Does Opening a New Credit Card Affect Your Credit Score?

Are you considering opening a new credit card but wondering if the impact to your credit score will outweigh the benefits of a sign-up bonus or 0% APR savings? You should know that the short-term negative impact to your credit score is typically negligible.

Your application will trigger a hard inquiry which causes your score to dip slightly. And, if approved, a new line of credit will reduce the overall age of your credit accounts, which may also reduce your score a bit.

However, in the long run, a new credit card can help you improve your credit score by boosting the amount of available credit you have. Also, if you make timely payments on your new account, it can help you establish a positive payment history on your report.

How does opening a new credit card hurt your credit score?

When you open a new credit card, there are two things that can cause your credit score to drop: a hard inquiry on your credit report and a decrease in your average age of accounts.

It generates a hard inquiry on your credit report

Applying for new credit generates a hard inquiry when the lender pulls your credit report from one of the three credit bureaus. This is done to review your creditworthiness and generally results in a 5- to 10-point drop in your credit score. Your credit score generally rebounds in a few months; however, the inquiry stays on your credit report for two years.

Note that this inquiry happens whether or not you are approved. If you are concerned that you may not be approved, consider checking if you’re prequalified for a credit card.

See the best preapproved credit cards.

The average age of your accounts decreases

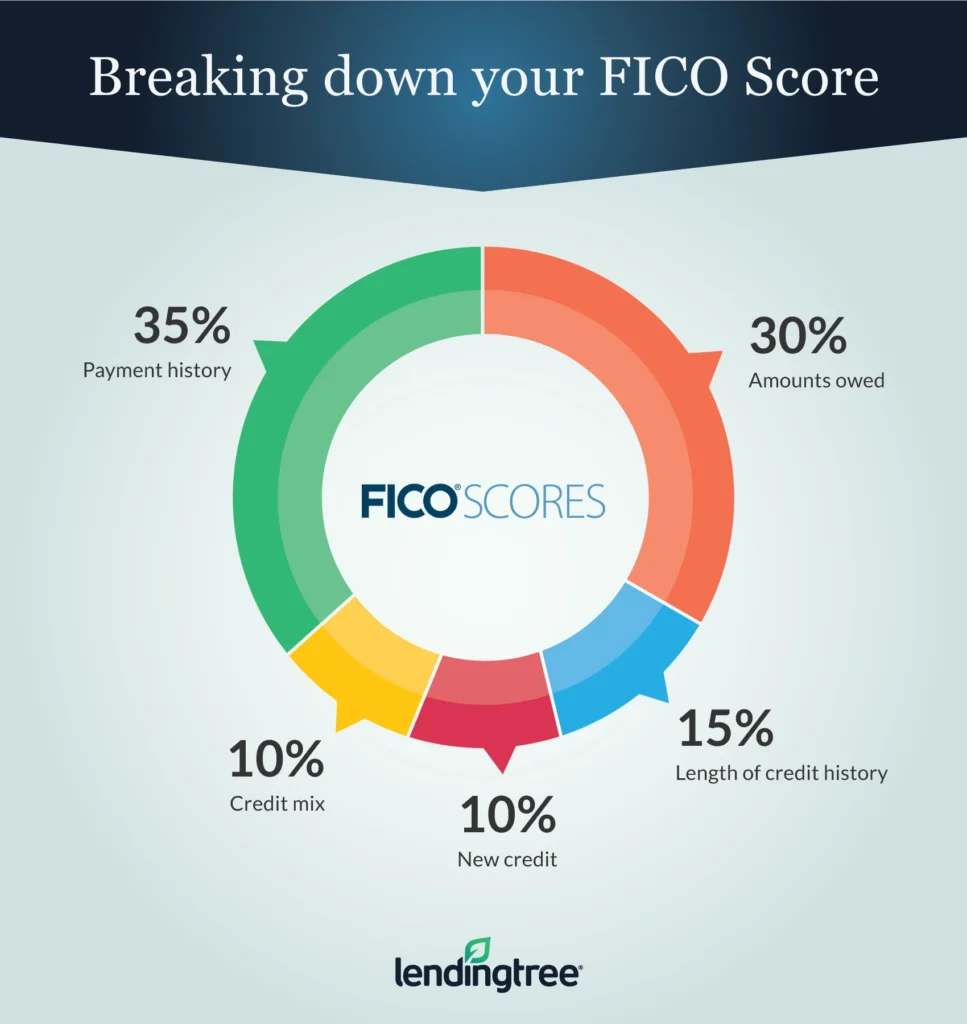

As mentioned, a new credit account will reduce the average age of your accounts. Your length of credit history makes up 15% of your FICO credit score. While it’s not a large amount, it is one factor of your credit score that you have a good amount of control over so be mindful of when you open a credit card. Additionally, experts advise against closing your oldest credit card. The impact of adding another card to your credit mix isn’t as large when you’re just starting to build credit. However, if you have an average credit age of 10 years and then open a new card, the average age will drop significantly.

How does opening a new credit card help your credit score?

Opening a new credit card can benefit your credit score by improving your credit utilization ratio, diversifying your credit mix and helping you build a strong credit history.

Improves your credit utilization ratio

This is the primary way in which opening a new credit card can benefit your credit score, and it’s a major factor. Your credit utilization ratio is the technical term for how much of your available credit you are using. It’s recommended that you keep your balances below 30%, and having a large credit line makes this easier.

For example, if you have a credit card with a $1,000 credit limit with a $300 balance, that’s 30% utilization. if you open a new card that gives you another $1,000 credit limit, that reduces your overall utilization to 15% ($300/$2,000 = 15%). Note that utilization is calculated both per individual account and across all your accounts.

When you add a new credit card to your wallet (or request a credit limit increase on an existing card) your overall utilization ratio should decrease as long as you don’t spend more.

Paying off your card or cards in full as often as possible (for instance, at the end of every week) can help ensure your issuer reports a low utilization to the credit bureaus at the end of the billing cycle.

Diversifies your credit mix

Your credit mix makes up 10% of your credit score and takes into consideration the types of credit products you have such as auto loans, personal loans or mortgages. Opening a credit card helps expand the types of credit you have if you don’t have one yet. If you do, then there will be less impact.

Builds a strong payment history

Your credit report is a history that makes up the largest part of your credit score and represents how you handle credit. Your monthly payments on your new credit card will add to this. Assuming you keep your credit utilization low and make all of your payments on time, positive data will be added to your report. This is helpful if you have some blemishes on it, such as late or missed payments or accounts in default.

Note that any new, positive information does not cancel out or erase the blemishes. It simply shows that you’re using credit responsibly.

How many credit cards is too many?

Having at least one credit card is a good thing because it can help you build credit. But how many credit cards should you have? There’s no one-size-fits-all answer. For some consumers, one credit card is enough, as long as it reports payment activity to the three credit bureaus. Other consumers may use two, three or even more credit cards to earn rewards in different spending categories.

Just be sure that however many credit cards you use, you keep track of your payment due dates. Some issuers allow you to customize your due date, which means you might be able to schedule all your cards to have the same due date.

You could also set up email or text message alerts for when a due date is approaching, or activate autopay so at least the minimum payment is made automatically — on-time payments are the most important factor of your credit score.

How to build credit and keep a good credit score

These are the five factors that make up your FICO Score:

With these factors in mind, here are some tips for how to build and keep a good credit score:

-

Pay on time, every time.

If you can, always pay off your cards in full. And if you can’t do that, make at least the minimum payment to avoid having a late payment on your record. The good news is that payments aren’t typically reported as late to the bureaus until you’re 30 days past due. If you realize you’ve missed a due date, act quickly to submit the payment. -

Keep your balances low.

You don’t want to max out your credit cards. Utilization is the second-most impactful factor affecting your credit score, and carrying high balances can be a signal to lenders you may be at risk of not being able to pay back what you owe. Carrying a balance does not help your credit score, so pay it off in full if you’re able. -

Apply for new credit sparingly.

You don’t want to end up with numerous inquiries on your credit reports, which can be a warning sign to lenders that you’re desperate for credit. And you don’t want to continually reduce the average age of your accounts by opening new ones, either. Time is a powerful ally when it comes to building credit. -

Maintain a healthy credit mix.

Applying for credit products in a responsible way, as needed, can improve your credit score by showing you can manage different types of accounts. For instance, you may take out student loans and open a student credit card while in college, take out an auto loan after graduation and, eventually, apply for a mortgage.

Browse our top picks for the best credit cards to build credit.

Important credit card terms for new cardholders to know

If you’re new to credit, you’ll want to make sure you understand the relevant terminology:

-

APR

This stands for annual percentage rate. With some financial products, APR and interest rates differ, but they mean the same thing when referring to credit cards. Note that some cards offer 0% introductory APR periods on purchases or balance transfers, during which time interest won’t accrue on eligible balances. -

Statement closing date

The last day in your billing cycle is the statement closing date. Purchases that you make after that date (or purchases that post after that date) will appear on the next billing cycle. -

Payment due date

This is the date your credit card bill is due. You’re required to make at least the minimum payment, though it’s better to pay off your balance in full to avoid interest charges. Your due date remains the same from month to month, and some issuers allow the flexibility to request the due date of your choice. -

Minimum payment

Each billing cycle, you must pay at least the minimum due. Your minimum payment is likely calculated one of two ways: either as a percentage of your total balance or as all of the interest owed plus 1% of your principal balance. There’s also typically a threshold for your minimum payment, such as $25, and if you’re carrying less than that on the card you’ll have to pay off your balance in full. -

Grace period

Most credit cards offer a grace period, a window of time between when your billing cycle ends and your payment is due. If you pay your card in full by the due date, a grace period allows you to avoid incurring interest charges. Note, however, that if you roll a balance over from one billing cycle to the next, you’ll be charged not only on the unpaid balance, but also on purchases made in the new billing cycle. -

Late fee

If you pay late, your issuer can charge a late fee. You can be charged up to $30 for your first late payment, and if you have a subsequent late payment within six billing cycles, you can be charged up to $41 for that. -

Penalty APR

In addition to a late fee, missing your payment due date can also trigger a penalty APR, an elevated interest rate. This will apply to new purchases on the card, and if you don’t pay up within 60 days, the higher APR can be applied to your current balance, too. If you trigger a penalty APR, you may take some solace in the fact that the Credit Card Act of 2009 requires issuers to reinstate your regular purchase APR after you’ve made consecutive on-time payments during the six months following the activation of the penalty rate. -

Annual fee

Some credit cards charge an annual fee, which you’ll pay just to have the account. Typically, we recommend looking at credit cards with no annual fee, unless you want a rewards card that offers benefits like airport lounge access, travel protections or credits for certain types of spending. -

Foreign transaction fee

Many cards charge a foreign transaction fee of around 3% for purchases outside the United States. If planning a trip abroad, consider getting a credit card with no foreign transaction fee instead. -

Balance transfer fee

If you plan on transferring a balance from an existing credit card to your new one to save on interest charges, beware that many credit cards charge a balance transfer fee of 3% to 5% of the amount transferred. That means, for example, if you transfer a $1,000 balance to a card that charges a 3% balance transfer fee, you’ll pay $30 to do so. There are credit cards with no balance transfer fee, but they’re relatively rare.

Does preapproval lower your credit score?

Getting preapproved for a credit card does not lower your credit score because the issuer only does a soft credit pull at that point. If you are preapproved, you can apply for the card with confidence that you have a good chance of being approved.

Want to learn more? Here’s everything you need to know about leasing a car.

Things to consider before applying for a new credit card

- You will see a temporary drop in your credit score after you apply for a credit card. This applies whether or not you are approved for the card.

- Opening a new credit card will decrease the average age of your credit lines. Keep your oldest credit card open, and use it occasionally, so it works in your favor. If it has an annual fee, ask if you can downgrade to a fee-free card while maintaining the age of the account.

- Consider any upcoming purchases, like buying a car or home, before you open a new card. If you plan to make large financial purchases requiring a loan, hold off on opening a new credit card. Opening multiple lines of credit in a short period of time is a red flag to lenders.

Frequently asked questions

You can check your credit score for free with LendingTree Spring.

It typically takes seven to 10 business days to receive your physical credit card in the mail, though some issuers offer expedited delivery that may have a fee.

No, checking your credit score doesn’t impact your credit at all. You can check your credit score for free with LendingTree Spring and monitor your progress as you work to build and keep a good score.

Some issuers may provide you with an instant credit card number, allowing you to use it for online purchases or with a digital wallet before your physical card arrives.

You generally shouldn’t close your old credit card accounts. If you close a credit card and the account is in good standing, it’ll stay on your credit reports for 10 years, so you don’t lose that positive history right away. However, you will lose that line of credit, meaning your utilization ratio could increase if you’re carrying a balance on any other cards.

No, this is a myth. As long as you’re using your credit card, paying on time and keeping utilization low, you’ll build credit — no need to carry a balance.

Recommended Articles