49% of Americans Can’t Afford a $1,000 Emergency, With Many Relying on Credit Cards for Unexpected Expenses

If a $1,000 financial emergency hit your household tomorrow, would you be prepared? The answer for about half of Americans, according to a new report from LendingTree, is no.

Short-term financial crises happen. From job losses and home repairs to sick pets and flat tires, these events come in all shapes and sizes. We don’t know when they’ll happen or what form they’ll take, but we know we’ll eventually face one. That’s why “build up your emergency fund” is one of the most commonly offered pieces of personal finance advice. Your savings give you and your family more wiggle room financially when things get a little crazy for a while.

However, building those savings can be easier said than done, especially with stubborn inflation, rising interest rates, restarted student loan payments and, well, life in general. With this survey, we asked how people felt about their ability to handle these trying-but-often-short-lived financial rough patches — what they told us was troubling.

In short, about half of us aren’t ready. Here’s more of what we found.

Key findings

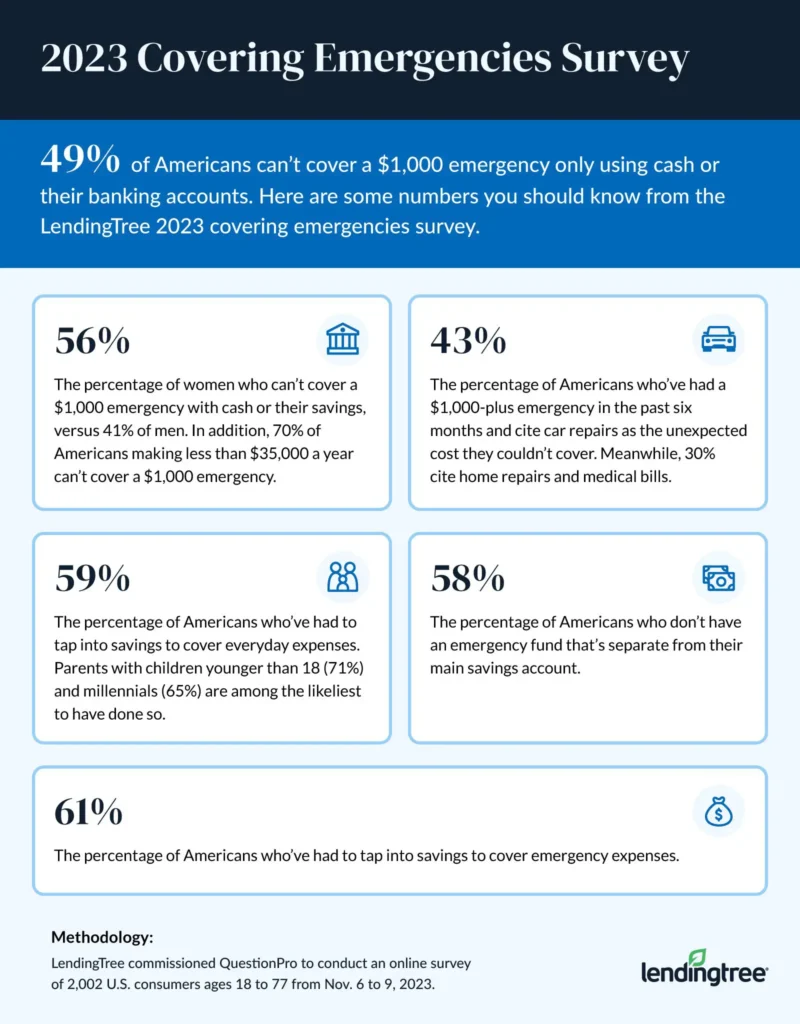

- Turbulent times have proven the value of having emergency savings, yet many Americans are admittedly unprepared. Most Americans (93%) have faced a financial emergency at least once, and 32% have faced an emergency expense in the past six months alone. However, almost half (49%) of U.S. adults admit they wouldn’t be able to cover a $1,000 emergency using only cash or their banking accounts.

- The absence of an emergency fund is sending people into debt. Among those who’ve had a $1,000-plus financial emergency in the past six months, the costly culprits were car repairs (43%), home repairs (30%) and medical bills (30%). Within this same group, 55% were forced into debt to cover the expenses, with 84% having to scrounge for $1,000 or more. In addition, over a quarter (27%) of Americans are still in debt because of a past financial emergency.

- In case of emergency, use plastic? Most Americans (58%) don’t have a designated emergency fund, and 40% say they would pay for a surprise expense with a credit card. What’s holding people back from creating a rainy-day fund? 49% without one blame the cost of living, 34% cite the lack of budget and 24% each say they either have a low-paying job or just don’t feel the need. In addition, among those with an emergency fund, just 20% are taking advantage of a high-yield savings account.

- Those with savings are no stranger to tapping into them. 59% report using their savings to cover everyday expenses, with parents of children younger than 18 (71%) and millennials (65%) among those leading the way. When asked how much money they’d need to save for a financial emergency to avoid additional stress, 40% would feel comfortable having a modest amount — below $2,500 — set aside. 21% say they’d need at least $10,000 saved to feel secure.

Nearly half of consumers aren’t prepared for inevitable rainy day

From time to time, almost everyone faces a short-term financial emergency. Our survey shows that 93% of Americans have faced one at some point (good for that other lucky 7%, right?) and 32% of Americans have done so in the past six months.

Parents of young children (45%), those who make $75,000 to $99,999 a year (42%), six-figure earners (38%) and millennials (ages 27 to 42) (38%) are most likely to say they’ve faced a financial crisis that cost them at least $1,000 in the past six months. However, hard times come for most of us at some point, so not being in one of these groups isn’t license to put off saving. If anything, it should be motivating to know you may still have time to stash money before something goes wrong.

One thing that’s crystal clear from this report is that millions of us need that extra time. Nearly half (49%) of consumers say they couldn’t cover the cost of a $1,000 emergency expense using only cash or funds from their checking or savings accounts. That includes:

- 70% of those making less than $35,000 a year

- 61% of Gen Xers (ages 43 to 58)

- 56% of women

One of the most confident groups might be surprising: 68% of baby boomers (ages 59 to 77) say they could cover the expense. That’s eye-opening considering that many are retired and now on fixed income, or at least past their prime earning years. However, it may indicate that they’re more likely to have more retirement savings and home equity to tap, or that they’ve perhaps adjusted their spending in line with their reduced income.

Absence of emergency fund is sending people into debt

The most common cause of a financial emergency was a car repair, cited by 43% of those who say they’ve faced an emergency in the past six months. Home repairs and medical bills (both at 30%) and job loss (20%) were the next most common.

What kind of emergency did you face that cost you at least $1,000?

| Car repair | 43% |

| Home repair | 30% |

| Medical bill | 30% |

| Job loss | 20% |

| Other | 12% |

| Pet issue | 10% |

Whatever the cause, these emergencies frequently pushed people into debt. Overall, 27% of Americans say they’re currently in debt due to an emergency expense they couldn’t cover. Among those who faced a financial emergency in the past six months, more than half (55%) took on debt because of it, with 27% of them taking on more than $5,000 in debt.

The younger you are, the more likely you are to say you’ve gone into debt over a $1,000-plus financial emergency in the past six months. Among millennials, 61% say they’ve done so, compared with 32% of baby boomers. Further, 65% of those with children younger than 18 say they’ve done this, versus 52% with no kids and 42% with older children.

Even high incomes don’t make you immune to this type of debt. While lower-income Americans are generally more likely to do so, nearly half (49%) of those making $100,000 or more a year say they have as well.

In case of emergency, use plastic?

The unfortunate truth for millions of Americans is that their credit cards are their de facto emergency fund. Our report found that 58% of Americans have no emergency fund, and that 40% would use a credit card to pay for a future surprise expense. That’s always a dicey proposition — but it’s even more so today, with the average interest rate on a new credit card reaching record highs of 24.56%, according to LendingTree data.

Add in the fact that high-yield savings accounts are offering their biggest returns in decades and the lack of savings looks even worse. Just 20% of those with an emergency fund say theirs is in a high-yield savings account — which means that many, many Americans aren’t getting nearly the returns they could on that savings.

Where do you keep your emergency fund?

| Checking or savings account | 50% |

| High-yield savings account | 20% |

| Cash | 18% |

| Other | 8% |

| Brokerage account | 5% |

Women are far more likely than men (65% versus 51%) to say they don’t have an emergency fund. Gen Xers are by far the most likely age group to not have an emergency fund, with 69% saying so, compared with 60% of baby boomers, 53% of millennials and 51% of Gen Zers. Plus, unsurprisingly, the lower your income, the more likely you are to not have an emergency fund: 75% of those making $35,000 or less don’t have one, versus 38% of those earning $100,000-plus a year.

Of course, as expensive as life is in 2023 (and will continue to be in 2024), building an emergency fund is easier said than done. Among those who said they don’t have one, nearly half (49%) say the high cost of living has prevented them from having an emergency fund, 34% blame the lack of a budget and 24% each say they have a low-paying job or don’t see the need for an emergency fund. That last part is perhaps the most concerning: While the ultra-rich may not need an emergency fund — Jeff Bezos and Elon Musk will probably be OK without one — almost everyone else does.

Those with savings are no stranger to tapping into them

For many Americans, savings aren’t just necessary when emergencies strike. Nearly 6 in 10 respondents (59%) say they’ve had to lean on savings to cover everyday expenses sometime in the past. Nearly two-thirds of millennials (65%) say so, while just 50% of boomers say the same. Parents with kids younger than 18 are the most likely to say so, at 71%. Meanwhile, men and women are equally likely to say so, both at 59%.

Have you ever had to tap into savings to cover everyday expenses? (By demographics)

| Overall | 59% |

| By gender | |

| Men | 59% |

| Women | 59% |

| By generation | |

| Gen Zers | 57% |

| Millennials | 65% |

| Gen Xers | 61% |

| Baby boomers | 50% |

| By parental status | |

| Parents with children younger than 18 | 71% |

| Parents with children 18 or older | 54% |

| Adults without children | 53% |

| By household income | |

| Less than $35,000 | 58% |

| $35,000 to $49,999 | 57% |

| $50,000 to $74,999 | 62% |

| $75,000 to $99,999 | 66% |

| $100,000 or more | 57% |

We also asked how much you would need to have saved to not feel financial stress in an emergency. Six in 10 respondents say $2,500 or more, including 21% who say $10,000 or more. (Among those making $100,000 or more, 44% say they’d need $10,000 or more saved to feel comfortable — more than double the overall average.) Just 15% overall say less than $1,000.

What you should do next

Building even a small emergency fund is often easier said than done. Most Americans’ financial margins for error is tiny, meaning they have very little money — if any — to reserve for savings. That’s an unfortunate reality for millions of people in this country.

Still, it’s difficult to overstate the importance of emergency savings to a household’s overall financial stability. So how do you get there?

For many, it’s about your income. You’re ruthlessly squeezing every little thing you can out of what you earn, and your focus needs to be on bringing in more money to help provide your family with a little more cushion.

For others, however, the money is there, but changes need to be made to get the most out of it. Here are some tips to help you do that:

- Reassess your priorities. Reaching goals often requires sacrifice, especially when it comes to your money. If you can find extra money each month to put toward your savings by cutting back on some expenses that aren’t a priority for you, you should seriously consider it. That doesn’t necessarily mean cutting back on everything that brings you joy — it just means taking a thoughtful approach to how you use your money, focusing your spending on the things that matter to you.

- Automate savings. Let technology help keep you disciplined. Redirect a set dollar amount out of each paycheck into savings automatically, so that money is never available in your checking account to spend. Then, if you’re lucky enough to get a raise or a new higher-paying job, bump up that set amount accordingly.

- Pay down debt and build up savings simultaneously. Again, it can be easier said than done. Plus, it’ll likely mean you might pay a little more interest and take a little longer to pay off your debt. However, savings are the key to breaking the cycle of debt that so many Americans feel trapped in. If you don’t have savings when you get your debt down to $0, the next unexpected expense — the sick pet or the broken-down car — goes straight onto your credit card, putting you right back in debt. However, you don’t have to do that if you have some money stashed away. You can pay some, or all, of the expense with cash, then get back to replenishing your savings with your next paycheck. It’s a big, big deal.

- Take advantage of high-yield savings accounts. This is a big one: These accounts’ yields are the biggest in decades, sometimes returning 5% or more to savers. That means your savings can go more quickly than you’d imagine, but only if you have one of these accounts.

- Refinance your debt to a lower interest rate, if possible. High interest rates are great for savers, but they’re a nightmare when you have debt. If your rates are too high — and whose aren’t? — consider a 0% balance transfer credit card or a low-interest personal loan. Either can shorten your payoff time and shrink the amount of interest you owe, as well as consolidate the number of bills you have to pay each month. You should also consider calling your lender and asking for a lower rate: An April 2023 LendingTree survey found that 76% of those who asked for a lower interest rate on a credit card in the past year got one, and the average reduction was 6 percentage points.

Whatever you choose, the most important thing to do is to get started, and there’s no better time to do so than right now.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,002 U.S. consumers ages 18 to 77 from Nov. 6 to 9, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get debt consolidation loan offers from up to 5 lenders in minutes