Debt Consolidation Calculator

See how much you can save by combining debts

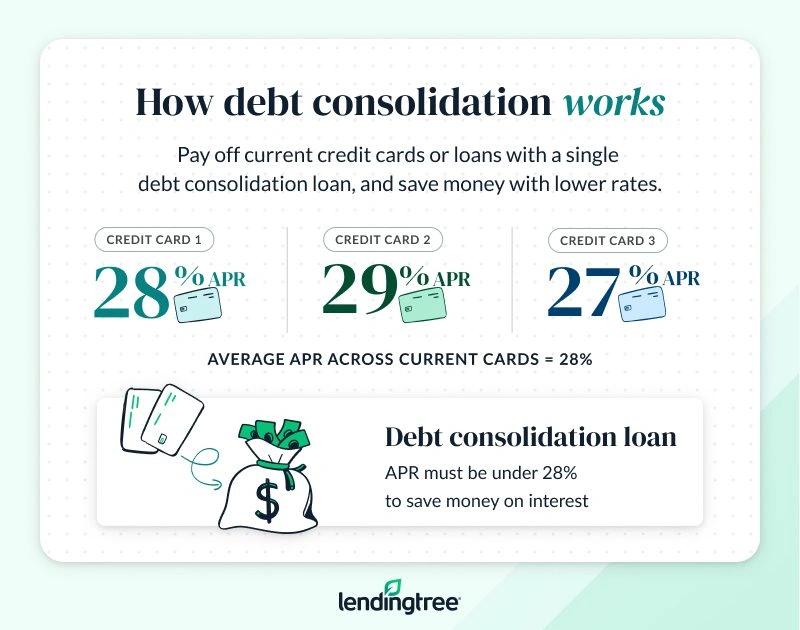

How does debt consolidation work?

The definition of debt consolidation is combining several smaller debts into one larger debt. Consolidating debt can help you save money, get affordable monthly payments and get out of debt sooner.

You can consolidate personal loans or credit cards. There are two popular ways to consolidate debt:

- A debt consolidation loan is a single loan you can use to pay off your current loans or credit card debt. Debt consolidation loans are best if you need to stretch out your loan payments over a long period of time.

- A 0% APR credit card offers a temporary interest-free period to pay off your credit card debt. You’ll likely pay a fee to transfer your balance to your 0% APR credit card, and then you’ll have a set number of months — typically six to 21 — to pay off your balance without making interest payments.

Let’s say you have $10,000 in credit card debt. You could save up to $3,000 in interest and reduce your time in debt by 10 months when you consolidate with a loan. Using a 0% APR credit card to consolidate that same debt could help you save $1,443.

Use our calculator to determine how much you can save in your particular financial situation.

How much does debt consolidation cost?

Lenders and credit card companies often charge fees to consolidate debt. Personal loan lenders charge origination fees, and credit card companies charge balance transfer fees.

| Origination fee | Balance transfer fee |

|---|---|

|

|

While there are many loans without origination fees, it’s less common to find a balance transfer credit card with no transfer fee. That said, balance transfer fees tend to be on the small side, so do the math to decide which option is best for you.

Does debt consolidation hurt your credit?

Yes, there are ways debt consolidation can hurt your credit, but your score may be better off in the long run.

When you take out a new loan or credit card to consolidate debt, the lender will pull your credit, which will temporarily knock a few points off your credit score.

Closing old credit cards will decrease the average age of your accounts and the amount of available credit you have — two factors that contribute to your credit score. Keep your old cards open to avoid this.

But debt consolidation could significantly boost your credit in the long run, depending on how you make payments. Consolidating debt can lower your monthly payments, making them easier to pay on time. And making on-time payments is the best way to improve your credit score.

Using a loan to pay off $1,000 in credit card debt can boost your credit score by 29 points after just one month.

Is debt consolidation a good idea?

Debt consolidation is a good idea if you can save money by qualifying for lower interest rates than the ones you’re currently paying. You can see rates from up to five of the nation’s largest network of lenders in minutes when you fill out a single form with the LendingTree marketplace.

If you don’t qualify for low rates, consider these alternatives to get out of debt:

Debt restructuring

Negotiate your terms with your creditors

Debt settlement

Work with a debt settlement company to reduce your debt=

Credit counseling

Work with a credit counselor to create a plan to pay off your debt

Frequently asked questions

You can get your credit score for free on LendingTree Spring. In addition, we’ve compiled some of the best credit monitoring services that can also provide your score.

You can find all this information on your credit card statement or monthly loan statement for each debt you owe. These statements are typically available on your online account with your credit card company or lender.