Cheapest Car Insurance in New Jersey (2026)

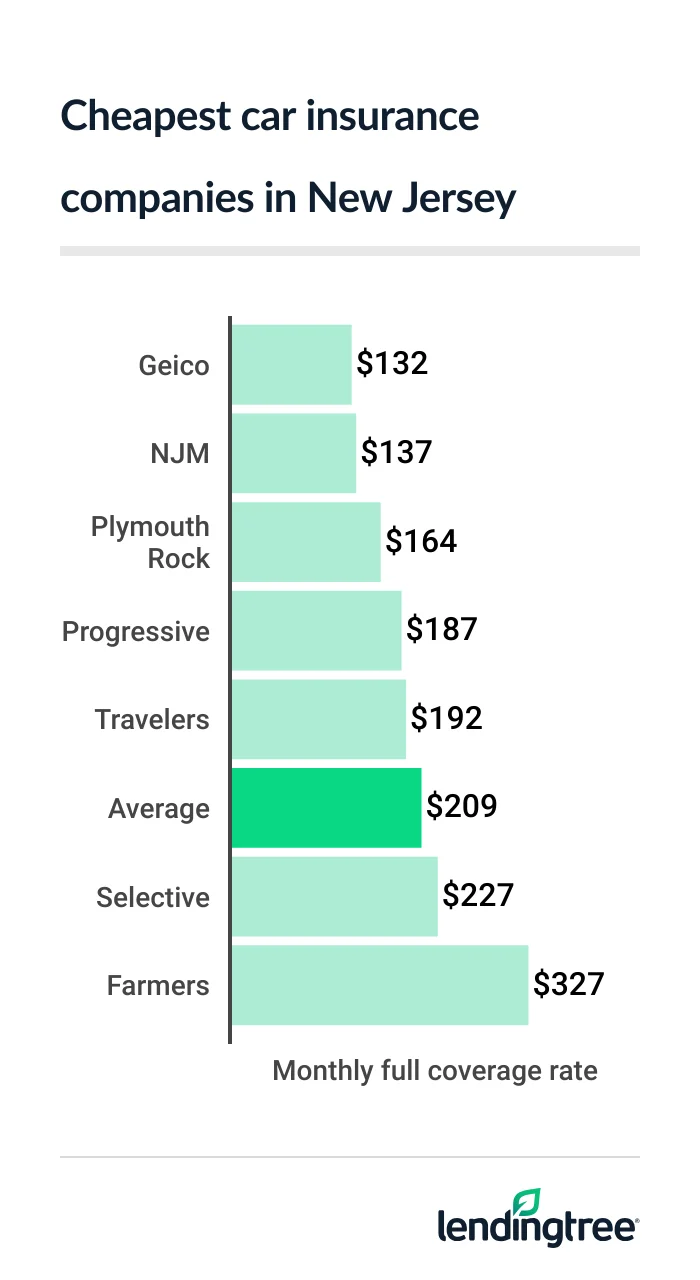

Geico has the cheapest full coverage car insurance in New Jersey at $132 a month. NJM is only slightly more expensive but has a higher satisfaction score.

Best cheap New Jersey car insurance

Cheapest full coverage car insurance in New Jersey: Geico

Geico has the cheapest full coverage car insurance in New Jersey at $132 a month. NJM is only slightly more expensive at $137 a month. NJM is a better choice for full coverage

Full coverage car insurance costs $209 a month, on average, for a typical New Jersey driver. The amount you pay depends on factors like your driving record, vehicle and credit history.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Geico | $132 | |

| NJM | $137 | |

| Plymouth Rock | $164 | |

| Progressive | $187 | |

| Travelers | $192 | |

| Selective | $227 | |

| State Farm | $246 | |

| Allstate | $268 | |

| Farmers | $327 | |

Companies treat these factors differently and offer different car insurance discounts. This makes it good to compare car insurance quotes to find the cheapest company for your situation.

Cheapest minimum coverage New Jersey car insurance: Geico

At $66 a month, Geico has New Jersey’s cheapest liability insurance, or minimum coverage. NJM only costs a little more at $70 a month. However, Geico also has a few more discounts than NJM. These can help make Geico a cheaper option for you.

Cheap liability insurance

| Company | Monthly rate |

|---|---|

| Geico | $66 |

| NJM | $70 |

| Plymouth Rock | $83 |

| Progressive | $120 |

| Selective | $121 |

| Travelers | $127 |

| Allstate | $149 |

| State Farm | $159 |

| Farmers | $181 |

The minimum coverages available in standard and basic policies include liability

Cheapest car insurance for New Jersey teens: Geico

Geico has New Jersey’s cheapest car insurance for teens. It charges young drivers an average of $97 a month for minimum coverage. This is 40% less than the next-cheapest rate of $162 a month from NJM.

Geico’s full coverage rates for teens average $179 a month. This beats NJM’s rate of $278 a month by 35%.

Teen auto insurance rates

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Geico | $97 | $179 |

| NJM | $162 | $278 |

| Travelers | $287 | $431 |

| Allstate | $365 | $756 |

| Selective | $374 | $608 |

| State Farm | $496 | $733 |

| Farmers | $512 | $977 |

| Plymouth Rock | $633 | $1,179 |

| Progressive | $660 | $972 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This, in turn, leads to high insurance rates for young drivers. Most teens get cheaper rates on a parent’s car insurance than they do on their own.

Discounts can also make car insurance more affordable for young drivers.

- Most companies, including Geico, NJM and Travelers, give teens a discount for getting good grades.

- These three companies, and others, also give teens a discount for completing a driver training course.

Make sure to ask about these and other young driver discounts when you get your quotes.

Cheapest NJ car insurance after a speeding ticket: Plymouth Rock

Drivers with a speeding ticket can get New Jersey’s cheapest car insurance from Plymouth Rock at $164 a month. This is barely cheaper than Geico’s rate of $169 a month. Of the two companies, Geico has the better satisfaction rating from J.D. Power

Insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| Plymouth Rock | $164 |

| Geico | $169 |

| NJM | $179 |

| Selective | $227 |

| State Farm | $246 |

| Travelers | $246 |

| Progressive | $254 |

| Allstate | $385 |

| Farmers | $552 |

A speeding ticket raises the average rate of full coverage in New Jersey by 29% to $269 a month. However, some companies have smaller rate increases. Comparing quotes is a good way to get cheaper car insurance with a bad driving record.

Best NJ car insurance rates after an accident: NJM

For drivers with an at-fault accident, NJM has the cheapest car insurance at $148 a month. Geico is the next-cheapest company for car insurance after an accident at $182 a month. However, Geico’s driver affiliation discount

Insurance rates after an accident

| Company | Monthly rate |

|---|---|

| NJM | $148 |

| Geico | $182 |

| Plymouth Rock | $231 |

| Progressive | $311 |

| Travelers | $320 |

| Selective | $370 |

| State Farm | $408 |

| Allstate | $619 |

| Farmers | $630 |

Cheap NJ car insurance for bad teen drivers: Geico

New Jersey teens with a bad driving record get the cheapest car insurance quotes from Geico. The company charges teens with a speeding ticket $129 a month for minimum coverage. This is 36% less than NJM’s rate of $202 a month.

Geico’s rate of $121 a month for teens with an accident is 25% less than NJM’s rate.

Teen insurance rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Geico | $129 | $121 |

| NJM | $202 | $162 |

| Travelers | $363 | $483 |

| Selective | $374 | $615 |

| State Farm | $496 | $831 |

| Allstate | $560 | $963 |

| Plymouth Rock | $633 | $955 |

| Progressive | $703 | $778 |

| Farmers | $708 | $834 |

New Jersey’s cheapest DWI insurance: NJM

At $179 a month, NJM has New Jersey’s cheapest car insurance after a DWI (driving while intoxicated). Geico is only slightly more expensive at $185 a month. Of the two, NJM has a higher J.D. Power score, which usually means better customer service.

Insurance rates with a DWI

| Company | Monthly rate |

|---|---|

| NJM | $179 |

| Geico | $185 |

| Plymouth Rock | $198 |

| Progressive | $227 |

| Travelers | $296 |

| Farmers | $409 |

| Allstate | $409 |

| Selective | $453 |

| State Farm | $978 |

Best NJ car insurance rates for bad credit: NJM

New Jersey drivers with bad credit can get the cheapest car insurance from NJM at $229 a month. This is 49% less than the average bad credit car insurance rate of $450 a month. Progressive is the next-cheapest company at $307 a month.

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| NJM | $229 |

| Progressive | $307 |

| Geico | $380 |

| Plymouth Rock | $385 |

| Selective | $409 |

| Travelers | $416 |

| Farmers | $429 |

| Allstate | $477 |

| State Farm | $1,015 |

Your insurance credit score is only slightly different from the one a lender uses for a loan application. Insurance companies focus on things like your payment history and the amounts you borrow. You can improve both credit scores by avoiding late payments and paying down debts.

Best car insurance in New Jersey

NJM, Geico and Plymouth Rock stand out as New Jersey’s best car insurance companies for different reasons.

Best overall: NJM

Low rates and an excellent satisfaction rating help make NJM the state’s best overall car insurance company. Its excellent satisfaction score means its customers like its prices, coverage options and service. Its rates are also well below state averages for most types of drivers.

Best for cheap rates: Geico

Geico is often the best choice for cheap rates. Its full coverage rates are 37% less than the state average. It also has more discounts than most other companies, which can help you save more.

Geico’s satisfaction rating beats the industry average. However, NJM and State Farm have better ratings.

Best coverage options: Plymouth Rock

Plymouth Rock has the state’s best car insurance coverage options. Its add-on coverage for accident forgiveness

Insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| Selective | 3.5 | NR | A+ |

| State Farm | 4.5 | 650 | A++ |

| Travelers | 4.4 | 613 | A++ |

| Plymouth Rock | 4.3 | 608 | A- |

| NJM | 4.2 | 721 | A+ |

| Progressive | 3.8 | 621 | A+ |

| Geico | 3.7 | 645 | A++ |

| Allstate | 3.2 | 635 | A+ |

| Farmers | 3.1 | 622 | A |

New Jersey car insurance rates by city

At $314 a month, Newark and Irvington have the most expensive car insurance among New Jersey’s boroughs, cities and towns. These rates are 50% higher than the state average.

Car insurance tends to cost more in areas with high crash and car theft rates. High medical and car repair costs can also drive up an area’s insurance rates.

Bay Head is one of eight areas with the state’s cheapest car insurance at $176 a month. The others are Brielle, Manasquan, Mantoloking, Normandy Beach, Point Pleasant, Point Pleasant Beach and Sea Girt.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Absecon | $225 | 8% |

| Adelphia | $207 | -1% |

| Allendale | $196 | -6% |

| Allenhurst | $198 | -5% |

| Allentown | $188 | -10% |

| Allenwood | $179 | -14% |

| Alpha | $192 | -8% |

| Alpine | $224 | 7% |

| Andover | $192 | -8% |

| Annandale | $190 | -9% |

| Asbury | $190 | -9% |

| Asbury Park | $198 | -5% |

| Ashland | $201 | -4% |

| Atco | $220 | 6% |

| Atlantic City | $275 | 32% |

| Atlantic Highlands | $191 | -9% |

| Audubon | $188 | -10% |

| Audubon Park | $188 | -10% |

| Augusta | $192 | -8% |

| Avalon | $183 | -12% |

| Avenel | $222 | 6% |

| Avon-by-the-Sea | $180 | -14% |

| Baptistown | $190 | -9% |

| Barclay | $201 | -4% |

| Barnegat | $181 | -13% |

| Barnegat Light | $181 | -13% |

| Barrington | $194 | -7% |

| Basking Ridge | $187 | -10% |

| Bay Head | $176 | -16% |

| Bayonne | $258 | 24% |

| Bayville | $198 | -5% |

| Beach Haven | $181 | -13% |

| Beach Haven West | $181 | -13% |

| Beachwood | $198 | -5% |

| Beattystown | $192 | -8% |

| Beckett | $196 | -6% |

| Bedminster | $193 | -8% |

| Belford | $190 | -9% |

| Belle Mead | $189 | -9% |

| Belleville | $265 | 27% |

| Bellmawr | $205 | -2% |

| Belmar | $177 | -15% |

| Belvidere | $192 | -8% |

| Bergenfield | $244 | 17% |

| Berkeley Heights | $195 | -6% |

| Berlin | $220 | 6% |

| Bernardsville | $188 | -10% |

| Beverly | $191 | -9% |

| Birmingham | $192 | -8% |

| Blackwells Mills | $217 | 4% |

| Blackwood | $207 | -1% |

| Blairstown | $192 | -8% |

| Blawenburg | $191 | -8% |

| Bloomfield | $255 | 22% |

| Bloomingdale | $196 | -6% |

| Bloomsbury | $192 | -8% |

| Bogota | $250 | 20% |

| Boonton | $186 | -11% |

| Bordentown | $188 | -10% |

| Bound Brook | $203 | -3% |

| Bradley Beach | $196 | -6% |

| Bradley Gardens | $195 | -7% |

| Branchville | $199 | -5% |

| Brass Castle | $192 | -8% |

| Brick | $198 | -5% |

| Bridgeport | $196 | -6% |

| Bridgeton | $212 | 2% |

| Bridgewater | $195 | -7% |

| Brielle | $176 | -16% |

| Brigantine | $223 | 7% |

| Broadway | $194 | -7% |

| Brookdale | $255 | 22% |

| Brooklawn | $202 | -3% |

| Brookside | $186 | -11% |

| Browns Mills | $199 | -4% |

| Brownville | $212 | 2% |

| Budd Lake | $188 | -10% |

| Buena | $222 | 6% |

| Burlington | $191 | -9% |

| Butler | $187 | -10% |

| Buttzville | $192 | -8% |

| Caldwell | $204 | -2% |

| Califon | $190 | -9% |

| Camden | $278 | 33% |

| Cape May | $183 | -12% |

| Cape May Court House | $185 | -11% |

| Cape May Point | $183 | -12% |

| Carlstadt | $243 | 16% |

| Carneys Point | $199 | -5% |

| Carteret | $259 | 24% |

| Cedar Brook | $217 | 4% |

| Cedar Glen Lakes | $198 | -5% |

| Cedar Glen West | $198 | -5% |

| Cedar Grove | $218 | 4% |

| Cedar Knolls | $185 | -11% |

| Cedarville | $212 | 2% |

| Changewater | $190 | -9% |

| Chatham | $189 | -10% |

| Chatsworth | $196 | -6% |

| Cherry Hill | $200 | -4% |

| Cherry Hill Mall | $200 | -4% |

| Chesilhurst | $216 | 3% |

| Chester | $187 | -10% |

| Chesterfield | $187 | -10% |

| Clark | $209 | 0% |

| Clarksboro | $196 | -6% |

| Clayton | $221 | 6% |

| Clearbrook Park | $210 | 1% |

| Clementon | $222 | 6% |

| Cliffside Park | $279 | 34% |

| Cliffwood | $210 | 1% |

| Cliffwood Beach | $202 | -3% |

| Clifton | $268 | 28% |

| Clinton | $190 | -9% |

| Closter | $224 | 7% |

| Collingswood | $193 | -8% |

| Cologne | $213 | 2% |

| Colonia | $220 | 5% |

| Colts Neck | $195 | -7% |

| Columbia | $192 | -8% |

| Columbus | $188 | -10% |

| Concordia | $210 | 1% |

| Convent Station | $186 | -11% |

| Cookstown | $191 | -9% |

| Country Lake Estates | $199 | -4% |

| Cranbury | $202 | -3% |

| Crandon Lakes | $192 | -8% |

| Cranford | $206 | -2% |

| Cream Ridge | $193 | -7% |

| Cresskill | $224 | 7% |

| Crestwood Village | $198 | -5% |

| Dayton | $199 | -5% |

| Deal | $198 | -5% |

| Deepwater | $199 | -5% |

| Deerfield Street | $221 | 6% |

| Delaware Park | $192 | -8% |

| Delmont | $211 | 1% |

| Demarest | $227 | 9% |

| Dennisville | $189 | -10% |

| Denville | $184 | -12% |

| Dividing Creek | $212 | 2% |

| Dorchester | $212 | 2% |

| Dorothy | $219 | 5% |

| Dover | $191 | -8% |

| Dover Beaches North | $184 | -12% |

| Dover Beaches South | $192 | -8% |

| Dumont | $220 | 5% |

| Dunellen | $207 | -1% |

| East Brunswick | $210 | 0% |

| East Franklin | $217 | 4% |

| East Freehold | $209 | 0% |

| East Hanover | $202 | -3% |

| East Newark | $267 | 28% |

| East Orange | $304 | 46% |

| East Rutherford | $239 | 15% |

| Eatontown | $190 | -9% |

| Echelon | $203 | -3% |

| Edgewater | $281 | 35% |

| Edison | $215 | 3% |

| Egg Harbor City | $223 | 7% |

| Egg Harbor Township | $220 | 6% |

| Elizabeth | $302 | 45% |

| Elizabethport | $302 | 45% |

| Ellisburg | $198 | -5% |

| Elmer | $204 | -2% |

| Elmwood Park | $268 | 28% |

| Elwood | $228 | 9% |

| Emerson | $214 | 2% |

| Englewood | $272 | 31% |

| Englewood Cliffs | $262 | 26% |

| Englishtown | $210 | 1% |

| Erma | $183 | -12% |

| Essex Fells | $228 | 9% |

| Estell Manor | $221 | 6% |

| Ewan | $201 | -4% |

| Fair Haven | $191 | -9% |

| Fair Lawn | $243 | 17% |

| Fairfield | $205 | -2% |

| Fairton | $213 | 2% |

| Fairview | $244 | 17% |

| Fanwood | $215 | 3% |

| Far Hills | $190 | -9% |

| Farmingdale | $201 | -4% |

| Fieldsboro | $188 | -10% |

| Finderne | $195 | -7% |

| Flagtown | $194 | -7% |

| Flanders | $188 | -10% |

| Flemington | $192 | -8% |

| Florence | $190 | -9% |

| Florham Park | $190 | -9% |

| Folsom | $225 | 8% |

| Fords | $215 | 3% |

| Forked River | $187 | -10% |

| Fort Dix | $193 | -7% |

| Fort Lee | $281 | 35% |

| Fort Monmouth | $191 | -9% |

| Fortescue | $212 | 1% |

| Franklin | $204 | -2% |

| Franklin Center | $217 | 4% |

| Franklin Lakes | $195 | -6% |

| Franklin Park | $217 | 4% |

| Franklinville | $222 | 6% |

| Freehold | $209 | 0% |

| Frenchtown | $190 | -9% |

| Garfield | $269 | 29% |

| Garwood | $206 | -2% |

| Gibbsboro | $203 | -3% |

| Gibbstown | $196 | -6% |

| Gillette | $188 | -10% |

| Gladstone | $190 | -9% |

| Glassboro | $202 | -3% |

| Glasser | $187 | -10% |

| Glen Gardner | $190 | -9% |

| Glen Ridge | $233 | 12% |

| Glen Rock | $208 | -1% |

| Glendora | $203 | -3% |

| Glenwood | $208 | -1% |

| Gloucester City | $202 | -3% |

| Golden Triangle | $198 | -5% |

| Goshen | $190 | -9% |

| Great Meadows | $192 | -8% |

| Green Creek | $189 | -10% |

| Green Knoll | $195 | -7% |

| Green Village | $188 | -10% |

| Greendell | $192 | -8% |

| Greentree | $201 | -4% |

| Greenwich | $197 | -6% |

| Grenloch | $203 | -3% |

| Groveville | $188 | -10% |

| Guttenberg | $285 | 36% |

| Hackensack | $267 | 28% |

| Hackettstown | $192 | -8% |

| Haddon Heights | $187 | -11% |

| Haddonfield | $187 | -11% |

| Hainesport | $191 | -8% |

| Haledon | $243 | 17% |

| Hamburg | $204 | -2% |

| Hamilton Square | $189 | -10% |

| Hammonton | $228 | 9% |

| Hampton | $190 | -9% |

| Hancocks Bridge | $204 | -2% |

| Harrington Park | $217 | 4% |

| Harrison | $267 | 28% |

| Harrisonville | $201 | -4% |

| Harvey Cedars | $181 | -13% |

| Hasbrouck Heights | $242 | 16% |

| Haskell | $198 | -5% |

| Haworth | $217 | 4% |

| Hawthorne | $238 | 14% |

| Hazlet | $195 | -6% |

| Heathcote | $200 | -4% |

| Heislerville | $212 | 2% |

| Helmetta | $209 | 0% |

| Hewitt | $200 | -4% |

| Hi-Nella | $200 | -4% |

| Hibernia | $188 | -10% |

| High Bridge | $190 | -9% |

| Highland Lakes | $208 | -1% |

| Highland Park | $217 | 4% |

| Highlands | $193 | -8% |

| Hightstown | $194 | -7% |

| Hillsborough | $190 | -9% |

| Hillsdale | $201 | -4% |

| Hillside | $274 | 31% |

| Ho-Ho-Kus | $199 | -4% |

| Hoboken | $269 | 29% |

| Holiday City South | $198 | -5% |

| Holiday City-Berkeley | $198 | -5% |

| Holiday Heights | $198 | -5% |

| Holmdel | $194 | -7% |

| Hopatcong | $189 | -9% |

| Hopewell | $193 | -8% |

| Howell | $210 | 0% |

| Imlaystown | $195 | -7% |

| Interlaken | $198 | -5% |

| Ironia | $188 | -10% |

| Irvington | $314 | 50% |

| Iselin | $222 | 6% |

| Island Heights | $195 | -7% |

| Jackson | $213 | 2% |

| Jamesburg | $210 | 1% |

| Jersey City | $272 | 30% |

| Jobstown | $190 | -9% |

| Johnsonburg | $193 | -8% |

| Joint Base Mdl | $192 | -8% |

| Juliustown | $190 | -9% |

| Keansburg | $200 | -4% |

| Kearny | $267 | 28% |

| Keasbey | $221 | 6% |

| Kendall Park | $204 | -2% |

| Kenilworth | $221 | 6% |

| Kenvil | $189 | -9% |

| Keyport | $202 | -3% |

| Kingston | $195 | -6% |

| Kingston Estates | $201 | -4% |

| Kinnelon | $187 | -10% |

| Lafayette | $192 | -8% |

| Lake Como | $177 | -15% |

| Lake Hiawatha | $188 | -10% |

| Lake Hopatcong | $188 | -10% |

| Lake Mohawk | $192 | -8% |

| Lakehurst | $197 | -6% |

| Lakewood | $231 | 11% |

| Lambertville | $192 | -8% |

| Landing | $187 | -11% |

| Landisville | $217 | 4% |

| Lanoka Harbor | $183 | -12% |

| Laurel Lake | $212 | 2% |

| Laurel Springs | $222 | 6% |

| Laurence Harbor | $208 | 0% |

| Lavallette | $184 | -12% |

| Lawnside | $202 | -3% |

| Lawrence Township | $200 | -4% |

| Lawrenceville | $200 | -4% |

| Layton | $192 | -8% |

| Lebanon | $192 | -8% |

| Ledgewood | $189 | -10% |

| Leeds Point | $217 | 4% |

| Leesburg | $212 | 2% |

| Leisure Knoll | $198 | -5% |

| Leisure Village | $231 | 11% |

| Leisure Village East | $231 | 11% |

| Leisure Village West | $198 | -5% |

| Leisuretowne | $193 | -7% |

| Leonardo | $190 | -9% |

| Leonia | $255 | 22% |

| Liberty Corner | $187 | -10% |

| Lincoln Park | $199 | -5% |

| Lincroft | $190 | -9% |

| Linden | $271 | 30% |

| Lindenwold | $222 | 6% |

| Linwood | $209 | 0% |

| Little Falls | $235 | 12% |

| Little Ferry | $255 | 22% |

| Little Silver | $191 | -9% |

| Little York | $192 | -8% |

| Livingston | $226 | 8% |

| Lodi | $264 | 26% |

| Long Branch | $194 | -7% |

| Long Valley | $190 | -9% |

| Longport | $216 | 3% |

| Lumberton | $189 | -10% |

| Lyndhurst | $235 | 13% |

| Lyons | $187 | -10% |

| Madison | $186 | -11% |

| Madison Park | $214 | 3% |

| Magnolia | $202 | -3% |

| Mahwah | $196 | -6% |

| Malaga | $222 | 6% |

| Manahawkin | $181 | -13% |

| Manasquan | $176 | -16% |

| Manchester Township | $198 | -5% |

| Mantoloking | $176 | -16% |

| Mantua | $201 | -4% |

| Manville | $195 | -7% |

| Maple Shade | $198 | -5% |

| Maplewood | $264 | 27% |

| Margate City | $223 | 7% |

| Marlboro | $210 | 0% |

| Marlton | $197 | -5% |

| Marmora | $187 | -10% |

| Martinsville | $197 | -5% |

| Matawan | $210 | 0% |

| Mauricetown | $212 | 2% |

| Mays Landing | $223 | 7% |

| Maywood | $233 | 12% |

| Mc Afee | $208 | 0% |

| McGuire AFB | $190 | -9% |

| Medford | $195 | -7% |

| Medford Lakes | $195 | -7% |

| Mendham | $189 | -9% |

| Mercerville | $200 | -4% |

| Merchantville | $233 | 12% |

| Metuchen | $210 | 1% |

| Mickleton | $196 | -6% |

| Middlebush | $217 | 4% |

| Middlesex | $204 | -3% |

| Middletown | $190 | -9% |

| Middleville | $194 | -7% |

| Midland Park | $199 | -4% |

| Milford | $190 | -9% |

| Millburn | $225 | 8% |

| Millington | $188 | -10% |

| Millstone | $190 | -9% |

| Millstone Township | $202 | -3% |

| Milltown | $213 | 2% |

| Millville | $212 | 2% |

| Milmay | $218 | 5% |

| Mine Hill | $188 | -10% |

| Minotola | $217 | 4% |

| Mizpah | $217 | 4% |

| Monmouth Beach | $193 | -8% |

| Monmouth Junction | $204 | -2% |

| Monroe Township | $210 | 1% |

| Monroeville | $207 | -1% |

| Montague | $206 | -1% |

| Montclair | $233 | 12% |

| Montvale | $195 | -6% |

| Montville | $197 | -6% |

| Moonachie | $253 | 21% |

| Moorestown | $188 | -10% |

| Moorestown-Lenola | $188 | -10% |

| Morganville | $210 | 0% |

| Morris Plains | $185 | -11% |

| Morristown | $186 | -11% |

| Mount Arlington | $188 | -10% |

| Mount Ephraim | $202 | -3% |

| Mount Freedom | $188 | -10% |

| Mount Holly | $189 | -10% |

| Mount Laurel | $195 | -7% |

| Mount Royal | $197 | -5% |

| Mount Tabor | $184 | -12% |

| Mountain Lake | $192 | -8% |

| Mountain Lakes | $185 | -12% |

| Mountainside | $200 | -4% |

| Mullica Hill | $199 | -5% |

| Mystic Island | $181 | -13% |

| National Park | $200 | -4% |

| Navesink | $191 | -9% |

| Neptune | $197 | -6% |

| Neptune City | $197 | -6% |

| Neshanic Station | $190 | -9% |

| Netcong | $187 | -11% |

| New Brunswick | $228 | 9% |

| New Egypt | $190 | -9% |

| New Gretna | $192 | -8% |

| New Lisbon | $192 | -8% |

| New Milford | $234 | 12% |

| New Providence | $196 | -6% |

| New Vernon | $187 | -10% |

| Newark | $314 | 50% |

| Newfield | $219 | 5% |

| Newfoundland | $191 | -8% |

| Newport | $212 | 2% |

| Newton | $192 | -8% |

| Newtonville | $226 | 8% |

| Norma | $213 | 2% |

| Normandy Beach | $176 | -16% |

| North Arlington | $242 | 16% |

| North Beach Haven | $181 | -13% |

| North Bergen | $297 | 42% |

| North Brunswick | $228 | 9% |

| North Caldwell | $204 | -2% |

| North Cape May | $183 | -12% |

| North Haledon | $243 | 17% |

| North Middletown | $190 | -9% |

| North Plainfield | $268 | 28% |

| North Wildwood | $183 | -12% |

| Northfield | $223 | 7% |

| Northvale | $217 | 4% |

| Norwood | $224 | 7% |

| Nutley | $237 | 14% |

| Oak Ridge | $192 | -8% |

| Oak Valley | $201 | -4% |

| Oakhurst | $194 | -7% |

| Oakland | $196 | -6% |

| Oaklyn | $198 | -5% |

| Ocean Acres | $181 | -13% |

| Ocean City | $190 | -9% |

| Ocean Gate | $198 | -5% |

| Ocean Grove | $196 | -6% |

| Ocean View | $183 | -12% |

| Oceanport | $191 | -9% |

| Oceanville | $219 | 5% |

| Ogdensburg | $204 | -2% |

| Old Bridge | $212 | 2% |

| Old Tappan | $203 | -3% |

| Oldwick | $192 | -8% |

| Olivet | $204 | -2% |

| Oradell | $221 | 6% |

| Orange | $304 | 46% |

| Oxford | $192 | -8% |

| Palisades Park | $279 | 34% |

| Palmyra | $192 | -8% |

| Panther Valley | $192 | -8% |

| Paramus | $223 | 7% |

| Park Ridge | $195 | -6% |

| Parlin | $216 | 3% |

| Parsippany | $188 | -10% |

| Passaic | $304 | 46% |

| Paterson | $303 | 45% |

| Paulsboro | $202 | -3% |

| Peapack | $189 | -10% |

| Pedricktown | $197 | -6% |

| Pemberton | $193 | -7% |

| Pemberton Heights | $193 | -7% |

| Pennington | $194 | -7% |

| Penns Grove | $199 | -5% |

| Pennsauken | $233 | 12% |

| Pennsville | $199 | -5% |

| Pequannock | $191 | -8% |

| Perth Amboy | $273 | 31% |

| Phillipsburg | $192 | -8% |

| Picatinny Arsenal | $190 | -9% |

| Pine Beach | $198 | -5% |

| Pine Brook | $197 | -6% |

| Pine Hill | $222 | 6% |

| Pine Lake Park | $198 | -5% |

| Pine Ridge at Crestwood | $198 | -5% |

| Piscataway | $213 | 2% |

| Pitman | $201 | -4% |

| Pittstown | $190 | -9% |

| Plainfield | $268 | 28% |

| Plainsboro | $201 | -4% |

| Plainsboro Center | $201 | -4% |

| Pleasantville | $225 | 8% |

| Pluckemin | $191 | -8% |

| Point Pleasant | $176 | -16% |

| Point Pleasant Beach | $176 | -16% |

| Pomona | $217 | 4% |

| Pompton Lakes | $198 | -5% |

| Pompton Plains | $191 | -8% |

| Port Elizabeth | $214 | 2% |

| Port Monmouth | $190 | -9% |

| Port Murray | $192 | -8% |

| Port Norris | $212 | 2% |

| Port Reading | $222 | 6% |

| Port Republic | $181 | -13% |

| Pottersville | $190 | -9% |

| Presidential Lakes Estates | $199 | -4% |

| Princeton | $195 | -6% |

| Princeton Junction | $194 | -7% |

| Princeton Meadows | $201 | -4% |

| Prospect Park | $243 | 17% |

| Quakertown | $190 | -9% |

| Rahway | $258 | 24% |

| Ramblewood | $195 | -7% |

| Ramsey | $194 | -7% |

| Ramtown | $210 | 0% |

| Rancocas | $190 | -9% |

| Randolph | $185 | -11% |

| Raritan | $193 | -7% |

| Red Bank | $190 | -9% |

| Richland | $221 | 6% |

| Richwood | $199 | -5% |

| Ridgefield | $279 | 34% |

| Ridgefield Park | $255 | 22% |

| Ridgewood | $202 | -3% |

| Ringoes | $190 | -9% |

| Ringwood | $195 | -7% |

| Rio Grande | $183 | -12% |

| River Edge | $223 | 7% |

| Riverdale | $190 | -9% |

| Riverside | $191 | -9% |

| Riverton | $190 | -9% |

| Robbinsville | $188 | -10% |

| Robertsville | $210 | 0% |

| Rochelle Park | $233 | 12% |

| Rockaway | $190 | -9% |

| Rockleigh | $217 | 4% |

| Rocky Hill | $199 | -5% |

| Roebling | $190 | -9% |

| Roosevelt | $197 | -6% |

| Roseland | $226 | 8% |

| Roselle | $271 | 30% |

| Roselle Park | $256 | 23% |

| Rosemont | $190 | -9% |

| Rosenhayn | $212 | 2% |

| Rossmoor | $210 | 1% |

| Rumson | $193 | -8% |

| Runnemede | $204 | -2% |

| Rutherford | $238 | 14% |

| Saddle Brook | $236 | 13% |

| Saddle River | $195 | -6% |

| Salem | $200 | -4% |

| Sayreville | $214 | 3% |

| Schooleys Mountain | $191 | -8% |

| Scotch Plains | $215 | 3% |

| Sea Bright | $193 | -8% |

| Sea Girt | $176 | -16% |

| Sea Isle City | $183 | -12% |

| Seabrook Farms | $212 | 2% |

| Seaside Heights | $192 | -8% |

| Seaside Park | $192 | -8% |

| Secaucus | $238 | 14% |

| Sergeantsville | $190 | -9% |

| Sewaren | $222 | 6% |

| Sewell | $200 | -4% |

| Shark River Hills | $197 | -6% |

| Shiloh | $212 | 2% |

| Ship Bottom | $181 | -13% |

| Short Hills | $225 | 8% |

| Shrewsbury | $191 | -9% |

| Sicklerville | $223 | 7% |

| Silver Lake | $265 | 27% |

| Silver Ridge | $198 | -5% |

| Singac | $235 | 12% |

| Six Mile Run | $217 | 4% |

| Skillman | $193 | -8% |

| Smithville | $224 | 7% |

| Society Hill | $213 | 2% |

| Somerdale | $200 | -4% |

| Somers Point | $216 | 4% |

| Somerset | $217 | 4% |

| Somerville | $193 | -7% |

| South Amboy | $214 | 3% |

| South Bound Brook | $207 | -1% |

| South Dennis | $192 | -8% |

| South Hackensack | $254 | 22% |

| South Orange | $263 | 26% |

| South Plainfield | $217 | 4% |

| South River | $211 | 1% |

| South Seaville | $191 | -9% |

| South Toms River | $198 | -5% |

| Sparta | $193 | -8% |

| Spotswood | $207 | -1% |

| Spring Lake | $178 | -15% |

| Spring Lake Heights | $178 | -15% |

| Springdale | $201 | -4% |

| Springfield | $219 | 5% |

| Stanhope | $188 | -10% |

| Stanton | $196 | -6% |

| Stewartsville | $192 | -8% |

| Stirling | $188 | -10% |

| Stockholm | $192 | -8% |

| Stockton | $190 | -9% |

| Stone Harbor | $183 | -12% |

| Stratford | $200 | -4% |

| Strathmere | $187 | -10% |

| Strathmore | $210 | 0% |

| Succasunna | $188 | -10% |

| Summit | $196 | -6% |

| Surf City | $181 | -13% |

| Sussex | $206 | -1% |

| Swartswood | $192 | -8% |

| Swedesboro | $196 | -6% |

| Teaneck | $245 | 17% |

| Ten Mile Run | $195 | -6% |

| Tenafly | $227 | 8% |

| Tennent | $202 | -3% |

| Teterboro | $230 | 10% |

| Thorofare | $200 | -4% |

| Three Bridges | $189 | -9% |

| Tinton Falls | $195 | -7% |

| Titusville | $190 | -9% |

| Toms River | $198 | -5% |

| Totowa | $235 | 12% |

| Towaco | $199 | -5% |

| Township Of Washington | $202 | -3% |

| Tranquility | $193 | -8% |

| Trenton | $230 | 10% |

| Tuckahoe | $185 | -11% |

| Tuckerton | $181 | -13% |

| Turnersville | $204 | -2% |

| Twin Rivers | $194 | -7% |

| Union | $274 | 31% |

| Union Beach | $202 | -3% |

| Union City | $285 | 36% |

| Upper Montclair | $233 | 12% |

| Upper Pohatcong | $192 | -8% |

| Upper Saddle River | $195 | -6% |

| Vauxhall | $274 | 31% |

| Ventnor City | $223 | 7% |

| Vernon | $208 | -1% |

| Vernon Center | $208 | -1% |

| Vernon Valley | $208 | -1% |

| Verona | $221 | 6% |

| Victory Gardens | $191 | -8% |

| Victory Lakes | $223 | 7% |

| Vienna | $193 | -8% |

| Villas | $185 | -11% |

| Vincentown | $193 | -7% |

| Vineland | $217 | 4% |

| Vista Center | $213 | 2% |

| Voorhees | $210 | 0% |

| Waldwick | $195 | -6% |

| Wallington | $263 | 26% |

| Wallpack Center | $198 | -5% |

| Wanamassa | $198 | -5% |

| Wanaque | $198 | -5% |

| Waretown | $183 | -12% |

| Warren | $196 | -6% |

| Washington | $192 | -8% |

| Watchung | $223 | 7% |

| Waterford Works | $216 | 3% |

| Wayne | $226 | 8% |

| Weehawken | $269 | 29% |

| Wenonah | $201 | -4% |

| West Belmar | $177 | -15% |

| West Berlin | $216 | 4% |

| West Cape May | $183 | -12% |

| West Creek | $181 | -13% |

| West Freehold | $209 | 0% |

| West Long Branch | $190 | -9% |

| West Milford | $194 | -7% |

| West New York | $285 | 36% |

| West Orange | $256 | 23% |

| West Wildwood | $183 | -12% |

| Westfield | $203 | -3% |

| Westville | $206 | -1% |

| Westwood | $203 | -3% |

| Wharton | $188 | -10% |

| Whippany | $185 | -11% |

| White Horse | $217 | 4% |

| White Meadow Lake | $190 | -9% |

| Whitehouse | $190 | -9% |

| Whitehouse Station | $190 | -9% |

| Whitesboro | $185 | -11% |

| Whittingham | $210 | 1% |

| Wickatunk | $201 | -4% |

| Wildwood | $183 | -12% |

| Wildwood Crest | $183 | -12% |

| Williamstown | $223 | 7% |

| Willingboro | $220 | 5% |

| Windsor | $190 | -9% |

| Winslow | $224 | 8% |

| Wood Ridge | $238 | 14% |

| Wood-Ridge | $238 | 14% |

| Woodbine | $194 | -7% |

| Woodbridge | $221 | 6% |

| Woodbury | $200 | -4% |

| Woodbury Heights | $200 | -4% |

| Woodcliff Lake | $197 | -6% |

| Woodland Park | $235 | 12% |

| Woodlynne | $198 | -5% |

| Woodstown | $203 | -3% |

| Wrightstown | $190 | -9% |

| Wyckoff | $198 | -5% |

| Yardville | $188 | -10% |

| Yorketown | $210 | 1% |

| Zarephath | $218 | 4% |

Minimum coverage for car insurance in New Jersey

Car insurance is required by law in New Jersey. Most drivers get standard car insurance. However, you can also drive legally with a cheaper basic policy.

As of Jan. 1, 2026, minimum amounts of coverage available in a standard car insurance policy include:

- Bodily injury liability: $35,000 per person, $70,000 per accident

- Property damage liability: $25,000

- Personal injury protection (PIP): $15,000

Basic New Jersey car insurance policies include:

- Bodily injury liability: Optional

- Property damage liability: $5,000

- PIP: $15,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property.

You can add collision

Low-income car insurance in New Jersey

New Jersey’s Special Automobile Insurance Policy (SAIP) program provides affordable car insurance for low-income drivers. You have to qualify for federal Medicaid with hospitalization benefits to get SAIP insurance.

SAIP is also known as dollar-a-day insurance, because policies cost $365 a year. You can pay in two installments or save $5 by paying in full upfront. SAIPs meet the state’s minimum insurance requirements.

If you’re injured in a car accident, a SAIP covers your emergency medical treatment. Unfortunately, it doesn’t cover:

- Visits to a doctor’s office or other outpatient treatment

- Injuries or damage you cause to other people or their property

- Damage to your own car

Frequently asked questions

Car insurance in New Jersey costs an average of $209 a month for full coverage. Standard policies with minimum coverage cost an average of $119 a month. Basic policies are cheaper, but they don’t provide as much protection as standard policies.

Geico and NJM have the cheapest car insurance in New Jersey for most drivers. Geico is a little cheaper than NJM for drivers with a good record. NJM has the cheapest rates after an accident or DWI.

How we selected the cheapest car insurance companies in New Jersey

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $15,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in New Jersey

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.