Cheapest Car Insurance in Michigan (2026)

Most Michigan drivers get the cheapest car insurance from Progressive, at $134 per month for full coverage and $64 per month for minimum coverage.

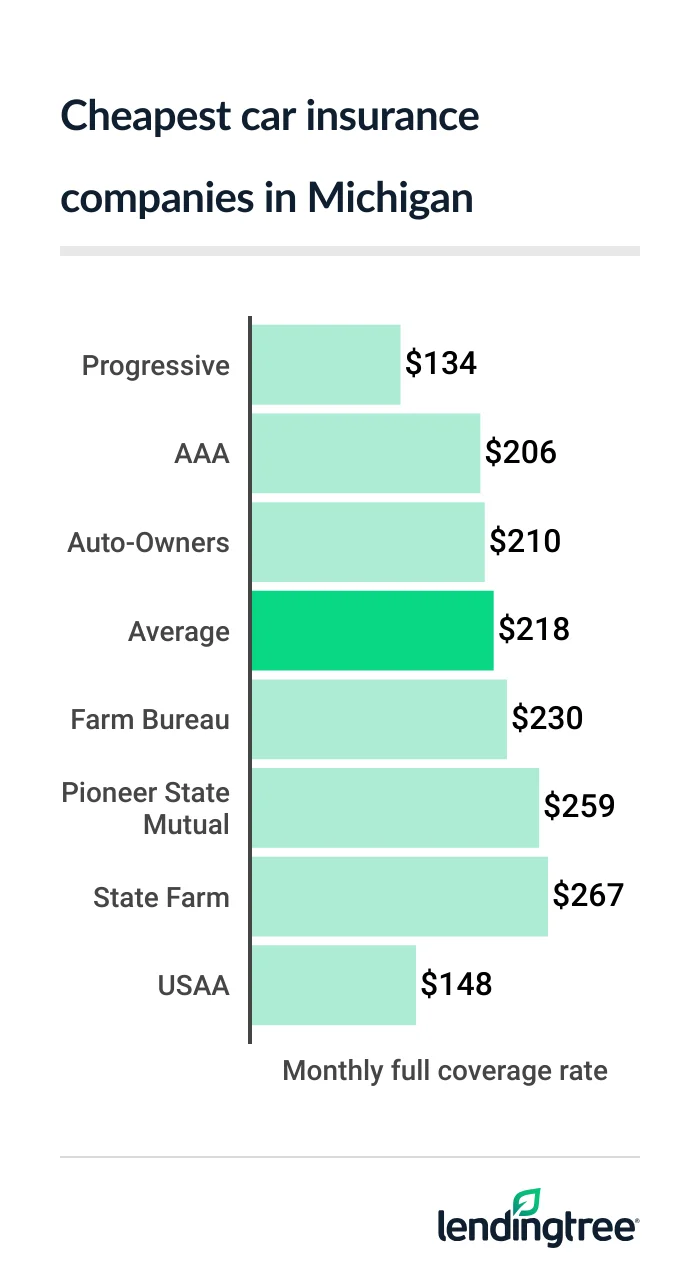

Best cheap car insurance in Michigan

Cheapest full coverage car insurance in Michigan: Progressive

At $134 per month, Progress has Michigan’s cheapest full coverage car insurance rates. That’s $84 less than the state average of $218 per month.

AAA, Auto-Owners and USAA also offer full coverage

- Although Auto-Owners has a more expensive average rate than Progressive, there are a few reasons you might choose it for full coverage.

- Auto-Owners scores a bit better with customers, based on its J.D. Power satisfaction rating. It also offers several car insurance discounts and coverage options, including accident forgiveness, loan or lease gap and road trouble service.

Full coverage auto insurance rates in MI

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Progressive | $134 | |

| AAA | $206 | |

| Auto-Owners | $210 | |

| Farm Bureau | $230 | |

| Pioneer State Mutual | $259 | Not rated |

| State Farm | $267 | |

| Frankenmuth | $287 | Not rated |

| USAA* | $148 | |

Michigan’s cheapest liability insurance: Progressive

Progressive also has the cheapest car insurance in Michigan for drivers that only want liability or minimum coverage. The company’s average rate for minimum coverage

Liability auto insurance rates in MI

| Company | Monthly rate |

|---|---|

| Progressive | $64 |

| Auto-Owners | $66 |

| Pioneer State Mutual | $68 |

| Farm Bureau | $68 |

| AAA | $70 |

| Frankenmuth | $106 |

| State Farm | $136 |

| USAA* | $43 |

Michigan drivers looking for the cheapest liability insurance should also consider Auto-Owners, Farm Bureau and Pioneer State Mutual. Each of these companies have average rates that are just a few dollars per month more than Progressive.

To find out which of these companies will be the cheapest for you, compare car insurance quotes from each of them before you renew or buy a policy.

Cheap car insurance in Michigan for teen drivers: Auto-Owners

Most Michiganders get the cheapest teen car insurance quotes from Auto-Owners. Its rates average $102 per month for teen liability coverage, and $331 per month for teen full coverage.

Farm Bureau comes in second for most Michigan teens, at $110 per month for liability and $377 per month for full coverage.

Monthly car insurance rates for teen drivers

| Company | Minimum | Full |

|---|---|---|

| Auto-Owners | $102 | $331 |

| Farm Bureau | $110 | $377 |

| Pioneer State Mutual | $118 | $440 |

| AAA | $137 | $406 |

| Frankenmuth | $223 | $535 |

| Progressive | $229 | $537 |

| State Farm | $367 | $661 |

| USAA* | $75 | $298 |

Young drivers pay a lot more for car insurance than older drivers, even if they have clean driving records. This is mostly because they tend to get into more accidents.

Teen car insurance costs less if the teen is added to a parent’s policy. You can also save money by getting certain discounts, like ones for getting good grades or taking a driver’s education course.

Best Michigan auto insurance quotes after a speeding ticket: Progressive

With an average rate of $171 per month, Progressive offers the cheapest auto insurance for Michigan drivers with a speeding ticket on their records.

The average Michigan driver pays $254 per month for auto insurance after a ticket. Progressive’s rate is $83 per month cheaper.

Auto insurance rates after an accident

| Company | Monthly rate |

|---|---|

| Progressive | $171 |

| Farm Bureau | $230 |

| AAA | $242 |

| Auto-Owners | $247 |

| Pioneer State Mutual | $276 |

| State Farm | $335 |

| Frankenmuth | $337 |

| USAA* | $190 |

Farm Bureau, AAA and Auto-Owners are also cheaper than the state average. None of them have more discounts than Progressive, but they could still be your cheapest option if you get a few of the right ones.

With AAA, for example, you can earn a discount if you get a quote more than seven days before you buy a policy. Auto-Owners has discounts for certain vehicle safety features. And you can save money with Farm Bureau if you drive fewer than 7,500 miles a year.

Cheapest Michigan car insurance rates after an accident: Progressive

Progressive has the cheapest car insurance after an accident in Michigan, at $207 per month. Auto-Owners offer the state’s second-cheapest rates, at $247 per month.

Auto insurance quotes after an accident

| Company | Monthly rate |

|---|---|

| Progressive | $207 |

| Auto-Owners | $247 |

| Farm Bureau | $282 |

| AAA | $286 |

| Pioneer State Mutual | $306 |

| State Farm | $312 |

| Frankenmuth | $368 |

| USAA* | $208 |

The average cost of car insurance in Michigan for drivers with an at-fault accident on their records is $277 per month. That’s around $60 per month more than what drivers with clean records pay for the same coverage.

Best cheap insurance for Michigan teens with a ticket or accident: Farm Bureau

Michigan teens with a ticket or accident on their driving records get the cheapest car insurance from Farm Bureau and Auto-Owners, based on our data.

Monthly rates for teens with a bad driving record

| Company | Ticket | Accident |

|---|---|---|

| Farm Bureau | $110 | $135 |

| Auto-Owners | $128 | $128 |

| Pioneer State Mutual | $130 | $145 |

| AAA | $151 | $172 |

| Progressive | $248 | $274 |

| Frankenmuth | $254 | $320 |

| State Farm | $489 | $448 |

| USAA* | $111 | $131 |

Farm Bureau’s average car insurance rate for teens with a speeding ticket is $110 per month. Auto-Owners is next for most of these drivers, at $128 per month.

For teen drivers with an accident on their records, Auto-Owners has the lowest rates of $128 per month. Farm Bureau comes in second, at $135 per month.

Auto-Owners offers a few more discounts than Farm Bureau does. The company has discounts for teens who get good grades and those who agree to have their driving monitored. It also gives a discount to students who go away to college and don’t take a vehicle.

You can also get accident forgiveness and loan or lease gap coverage from Auto-Owners, but not from Farm Bureau.

Cheapest car insurance in Michigan for drivers with an OWI: Progressive

Progressive has Michigan’s cheapest DUI insurance quotes, at $161 per month. Auto-Owners and Pioneer State Mutual are the next-cheapest companies for drivers with a DUI

Auto-Owners’ average rate after an OWI is $438 per month, while Pioneer State Mutual’s is $462.

Car insurance rates with an OWI

| Company | Monthly rate |

|---|---|

| Progressive | $161 |

| Auto-Owners | $438 |

| Pioneer State Mutual | $462 |

| AAA | $480 |

| Farm Bureau | $519 |

| State Farm | $719 |

| Frankenmuth | $1,194 |

| USAA* | $266 |

In Michigan, most drivers with an OWI pay $530 per month for car insurance. This is nearly two-and-a-half times more than what residents with a clean driving record pay.

Per month, Michigan drivers with an OWI pay over $300 more for car insurance than those with clean records.

Best car insurance companies in Michigan

Progressive and Auto-Owners are the best car insurance companies for most Michigan drivers.

Progressive is the state’s best company overall, with the lowest rates for most driver and coverage types. It also has more discount and coverage options than most of the companies we surveyed in Michigan.

Michigan car insurance company ratings

| Company | LendingTree | J.D. Power | AM Best |

|---|---|---|---|

| AAA | 652 | A+ | |

| Auto-Owners | 638 | A+ | |

| Farm Bureau | 645 | A | |

| Frankenmuth | Not rated | Not rated | A |

| Pioneer State Mutual | Not rated | Not rated | A+ |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

Auto-Owners usually isn’t cheaper than Progressive in Michigan, but it’s often close enough in cost that it could be the cheapest option for some drivers. Also, it has a slightly better customer satisfaction rating from J.D. Power.

USAA is also one of the state’s best car insurance companies if you or a family member are active duty or retired military. Its rates are often among the cheapest in Michigan, and no other company matches its reputation for customer service.

Michigan car insurance rates by city

Michigan’s cheapest city for car insurance is Shoreham, where rates average $170 per month.

Hamtramck, part of the Detroit metro area, has the state’s most expensive car insurance rates, at $568 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Acme | $206 | -6% |

| Addison | $215 | -1% |

| Adrian | $204 | -6% |

| Afton | $221 | 2% |

| Ahmeek | $215 | -1% |

| Alanson | $208 | -4% |

| Alba | $212 | -3% |

| Albion | $241 | 11% |

| Alden | $209 | -4% |

| Alger | $232 | 7% |

| Algonac | $209 | -4% |

| Allegan | $212 | -3% |

| Allen Park | $279 | 28% |

| Allendale | $198 | -9% |

| Allenton | $239 | 10% |

| Allouez | $216 | -1% |

| Alma | $208 | -4% |

| Almont | $228 | 5% |

| Alpena | $204 | -6% |

| Alpha | $225 | 3% |

| Alto | $213 | -2% |

| Amasa | $226 | 4% |

| Anchorville | $235 | 8% |

| Ann Arbor | $188 | -13% |

| Applegate | $238 | 9% |

| Argentine | $221 | 2% |

| Armada | $230 | 6% |

| Arnold | $216 | -1% |

| Ashley | $212 | -2% |

| Athens | $224 | 3% |

| Atlanta | $222 | 2% |

| Atlantic Mine | $210 | -3% |

| Attica | $227 | 4% |

| Au Gres | $221 | 1% |

| Au Sable | $214 | -2% |

| Au Train | $233 | 7% |

| Auburn | $186 | -14% |

| Auburn Hills | $231 | 6% |

| Augusta | $206 | -5% |

| Avoca | $229 | 5% |

| Azalia | $211 | -3% |

| Bad Axe | $226 | 4% |

| Bailey | $223 | 3% |

| Baldwin | $264 | 21% |

| Bancroft | $215 | -1% |

| Bangor | $210 | -4% |

| Bannister | $221 | 2% |

| Baraga | $220 | 1% |

| Barbeau | $213 | -2% |

| Barryton | $253 | 16% |

| Barton City | $231 | 6% |

| Bath | $196 | -10% |

| Battle Creek | $220 | 1% |

| Bay City | $190 | -13% |

| Bay Port | $217 | 0% |

| Bay Shore | $208 | -4% |

| Beaver Island | $202 | -7% |

| Beaverton | $240 | 10% |

| Bedford | $228 | 5% |

| Beecher | $294 | 35% |

| Beechwood | $195 | -10% |

| Belding | $230 | 6% |

| Bellaire | $209 | -4% |

| Belleville | $249 | 14% |

| Belmont | $210 | -4% |

| Bentley | $232 | 7% |

| Benton Harbor | $200 | -8% |

| Benton Heights | $204 | -6% |

| Bergland | $224 | 3% |

| Berkley | $232 | 6% |

| Berrien Center | $203 | -7% |

| Berrien Springs | $208 | -5% |

| Bessemer | $218 | 0% |

| Beulah | $211 | -3% |

| Beverly Hills | $243 | 12% |

| Big Bay | $217 | 0% |

| Big Rapids | $234 | 8% |

| Bingham Farms | $245 | 13% |

| Birch Run | $219 | 1% |

| Birmingham | $233 | 7% |

| Bitely | $252 | 16% |

| Black River | $230 | 6% |

| Blanchard | $226 | 4% |

| Blissfield | $200 | -8% |

| Bloomfield Hills | $257 | 18% |

| Boon | $208 | -4% |

| Boyne City | $207 | -5% |

| Boyne Falls | $207 | -5% |

| Bradley | $209 | -4% |

| Branch | $259 | 19% |

| Breckenridge | $211 | -3% |

| Breedsville | $211 | -3% |

| Brethren | $232 | 6% |

| Bridgeport | $238 | 9% |

| Bridgman | $188 | -13% |

| Brighton | $192 | -12% |

| Brimley | $204 | -6% |

| Britton | $195 | -10% |

| Brohman | $246 | 13% |

| Bronson | $214 | -1% |

| Brooklyn | $218 | 0% |

| Brown City | $242 | 11% |

| Brownlee Park | $221 | 2% |

| Bruce Crossing | $238 | 9% |

| Brutus | $202 | -7% |

| Buchanan | $197 | -10% |

| Buckley | $225 | 3% |

| Buena Vista | $243 | 12% |

| Burnips | $201 | -8% |

| Burr Oak | $226 | 4% |

| Burt | $221 | 1% |

| Burt Lake | $205 | -6% |

| Burton | $250 | 15% |

| Byron | $223 | 3% |

| Byron Center | $204 | -6% |

| Cadillac | $204 | -6% |

| Calumet | $208 | -5% |

| Canadian Lakes | $243 | 12% |

| Cannonsburg | $211 | -3% |

| Capac | $230 | 6% |

| Carleton | $215 | -1% |

| Carney | $249 | 15% |

| Caro | $227 | 4% |

| Carrollton | $209 | -4% |

| Carson City | $245 | 13% |

| Carsonville | $243 | 12% |

| Caseville | $218 | 0% |

| Caspian | $228 | 5% |

| Cass City | $239 | 10% |

| Cassopolis | $223 | 2% |

| Cedar | $195 | -10% |

| Cedar Lake | $244 | 12% |

| Cedar Springs | $223 | 3% |

| Cedarville | $208 | -5% |

| Cement City | $219 | 1% |

| Center Line | $353 | 62% |

| Central Lake | $209 | -4% |

| Centreville | $206 | -5% |

| Ceresco | $210 | -4% |

| Champion | $214 | -2% |

| Channing | $226 | 4% |

| Charlevoix | $208 | -5% |

| Charlotte | $213 | -2% |

| Chatham | $236 | 9% |

| Cheboygan | $203 | -7% |

| Chelsea | $206 | -5% |

| Chesaning | $214 | -1% |

| Chippewa Lake | $238 | 9% |

| Clare | $233 | 7% |

| Clarklake | $216 | -1% |

| Clarkston | $219 | 0% |

| Clarksville | $224 | 3% |

| Clawson | $223 | 2% |

| Clayton | $206 | -5% |

| Clifford | $237 | 9% |

| Climax | $202 | -7% |

| Clinton | $197 | -9% |

| Clio | $222 | 2% |

| Cloverdale | $216 | -1% |

| Coldwater | $210 | -4% |

| Coleman | $206 | -6% |

| Coloma | $188 | -13% |

| Colon | $217 | 0% |

| Columbiaville | $220 | 1% |

| Comins | $227 | 4% |

| Comstock Northwest | $210 | -4% |

| Comstock Park | $204 | -6% |

| Conklin | $203 | -7% |

| Constantine | $205 | -6% |

| Cooks | $234 | 7% |

| Coopersville | $198 | -9% |

| Copemish | $235 | 8% |

| Copper City | $212 | -3% |

| Copper Harbor | $218 | 0% |

| Coral | $241 | 11% |

| Cornell | $236 | 8% |

| Corunna | $210 | -4% |

| Covington | $217 | 0% |

| Cross Village | $198 | -9% |

| Croswell | $229 | 5% |

| Crystal Falls | $222 | 2% |

| Curran | $227 | 4% |

| Curtis | $212 | -3% |

| Custer | $239 | 10% |

| Cutlerville | $202 | -7% |

| Daggett | $260 | 19% |

| Dansville | $212 | -2% |

| Davisburg | $224 | 3% |

| Davison | $211 | -3% |

| De Tour Village | $227 | 4% |

| DeWitt | $195 | -10% |

| Dearborn | $418 | 92% |

| Dearborn Heights | $329 | 51% |

| Decatur | $213 | -2% |

| Decker | $240 | 10% |

| Deckerville | $243 | 12% |

| Deerfield | $201 | -8% |

| Deerton | $212 | -2% |

| Deford | $236 | 8% |

| Delton | $229 | 5% |

| Detroit | $548 | 152% |

| Detroit Beach | $221 | 1% |

| Dexter | $197 | -10% |

| Dimondale | $195 | -10% |

| Dodgeville | $206 | -5% |

| Dollar Bay | $203 | -7% |

| Douglas | $190 | -13% |

| Dowagiac | $213 | -2% |

| Dowling | $229 | 5% |

| Drayton Plains | $233 | 7% |

| Drummond Island | $228 | 5% |

| Dundee | $198 | -9% |

| Durand | $214 | -1% |

| East Grand Rapids | $208 | -5% |

| East Jordan | $216 | -1% |

| East Lansing | $197 | -10% |

| East Leroy | $211 | -3% |

| East Tawas | $211 | -3% |

| Eastlake | $232 | 6% |

| Eastpointe | $348 | 60% |

| Eastport | $205 | -6% |

| Eastwood | $216 | -1% |

| Eaton Rapids | $207 | -5% |

| Eau Claire | $198 | -9% |

| Eben Junction | $232 | 7% |

| Eckerman | $214 | -2% |

| Ecorse | $395 | 82% |

| Edgemont Park | $220 | 1% |

| Edmore | $246 | 13% |

| Edwardsburg | $224 | 3% |

| Elberta | $210 | -3% |

| Elk Rapids | $198 | -9% |

| Elkton | $218 | 0% |

| Ellsworth | $211 | -3% |

| Elm Hall | $223 | 2% |

| Elmira | $212 | -2% |

| Elsie | $224 | 3% |

| Elwell | $212 | -3% |

| Engadine | $218 | 0% |

| Escanaba | $233 | 7% |

| Essexville | $187 | -14% |

| Evart | $239 | 10% |

| Ewen | $222 | 2% |

| Fair Haven | $224 | 3% |

| Fair Plain | $201 | -7% |

| Fairgrove | $209 | -4% |

| Fairview | $218 | 0% |

| Falmouth | $229 | 5% |

| Farmington | $246 | 13% |

| Farmington Hills | $255 | 17% |

| Farwell | $235 | 8% |

| Felch | $234 | 7% |

| Fennville | $206 | -5% |

| Fenton | $212 | -3% |

| Fenwick | $232 | 7% |

| Ferndale | $307 | 41% |

| Ferrysburg | $182 | -17% |

| Fife Lake | $216 | -1% |

| Filer City | $226 | 4% |

| Filion | $228 | 5% |

| Flat Rock | $236 | 8% |

| Flint | $316 | 45% |

| Flushing | $224 | 3% |

| Forest Hills | $203 | -7% |

| Forestville | $242 | 11% |

| Foster City | $232 | 7% |

| Fostoria | $236 | 8% |

| Fountain | $246 | 13% |

| Fowler | $206 | -6% |

| Fowlerville | $218 | 0% |

| Frankenmuth | $215 | -1% |

| Frankfort | $210 | -3% |

| Franklin | $246 | 13% |

| Fraser | $276 | 27% |

| Freeland | $191 | -12% |

| Freeport | $221 | 2% |

| Fremont | $227 | 4% |

| Frontier | $220 | 1% |

| Fruitport | $199 | -9% |

| Fulton | $212 | -3% |

| Gaastra | $223 | 2% |

| Gagetown | $235 | 8% |

| Galesburg | $204 | -6% |

| Galien | $200 | -8% |

| Garden | $238 | 9% |

| Garden City | $272 | 25% |

| Gaylord | $200 | -8% |

| Genesee | $241 | 11% |

| Germfask | $222 | 2% |

| Gibraltar | $219 | 1% |

| Gladstone | $231 | 6% |

| Gladwin | $228 | 5% |

| Glenn | $192 | -12% |

| Glennie | $231 | 6% |

| Gobles | $214 | -2% |

| Goetzville | $218 | 0% |

| Good Hart | $202 | -7% |

| Goodells | $224 | 3% |

| Goodrich | $219 | 1% |

| Gould City | $222 | 2% |

| Gowen | $236 | 9% |

| Grand Beach | $199 | -8% |

| Grand Blanc | $221 | 2% |

| Grand Haven | $179 | -18% |

| Grand Junction | $214 | -2% |

| Grand Ledge | $202 | -7% |

| Grand Marais | $222 | 2% |

| Grand Rapids | $211 | -3% |

| Grandville | $195 | -10% |

| Grass Lake | $212 | -2% |

| Grawn | $199 | -9% |

| Grayling | $202 | -7% |

| Greenville | $233 | 7% |

| Gregory | $215 | -1% |

| Greilickville | $192 | -12% |

| Grosse Pointe | $305 | 40% |

| Grosse Pointe Farms | $290 | 33% |

| Grosse Pointe Park | $316 | 45% |

| Grosse Pointe Woods | $287 | 32% |

| Gulliver | $218 | 0% |

| Gwinn | $218 | 0% |

| Hagar Shores | $190 | -12% |

| Hale | $228 | 5% |

| Hamilton | $196 | -10% |

| Hamtramck | $568 | 161% |

| Hancock | $205 | -6% |

| Hanover | $239 | 10% |

| Harbert | $193 | -11% |

| Harbor Beach | $240 | 10% |

| Harbor Springs | $200 | -8% |

| Harper Woods | $434 | 100% |

| Harrietta | $233 | 7% |

| Harrison | $232 | 7% |

| Harsens Island | $223 | 2% |

| Hart | $219 | 1% |

| Hartford | $202 | -7% |

| Haslett | $192 | -12% |

| Hastings | $223 | 2% |

| Hawks | $218 | 0% |

| Hazel Park | $349 | 60% |

| Hemlock | $212 | -2% |

| Henderson | $213 | -2% |

| Hermansville | $254 | 17% |

| Herron | $212 | -2% |

| Hesperia | $246 | 13% |

| Hessel | $203 | -7% |

| Hickory Corners | $221 | 2% |

| Higgins Lake | $218 | 0% |

| Highland Park | $546 | 151% |

| Hillsdale | $228 | 5% |

| Holland | $190 | -12% |

| Holly | $219 | 1% |

| Holt | $201 | -8% |

| Homer | $239 | 10% |

| Honor | $212 | -3% |

| Horton | $239 | 10% |

| Houghton | $206 | -6% |

| Houghton Lake | $219 | 1% |

| Houghton Lake Heights | $220 | 1% |

| Howard City | $230 | 6% |

| Howell | $206 | -5% |

| Hubbard Lake | $219 | 1% |

| Hubbardston | $236 | 8% |

| Hubbell | $215 | -1% |

| Hudson | $215 | -1% |

| Hudsonville | $186 | -15% |

| Hulbert | $206 | -5% |

| Huntington Woods | $254 | 17% |

| Idlewild | $259 | 19% |

| Imlay City | $227 | 4% |

| Indian River | $214 | -2% |

| Ingalls | $246 | 13% |

| Inkster | $345 | 59% |

| Interlochen | $201 | -8% |

| Ionia | $221 | 2% |

| Iron Mountain | $216 | -1% |

| Iron River | $224 | 3% |

| Irons | $249 | 14% |

| Ironwood | $217 | 0% |

| Ishpeming | $207 | -5% |

| Ithaca | $214 | -1% |

| Jackson | $206 | -6% |

| Jasper | $201 | -8% |

| Jeddo | $224 | 3% |

| Jenison | $189 | -13% |

| Jerome | $236 | 8% |

| Johannesburg | $205 | -6% |

| Jones | $214 | -2% |

| Jonesville | $230 | 6% |

| K. I. Sawyer | $214 | -2% |

| Kalamazoo | $209 | -4% |

| Kaleva | $233 | 7% |

| Kalkaska | $212 | -3% |

| Kearsarge | $213 | -2% |

| Keego Harbor | $269 | 24% |

| Kendall | $207 | -5% |

| Kent City | $220 | 1% |

| Kentwood | $211 | -3% |

| Kewadin | $200 | -8% |

| Kincheloe | $207 | -5% |

| Kinde | $228 | 5% |

| Kingsford | $209 | -4% |

| Kingsley | $211 | -3% |

| L’Anse | $223 | 2% |

| Lachine | $217 | 0% |

| Lacota | $209 | -4% |

| Laingsburg | $222 | 2% |

| Lake | $244 | 12% |

| Lake Angelus | $224 | 3% |

| Lake Ann | $201 | -8% |

| Lake City | $222 | 2% |

| Lake Fenton | $214 | -2% |

| Lake George | $235 | 8% |

| Lake Isabella | $231 | 6% |

| Lake Leelanau | $195 | -10% |

| Lake Linden | $212 | -3% |

| Lake Michigan Beach | $190 | -13% |

| Lake Odessa | $225 | 3% |

| Lake Orion | $222 | 2% |

| Lakeland | $208 | -4% |

| Lakes of the North | $206 | -5% |

| Lakeside | $203 | -7% |

| Lakeview | $247 | 13% |

| Lakeville | $237 | 9% |

| Lakewood Club | $209 | -4% |

| Lambertville | $215 | -1% |

| Lamont | $193 | -11% |

| Lansing | $216 | -1% |

| Lapeer | $212 | -2% |

| Lathrup Village | $358 | 65% |

| Laurium | $211 | -3% |

| Lawrence | $212 | -3% |

| Lawton | $209 | -4% |

| Lennon | $215 | -1% |

| Leonard | $243 | 11% |

| Leroy | $233 | 7% |

| Leslie | $233 | 7% |

| Level Park-Oak Park | $226 | 4% |

| Levering | $199 | -8% |

| Lewiston | $213 | -2% |

| Lexington | $225 | 3% |

| Limestone | $233 | 7% |

| Lincoln | $233 | 7% |

| Lincoln Park | $294 | 35% |

| Linden | $221 | 1% |

| Linwood | $197 | -10% |

| Litchfield | $225 | 4% |

| Little Lake | $223 | 3% |

| Livonia | $227 | 4% |

| Long Lake | $227 | 4% |

| Loomis | $221 | 2% |

| Loretto | $233 | 7% |

| Lowell | $211 | -3% |

| Ludington | $212 | -3% |

| Luna Pier | $230 | 6% |

| Lupton | $229 | 5% |

| Luther | $255 | 17% |

| Luzerne | $222 | 2% |

| Macatawa | $194 | -11% |

| Mackinac Island | $195 | -11% |

| Mackinaw City | $211 | -3% |

| Madison Heights | $258 | 19% |

| Mancelona | $208 | -4% |

| Manchester | $216 | -1% |

| Manistee | $224 | 3% |

| Manistee Lake | $208 | -4% |

| Manistique | $231 | 6% |

| Manitou Beach-Devils Lake | $211 | -3% |

| Manton | $229 | 5% |

| Maple City | $198 | -9% |

| Maple Rapids | $214 | -2% |

| Marcellus | $209 | -4% |

| Marine City | $210 | -4% |

| Marlette | $241 | 11% |

| Marne | $202 | -7% |

| Marquette | $187 | -14% |

| Marshall | $209 | -4% |

| Marysville | $191 | -12% |

| Mason | $207 | -5% |

| Mass City | $231 | 6% |

| Mattawan | $209 | -4% |

| Maybee | $228 | 5% |

| Mayville | $241 | 11% |

| McBain | $225 | 3% |

| McBride | $239 | 10% |

| McMillan | $218 | 0% |

| Mcbrides | $239 | 10% |

| Mears | $222 | 2% |

| Mecosta | $245 | 13% |

| Melvin | $238 | 9% |

| Melvindale | $387 | 78% |

| Memphis | $234 | 8% |

| Mendon | $215 | -1% |

| Menominee | $215 | -1% |

| Merrill | $214 | -2% |

| Merritt | $228 | 5% |

| Mesick | $232 | 7% |

| Metamora | $228 | 5% |

| Michigamme | $213 | -2% |

| Michigan Center | $208 | -4% |

| Middleton | $223 | 2% |

| Middletown | $213 | -2% |

| Middleville | $214 | -2% |

| Midland | $186 | -14% |

| Mikado | $224 | 3% |

| Milan | $200 | -8% |

| Milford | $205 | -6% |

| Millersburg | $235 | 8% |

| Millington | $235 | 8% |

| Minden City | $244 | 12% |

| Mio | $222 | 2% |

| Mohawk | $221 | 2% |

| Moline | $210 | -3% |

| Monroe | $220 | 1% |

| Montague | $204 | -6% |

| Montgomery | $223 | 3% |

| Montrose | $208 | -4% |

| Moran | $198 | -9% |

| Morenci | $197 | -10% |

| Morley | $240 | 10% |

| Morrice | $221 | 2% |

| Mosherville | $228 | 5% |

| Mount Clemens | $285 | 31% |

| Mount Morris | $276 | 27% |

| Mount Pleasant | $210 | -3% |

| Muir | $234 | 8% |

| Mullett Lake | $213 | -2% |

| Mulliken | $213 | -2% |

| Munger | $191 | -12% |

| Munising | $220 | 1% |

| Munith | $229 | 5% |

| Muskegon | $213 | -2% |

| Muskegon Heights | $221 | 1% |

| Nadeau | $236 | 8% |

| Napoleon | $212 | -3% |

| Nashville | $225 | 3% |

| National City | $217 | 0% |

| National Mine | $220 | 1% |

| Naubinway | $214 | -2% |

| Nazareth | $213 | -2% |

| Negaunee | $203 | -7% |

| New Baltimore | $238 | 10% |

| New Boston | $267 | 23% |

| New Buffalo | $207 | -5% |

| New Era | $205 | -6% |

| New Haven | $261 | 20% |

| New Hudson | $206 | -5% |

| New Lothrop | $209 | -4% |

| New Troy | $197 | -10% |

| Newaygo | $235 | 8% |

| Newberry | $213 | -2% |

| Newport | $224 | 3% |

| Niles | $213 | -2% |

| Nisula | $222 | 2% |

| North Adams | $226 | 4% |

| North Branch | $234 | 7% |

| North Muskegon | $202 | -7% |

| North Street | $205 | -6% |

| Northport | $195 | -11% |

| Northview | $204 | -6% |

| Northville | $210 | -4% |

| Norton Shores | $209 | -4% |

| Norvell | $234 | 8% |

| Norway | $227 | 4% |

| Novi | $224 | 3% |

| Nunica | $201 | -8% |

| Oak Hill | $225 | 3% |

| Oak Park | $366 | 68% |

| Oakley | $220 | 1% |

| Oden | $203 | -7% |

| Okemos | $191 | -12% |

| Old Mission | $197 | -10% |

| Olivet | $210 | -3% |

| Omena | $194 | -11% |

| Omer | $226 | 4% |

| Onaway | $233 | 7% |

| Onsted | $211 | -3% |

| Ontonagon | $220 | 1% |

| Orchard Lake Village | $259 | 19% |

| Ortonville | $237 | 9% |

| Oscoda | $214 | -1% |

| Osseo | $227 | 4% |

| Ossineke | $208 | -4% |

| Otisville | $234 | 8% |

| Otsego | $198 | -9% |

| Ottawa Lake | $215 | -1% |

| Otter Lake | $239 | 10% |

| Ovid | $215 | -1% |

| Owendale | $224 | 3% |

| Owosso | $210 | -4% |

| Oxford | $227 | 4% |

| Painesdale | $216 | -1% |

| Palmer | $199 | -8% |

| Palms | $244 | 12% |

| Palo | $230 | 6% |

| Paradise | $215 | -1% |

| Parchment | $215 | -1% |

| Paris | $229 | 5% |

| Paw Paw | $208 | -4% |

| Paw Paw Lake | $192 | -12% |

| Pearl Beach | $217 | 0% |

| Peck | $232 | 7% |

| Pelkie | $219 | 0% |

| Pellston | $205 | -6% |

| Pentwater | $215 | -1% |

| Perkins | $243 | 12% |

| Perrinton | $219 | 1% |

| Perronville | $246 | 13% |

| Perry | $222 | 2% |

| Petersburg | $216 | -1% |

| Petoskey | $198 | -9% |

| Pewamo | $231 | 6% |

| Pigeon | $219 | 1% |

| Pinckney | $207 | -5% |

| Plainwell | $198 | -9% |

| Pleasant Lake | $230 | 6% |

| Pleasant Ridge | $256 | 18% |

| Plymouth | $205 | -6% |

| Pointe Aux Pins | $190 | -13% |

| Pompeii | $216 | -1% |

| Pontiac | $321 | 47% |

| Port Hope | $238 | 9% |

| Port Huron | $208 | -4% |

| Port Sanilac | $237 | 9% |

| Portage | $183 | -16% |

| Portland | $216 | -1% |

| Potterville | $206 | -6% |

| Powers | $251 | 15% |

| Prescott | $232 | 6% |

| Presque Isle Harbor | $211 | -3% |

| Prudenville | $220 | 1% |

| Pullman | $214 | -2% |

| Quinnesec | $216 | -1% |

| Ralph | $236 | 8% |

| Ramsay | $226 | 4% |

| Rapid City | $214 | -2% |

| Rapid River | $246 | 13% |

| Ravenna | $215 | -1% |

| Reed City | $236 | 8% |

| Reese | $207 | -5% |

| Remus | $239 | 10% |

| Rhodes | $248 | 14% |

| Richmond | $231 | 6% |

| Richville | $227 | 4% |

| Riga | $190 | -13% |

| River Rouge | $426 | 96% |

| Riverdale | $225 | 3% |

| Riverview | $235 | 8% |

| Rives Junction | $226 | 4% |

| Robin Glen-Indiantown | $238 | 9% |

| Rochester | $225 | 3% |

| Rochester Hills | $225 | 3% |

| Rock | $245 | 13% |

| Rockford | $211 | -3% |

| Rockland | $228 | 5% |

| Rockwood | $216 | -1% |

| Rodney | $240 | 10% |

| Rogers City | $219 | 1% |

| Romeo | $230 | 6% |

| Romulus | $314 | 44% |

| Roosevelt Park | $202 | -7% |

| Roscommon | $214 | -2% |

| Rose City | $234 | 7% |

| Rosebush | $217 | 0% |

| Roseville | $301 | 38% |

| Rothbury | $208 | -4% |

| Royal Oak | $232 | 7% |

| Rumely | $233 | 7% |

| Ruth | $242 | 11% |

| Saginaw | $235 | 8% |

| Salem | $223 | 2% |

| Saline | $187 | -14% |

| Samaria | $220 | 1% |

| Sand Creek | $201 | -8% |

| Sand Lake | $225 | 4% |

| Sandusky | $234 | 7% |

| Sanford | $200 | -8% |

| Saranac | $223 | 2% |

| Sault Ste. Marie | $196 | -10% |

| Sawyer | $192 | -12% |

| Schoolcraft | $192 | -12% |

| Scotts | $203 | -7% |

| Scottville | $230 | 6% |

| Sears | $252 | 16% |

| Sebewaing | $227 | 4% |

| Seney | $220 | 1% |

| Shaftsburg | $222 | 2% |

| Shelby | $208 | -4% |

| Shelbyville | $212 | -3% |

| Shepherd | $212 | -3% |

| Sheridan | $242 | 11% |

| Shingleton | $233 | 7% |

| Shoreham | $170 | -22% |

| Sidnaw | $208 | -4% |

| Silverwood | $240 | 10% |

| Six Lakes | $250 | 15% |

| Skanee | $226 | 4% |

| Smiths Creek | $210 | -4% |

| Smyrna | $226 | 4% |

| Snover | $242 | 11% |

| Somerset Center | $227 | 4% |

| South Boardman | $222 | 2% |

| South Branch | $229 | 5% |

| South Gull Lake | $207 | -5% |

| South Haven | $200 | -8% |

| South Lyon | $203 | -7% |

| South Monroe | $219 | 1% |

| South Range | $210 | -3% |

| South Rockwood | $228 | 5% |

| Southfield | $374 | 72% |

| Southgate | $255 | 17% |

| Spalding | $236 | 9% |

| Sparta | $207 | -5% |

| Spring Arbor | $222 | 2% |

| Spring Lake | $181 | -17% |

| Springfield | $224 | 3% |

| Springport | $247 | 14% |

| Spruce | $218 | 0% |

| St. Charles | $233 | 7% |

| St. Clair | $201 | -8% |

| St. Clair Shores | $246 | 13% |

| St. Helen | $222 | 2% |

| St. Ignace | $193 | -11% |

| St. Johns | $201 | -8% |

| St. Joseph | $170 | -22% |

| St. Louis | $210 | -4% |

| Standish | $219 | 1% |

| Stanton | $250 | 15% |

| Stanwood | $242 | 11% |

| Stephenson | $248 | 14% |

| Sterling | $226 | 4% |

| Sterling Heights | $291 | 34% |

| Stevensville | $174 | -20% |

| Stockbridge | $235 | 8% |

| Sturgis | $225 | 3% |

| Sumner | $226 | 4% |

| Swartz Creek | $220 | 1% |

| Sylvan Beach | $200 | -8% |

| Sylvan Lake | $291 | 34% |

| Tawas City | $212 | -3% |

| Taylor | $303 | 39% |

| Tecumseh | $199 | -9% |

| Tekonsha | $221 | 1% |

| Temperance | $212 | -2% |

| Thompsonville | $227 | 4% |

| Three Oaks | $209 | -4% |

| Three Rivers | $208 | -4% |

| Tipton | $209 | -4% |

| Toivola | $222 | 2% |

| Topinabee | $215 | -1% |

| Tower | $229 | 5% |

| Traverse City | $191 | -12% |

| Trenary | $239 | 10% |

| Trenton | $246 | 13% |

| Trout Creek | $231 | 6% |

| Trout Lake | $203 | -7% |

| Trowbridge Park | $190 | -13% |

| Troy | $240 | 10% |

| Trufant | $239 | 10% |

| Tustin | $228 | 5% |

| Twin Lake | $212 | -3% |

| Twining | $237 | 9% |

| Ubly | $239 | 10% |

| Union | $211 | -3% |

| Union City | $228 | 5% |

| Union Lake | $230 | 5% |

| Union Pier | $206 | -5% |

| Unionville | $225 | 3% |

| University Center | $186 | -15% |

| Utica | $255 | 17% |

| Vandalia | $222 | 2% |

| Vanderbilt | $206 | -6% |

| Vandercook Lake | $203 | -7% |

| Vassar | $214 | -2% |

| Vermontville | $225 | 3% |

| Vernon | $212 | -3% |

| Vestaburg | $241 | 11% |

| Vicksburg | $204 | -6% |

| Vulcan | $240 | 10% |

| Wacousta | $204 | -6% |

| Wakefield | $222 | 2% |

| Waldron | $228 | 5% |

| Walhalla | $224 | 3% |

| Walker | $200 | -8% |

| Walkerville | $251 | 15% |

| Wallace | $225 | 3% |

| Walled Lake | $225 | 3% |

| Walloon Lake | $206 | -5% |

| Warren | $329 | 51% |

| Waters | $204 | -6% |

| Watervliet | $197 | -9% |

| Watton | $217 | 0% |

| Waverly | $206 | -5% |

| Wayland | $206 | -5% |

| Wayne | $287 | 32% |

| Webberville | $224 | 3% |

| Weidman | $233 | 7% |

| Wells | $233 | 7% |

| Wellston | $232 | 7% |

| West Branch | $226 | 4% |

| West Ishpeming | $208 | -4% |

| West Monroe | $219 | 0% |

| West Olive | $190 | -13% |

| Westland | $282 | 30% |

| Weston | $210 | -3% |

| Westphalia | $201 | -8% |

| Westwood | $212 | -2% |

| Wetmore | $237 | 9% |

| White Cloud | $239 | 10% |

| White Pine | $219 | 1% |

| Whitehall | $197 | -10% |

| Whitmore Lake | $195 | -10% |

| Whittaker | $210 | -4% |

| Whittemore | $221 | 2% |

| Williamsburg | $201 | -8% |

| Williamston | $204 | -6% |

| Willis | $224 | 3% |

| Wilson | $244 | 12% |

| Winn | $224 | 3% |

| Wixom | $230 | 6% |

| Wolf Lake | $210 | -3% |

| Wolverine | $221 | 1% |

| Wolverine Lake | $227 | 4% |

| Woodhaven | $246 | 13% |

| Woodland Beach | $218 | 0% |

| Wyandotte | $241 | 11% |

| Wyoming | $207 | -5% |

| Yale | $237 | 9% |

| Ypsilanti | $239 | 10% |

| Zeeland | $182 | -17% |

The average cost of car insurance in Michigan’s biggest cities:

- Ann Arbor, $188 per month

- Dearborn, $418 per month

- Detroit, $548 per month

- Grand Rapids, $211 per month

- Lansing, $216 per month

Best and worst drivers in Michigan

The best drivers in Michigan live in Sterling Heights, while the state’s worst drivers reside in Dearborn Heights. We found that drivers in these cities and suburbs are involved in the least and most traffic incidents in Michigan, respectively.

Also, the state’s younger drivers are far more likely to get a speeding ticket, be in an accident or drive under the influence (DUI) than older drivers, based on our research.

Age groups and ZIP codes with high accident and other incident rates usually pay more for car insurance. Car insurance companies charge them higher rates to offset their higher risk of filing a claim.

Best drivers in Michigan by city

Sterling Heights has the best drivers among Michigan’s biggest cities and suburbs, based on driving incident rates. Driving incidents include speeding citations, accidents and DUIs.

There were just over four driving incidents per 1,000 drivers in Sterling Heights between August 2023 and August 2024, according to our data.

Best drivers by city or suburb

| City/suburb | Incidents per 1,000 drivers |

|---|---|

| Sterling Heights | 4.05 |

| Rochester Hills | 4.84 |

| Macomb Township | 4.85 |

| Pontiac | 4.91 |

| Flint | 5.08 |

Worst drivers in Michigan by city

Dearborn Heights is home to Michigan’s worst drivers. Nearly 11 drivers out of every 1,000 in this Detroit suburb were part of a driving incident like speeding or an accident over the past year.

Waterford Township has an incident rate that’s almost as high, our data shows.

Worst drivers by city or suburb

| City/suburb | Incidents per 1,000 drivers |

|---|---|

| Dearborn Heights | 10.78 |

| Waterford Township | 10.74 |

| Taylor | 9.84 |

| Dearborn | 9.83 |

| Novi | 9.68 |

Best and worst drivers by age group

Young drivers in Michigan are involved in many more traffic incidents than older drivers.

Gen Z drivers have the state’s highest incident rate of 36.71. Millennial drivers come in second, with a 17.08 incident rate.

Baby boomers are the best generation of drivers in Michigan. They have the state’s lowest number of traffic incidents at just over 11.5 per 1,000 drivers.

Driving incident rates by generation (per 1,000 drivers)

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z | 36.71 |

| Millennial | 17.08 |

| Gen X | 12.88 |

| Baby Boomer | 11.54 |

| Silent Generation | 13.42 |

Best and worst drivers by car brand

Pontiacs are the car make or brand that are least likely to be part of a traffic incident in Michigan. About 9.5 Pontiac drivers out of 1,000 were involved in an incident over the past year.

Saturn comes in second, with an average incident rate of 9.71.

Best drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Pontiac | 9.44 |

| Saturn | 9.71 |

| Mitsubishi | 11.35 |

| Cadillac | 11.77 |

| Chrysler | 12.73 |

Tesla and Subaru drivers are the most likely to be involved in a traffic incident in Michigan, our data shows. These car brands are each part of 23.4 incidents per 1,000 drivers.

Ram, BMW and Infiniti round out the state’s worst drivers by car make or brand.

Worst drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Tesla | 23.40 |

| Subaru | 23.40 |

| Ram | 22.05 |

| BMW | 19.70 |

| Infiniti | 18.96 |

Minimum coverage for car insurance in Michigan

You need to get these coverage types and amounts to meet Michigan’s minimum car insurance requirements.

- Personal injury protection (PIP): $50,000 and up

- Property protection insurance (PPI): $1 million

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $10,000

PIP covers injuries to you and your passengers after an accident, no matter who caused it. It also covers lost wages, essential services during your recovery and funeral expenses for fatal accidents. Most drivers need at least $250,000 in PIP, but you can buy more. Medicare and Medicaid recipients can get lower limits.

PPI covers damage you cause to other people’s property. It applies to items like buildings, fences and parked vehicles. PPI does not cover vehicles in other situations.

Bodily injury liability covers injuries you cause to other people. It pays for expenses that an accident victim’s own PIP does not cover.

Michigan state law doesn’t require full coverage car insurance, which usually includes collision

Michigan’s no-fault law

Michigan is a no-fault insurance state. If you’re in an accident, your own policy’s PIP covers your medical bills. Your collision and comprehensive, if you have them, cover damage to your own car.

You can only be sued for injuring someone in an accident if their injuries are especially severe. If you cause an accident, you can also be held liable for up to $1,000 of the other driver’s car repair expenses.

The no-fault rules usually don’t apply to:

- Accidents that happen out of state

- Accidents in Michigan with a driver from out of state

Frequently asked questions

Car insurance in Michigan costs $218 per month, on average, if you buy full coverage. If you only buy minimum coverage, the state’s average cost is $78 per month.

What you pay for car insurance in Michigan can differ greatly depending on where you live. Drivers who live in and around Detroit pay much higher rates than those who live elsewhere in the state, for example.

Progressive has Michigan’s cheapest car insurance for most drivers. It has the lowest full coverage insurance rate of $134 per month.

USAA has the state’s lowest average rate for minimum coverage, at $43 per month, but only members of the military and their families qualify. Most Michigan drivers get the cheapest minimum coverage from Progressive, at $64 per month.

It depends. Comprehensive coverage isn’t required by law in Michigan. However, you’ll usually have to get it for a car loan or lease, along with collision coverage. Both are also worth having for any car worth more than a few thousand dollars, whether you have a loan or not.

How we selected the cheapest car insurance companies in Michigan

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $250,000

- Property protection insurance: $1 million

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Michigan

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.