On this page

- Our top card pick

- Compare best low-interest credit cards

- What is a low-interest-rate credit card?

- Pros and cons of low-interest credit cards

- How does credit card interest work?

- What is a good interest rate on a credit card?

- How to get a low-interest credit card

- How to get a lower interest rate on a credit card

- FAQs

- Methodology

Best Low-Interest Credit Cards in 2025

Our top pick for best low-interest card

Our top pick for best low-interest card

BECU Visa Credit Card

The BECU Visa Credit Card has two things going for it — a 0% intro APR for 12 months on purchases and a low APR of 12.74% to 23.74% Variable. You’ll also get an introductory APR for any balance transfers within the first 90 days of having the card.

Citi is an advertising partner.

Credit card APRs are on the rise and, with that, cardholders are paying more and more interest. Americans paid an estimated $133.1 billion in credit card interest and fees to banks, credit unions and finance companies in 2022. So if you want to avoid credit card interest, you might be looking for a low-interest credit card.

A low interest credit card is typically defined as either having a rate below 20% or having a 0% intro rate. Many of the cards below can help you save more than a hundred dollars in interest on a large purchase or a balance transfer from another credit card.

Best Low-Interest Credit Cards in 2024

Lowest interest rate credit card

BECU Visa Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Regular APR starting at 12.74% to 23.74% Variable, plus a 0% intro APR on balance transfers and new purchases

Get a 0% intro APR for 12 months on purchases and a low APR of 12.74% to 23.74% Variable

- Low everyday interest rate

- $0 annual fee

- Intro APR offer on both balance transfers and purchases

- $0 balance transfer fee

- $0 foreign transaction fees

- Requires credit union membership to apply

- No rewards program

- Minimal benefits

The BECU Visa Credit Card is our choice for the lowest interest card because of its powerful combination of features. Not only does it come with one of the lowest ongoing APRs of any credit card (currently 12.74% to 23.74% Variable), it also offers an interest-free offer on both purchases and balance transfers. You’ll get a 0% intro APR for 12 months on purchases followed by a low APR of 12.74% to 23.74% Variable, as well as an intro APR of 0% intro APR for 12 months on balance transfers when completed within 90 days of account opening (after which, a 12.74% to 23.74% Variable APR applies).

The BECU Visa Credit Card also comes with a $0 balance transfer fee, $0 cash advance fee, $0 foreign transaction fees and $0 annual fee.

- No annual fee

- No balance transfer fees

- No cash advance fees

- No foreign transaction fees

- Choose from four card designs

Low-interest business credit card

U.S. Bank Business Platinum Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.0% intro APR for 18 billing cycles on balance transfers and purchases

0% intro on balance transfers for 12 billing cycles (followed by a 16.24% - 25.24% variable APR) and 0% intro on purchases for 12 billing cycles (followed by a 16.24% - 25.24% variable APR)

- Long intro APR for purchases and balance transfers

- $0 annual fee

- Fairly low ongoing APR

- Card controls and expense management

- Employee cards for no annual fee

- No rewards program

- Limited benefits

- Foreign transaction fees

The U.S. Bank Business Platinum Card offers one of the longest introductory periods on balance transfers and purchases of any business credit card around. If you’re carrying a large balance on another card, or you want to finance a large purchase, you’ll have over a year to pay it down with no interest.

And while it’s light on other benefits, it does come with other useful tools for your small business, including controls for employee cards and expense management.

- 0% Intro APR on purchase and balance transfers for 12 billing cycles. After that, a variable APR currently 16.24% - 25.24%.

- Save on interest when you transfer balances from higher rate credit cards.

- Take control of your card spend with U.S. Bank Spend Management—a game-changing platform for monitoring and managing business expenses and employee spending.

- No annual fee.

- Terms and conditions apply.

Low-interest credit card for fair credit

Navy Federal Platinum Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro APR of 0.99% on balance transfers, plus a low regular APR

0.99% introductory APR for 12 months for balance transfers requested within 60 days of account opening (then 10.49% to 18.00% (variable) APR)

- Low everyday interest rate

- Intro APR on balance transfers

- $0 annual fee

- $0 foreign transaction fees

- Qualify with fair / good / excellent credit

- Requires membership in Navy Federal Credit Union

- No rewards program

- Minimal benefits

The Navy Federal Platinum Credit Card is one of few cards available to people with fair credit that includes an introductory APR. You’ll get a 0.99% introductory APR for 12 months for balance transfers requested within 60 days of account opening. After that, you’ll get a relatively low APR of 10.49% to 18.00% (variable). Plus, unlike many other cards with balance transfer offers, it doesn’t have any balance transfer fees.

There are also no annual fees or foreign transaction fees with the card. However, you’ll need to be a member of Navy Federal Credit Union to apply for this card. Membership requires you to be a member of the armed forces, Department of Defense, or a veteran, or a family member of one of the above.

- 0.99% introductory APR for 12 months for balance transfers requested within 60 days of account opening. Applies to balance transfers requested within 60 days of account opening.

- After the intro period, a 10.49% to 18.00% (variable) APR applies

- No balance transfer fee

- No annual fee

Low-interest credit card with no credit check

Secured Self Visa® Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.APR of just Variable APR of 27.49% as of 1/1/2026

This rate is lower than the average interest rate for a secured credit card

- Lower-than-average APR for a secured credit card

- No hard credit check required

- Helps build credit by reporting to the major credit bureaus

- Designed for people with bad or poor credit

- Deposit as low as $100

- You control your credit limit

- Foreign transaction fee: None

- Security deposit required

- Requires signing up for the Self Credit Builder plan

- No rewards program

If you have bad credit or are working on establishing your credit history, you might consider the Secured Self Visa® Credit Card. It’s a secured credit card designed for people with bad or poor credit that happens to feature a lower-than-average APR of Variable APR of 27.49% as of 1/1/2026.

There’s no hard credit check performed when you apply. Instead, you’ll need to sign up for the Self Credit Builder plan and meet certain eligibility requirements. Then, you’ll put down a security deposit that will convert to your card’s credit limit.

You can open a card with a deposit as low as $100. Plus, Self will also regularly review your account to possibly increase your credit limit, as long as your account remains in good standing.

- Click APPLY NOW to apply online.

- No hard credit check or credit score required

- See if you’re approved in minutes

- Fund the secured Self Visa® Credit Card1 with a minimum security deposit of $100.

- $0 annual fee for the first year only, $25 annual fee thereafter. Variable APR of 27.49% as of 1/1/2026. Offer valid for new customers only.

- Reports to all 3 major credit bureaus to build credit history

- Be automatically considered for a higher credit line in just 6 months—no extra deposit needed

- Monitor your credit progress in the app with free access to your Credit Score.

- Secure your credit line with a refundable security deposit - as low as $100.5

- Use your card anywhere Visa is accepted–in the US.

- Enjoy peace of mind with $0 Fraud Liability Guarantee for Lost/Stolen Cards with Visa’s Zero Liability Policy

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Manage your account online, by phone or in Self mobile app

- If you don’t have the $100 security deposit today, consider a Credit Builder Account2 starting at $25 a month4. Consistent, on-time payments help you build credit and build savings to secure the secured Self Visa® Credit Card.3

- 1Self is not a bank. Secured Self Visa Credit Card issued/held by Lead Bank, Sunrise Banks, N.A., or First Century Bank, N.A. See self.inc/visa-secured-credit-card for details including important rate and fee information.

- 2Self is not a bank. Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., or First Century Bank, N.A., each Member FDIC. See self.inc/credit-builder-loan for details including important rate and fee information.

- 3Qualification for the secured Self Visa® Credit Card is based on meeting eligibility requirements, including income and expense requirements and establishment of security interest. Criteria subject to change

- 4$25/mo, 24 mos, 15.92% APR; $35/mo, 24 mos, 15.69% APR; $48/mo, 24 mos, 15.51% APR; $150/mo, 24 mos, 15.82% APR. See self.inc/pricing

- 5Deposits are returned upon account closure after settling outstanding balances.

- Rates & Fees

Low-interest secured credit card

DCU Visa® Platinum Secured Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.APR of just 15.25% (variable)

This rate is lower than the average interest rate for a secured credit

- Exceptionally low APR for a secured credit card

- $0 annual fee

- You can be approved even with poor credit

- Relatively low everyday interest rate

- $0 foreign transaction fee

- Requires credit union membership

- No rewards program

- Requires a security deposit

The DCU Visa® Platinum Secured Credit Card is another option if your credit is less-than-ideal and you’re looking for a secured card. It features an APR of 15.25% (variable), one of the lowest rates you’ll find among secured credit cards.

While you are required to put down an initial security deposit, that deposit will turn into your initial credit limit. The DCU Visa® Platinum Credit Card also requires credit union membership to apply, but you can be approved even with bad or poor credit. Further, there’s a $0 annual fee, no balance transfer fee, no cash advance fee and $0 foreign transaction fees.

- APR as low as 15.75% variable

- No annual fee

- No balance transfer fee

- No cash advance fee

- No foreign transaction fee

Low-interest cash back credit card

Chase Freedom Unlimited®

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.0% APR on purchases and balance transfers for 15 months

0% Intro APR on Purchases for 15 months (followed by a 18.24% - 27.74% Variable APR) and 0% Intro APR on Balance Transfers for 15 months (followed by a 18.49%, 24.49%, or 28.49% Variable APR)

- Long intro APR on purchases and balance transfers

- $0 annual fee

- Generous sign-up bonus

- Earn rewards with every purchase

- Access to the valuable Chase Ultimate Rewards® program

- Requires good / excellent credit

- Relatively high regular APR

- Foreign transaction fee

The Chase Freedom Unlimited® is one of the best cash back cards you can find with an introductory APR on both purchases and balance transfers. It gives you a longer-than-average intro period to pay down a balance, plus a great cash rewards program that makes it worth keeping in the long run.

Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases.

In addition, if you also have a premium Chase credit card, you can combine the rewards you earn with the Chase Freedom Unlimited® to possibly get even more value from your rewards. The card does usually require a better credit score than other cards, however, so if your credit is still fair or below, you might want to consider another card on this list.

- Click APPLY NOW to apply online.

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 18.24% - 27.74%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

- Rates & Fees

Balance transfer credit card with a low interest rate

BankAmericard® credit card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.X% Intro APR for XX billing cycles for purchases (followed by a XX.XX% - XX.XX% Variable APR ) and X% Intro APR for XX billing cycles for any balance transfers made in the first 60 days (followed by a XX.XX% - XX.XX% Variable APR on balance transfers)

- One of the longest intro periods for balance transfers and purchases

- $0 annual fee

- 0% intro APR offer on purchases

- 0% intro APR offer on balance transfers

- Requires good / excellent credit

- No ongoing rewards program

- Foreign transaction fees

- Few other benefits

The BankAmericard® credit card comes with one of the longest intro periods for purchases and balance transfers around. You’ll have a year and a half to pay down a balance interest-free. But while it doesn’t have a rewards program or many other perks, you’ll enjoy that it doesn’t have an annual fee or a penalty APR.

- Click APPLY NOW to apply online.

- New! X% Intro APR for XX billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently XX.XX% - XX.XX% will apply. A X% fee applies to all balance transfers. Balance transfers may not be used to pay any account provided by Bank of America.

- No annual fee.

- No penalty APR. Paying late won't automatically raise your interest rate (APR). Other account pricing and terms apply.

- This offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

Low-interest travel credit card

Capital One VentureOne Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.0% APR for purchases and balance transfers for 15 months

0% intro on purchases for 15 months (followed by a 18.49% - 28.49% (variable) APR) and 0% intro on balance transfers for 15 months (followed by a 18.49% - 28.49% (variable) APR)

- Long intro APR for balance transfers and purchases

- $0 annual fee

- Earn rewards with each purchase

- Solid initial welcome offer

- No foreign transaction fee

- Recommended for consumers with good / excellent credit

- There is a fee for balance transfers

- Lower rewards rate than some other cards

- High regular APR

If you’re looking to finance an upcoming trip or transfer an existing balance to a travel credit card, the Capital One VentureOne Rewards Credit Card may be your best bet. It features a longer-than-average intro APR on both balance transfers and purchases. It also offers a solid (if not stunning) rewards program.

You’ll earn 1.25 Miles per dollar on every purchase, every day; 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel. The card also comes with a solid initial welcome offer that can boost your rewards balance. Further, as a no-annual-fee card, it doesn’t have a ton of travel perks — however, it does offer no foreign transaction fees, which makes it a good option for foreign travel.

- Click APPLY NOW to apply online.

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- $0 annual fee and no foreign transaction fees

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 18.49% - 28.49% variable APR after that; balance transfer fee applies

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

- Rates & Fees

Low-interest gas credit card

Citi Custom Cash® Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.0% APR on balance transfers and purchases for 15 months

0% intro APR for 18 months on Balance Transfers (followed by a 17.49% - 27.49% (variable) APR and N/A (followed by a 17.49% - 27.49% (variable) APR)

- Long intro APR on purchases and balance transfers

- $0 annual fee

- Earn up to 5% cash back in one category, including gas

- Solid initial welcome offer

- 5% category capped at $500 in purchases per month

- Other purchases only earn 1% cash back

- 5% balance transfer fee

- Foreign transaction fee

The Citi Custom Cash® Card isn’t just a really rewarding card for gas purchases. It also gives you over a year to finance a new purchase or pay down an existing balance, interest-free.

It has a unique rewards structure: Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. The 5% category includes gas purchases, making a great option for a dedicated gas card.

Keep in mind, though, that you’ll only earn 1% in any category other than your highest spending one. That means the Custom Cash card is better suited to only be used for one category rather than as an everyday card.

The welcome offer and the ongoing rewards are paid out in ThankYou points, which you can either redeem as cash or use for travel expenses. The Citi Custom Cash® Card also has a $0 annual fee.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 17.99% - 27.99%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2026.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

Side-by-side comparison of the best low-interest credit cards

| Credit Cards | Our Ratings | Regular APR | Penalty APR | Recommended Credit Credit scores ranges may vary. Your individual chance at approval may vary due to factors such as creditors using a particular variation at their discretion | |

|---|---|---|---|---|---|

BECU Visa Credit Card*

|

3.5

Lowest interest rate credit card

|

12.74% to 23.74% Variable | N/A | N/A | |

U.S. Bank Business Platinum Card*

|

Low-interest business credit card

|

16.24% - 25.24% Variable | 29.99% Fixed | Good / Excellent | |

Navy Federal Platinum Credit Card*

|

Low-interest credit card for fair credit

|

10.49% to 18.00% (variable) | 18.00% | Fair / Good / Excellent | |

Secured Self Visa® Credit Card

on Self's secure site Rates & Fees |

Low-interest credit card with no credit check

|

Variable APR of 27.49% as of 1/1/2026 | N/A | Poor |

on Self's secure site Rates & Fees |

DCU Visa® Platinum Secured Credit Card*

|

Low-interest secured credit card

|

15.25% (variable) | 18.00% | Poor | |

Chase Freedom Unlimited®

on Chase's secure site Rates & Fees |

Low-interest cash back credit card

|

18.24% - 27.74% Variable | Up to 29.99% | Good / Excellent |

on Chase's secure site Rates & Fees |

BankAmericard® credit card

on Bank Of America's secure site |

Balance transfer credit card with a low interest rate

|

XX.XX% - XX.XX% Variable APR | None | Good / Excellent |

on Bank Of America's secure site |

Capital One VentureOne Rewards Credit Card

on Capital One's secure site Rates & Fees |

Low-interest travel credit card

|

18.49% - 28.49% (Variable) | None | Good / Excellent |

on Capital One's secure site Rates & Fees |

Citi Custom Cash® Card*

|

Low-interest gas credit card

|

17.49% - 27.49% (Variable) | Up to 29.99% (Variable) | Good / Excellent |

What is a low-interest-rate credit card?

A low-interest-rate card is generally one that either has an APR that falls below the average credit card interest rate for its category or an introductory 0% APR offer. Many of the cards in this article have 0% intro APR offers. There are usually two different types of intro 0% APR offers: Some offer a 0% rate on all purchases for a given period of time, while others offer the 0% rate on balance transfers.

It’s important to note that these introductory 0% offers only work for a certain period of time — after that, it’s better to have a card with a low ongoing APR if you’re planning on carrying a balance.

What is a low-interest-rate credit card?

- Can help you save on interest when carrying a balance

- Useful for making large purchases

- Don’t often earn rewards or offer many benefits

- Require good to excellent credit for the lowest APR

How does credit card interest work?

Follow the tips below so you get the most value out of your low-interest card:

-

Keep your balance under control

Even if you need to carry a balance, don’t let that balance keep growing. Plan a concrete amount that you can pay each month and stick to it. If you can, make more than the minimum payment — because when you only pay the minimum, your payment goes toward both interest charges and the principal amount of your debt.

-

Pay on time

It’s important to pay at least the minimum due every month, as this is the top factor in building a good credit score. If your card has a 0% intro APR, paying late could cause you to lose that intro rate. Setting up autopay is one way to ensure your bill is always paid on time.

-

Transfer balances quickly

If your card offers a 0% intro APR period on balance transfers, be aware that there might be a limited window of time to take advantage of the 0% APR offer. Many cards require you to transfer a balance within 60 days to qualify for the intro APR.

-

Continue to make payments on any transferred balances

If you request a balance transfer, you should continue making payments on your old card until the balance transfer payment goes through.

What is a good interest rate on a credit card?

The average credit card interest rate currently stands at 24.59%. However, a “good” interest rate will depend on the type of card you have. For instance, cards with few benefits tend to have lower interest rates than cards with rewards programs and travel perks. In addition, many credit cards offer a range of APRs. In this case, your interest rate will depend on your credit score and history, with lower interest rates being given to applicants with higher credit scores.

You can find the average interest rate by type of credit card in our table below. Cards with good interest rates should fall below these averages:

| Category | Minimum APR | Maximum APR | Average | Previous month |

|---|---|---|---|---|

| Average APR for all new card offers | 21.11% | 28.07% | 24.59% | 24.59% |

| 0% balance transfer cards | 18.74% | 27.86% | 23.30% | 23.30% |

| No-annual-fee cards | 20.61% | 27.71% | 24.16% | 24.16% |

| Rewards cards | 20.88% | 28.13% | 24.50% | 24.50% |

| Cash back cards | 21.04% | 27.79% | 24.42% | 24.42% |

| Travel rewards cards | 20.90% | 28.74% | 24.82% | 24.82% |

| Airline credit cards | 21.27% | 29.37% | 25.32% | 25.32% |

| Hotel credit cards | 21.73% | 29.43% | 25.58% | 25.58% |

| Low-interest credit cards | 13.69% | 22.52% | 18.11% | 18.11% |

| Grocery rewards cards | 20.53% | 28.16% | 24.35% | 24.35% |

| Gas rewards cards | 20.99% | 27.98% | 24.49% | 24.49% |

| Dining rewards cards | 20.69% | 28.47% | 24.58% | 24.58% |

| Student credit cards | 19.56% | 27.85% | 23.70% | 23.70% |

| Secured credit cards | 27.06% | 27.06% | 27.06% | 27.06% |

How to get a low-interest credit card

Applying for a low-interest credit card works in much the same way as applying for any other credit card:

- Understand your credit score and what cards you’re likely to be approved for

- Decide which low-interest credit card you want to apply for

- Gather your financial and demographic information

- Apply for the card, either over the phone, in a bank branch or online

- If you’re approved, then start using the card.

- If you applied for a card with an intro 0% APR on balance transfers, make sure to do any such transfers during the initial window (usually 60 to 90 days)

How to get a lower interest rate on a credit card

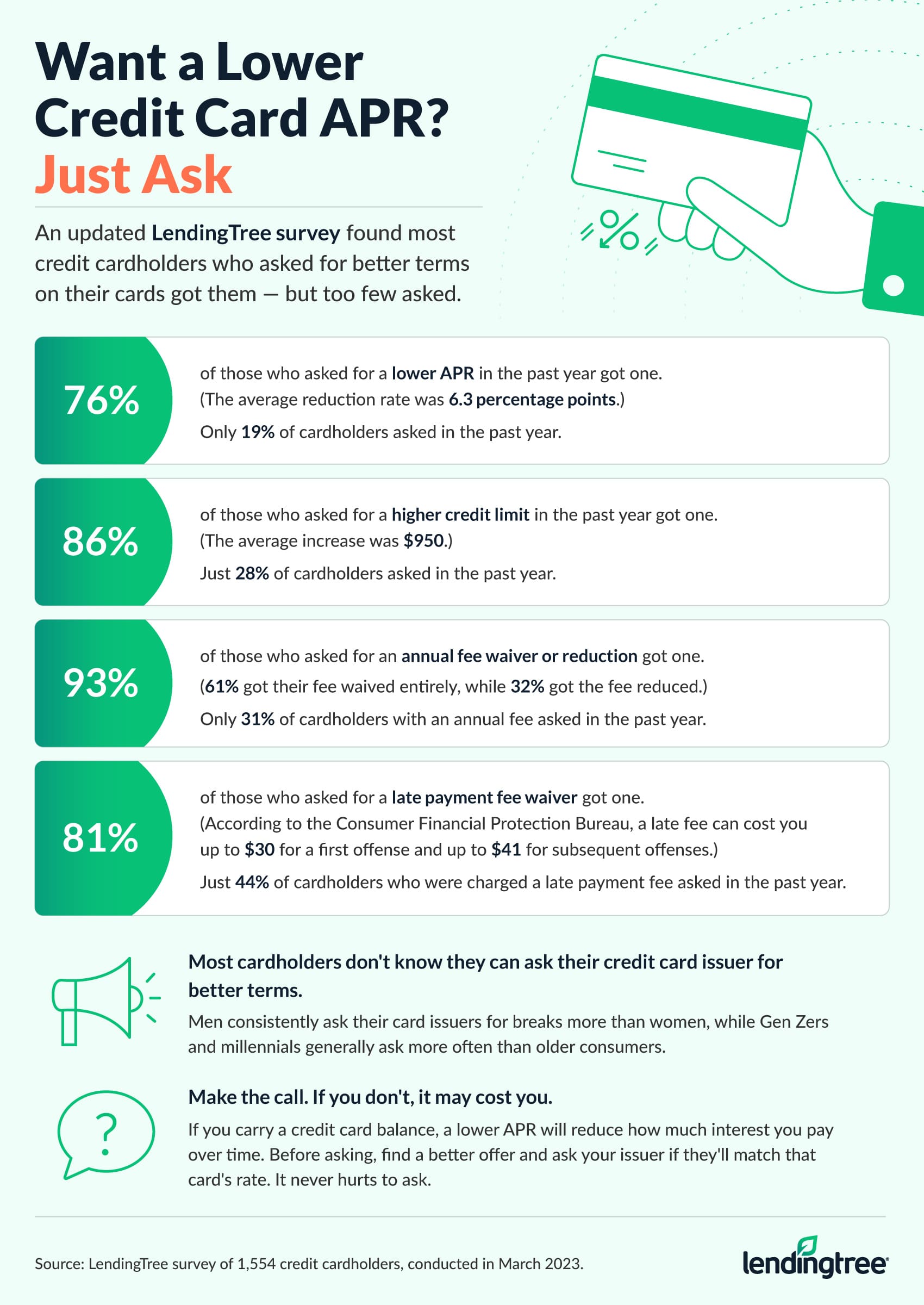

If your credit card has a relatively high interest rate, you may be able to contact your issuer to have them lower it. A LendingTree study showed that 76% of recent requests for a lower APR were granted by the credit card company. Here are a few tips for how to get a lower interest rate on a credit card:

- Have a long history with the bank

- Pay your bills on time as much as possible

- It never hurts to ask for a lower interest rate, but don’t ask every month

- Banks may also waive or reduce late fees or other fees

Frequently asked questions

Your interest rate is the rate at which interest is charged on any outstanding balances. The APR (annual percentage rate), meanwhile, reflects the total cost of borrowing. This means that the APR includes the interest rate, but also includes any fees or other charges issued by the bank. It also means the APR is almost always equal to or higher than the interest rate for a given credit card.

Yes, it is possible for credit card companies to lower your interest rate. In many cases, all you need to do is call up the customer service department and ask if your interest rate can be lowered. The more valuable you are as a customer (by being a long-time customer and/or regularly paying your bills on time), the more likely the bank is to grant your request.

Interest rates are typically variable — which means they not only change over time, but they also depend on each borrower’s specific financial situation. So while one bank may have the lowest interest rate for one borrower, another borrower might have a lower interest rate with a different bank. Many of the credit card offers in this article have relatively low interest rates and might be worth checking out if you’re looking for a card with the lowest interest rate.

Fixed-rate cards are less common than they used to be before the Credit CARD Act of 2009. Now, most credit cards are variable-rate cards, which means their APRs fluctuate based on an index like the Prime Rate. However, you can sometimes still find fixed-rate credit cards these days, generally through credit unions.

In order to get the best rate a credit card has to offer, you’ll likely need to have a very good or exceptional credit score. Generally, that’s considered a FICO Score between 740 and 850. If you have a lower score, even if you get approved for one of the cards on this list, the APR on your account might be set higher.

Probably not. Most credit cards with good 0% intro APR offers require a good credit score or better. A good credit score is one that’s anywhere from 670 to 739 — credit scores above that are considered very good or exceptional.

Methodology: How we chose the best low-interest credit cards

The most important criterion in compiling this list was each credit card’s regular APR. The cards listed here don’t offer rewards or premium benefits, but they do offer low interest rates (at least for consumers with good enough credit scores to qualify for the best rates).

In addition, none of the cards here charge an annual fee. If you’re trying to save money with a low-interest card, you probably don’t want to pay a fee just to carry your card.

We also considered accessibility. Many of the cards listed here require credit union membership; however, at least our top pick and the runner-up make it easy for anyone to join.

Finally, we included a selection of 0% intro APR credit cards. While these cards might not have the lowest regular APRs, for consumers who need a set window of time to pay off debt, they offer a chance to avoid interest charges entirely.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the BECU Visa Credit Card, U.S. Bank Business Platinum Card, Navy Federal Platinum Credit Card, DCU Visa® Platinum Secured Credit Card, Citi Custom Cash® Card and DCU Visa® Platinum Credit Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.