no other option, it’s best to avoid charging a card for a pet emergency,” Townsend says. “Pet owners should consider using savings to cover at least part of the cost or ask about financing through their veterinarian.”

This comes as 55% of pet owners have faced an unexpected emergency expense for their pet at least once — with 22% occurring in the last year. With pet owners likely to experience an emergency expense, those who don’t prepare may be at risk for taking on debt soon.

8 of 10 owners don’t have pet insurance

Despite the fact that the majority of pet owners have faced at least one emergency pet expense, 80% don’t have pet insurance. Those unexpected costs, Townsend says, could have been lessened by an insurance policy.

“Even if you pay for pet insurance for three years before needing it, you’ll still save on the cost of a major medical event like surgery or cancer,” Townsend says. “You’re likely to experience an unexpected emergency in your pet’s lifetime. If you’re not putting away funds to prepare for that, it’s a good idea to have pet insurance.”

By generation, Gen Zers are most likely to have pet insurance, with 40% of the youngest group of owners insuring their pets. Meanwhile, just 8% of baby boomers insure their pets — making them the least likely to do so.

Paying for your pooch: Expert advice on pet debt, insurance

With inflation soaring, it’s clear that paying for your pet may be particularly difficult these days — especially if you experience an unexpected emergency. Yet with enough preparation, you can cover your costs without taking on too much debt, Townsend says.

“In addition to pet insurance, there are other areas where pet owners can lower costs and not sacrifice quality,” Townsend says.

Here’s what she recommends:

- Determine which pet insurance is right for you. Ask yourself a few questions: How much can I afford out of pocket for vet bills? Without insurance, how would I pay for a major expense like an accident or a chronic health condition? How old is my pet? Does it have any preexisting conditions?

- Use cost-effective alternatives. Buying cheaper products or purchasing pet food in bulk can help you cut costs, particularly in the long run. Townsend also suggests that you consider training your pet yourself instead of hiring outside services. And if your pet requires vaccines, you can save on costs by using a vaccination clinic instead of a veterinarian. Note that while your veterinarian may suggest several types of vaccines, not all are required by law — check your state’s vaccine requirements to be sure.

- Look into local pet organizations for additional assistance. They may be able to connect you with organizations designed to provide pet necessities like food or discounted veterinary care. You can start by checking out the helpful list of resources on the Humane Society of the United States’s website. And for those struggling with the cost to spay or neuter a pet, agencies like the Pet Awareness and Welfare Society (PAWS) can provide low-cost options.

- If pet debt is unavoidable, consider financing major pet expenses. Using the right loans or credit cards to finance your furry friend’s major expenses may make the most sense — so long as you can afford the monthly payments. Some pet finance companies may offer special financing options with deferred interest, which could ease your financial burden.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,017 U.S. pet owners, ages 18 to 76, from Aug. 12-18, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

Get debt consolidation loan offers from up to 5 lenders in minutes