How to Get a Business Credit Card

Whether you’re a freelancer, the owner of a startup or someone who runs a more established business, getting a small business credit card can help you manage your business’s finances and earn rewards. However, applying for a business card can be a bit different than applying for a consumer card. We’ll walk you through the steps of how to apply for a business credit card and help you evaluate some of the top business cards available as well.

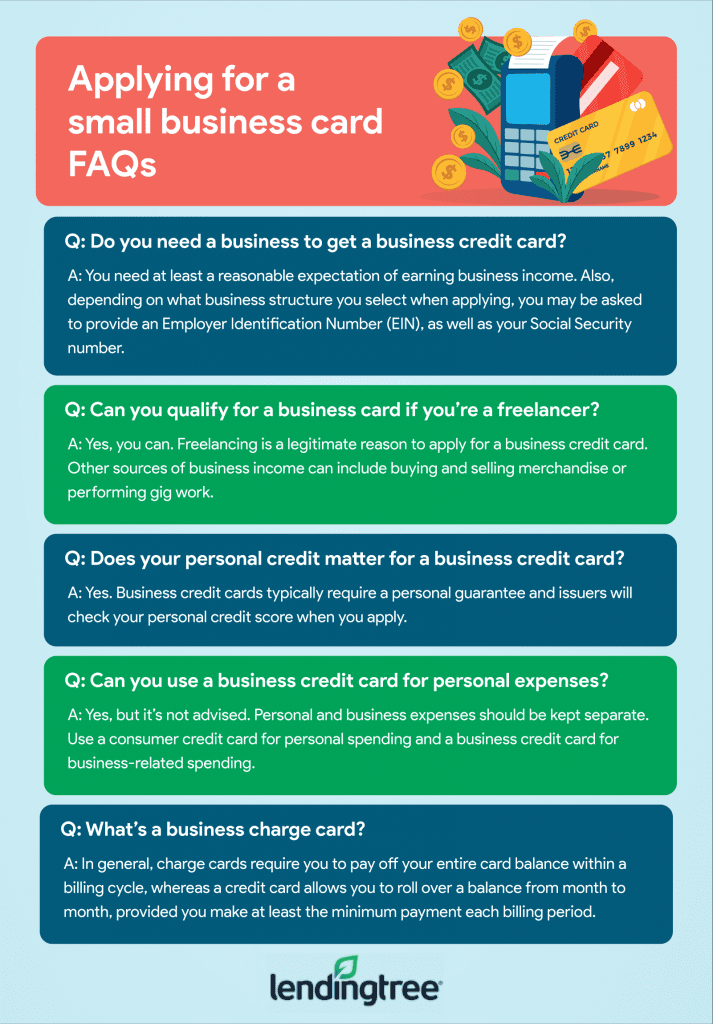

Whether you operate an existing business with established revenue or you’re just starting a new business and have a reasonable expectation of revenue, you can apply for a business credit card. And “business” doesn’t have to mean a multimillion dollar enterprise — it can be as simple as selling handcrafts on Etsy, writing freelance articles for a website or doing yardwork for neighbors. In these examples, you’d likely apply for a business card as a sole proprietor, using your Social Security number. Just note that you do need a business of some sort; issuers don’t want you to apply for a business card if you have no actual business.

Here’s some information you may need to have handy when applying for a business card:

- Your business structure. For example, Capital One allows you to select from the following options on its business card applications: sole proprietorship, corporation, partnership, nonprofit corporation, single-member limited liability company (LLC), multiple-member LLC or other.

- Your Employer Identification Number (EIN). Depending on the issuer and how your business is structured, you may or may not need to include your EIN on the application. For example, American Express requires this only if your business is a corporation or a partnership, while Capital One requires it for all structures other than a sole proprietorship.

- Your total annual business revenue. Don’t feel the need to inflate your revenue if your business is new.

- Your business’s full legal name. Your business’s legal name should be what’s listed on your EIN.

- Your business’s DBA. A DBA is a “Doing Business As” name. American Express, for example, requires you to provide your business’s DBA, or mark that it doesn’t have one.

- Your estimated monthly spending.

- The type of industry.

- The business address and contact info.

- The length of time in business.

- Number of employees.

- Your position in the business.

- Your personal information, such as Social Security number, birthdate, etc.

Though you might be able to apply without an EIN, having one can be helpful for your application. Nancy Parnella, director of the Barclays U.S. business credit card program, explains that having an EIN can allow for quicker approval of your application.

“Most business owners should have an EIN as it allows them to keep their personal and business finances separate,” Parnella says. “This is also advantageous when applying for a business credit card as it aids in verifying the business, which can expedite approval.”

Typically, a small business card requires a personal guarantee (meaning you’re personally responsible for what’s charged to the card) and a personal credit check. This means your personal credit score does matter when applying for a business credit card, and poor personal credit score is a reason you could be turned down for the business card you want.

For that reason, it’s wise to check your personal credit score before applying for a business card. You’re also entitled by law to one free copy of your credit report from each of the three consumer credit bureaus (Equifax, Experian and TransUnion) annually via annualcreditreport.com where you can check for and dispute any legitimate errors that may be dragging your score down. During the COVID-19 pandemic, the bureaus have offered free weekly credit reports, rather than just the one per year required by law.

Don’t despair if your personal credit leaves something to be desired, however. If you’ve been in business for some time and have built up a good business credit score, issuers may take that into account.

“The underwriting of a business card is fairly complex, and depending on the type of business and the card they are applying for, personal scores, business scores or both could be leveraged,” Parnella says. “We use a proprietary underwriting model at Barclays, which considers the size and complexity of the business, the type of business and the ownership structure to determine what combination of data is used for the decision. In [a situation where an applicant] has fair personal credit and excellent business credit, they could be considered for a card, but many other variables are considered before a final decision is made.”

If you’re turned down after applying for a mainstream business credit card, getting a secured business card might provide an opportunity to build up good business credit history. Know that you’ll have to pay a security deposit, and you may have to pay an annual fee as well.

Generally, a business credit card won’t appear on your personal credit report. Capital One and Discover are exceptions, as both report business card activity to the consumer credit bureaus. (Note that while most Capital One business cards will show up on your personal credit reports, the Capital One Spark Cash Plus doesn’t.)

However, if you are significantly late paying your business card bill — from any issuer — it’s likely to be reported to your personal credit report and can damage your personal credit score.

That’s because as was mentioned earlier, most small business credit cards require a personal guarantee, meaning you are the one ultimately responsible for making sure the card is paid up.

Here are a few questions to ask to help you evaluate the best type of card that will benefit your business most:

- Do you need employee cards? If so, you’ll benefit from considering a card that offers free employee cards, rather than charging an additional fee for each one. Plus, many business credit cards will allow you to track employee spending and set customizable limits, which provides a good way to ensure any cards you issue aren’t used improperly.

- What type of purchases make up the bulk of your business spending? Some business cards offer higher rewards rates in specific spending categories — office supply stores, for example. Other cards offer a flat rewards rate on every purchase, regardless of category.

- Does your business require frequent travel? You may want to consider applying for a business travel card or business gas card that can offset that can offset some of those expenses.

- Do you need to finance a big purchase? A business card with an introductory 0% APR can be a money-saver for large expenses. Or, if you want to earn extra cash back or rewards on a big purchase, this could be a good time to consider a business card with a generous sign-up bonus.

- How much do you think you’ll spend on a card each year? Determining your business’s annual spending will help you evaluate whether a card with an annual fee is worth it or not. For example, if you’re using a card that offers 2% cash back and charges a $150 annual fee, you’ll need to spend $7,500 per year to recoup the amount of the annual fee.

Based on our research of business cards available through LendingTree, as well as from top issuers, we’ve selected some of the best options for a variety of needs.

Elevated rewards on common business expenses

Ink Business Preferred® Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.- High-value sign-up bonus

- High rewards on business and travel purchases

- Flexible travel rewards and redemption options

- Points can be transferred to travel partners

- Wide range of additional business benefits

- Annual fee

- Requires excellent credit

The Ink Business Preferred® Credit Card lets you earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchases-with no limit to the amount you can earn. Plus, you can earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening..

There’s a $0 foreign transaction fee, so you can travel abroad without worrying about an extra charge being tacked on every time you use the card. The APR is reasonable at 19.49% - 25.49% variable.

You will have to pay a $95 annual fee for this card.

Who’s this card best for?

If you travel frequently for business and value flexibility in how you can use your credit card rewards, the Ink Business Preferred® Credit Card might be right for you. When booking travel through the Chase Ultimate Rewards® portal, you get 25% more value per point. Or, you can transfer points at a 1:1 rate to a variety of airline and hotel partners. This card requires excellent credit.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- Member FDIC

Flexible rewards program

American Express® Business Gold Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.- High rewards rate on common business purchases

- Valuable, flexible points

- Large welcome offer

- No foreign transaction fee

- Annual fee

- Points might be more complex to manage than cash back

- Rewards structure might not match all business spending patterns

The American Express® Business Gold Card offers uniquely flexible rewards. Earn 4X Membership Rewards® points on the top two eligible categories where your business spends the most each month from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.* Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.* Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required. Terms Apply (from a list of eligible categories, and capped at $150,000 spent per year, after which you earn 1X). Plus, earn 100,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

If you need flexibility in how much you can spend, you’ll appreciate that this card has no preset spending limit. What you can spend adapts based on factors including your purchase, payment and credit history.

Do note that the card comes with a hefty $375 annual fee. However, you don’t have to worry about a foreign transaction fee because there is none.

Purchases can be either paid in full each billing cycle or you can carry a balance (for eligible transactions) using the Pay Over Time feature. In the latter case, a 17.74% - 28.49% variable APR applies.

Who’s this card best for?

If the categories in which your business spends tend to fluctuate from month to month, the American Express® Business Gold Card‘s adaptability will serve you well. Note that you’ll need good / excellent credit to have a good chance of approval when applying for the American Express® Business Gold Card. Categories eligible for the boosted rewards rate include airfare purchased directly from airlines and U.S. purchases on the following:

- Online, TV and radio advertising

- Computer hardware, software and cloud systems from select technology providers

- Gas stations

- Restaurants, including takeout and delivery

- Shipping

- Welcome Offer: Earn 100,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- Earn 4X Membership Rewards® points on the top two eligible categories where your business spends the most each month from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.*

- Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.*

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.*

- Get up to a $12.95** statement credit back each month after you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. **Up to $12.95 plus applicable taxes on one membership fee.*

- The Business Gold Card comes in three metal designs: Gold, Rose Gold and White Gold. Make your selection when you apply on Americanexpress.com.

- *Terms Apply

If your personal or business credit score is less than stellar, you might have trouble qualifying for some of the higher-end business credit cards. However, there are a couple options. Below is an unsecured business card meant for fair credit and a secured business card that might be a good fit for business owners with Poor / Fair credit, if you’re willing to submit $500 to $25,000 to the issuer as a security deposit.

Fair or limited credit

Capital One Spark Classic for Business*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.- Designed for businesses with fair credit

- Cash back rewards on all purchases

- No annual fee

- Employee cards at no additional cost

- Opportunity to build business credit

- Cash back rate might be lower than some other business cards

- No introductory rewards bonus

- Foreign transaction fee

- Limited additional benefits compared to premium business cards

The Capital One Spark Classic for Business is aimed at business owners with fair credit who are looking for a card that doesn’t require a deposit. Plus, it earns earn unlimited 1% cash back for your business on every purchase, everywhere, with no limits or category restrictions. Plus, earn unlimited 5% cash back on hotels and rental cars booked through Capital One Business Travel..

You don’t have to worry about a foreign transaction fee. Like other Capital One business credit cards, the Capital One Spark Classic for Business charges $0.

The annual fee is $0 and the APR is 29.49% (variable).

Who’s this card best for?

If you don’t want to tie up money in a deposit for a secured card, the Capital One Spark Classic for Business is probably your best option. It’s accessible if you have fair credit, so the requirements aren’t as stringent as many other business cards. True, you’ll earn a lower cash back rate than some cards offer, but it’s a solid choice if you don’t think you’ll qualify for more high-end cards.

- Earn unlimited 1% cash back for your business on every purchase, everywhere, with no limits or category restrictions. Plus, earn unlimited 5% cash back on hotels and rental cars booked through Capital One Business Travel.

- No annual fee

- Build and strengthen credit for your business by using this credit card responsibly

- $0 Fraud Liability if your card is lost or stolen

- Free employee cards, which also earn unlimited 1% cash back on all purchases

- Rewards won't expire for the life of the account, and you can redeem your cash back for any amount

- No foreign transaction fees

You should have at least some kind of business income, or the expectation that you will earn business income, before applying. You don’t necessarily have to run a full-fledged business with a storefront and employees, however — something as simple as doing freelance work from time to time could allow you to qualify.

There isn’t a set amount of revenue your business must generate to qualify for a business credit card. It’s possible to get approved for a business card as a sole proprietor with relatively modest revenue, or even an estimate of expected revenue if your business is new and you don’t have numbers for a whole year yet.

The best practice is to keep business and personal expenses separate — use a business card for business expenses and a personal credit card for personal expenses. That way, if you ever need to produce records documenting your business expenses, they aren’t jumbled together with personal purchases.

If you run a business, whether it’s a big operation with several employees or just you selling products on eBay or Etsy, getting a business credit card is a smart move. It allows you to separate personal spending from business spending, makes it easier to track expenses and typically protects your finances better in cases of fraud than a debit card.

Yes, as a sole proprietor you can apply for a business credit card. Just note you can be denied for a variety of reasons, as with any credit card application.

In general, with charge cards you must pay off your card’s balance within a billing cycle, whereas a credit card allows you to roll over a balance from month to month. The benefit of a charge card is that you may have a flexible spending limit, whereas credit cards come with a set credit limit you typically can’t exceed.

Methodology

In selecting the business cards recommended here, we evaluated rewards programs for a variety of different spending habits. We also weighed welcome offers and benefits such as free employee cards.

In one instance, a selection was made based on availability to applicants with Poor / Fair credit.

Finally, annual fees were considered. Those cards that charge an annual fee offer enough value in rewards and benefits that business owners in some situations will find them worthwhile despite the cost of the fee.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Ink Business Preferred® Credit Card and Capital One Spark Classic for Business has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.