Parents With Young Children Spend Average of $731 Annually on Kids’ Extracurriculars, and Majority Believe It’ll Lead to Income or Career

As a parent, you want to give your child every opportunity to succeed — but at what cost?

When it comes to extracurriculars — which 71% of parents with children younger than 18 say at least one of their kids is involved in — it’s a hefty one. In fact, parents with kids in extracurriculars spend an annual average of $731 per child on these activities, according to the latest LendingTree survey of 2,000 U.S. consumers.

Here’s what else we found.

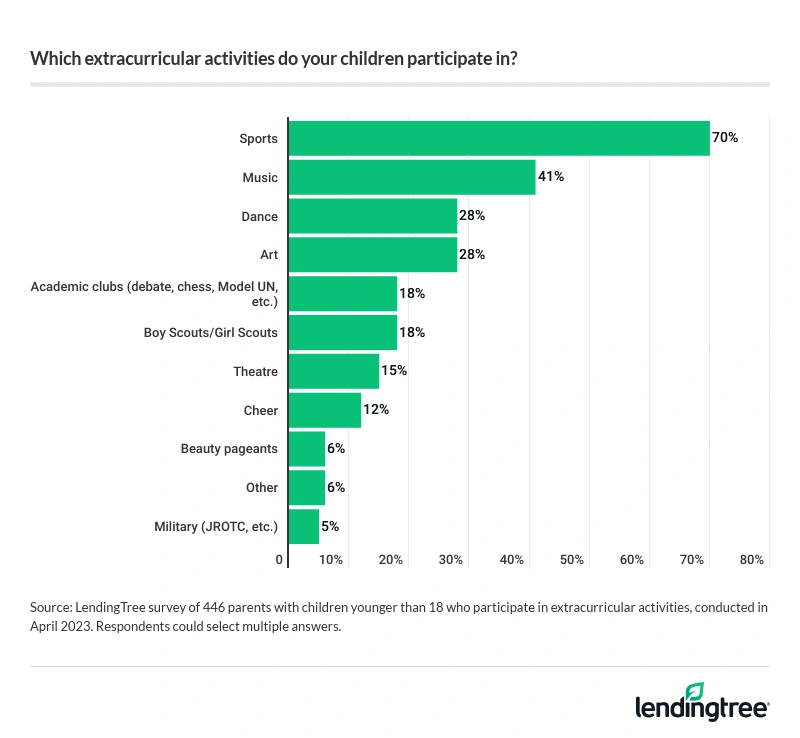

- Extracurriculars are the name of the game for children younger than 18, with sports being the fan favorite. 71% of parents with young children say at least one of their kids participates in extracurricular activities — sports top the list at 70%, followed by music (41%) and dance and art (tied at 28%). Parents who earn $100,000 or more a year are most likely to say one of their kids participates in a competitive activity, at 86%.

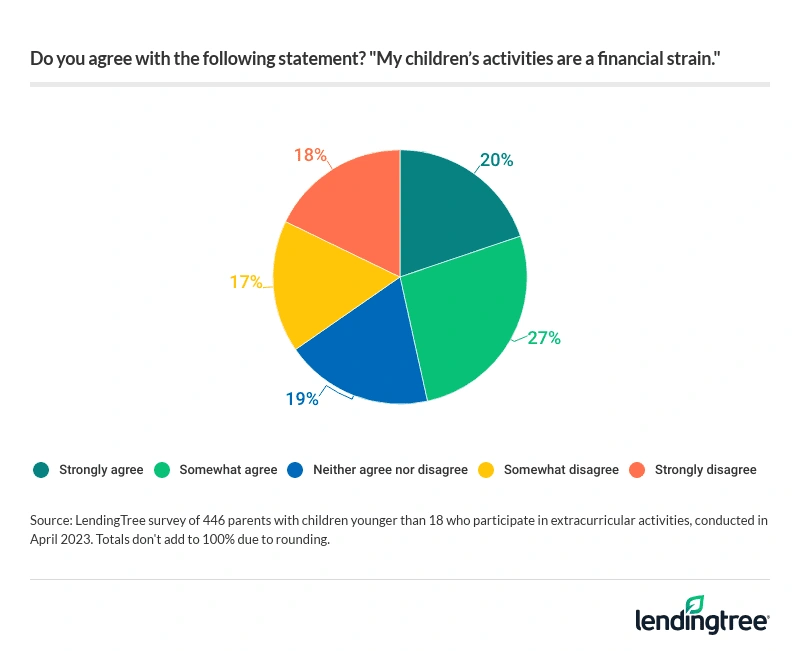

- Although kids may feel the heat to compete, extracurriculars are no (financial) cakewalk for parents. Parents with kids in extracurriculars spend a yearly average of $731 per child on activities, with the majority (62%) saying they’ve been stressed about paying for it. To help make ends meet, 42% of these parents say they’ve taken on debt to pay for their kids’ competitive activities, while 47% agree their children’s outside-of-school activities are at least somewhat of a financial strain.

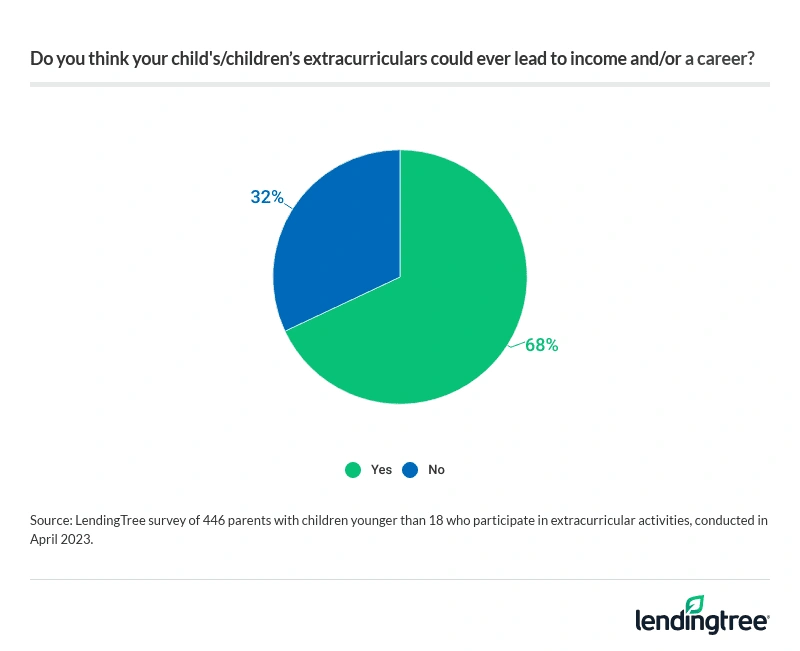

- Some justify the cost by viewing the extracurriculars as an investment in their children’s futures, although the ends may not justify the means. 68% of parents with kids in activities think these extracurriculars could one day lead to income or a career. (Dads (74%) are more optimistic about this than moms (61%).) In addition, 80% of parents who believe their child will continue their activity into college think they’ll receive tuition assistance for it. However, it may shock these parents that fewer than 2% of high school student-athletes are offered athletic scholarships.

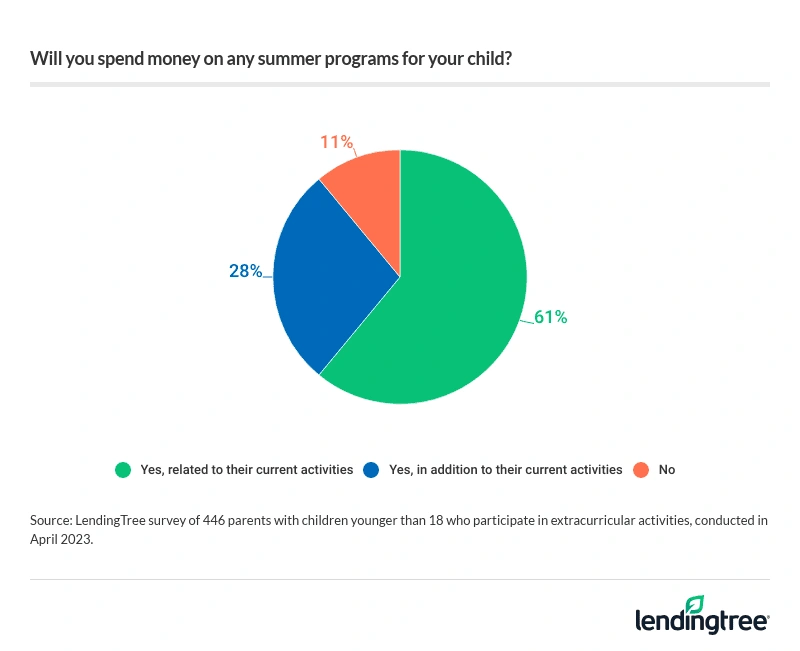

- Competitive activities don’t necessarily end when school breaks for summer, and neither do their expenses. 89% of parents with kids in extracurriculars plan to spend money on summer activity programs, with the average spend totaling $1,453 across all their children. Parents with an annual household income of $100,000 or more plan to spend substantially more, averaging $2,123 for this upcoming summer. Overall, 42% say they’ll go into debt to pay for those summer programs.

Majority of parents with young children have a child in extracurricular activities

Whether athletic, artistic or academic, for parents with young children, the world of extracurricular activities is thriving. In fact, 71% of parents with young children say at least one of their kids participates in extracurriculars. Sports reign supreme as the most popular choice (70%), followed by music (41%). Meanwhile, dance and art tie as the third most popular activities, at 28%.

A higher household income may translate to a greater likelihood of participation, with 86% of six-figure earners reporting that one of their kids is involved in an after-school activity. In comparison, it’s 55% for parents earning less than $35,000.

Dads are more likely to have a child in an extracurricular than moms, at 76% versus 66%. In addition, married parents (75%) are more likely to have a child involved in an extracurricular than those who’ve never been married (56%).

Parents with kids in extracurriculars spend an annual average of $731

Kids may feel excited about participating in extracurriculars, but their parents are feeling the financial burden. On average, parents with kids in after-school activities spend $731 per child annually on activities. On the high end, six-figure parents with kids participating in activities spend a yearly average of $1,033 per child.

These fees are coming at an emotional cost. In fact, the majority (62%) of these parents say they’ve been stressed about paying for it, and 42% say they’ve taken on debt to pay for their kids’ activities. Meanwhile, 47% agree that their children’s after-school activities are at least somewhat of a financial strain.

Moms notably feel it a bit more than dads do, with 66% of mothers saying they’ve been stressed about paying for their kids’ extracurriculars, versus 59% of dads. However, dads (47%) are more likely to take on debt than moms (35%) — and they’re also more likely to say paying for after-school activities is somewhat of a financial strain (53%, versus 38%).

According to LendingTree chief consumer finance analyst Matt Schulz, it’s understandable that these high costs come with financial stress.

“Any parent with a kid that’s active in extracurriculars can tell you that it can be really expensive to take part in them,” he says. “That’s true whether you’re talking about anything from soccer to choir to debate to robotics. They can all be really pricey, and the longer your kid does them and the better they are, the more it can cost. That can create real stress in families because any good parent wants to support their kids’ passions, but sometimes the cost can make that nearly impossible.”

How do parents primarily pay for their kids’ extracurricular expenses? The majority use plastic — 37% say they use a debit card, while 36% use a credit card. Six-figure earners are particularly keen on credit cards, with 56% of these parents primarily paying for their children’s extracurricular activities with a credit card.

Following debit and credit cards, 19% of parents pay for their kids’ activities with cash.

Many parents believe their child’s extracurriculars could lead to a career or income

While the cost of extracurriculars can be overwhelming, some justify the expenses as an investment in their child’s future. Of those with kids in activities, 68% think these extracurriculars may lead to future income or career opportunities for their kids. Dads tend to be more optimistic about the future payoff than moms, at 74% versus 61%.

Meanwhile, 78% believe their kids will continue their extracurriculars into college, and they’re hopeful their kids’ dedication will pay off. And of this group of parents, 80% think their kids will receive tuition assistance — that’s particularly true of six-figure earners (87%). However, according to the nonprofit NCSA, fewer than 2% of high school student-athletes are offered athletic scholarships.

Schulz advises parents to temper their expectations.

“Chances are that your kid isn’t going to be the next LeBron James, Serena Williams and Lionel Messi,” he says. “In fact, chances are your kid won’t even get a college scholarship to pursue that extracurricular activity. There’s nothing wrong with your kids dreaming big dreams and following big goals, but when it becomes clear that the pursuit of those dreams may start having a big negative impact on the family’s finances, it may be time to have a difficult conversation with your kid. It won’t be fun, but those types of talks are part of being a parent.”

89% of parents with kids in extracurriculars plan to pay for summer programs

The investment doesn’t end when school lets out. In fact, 89% of parents with kids in extracurriculars plan to spend money on summer activity programs — particularly, 61% say their summer programs are related to their kids’ current activities. Parents plan to spend an average of $1,453 across all their children.

Parents with an annual household income of $100,000 or more plan to spend the most, shelling out an average of $2,123 for this upcoming summer. In addition, dads plan to spend 20% more than moms on their kids’ summer programs ($1,575 versus $1,316).

In light of these high costs, 42% say they’ll go into debt to pay for their kids’ summer programs — a figure that’s higher among dads (50%) than moms (31%).

According to Schulz, there’s a lot of pressure to keep kids working on their extracurricular activities in the summer — but it’s not always the opportunity parents mean for it to be.

“Summer camps and activities can be a great way to help your kid improve, while also helping them meet new people and have exciting new experiences,” he says. “Generally, though, parents need to be wary of their kid burning out. Too often, extracurricular activities quickly become like jobs for kids, and that’s tough. Parents need to listen to their kids and try to recognize when they’re pushing them too far too fast. It can be difficult to see but it’s important to think about.”

Recreational relief: Expert tips on budgeting for your kids’ extracurriculars

According to Schulz, there’s practically no limit to how much you can spend to help your kids grow their skills and pursue their passion — and sometimes that’s scary. However, you don’t need to break the bank to help your children thrive.

Particularly, Schulz recommends the following:

- Budget, budget, budget. “Extracurricular activities can be crazy-expensive, so it’s vital to carve out room in your budget for them, if possible,” he says. “Before a new season or new school year starts, take a moment to think through the possible expenses, even speaking with other friends or relatives who’ve been through what you’re about to begin. You may not know what all the costs will be, but if you can get a ballpark idea and start saving money to put toward those costs, it can make a big difference.”

- You don’t always need new. “It’s easy to think that your kid needs the nicest musical instrument, shoes or equipment, but the truth is they probably don’t,” Schulz says. “A hand-me-down from a friend, relative or neighbor can be perfect, as can items from consignment stores or used sporting goods stores. It’ll work just as well, and it can make a real difference in costs.”

- Have your kid pitch in. “This won’t always be possible, but there are teachable moments to be found here,” he says. “Talking to your kid about the costs of their activities can be a great way to help them learn the value of a dollar. You don’t have to give them all the details or turn it into an economics lecture, but having a high-level talk about what the family is facing can be really useful. It can also be a great way to judge their enthusiasm for an activity. If you mention that your family may struggle to pay for that new instrument or registration for that soccer league and your son or daughter says they’ll do something to help pay for it, that’s a pretty good sign that they’re all in.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 77 from April 12 to 13, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.