What Are the Different Types of Auto Loans?

Nearly 80% of new cars are bought with some kind of auto loan. Knowing the pros and cons of different types of auto loans can give you confidence in finding the sort of financing that works best for you.

Car loan types vary by how you get them, how interest is calculated and whether the vehicle is used as collateral for the loan.

- Understand how the type of loan will impact your ability to pay off the loan early.

- Get prequalified on your own so you can compare loan terms.

- A dealer doesn’t have to show you the best rate for which you qualify.

- A secured, simple-interest loan is the best bet for auto financing.

Secured auto loans vs. unsecured auto loans

New and used car loans can be secured or unsecured. In a secured loan, the car is used as collateral and can be seized if you default on the loan. Most car loans are secured loans.

Secured auto loans

Pros

- Usually lower APR

- Many sources

- Better for bad credit

Cons

- Subject to repossession

- Can be less flexible

- Age/mileage restrictions

Unsecured auto loans

Pros

- No collateral requirements

- Based on creditworthiness

- Often no limits on how you use the money

Cons

- Can be harder to get

- Usually higher APR

- Often has shorter terms

Secured auto loans

The cost of a secured auto loan is based on your credit rating and your car’s value. If you default, the lender can repossess and sell the car. Secured loans typically have a lower annual percentage rate (APR) because of the collateral.

(APR includes interest or finance charges, as well as additional charges such as loan origination fees, giving you the total cost of borrowing the money.)

Secured loans are available in a number of different types:

- Traditional auto loan. Secured financing based on the value of the vehicle with equal monthly payments. You can use a traditional loan to buy both new and used cars, including certified pre-owned (CPO) vehicles.

- Car balloon loan: Auto financing with smaller monthly payments, but with a final payment at the end of the loan term that could be up to half the value of the car due. When the loan “balloons” at the end, you can make the final payment, trade in the car or sell it to pay off the loan.

- Business and fleet loans. Financing for vehicles used for businesses and fleets, including loans and lease financing, to take advantage of business tax provisions.

Unsecured auto loans

The cost of an unsecured auto loan is based not on the value of the vehicle but on the lender’s assessment of your ability to pay back the funds.

Rates for unsecured loans are usually higher, in order to compensate the lender for higher risk. Because the loan amount is based on your creditworthiness, not the value of the car, you can get an unsecured loan first and then go shopping for a car.

Also, you may not be subject to the same comprehensive/collision insurance coverage requirements that come with a secured loan.

If you default on the loan, your car won’t be repossessed, but the debt could be sent to a debt collector, which could severely harm your credit score.

Unsecured auto loans are also a good option if you’re buying a classic or collector car that won’t qualify for traditional financing.

Simple interest loans vs. precomputed interest auto loans

There are two ways to calculate the interest you pay on a loan: simple interest and precomputed interest. Simple interest is the more common method for auto loans.

If you plan to stick to the payment schedule, there’s not much difference between the two methods. However, if you think you’ll pay off the loan early, the simple interest loan offers more interest savings.

By comparison, if you pay off a precomputed interest loan early, you may or may not get a refund of the unearned interest.

Simple interest loans

Pros

- Interest calculated on actual balance

- You can reduce interest by paying the loan off early

Cons

- Larger portions of early payments go to interest

Precomputed interest auto loans

Pros

- Fixed monthly payments

- Fixed payment schedule

- Fixed amount of interest on each payment

Cons

- You owe all the interest at the start of the loan

- You might not reduce interest by paying the loan off early

Simple interest loans

In a simple interest auto loan, your payment is based on the interest rate, the balance of the loan and the daily interest accrued since the last payment. Depending on the loan terms, the interest may be calculated daily or monthly.

The monthly payments are determined at the beginning of the loan. You can get an idea of your payment costs with our auto loan calculator.

With simple interest, the payment amount will stay the same, but the proportion of the payment that goes toward interest will change over the life of the loan (starting with most going toward interest, but with principal getting more and more of the monthly amount as time goes on).

If you want to pay off the loan early, you can make additional principal payments, which will cut the total amount owed and, as a result, will reduce the amount of interest on the loan.

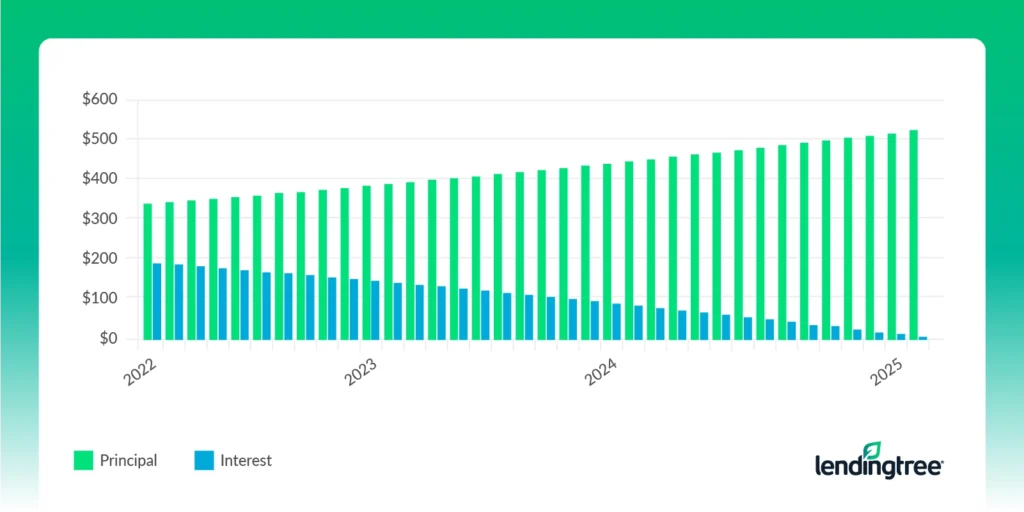

In the example below, the car payment is always $691.69. The amount of interest you pay (in blue) declines with each payment as the amount of principal you pay increases.

Precomputed interest auto loans

In a loan with precomputed interest, the loan balance, interest and origination fees are calculated at the beginning and divided over the loan’s life.

The main difference compared to a simple interest loan is you pay more interest in the early months of the loan. Because the interest is assigned to each payment, making extra payments does not reduce the interest or principal amount owed.

Like with a simple interest loan, borrowers benefit from a fixed monthly payment, a fixed interest rate and a structured payment schedule. If you are late making a payment, the amount of the payment that goes to the principal may be reduced to cover the fees.

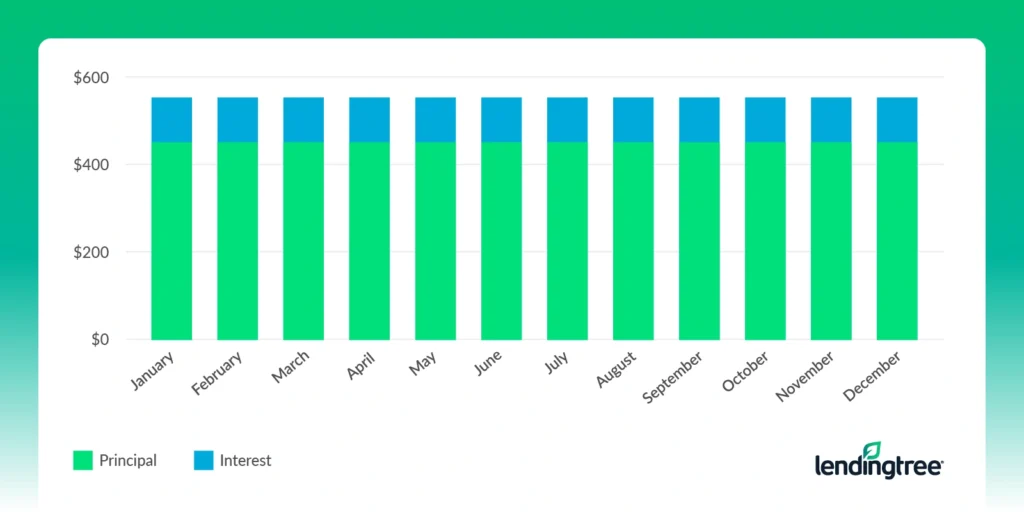

In the example below, the auto loan payment is $691.69 each month. The amount of interest you pay each month (in blue) stays the same. Unless you pay off the loan early, you may not notice a difference between simple and precomputed interest.

Direct auto financing vs. indirect auto financing

Direct auto financing involves just you and the lender (like a bank, credit union or online lender). Indirect lending occurs when there’s someone between you and the lender, such as a car dealership.

Most auto lenders work both ways — you can obtain a loan by applying directly or by working with a dealership.

Direct financingṣ

Pros

- Access to loan offers without influence from the dealership

- Ability to shop around for best rates

- No risk of dealer marking up rates or charging fees

Cons

- Filling out applications for each lender can take time

- You may need to compare complex offers

- You might not be able to access the most competitive rates

Indirect financing

Pros

- Can review multiple offers with one application

- Dealer may have incentive financing

- Dealer handles all the paperwork

Cons

- Dealers can mark up rates

- You might not see the offers best for you

- Lender may not be the best fit for you

Direct auto financing

With direct auto financing, you’re on your own. You can apply for a car loan at banks, credit unions and online lenders. You’ll have first-hand knowledge of the terms and offers without the information being filtered by a dealership.

The interest rates you are offered will be based on your credit score and payment history. Consider applying with lenders directly before you go to the dealership, so you can compare the market rates with the dealer’s offers.

Indirect auto financing

Most new and used car dealers offer to arrange financing for your car loan. The dealer’s finance office will send your application to multiple lenders, which could be some of the same ones you applied to directly.

For new car dealers, one of the lenders may be a “captive financing company” or “manufacturing finance” affiliated with the car company. For example, a Honda dealer is likely to offer you a loan with Honda Financial Services.

While it may seem convenient to use the dealer’s financing, keep in mind dealers can increase the APR over what the buyer may qualify for, charging a fee for handling the financing or other services.

Also, the dealer might not always show you the best option for your budget, so be sure to ask to see the best APR offers you received.

Prequalification vs. preapproval

As you’re shopping for an auto loan, you’ll read about getting “prequalified” or “preapproved.” While the terms sound similar and may sometimes be used interchangeably, they’re not really the same thing.

The differences include the dealer’s commitment to providing financing and how likely you are to get the interest rate quoted — in both cases, these terms are more likely to change with prequalification rather than with preapproval.

Also, preapproval may have more impact on your credit score.

In either case, you may see estimated financing terms, including the total amount you’re estimated to borrow, the APR and an estimated monthly payment.

You can use this information to estimate your car payment with one of our loan calculators.

Consider getting prequalified or preapproved for a car loan before you visit a dealership so you can compare the APRs you are offered at the dealer.

Prequalification

Pros

- Rough estimate of a loan offer

- Soft pull won’t affect credit score

- Apply to many lenders with one form

Cons

- APR may change

- Not as helpful when comparing other offers

- Approval not guaranteed

Preapproval

Pros

- APR unlikely to change

- Firm estimate for negotiation

- Demonstrates ability to pay for a car

Cons

- More financial info may be required

- Hard credit pull affects credit score

- Approval not guaranteed

Prequalification

You can apply for prequalification from a lender or a dealer to get an estimate for financing. Prequalification is less rigorous, since it’s based only on the information you provide and a soft credit inquiry. In many cases, you can apply online to see rate and payment options.

Prequalification can help you see how much you’re eligible to borrow and the estimated monthly payments.

Because prequalification is a preliminary step, the terms may change when you finalize the loan. You can use our list of auto lenders to apply.

Preapproved car loans

The preapproval stage is for when you’re ready to make a decision about which vehicle you want to buy.

A preapproved car loan is based on a hard credit pull and provides a more accurate estimate of what the lender may offer.

The lender may ask you to provide more information about your financial situation and ability to repay the loan, compared to prequalification. The APR and other terms are less likely to change after this step, but preapproval may temporarily lower your credit score.

Special types of auto loans

There are many types of loans for buying a car, not to mention refinancing a car. You may have special circumstances that require a specialized type of loan, such as these below.

Military auto loans

Auto loans designed for active duty and retired service members are available from both direct and indirect lenders. Some credit unions with military membership, such as Navy Federal Credit Union and PenFed, offer auto loans for military members.

Many auto manufacturers offer discounts ($500 to $1,000) through their captive finance companies to servicemembers. Also, the Servicemembers Civil Relief Act provides protection for military members who need to break a car lease due to a permanent change of station, as well as other benefits.

Buy here, pay here auto loans

These are typically used by people who aren’t able to access other types of car loans due to a low or no credit score. Interest rates tend to be higher than average, and the cars may be older or have higher mileage.

Buy here, pay here lenders might have predatory rates with higher payments that can increase the risk of repossession. We recommend considering a bad credit auto loan or looking for other financing sources.

Car title loans

The title of a paid-off car can be used to get a car title loan, where you can use the funds for something else.

These loans can have jaw-dropping interest rates of up to 300% APR. If you don’t pay the loan, the car can be repossessed and sold. They are best avoided if you have other options.

Frequently asked questions

The most common type of auto loan is a simple-interest secured loan with a lien against the vehicle’s title.

The APR will vary based on your credit score, payment history and loan terms. New cars often have APR incentive offers that offer the lowest rates. Look at what rates auto financiers are offering to get an idea of what’s available.

Common car payment terms range from 36 months to 72 months, although terms of up to 96 months may be available. The average new-car loan term is 67.87 months, according to Experian.

Get auto loan offers from up to 5 lenders in minutes