Luxury Vehicles Most Popular in D.C., California, New Jersey

There’s nothing quite like the freeing feeling of slipping behind the wheel, especially if it’s the wheel of a luxury ride. But high-end cars can pack a big financial punch: Automobiles are depreciating assets, and the ones that cost the most often lose value the fastest.

Still, some drivers insist on opulence. So the latest LendingTree study examines the states and cities where the highest (and lowest) share of vehicle loan queries are for luxury vehicles. We also look at which makes and models are the most popular among luxury seekers. By brand, BMW wins out. By model, Tesla’s Model Y takes the cake.

Key findings

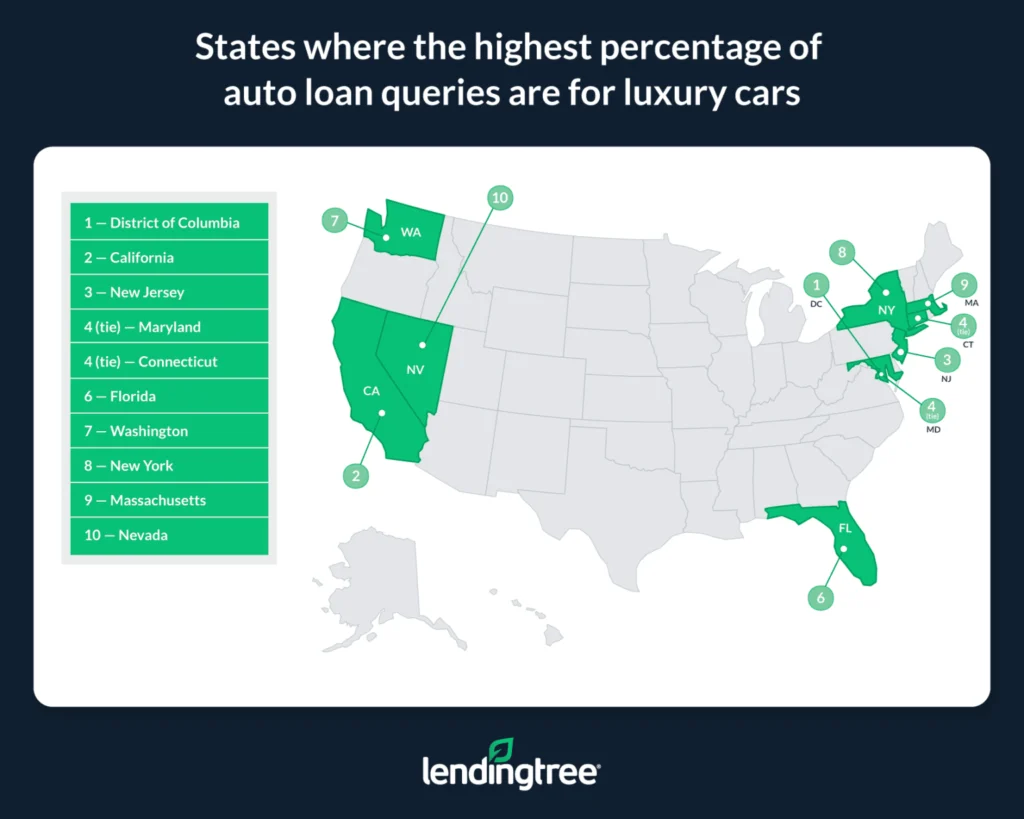

- People seeking auto loans in the District of Columbia, California and New Jersey are the most interested in luxury cars. More than 1 in 3 (35.2%) auto loan queries in D.C. from January through November 2024 were for luxury cars, ahead of California (31.1%) and New Jersey (29.2%). The average across the 50 states and D.C. is 16.7%.

- Among the nation’s 50 largest cities, San Francisco auto loan seekers show the most interest in luxury cars. Across auto loan queries in San Francisco, 43.9% are for luxury vehicles. New York (41.5%) and San Jose, Calif. (41.3%), follow.

- Omaha, Neb., auto loan seekers show the least interest in luxury cars. With just 14.3% of auto loan queries being for luxury makes, Omaha is worst on our list among the 50 largest cities, ahead of Tulsa, Okla. (15.2%), and Tucson, Ariz. (15.8%).

- Among luxury brands, BMW is the most popular, with Tesla just behind. Across the 23 makes deemed luxury, 16.6% of related auto loan queries were for BMWs. The only others above 10.0% were Tesla (15.8%), Mercedes-Benz (12.0%) and Lexus (11.1%).

- Broken down by luxury model, two Teslas — the Model Y and Model 3 — win out. The Tesla Model Y led the way, accounting for 6.8% of luxury auto loan queries, with the Model 3 following behind at 5.6%. BMWs occupied two of the next three spots.

35.2% of auto loan queries in D.C. for luxury cars

Analyzing LendingTree auto loan inquiries from January through November 2024, researchers found that 35.2% of all such queries in D.C. were made with luxury cars in mind.

That’s more than 1 in 3 inquiries — and more than double the average across the 50 states and D.C. of 16.7%.

The runners-up, California (where the rate of luxury-specific inquiries is 31.1%) and New Jersey (29.2%), led LendingTree chief consumer finance analyst Matt Schulz to a hypothesis.

“High incomes play a big role here,” he says, referencing these locations’ median household earnings, which are nearly $18,000 or higher above the national rate. “While lots of Americans love luxury cars, they are little more than a dream for most people because of how expensive they are.”

However, it might not just be money that makes the trend, Schulz says. Each of these areas features “notorious traffic spots” and “outrageously long commutes” for many.

“If you’re going to be forced to spend hours and hours each week stopping and starting in bumper-to-bumper traffic,” Schulz says, “you may consider getting a little more comfortable car to do it in.”

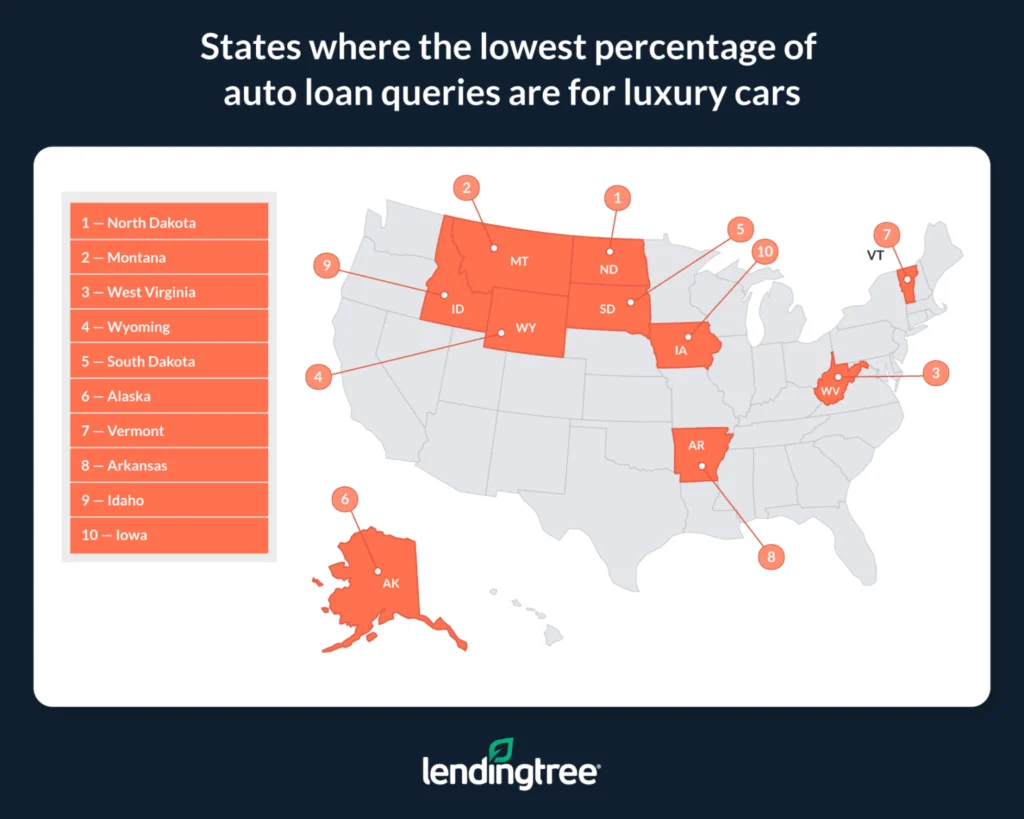

Conversely, North Dakota, Montana and West Virginia have the lowest proportion of luxury vehicle inquiries — 7.2%, 7.3% and 7.6%, respectively.

Given their sparser populations, rural and agricultural sensibilities, and lower-than-average median household incomes, it makes sense that residents of these states might not find a luxury vehicle the most practical option.

Full rankings

States where the highest/lowest percentage of auto loan queries are for luxury cars

| Rank | State | % of queries for luxury cars |

|---|---|---|

| 1 | District of Columbia | 35.2% |

| 2 | California | 31.1% |

| 3 | New Jersey | 29.2% |

| 4 | Maryland | 25.2% |

| 4 | Connecticut | 25.2% |

| 6 | Florida | 24.3% |

| 7 | Washington | 24.0% |

| 8 | New York | 23.8% |

| 9 | Massachusetts | 23.3% |

| 10 | Nevada | 22.8% |

| 11 | Rhode Island | 22.3% |

| 12 | Delaware | 21.4% |

| 12 | Georgia | 21.4% |

| 14 | Illinois | 21.3% |

| 15 | Texas | 20.8% |

| 16 | Hawaii | 20.0% |

| 16 | Virginia | 20.0% |

| 18 | Colorado | 19.3% |

| 19 | Utah | 18.7% |

| 20 | Arizona | 18.5% |

| 21 | North Carolina | 18.4% |

| 22 | South Carolina | 17.4% |

| 23 | Pennsylvania | 17.3% |

| 24 | Oregon | 16.5% |

| 25 | New Hampshire | 16.1% |

| 26 | Minnesota | 15.9% |

| 27 | Tennessee | 15.3% |

| 28 | Ohio | 14.0% |

| 29 | New Mexico | 13.8% |

| 30 | Alabama | 13.6% |

| 31 | Louisiana | 13.3% |

| 31 | Michigan | 13.3% |

| 33 | Kansas | 13.2% |

| 34 | Wisconsin | 13.1% |

| 34 | Oklahoma | 13.1% |

| 36 | Indiana | 12.2% |

| 37 | Missouri | 12.1% |

| 38 | Maine | 11.9% |

| 38 | Mississippi | 11.9% |

| 40 | Kentucky | 11.3% |

| 41 | Nebraska | 11.0% |

| 42 | Iowa | 10.9% |

| 43 | Idaho | 10.8% |

| 44 | Arkansas | 10.7% |

| 45 | Vermont | 10.4% |

| 46 | Alaska | 9.7% |

| 47 | South Dakota | 8.1% |

| 48 | Wyoming | 7.9% |

| 49 | West Virginia | 7.6% |

| 50 | Montana | 7.3% |

| 51 | North Dakota | 7.2% |

Among largest cities, San Francisco shows most luxury car interest

Along with looking at luxury car inquiries nationally and by state, we calculated the rates for the 50 U.S. cities with the largest populations.

From this view, we can see that the Bay Area — another area with far-higher-than-average earnings — has a particularly strong appetite for vehicular grandeur.

San Francisco had the highest proportion of luxury car inquiries at 43.9%, while nearby San Jose, Calif., came in third at 41.3%. Both cities have median household incomes of more than $141,000, compared with the national median of $78,538. Their presence toward the top of this list is likely a big reason California is second by state.

In second place was New York City, where 41.5% of auto loan inquiries were looking for the lap of luxury. (Although the city as a whole has a median income nearly on par with the national figure, it also has a higher-than-average population of celebrities, moguls and other wealthy people — though perhaps residents at that echelon can simply buy fancier cars with cash.)

Chances are some of the New Jersey residents mentioned in the by-state section are New York City-area commuters.

Cities where the highest percentage of auto loan queries are for luxury cars

| Rank | City | % of queries for luxury cars |

|---|---|---|

| 1 | San Francisco, CA | 43.9% |

| 2 | New York, NY | 41.5% |

| 3 | San Jose, CA | 41.3% |

| 4 | Los Angeles, CA | 40.7% |

| 5 | Miami, FL | 37.5% |

| 6 | Atlanta, GA | 36.7% |

| 7 | Seattle, WA | 35.8% |

| 8 | Washington, DC | 35.3% |

| 9 | Boston, MA | 34.3% |

| 10 | Oakland, CA | 33.9% |

Along with financial access, Schulz once again points to the traffic experienced by these densely populated cities. If you have to spend an hour or more in your vehicle every day to get to and from work, “it would be a whole lot more comfortable to do it in a luxury car with soft, heated leather seats, a top-of-the-line audio system and all the rest of the bells and whistles,” Schulz says.

Other cities on the top-10 list, like Los Angeles and Seattle, are similarly famous for their dense and frustrating traffic patterns.

Omaha, Neb., shows least luxury car interest

We also highlighted the 10 largest U.S. cities with the lowest interest in luxury cars. Here, the wide-open Midwest and West are the winners. Omaha, Neb., had the lowest proportion of luxury vehicle loan inquiries (14.3%), behind Tulsa, Okla. (15.2%), and Tucson, Ariz. (15.8%).

Cities where the lowest percentage of auto loan queries are for luxury cars

| Rank | City | % of queries for luxury cars |

|---|---|---|

| 1 | Omaha, NE | 14.3% |

| 2 | Tulsa, OK | 15.2% |

| 3 | Tucson, AZ | 15.8% |

| 4 | Indianapolis, IN | 16.3% |

| 5 | Mesa, AZ | 16.4% |

| 5 | Oklahoma City, OK | 16.4% |

| 7 | Colorado Springs, CO | 17.2% |

| 8 | El Paso, TX | 17.3% |

| 8 | Columbus, OH | 17.3% |

| 10 | Milwaukee, WI | 17.5% |

Omaha, Tulsa and Tucson have populations between 400,000 and 550,000 — which, while still metropolitan, is a far cry from the millions who inhabit the Bay Area and New York. Plus, many of these 10 are in relatively rugged states like Arizona, Oklahoma and Texas, where a pickup truck might be a more fitting style (and more useful) than a luxury sedan.

(Another interesting tidbit: Oklahoma took out the second-longest auto loans in the nation, according to another LendingTree study, at an average of 67.5 months.)

Full rankings

Cities where the highest/lowest percentage of auto loan queries are for luxury cars

| Rank | City | % of queries for luxury cars |

|---|---|---|

| 1 | San Francisco, CA | 43.9% |

| 2 | New York, NY | 41.5% |

| 3 | San Jose, CA | 41.3% |

| 4 | Los Angeles, CA | 40.7% |

| 5 | Miami, FL | 37.5% |

| 6 | Atlanta, GA | 36.7% |

| 7 | Seattle, WA | 35.8% |

| 8 | Washington, DC | 35.3% |

| 9 | Boston, MA | 34.3% |

| 10 | Oakland, CA | 33.9% |

| 11 | San Diego, CA | 33.0% |

| 12 | Dallas, TX | 32.7% |

| 13 | Austin, TX | 31.4% |

| 14 | Charlotte, NC | 29.8% |

| 15 | Chicago, IL | 29.0% |

| 16 | Long Beach, CA | 28.6% |

| 17 | Houston, TX | 27.7% |

| 18 | Tampa, FL | 27.3% |

| 19 | Nashville, TN | 26.6% |

| 20 | Baltimore, MD | 25.8% |

| 20 | Las Vegas, NV | 25.8% |

| 22 | Sacramento, CA | 25.7% |

| 23 | Philadelphia, PA | 25.3% |

| 24 | Raleigh, NC | 25.2% |

| 25 | Denver, CO | 23.8% |

| 26 | Fresno, CA | 23.2% |

| 27 | Portland, OR | 22.9% |

| 28 | Phoenix, AZ | 21.7% |

| 28 | Minneapolis, MN | 21.7% |

| 30 | San Antonio, TX | 20.3% |

| 30 | Jacksonville, FL | 20.3% |

| 32 | Bakersfield, CA | 20.2% |

| 33 | Arlington, TX | 20.0% |

| 34 | Memphis, TN | 19.8% |

| 35 | Virginia Beach, VA | 19.4% |

| 36 | Fort Worth, TX | 19.1% |

| 37 | Albuquerque, NM | 18.1% |

| 38 | Louisville, KY | 18.0% |

| 39 | Kansas City, MO | 17.8% |

| 40 | Detroit, MI | 17.6% |

| 41 | Milwaukee, WI | 17.5% |

| 42 | Columbus, OH | 17.3% |

| 42 | El Paso, TX | 17.3% |

| 44 | Colorado Springs, CO | 17.2% |

| 45 | Oklahoma City, OK | 16.4% |

| 45 | Mesa, AZ | 16.4% |

| 47 | Indianapolis, IN | 16.3% |

| 48 | Tucson, AZ | 15.8% |

| 49 | Tulsa, OK | 15.2% |

| 50 | Omaha, NE | 14.3% |

Luxury car seekers most interested in BMWs

Along with analyzing luxury vehicle interest by location, we also looked into which specific vehicles would-be borrowers were eyeing.

After analyzing luxury seekers’ choices at the make and model level (which we’ll dive into below), we found that BMW held the top spot as the most sought-after brand: 16.6% of luxury vehicle queries on the LendingTree platform during the studied period were for a Bimmer.

Tesla came in second at 15.8%, followed by Mercedes-Benz at 12.0%. (Lexus, at 11.1%, is the last luxury brand that enjoyed more than 10.0% of queries.)

Percentage of luxury car queries by make

| Rank | Make | % of luxury car queries for the make |

|---|---|---|

| 1 | BMW | 16.6% |

| 2 | Tesla | 15.8% |

| 3 | Mercedes-Benz | 12.0% |

| 4 | Lexus | 11.1% |

| 5 | Audi | 9.3% |

| 6 | Cadillac | 6.4% |

| 7 | Acura | 5.3% |

| 8 | Porsche | 4.2% |

| 9 | Land Rover | 4.1% |

| 10 | Infiniti | 3.7% |

In some cases, makes may be more popular because they have a lower entry price point. Certain 2025 BMWs and Teslas can be purchased for around $50,000, while the starting price for a brand-new Porsche hovers above $70,000.

But the desire for a specific brand, Schulz says, is unlikely to be all about budgeting. Often, he says, “people buy these vehicles just to keep up with or show off to the Joneses.”

That’s not to mention the fact that, in some cases, you get what you pay for. “These brands have long-cultivated reputations for producing quality products, and that matters a lot,” Schulz says, “especially considering the high price points for most of these brands’ vehicles.”

Among luxury models, Tesla Model Y, Model 3 top interest list

Finally, when we looked into the figures for specific luxury models, we found two Teslas in the lead. At the top, 6.8% of luxury vehicle inquiries were for Tesla Model Ys — the highest share by model — while Tesla Model 3s came in second at 5.6%. The BMW 3 Series pulled up in third at, fittingly, 3.0%.

Percentage of luxury car queries by model

| Rank | Model | % of luxury car queries for the model |

|---|---|---|

| 1 | Tesla Model Y | 6.8% |

| 2 | Tesla Model 3 | 5.6% |

| 3 | BMW 3 Series | 3.0% |

| 4 | Lexus RX | 2.4% |

| 5 | BMW X5 | 2.1% |

| 6 | Acura MDX | 1.9% |

| 7 | Mercedes-Benz C-Class | 1.8% |

| 7 | BMW X3 | 1.8% |

| 9 | BMW 5 Series | 1.7% |

| 10 | Mercedes-Benz GLE | 1.6% |

| 10 | Lexus NX | 1.6% |

| 10 | Audi Q5 | 1.6% |

The 2024 Model Y starts at a relatively conservative $44,630, and even fully tricked out doesn’t eclipse $55,000. The 2024 Model 3 is even more affordable, and Kelley Blue Book says it’s “arguably a bargain among electric sedans.”

In other words, along with their eco-friendliness and autonomous driving abilities, these Tesla models may be more accessible to luxury seekers still on a budget.

The same can be said for the 2024 BMW 3 Series, which starts at around $45,000. In fact, many of the vehicles on this list have an entry price point of around $50,000, which is on the lower end in the world of luxury vehicles. (Consider these prices, for instance, against the 2024 Tesla Cyberbeast truck, which starts at $99,990.)

Luxury car buying: Determining how much you can afford

It’s been said that you can afford anything — but not everything. If you have your sights set on a luxury vehicle, a little bit of planning can go a long way in figuring out how much you can afford (and sticking to it).

- Run the numbers. Unlike luxury vehicles, budgeting is rarely considered sexy. Still, it’s necessary, especially when considering a major investment like an expensive car. “Until you know how much money is coming in and going out of your household in a given month, you can’t adequately assess how much you can afford to pay regularly for that new car,” says Schulz, author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.” After all, a high-end vehicle is likely to come with a high-end monthly car payment. If the best set of wheels on the block is your priority, you might find other places to cut back, like dining out less or keeping up fewer streaming services. “Or you could also find that you can’t afford that Tesla Cybertruck right now,” Schulz says, “and that’s OK, too.”

- Choose a less-expensive luxury option. As we’ve shown, not all luxury vehicles are priced equally. Some start around $45,000, while the barrier to access is closer to $100,000 for others. If you’re loyal to a specific make, look around on its website to determine which models are closer to entry-level (as opposed to more premium vehicles). You’ll still get to drive around with that coveted hood ornament — without going bankrupt.

- Bump up your down payment. Auto loan rates today are sky-high, says Schulz, so “the less you need to finance, the better.” Given the expense of these vehicles, paying in cash might not be an option, even for high earners. Still, “if you’re able to put a significant down payment on the car,” Schulz advises, “it can make a difference in the total cost you’ll pay.”

- Consider buying used. Not all used cars are beaters — and by purchasing a luxury vehicle with a few miles under its hood, you can enjoy all the creature comforts without suffering drastic depreciation. According to Carfax, cars often lose 10% of their value nearly as soon as you drive them off the lot. With a luxury vehicle that costs $55,000, that’s a quick loss of $5,500. Make sure you do your research to ensure you don’t buy a lemon. Many dealerships will allow you to bring a used car to a mechanic of your choice before purchase, though a salesperson may need to tag along for security purposes.

- Friends don’t let friends shop alone. “It’s easy to get excited and say yes to things when you’re in that car dealership,” Schulz says — which, of course, is by design. The word a car salesperson most wants to hear is yes. “One of the best ways to ensure you don’t make a rash decision you’ll regret,” says Schulz, “is to bring along a wing person to keep you grounded. Having them there to say, Hey, isn’t that more than you were looking to spend? can be a helpful thing once that adrenaline gets flowing.” Make sure you pick someone who’ll call you out when the time comes.

Methodology

LendingTree researchers analyzed 1 million-plus completed auto loan inquiries for passenger vehicles on the LendingTree platform from Jan. 1 to Nov. 30, 2024, to determine the states and cities with the highest proportion of queries for luxury vehicles, as well as the makes and models that luxury shoppers consider. Auto loan inquiries without a vehicle make weren’t included. Makes and models with less than 100 queries during the analyzed period also were omitted.

To calculate the states with the highest proportion of luxury vehicle queries, a state’s number of luxury vehicle auto loan queries was divided by its total number of auto loan queries. This process was repeated for the 50 largest cities in the U.S. by population.

For luxury vehicle makes, we took a luxury vehicle make’s total number of queries over the time frame and divided it by the total number of luxury vehicle queries during the period to find the makes with the highest proportions of luxury vehicle queries. This process was repeated for luxury vehicle models.

To determine which brands were considered luxury, Carfax’s “Complete Guide to Luxury Car Brands” was utilized. The luxury brands included:

- Acura

- Alfa Romeo

- Aston Martin

- Audi

- Bentley

- BMW

- Cadillac

- Ferrari

- Genesis

- Infiniti

- Jaguar

- Lamborghini

- Land Rover

- Lexus

- Lincoln

- Lotus

- Maserati

- McLaren

- Mercedes-Benz

- Polestar

- Porsche

- Tesla

- Volvo

The cities evaluated included the biggest 50 by population according to the U.S. Census Bureau 2023 American Community Survey with one-year estimates.

Get auto loan offers from up to 5 lenders in minutes